Bitcoin Or MicroStrategy Stock: Investment Outlook For 2025

Table of Contents

Bitcoin's Potential in 2025

Bitcoin's Price Volatility and Growth Projections

Bitcoin's price is notoriously volatile. Its history is marked by significant price swings, influenced by various factors. Predicting its price in 2025 is challenging, but analyzing historical trends and market predictions offers some insight. Experts offer varying projections, but several factors could significantly impact Bitcoin's price:

- Adoption Rate: Widespread institutional and individual adoption will likely drive price increases. Increased usage as a payment method and store of value is crucial.

- Regulatory Changes: Clearer and more favorable regulatory frameworks globally could boost investor confidence and increase demand. Conversely, restrictive regulations could negatively impact the price.

- Macroeconomic Conditions: Global economic uncertainty, inflation rates, and monetary policies significantly influence Bitcoin's price, often acting as a safe haven asset during times of economic instability.

According to CoinDesk, Bitcoin's average daily trading volume has increased significantly in recent years, indicating growing market interest. Potential catalysts for price increases include further institutional adoption, increased use cases beyond speculation, and its established role as an inflation hedge.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries significant risks:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions, posing a considerable risk to investors. Changes in regulations can dramatically impact the value of Bitcoin.

- Security Vulnerabilities: Bitcoin exchanges and wallets are susceptible to hacking and theft. Investors must be vigilant about security best practices to minimize potential losses.

- Market Manipulation: The relatively young and less regulated nature of the cryptocurrency market makes it susceptible to manipulation, potentially leading to significant price swings.

- Potential for Significant Losses: The volatile nature of Bitcoin means investors could experience substantial losses.

Bitcoin's Long-Term Value Proposition

Despite the risks, many believe Bitcoin holds long-term value:

- Store of Value: Its limited supply of 21 million coins makes it a potential store of value, similar to gold.

- Hedge Against Inflation: Bitcoin's decentralized nature and limited supply are seen as a hedge against inflation, particularly during periods of economic uncertainty.

- Decentralized Digital Currency: Bitcoin's decentralized structure offers a potential alternative to traditional financial systems, making it appealing to those seeking financial freedom.

