Bitcoin Golden Cross Flash: Implications And Trading Strategies

Table of Contents

Understanding the Mechanics of a Bitcoin Golden Cross Flash

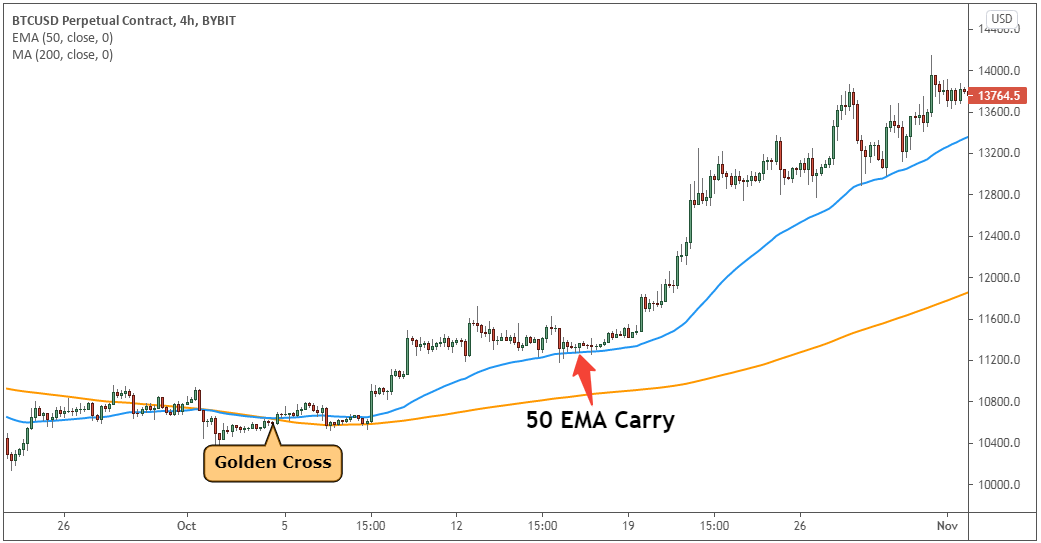

The Bitcoin Golden Cross occurs when the shorter-term 50-day moving average (MA) crosses above the longer-term 200-day MA. Traditionally, this crossover is viewed as a bullish signal, suggesting potential upward momentum. However, a "flash" golden cross signifies a very brief intersection, often lasting only a few hours or days, before the averages diverge again.

- Technical Aspects: The 50-day and 200-day MAs smooth out price fluctuations, providing a clearer picture of the overall trend. The intersection point indicates a potential shift in momentum.

- Chart Illustration: [Insert chart here showing a recent example of a Bitcoin golden cross flash. Clearly label the 50-day MA and 200-day MA.] This chart illustrates a classic example of a flash golden cross – a brief intersection followed by a reversal. The short duration is key to understanding its limitations.

- Why a "Flash"? Several factors can contribute to a flash golden cross, including temporary price spikes, market manipulation, or simply noise in the data. It's crucial to distinguish between a genuine shift in momentum and a fleeting anomaly. Keywords: 50-day MA, 200-day MA, moving average crossover, Bitcoin chart analysis, technical indicators.

Implications of a Bitcoin Golden Cross Flash

While a standard Bitcoin Golden Cross is often seen as a bullish sign, interpreting a flash golden cross requires caution.

Potential Bullish Momentum

- Typical Interpretation: A traditional golden cross suggests increasing buying pressure and the potential for a sustained price increase.

- Limitations of a Flash: A flash golden cross, due to its brief nature, doesn't guarantee sustained bullish momentum. It might simply represent a temporary price surge.

- Short-Term Potential: While a flash might precede a short-term price increase, expecting a major bull run based solely on this indicator is unwise.

False Signals and Market Noise

- Why False Signals Occur: Flash golden crosses can be false signals, often resulting from short-term price fluctuations unrelated to a fundamental shift in market sentiment.

- Influencing Factors: Bitcoin's price is affected by numerous external factors, including regulatory news, overall market sentiment, and adoption rates. A flash golden cross might be completely unrelated to these broader trends.

- Importance of Additional Indicators: Relying solely on a single indicator like a flash golden cross is risky. It's vital to analyze other indicators, such as volume, RSI, and MACD, for confirmation. Keywords: bullish signal, false signal, Bitcoin price prediction, market volatility, risk management, stop-loss order, position sizing.

Risk Management

- Bitcoin Market Volatility: The Bitcoin market is notoriously volatile; price swings can be substantial and rapid.

- Essential Risk Management: Effective risk management is paramount. This includes setting stop-loss orders to limit potential losses and employing appropriate position sizing.

- Strategies: Only invest what you can afford to lose. Diversify your portfolio across multiple assets to mitigate risk. Keywords: bullish signal, false signal, Bitcoin price prediction, market volatility, risk management, stop-loss order, position sizing.

Trading Strategies Following a Bitcoin Golden Cross Flash

Trading after a Bitcoin golden cross flash demands a cautious approach.

Conservative Approach

- Confirmation from Other Indicators: Wait for confirmation from other technical indicators before entering a trade. This reduces the risk of acting on a false signal.

- Gradual Entry: Instead of a large, immediate investment, adopt a gradual entry strategy. This limits exposure to potential losses if the price doesn't move as predicted.

- Strict Risk Management: Employ strict risk management techniques, including stop-loss orders and position sizing.

Aggressive Approach (with caution!)

- Potential for Quick Profits and Losses: An aggressive approach might target short-term price increases following the flash, but it carries a significantly higher risk of substantial losses.

- Short-Term Price Targets: Set clear, short-term price targets based on technical analysis and chart patterns.

- Stop-Loss is Crucial: Stop-loss orders are absolutely essential to limit potential losses.

Alternative Strategies

- Options Trading (Advanced): For experienced traders, options trading can offer alternative strategies, but this requires advanced knowledge and carries significant risk.

- Dollar-Cost Averaging: Dollar-cost averaging (DCA) is a less risky approach, involving regular investments regardless of price fluctuations. This strategy reduces the impact of short-term volatility. Keywords: trading strategy, Bitcoin trading strategy, cryptocurrency trading strategies, short-term trading, long-term trading, options trading, dollar-cost averaging.

Conclusion: Navigating the Bitcoin Golden Cross Flash and Beyond

A Bitcoin golden cross flash isn't a foolproof predictor of sustained bullish momentum. It requires careful analysis and a robust risk management strategy. Relying on multiple indicators and employing diverse trading strategies is crucial for navigating the volatile world of Bitcoin trading. Remember, thorough research is essential before making any trading decisions. Don't solely rely on the Bitcoin Golden Cross; understand its limitations and combine it with other analytical tools. Continue learning about Bitcoin trading and technical analysis to improve your trading skills and make informed decisions. Mastering the complexities of the Bitcoin Golden Cross and other indicators is key to success in this dynamic market.

Featured Posts

-

Saving Private Ryan Dethroned A Look At The New Contender For Best War Movie

May 08, 2025

Saving Private Ryan Dethroned A Look At The New Contender For Best War Movie

May 08, 2025 -

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025 -

Lahores Weather A Two Day Forecast For Eid Ul Fitr In Punjab

May 08, 2025

Lahores Weather A Two Day Forecast For Eid Ul Fitr In Punjab

May 08, 2025 -

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

May 08, 2025

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

May 08, 2025 -

Arsenals Arteta Faces Scrutiny Following Collymores Comments

May 08, 2025

Arsenals Arteta Faces Scrutiny Following Collymores Comments

May 08, 2025