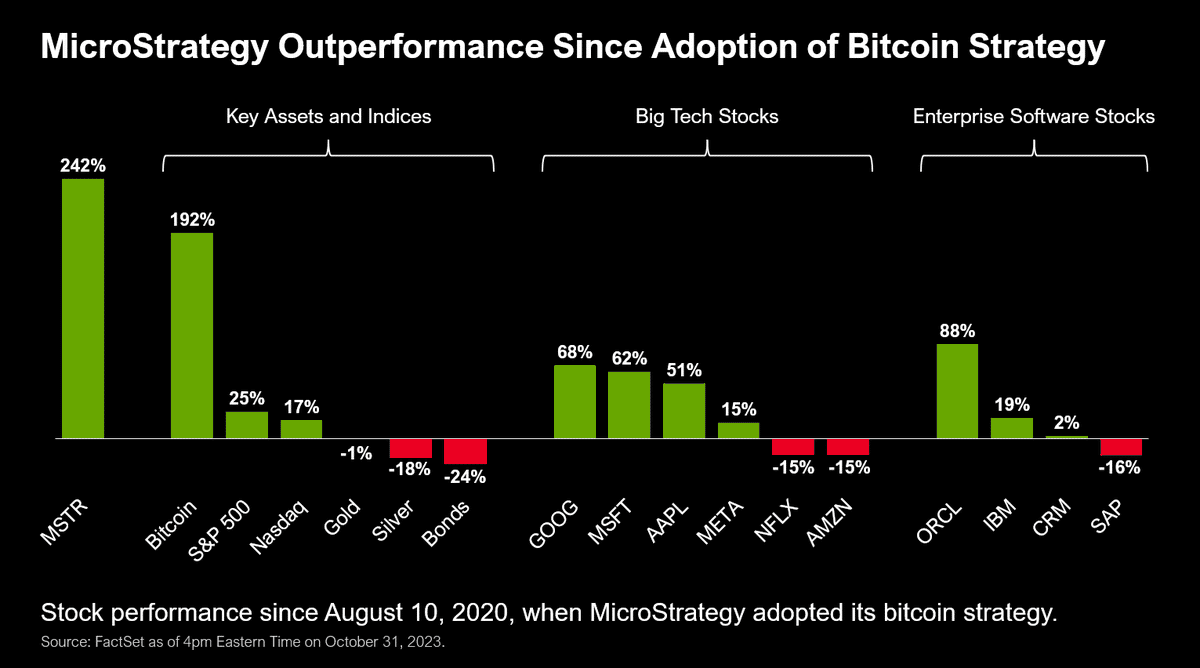

MicroStrategy's Investment Strategy and Stock Performance

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy, a business intelligence company, has made a significant strategic investment in Bitcoin. This has profoundly impacted its stock performance, creating a strong correlation between its stock price and Bitcoin's price. Their substantial Bitcoin holdings represent a significant part of their overall asset portfolio. The size of their holdings and their continued commitment to Bitcoin are key factors to consider. (Include data on the size of their holdings and sources here).

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents both risks and rewards:

- Correlation with Bitcoin: MicroStrategy's stock price is heavily influenced by Bitcoin's price volatility. Any significant drop in Bitcoin's value will directly impact MicroStrategy's share price.

- Business Performance: MicroStrategy's core business performance also impacts its stock price, independent of its Bitcoin holdings.

- Market Sentiment: Investor sentiment towards both Bitcoin and MicroStrategy will influence the stock price.

- Diversification: Investing in MicroStrategy offers indirect exposure to Bitcoin but doesn't provide diversification away from the cryptocurrency market. Direct Bitcoin investment carries more risk but potentially greater returns.

MicroStrategy's Future Growth Potential

MicroStrategy's future growth potential depends on several factors:

- Bitcoin's Future Price: The success of MicroStrategy's strategy is inherently tied to Bitcoin's future price.

- Core Business Performance: The company's success in its core business intelligence operations will also contribute to its overall valuation.

- Adoption of Bitcoin as a Corporate Asset: If more companies follow MicroStrategy's lead and incorporate Bitcoin into their treasury strategies, it could boost both Bitcoin's price and MicroStrategy's reputation.

Bitcoin vs. MicroStrategy: A Direct Comparison

Risk Tolerance and Investment Goals

The choice between direct Bitcoin investment and MicroStrategy stock hinges on your risk tolerance and investment goals:

- High-Risk, High-Reward: Direct Bitcoin investment suits those with high-risk tolerance and a long-term investment horizon.

- Moderate Risk: MicroStrategy stock offers a relatively less volatile approach but with potentially lower returns.

Liquidity and Accessibility

- Bitcoin: Bitcoin is readily traded on numerous cryptocurrency exchanges but can be subject to higher transaction fees and platform-specific risks.

- MicroStrategy Stock: MicroStrategy stock is traded on major stock exchanges, offering greater liquidity and accessibility for most investors.

Tax Implications

Tax implications differ significantly between Bitcoin and MicroStrategy stock. Bitcoin transactions are subject to capital gains taxes in many jurisdictions, while MicroStrategy stock is taxed according to standard stock market rules. Seek professional tax advice before making any investment decision.

Conclusion

The choice between investing in Bitcoin directly or through MicroStrategy stock in 2025 depends on your individual risk tolerance, investment goals, and understanding of the market. Direct Bitcoin investment offers higher potential rewards but also carries higher risk. MicroStrategy stock offers a less volatile but potentially less rewarding approach to Bitcoin exposure. Carefully weigh the pros and cons of both options before making any investment decision. Conduct thorough research and, if necessary, seek professional financial advice before investing in Bitcoin or MicroStrategy stock. Remember to diversify your portfolio appropriately. Make informed decisions about your Bitcoin or MicroStrategy investment strategy for 2025.

Featured Posts

-

Uber Stock Can Robotaxi Plans Fuel A Comeback

May 08, 2025

Uber Stock Can Robotaxi Plans Fuel A Comeback

May 08, 2025 -

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025 -

Dwp Updates Significant Changes To Universal Credit Verification

May 08, 2025

Dwp Updates Significant Changes To Universal Credit Verification

May 08, 2025 -

Nc State Running Back Kendrick Raphael Transfers

May 08, 2025

Nc State Running Back Kendrick Raphael Transfers

May 08, 2025 -

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025