Bitcoin Or MicroStrategy Stock: The Better Investment For 2025?

Table of Contents

Understanding Bitcoin's Investment Potential in 2025

Bitcoin's Price Volatility and Market Sentiment

Bitcoin's price has historically shown significant fluctuations. Factors influencing this volatility include regulatory changes, adoption rates, and technological advancements. A positive regulatory environment, increased institutional adoption, and successful technological upgrades like the Lightning Network could drive price appreciation. Conversely, negative regulatory actions, security breaches, or macroeconomic downturns can lead to sharp price declines.

Currently, market sentiment towards Bitcoin is mixed. While some see it as a hedge against inflation and a store of value, others remain skeptical due to its volatility. The level of future adoption by institutional investors remains a crucial factor influencing its price.

- Increased institutional adoption: Gradual but significant entry of large institutional investors.

- Potential regulatory hurdles: Varying regulatory landscapes across different jurisdictions.

- Technological upgrades (like the Lightning Network): Enhancements that improve scalability and transaction speed.

- Macroeconomic factors influencing cryptocurrency prices: Global economic conditions and inflation rates.

Bitcoin's Long-Term Growth Prospects

Bitcoin's limited supply (21 million coins) and its potential as a decentralized, inflation-resistant asset are key arguments for its long-term growth. Its scarcity could make it a desirable store of value, similar to gold, potentially driving its price higher over time. Increased global adoption as a medium of exchange and its integration into decentralized finance (DeFi) ecosystems further contribute to its long-term potential.

- Limited supply: Creates inherent scarcity, potentially driving up value.

- Potential as digital gold: Acts as a hedge against inflation and a store of value.

- Increased global adoption: Wider acceptance as a payment method.

- Role in DeFi ecosystems: Integration into decentralized finance applications.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries significant risks. Price volatility remains a primary concern, with the potential for substantial losses. Security risks, such as exchange hacks and private key loss, are also significant. Regulatory uncertainty, differing regulations across jurisdictions, and the potential for market manipulation add further complexity.

- Market manipulation: The potential for large actors to influence price artificially.

- Security breaches: Risk of losing funds due to exchange hacks or wallet vulnerabilities.

- Regulatory risks: Uncertainty surrounding future government regulations.

- Hacking vulnerabilities: Exposure to various hacking attempts and exploits.

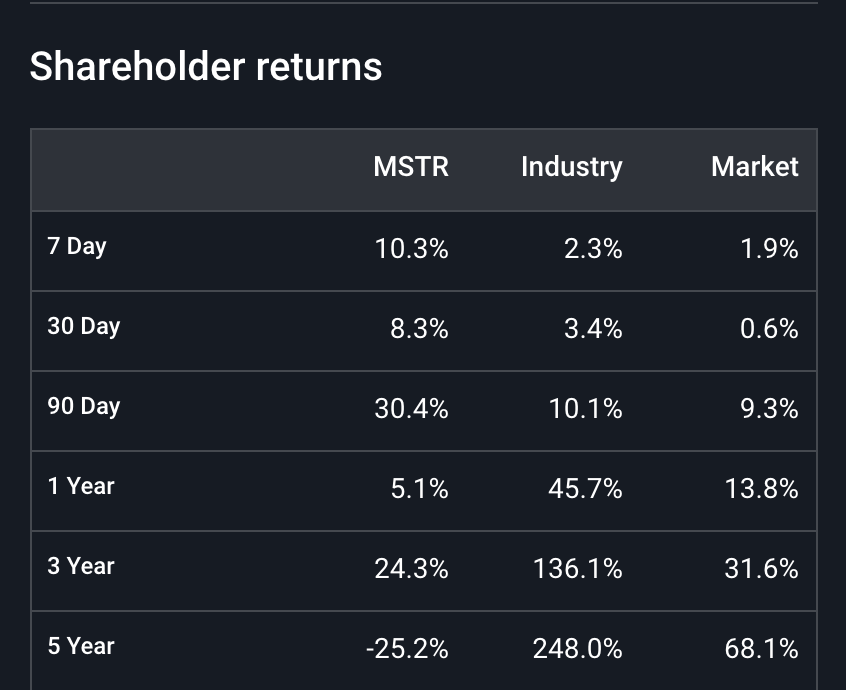

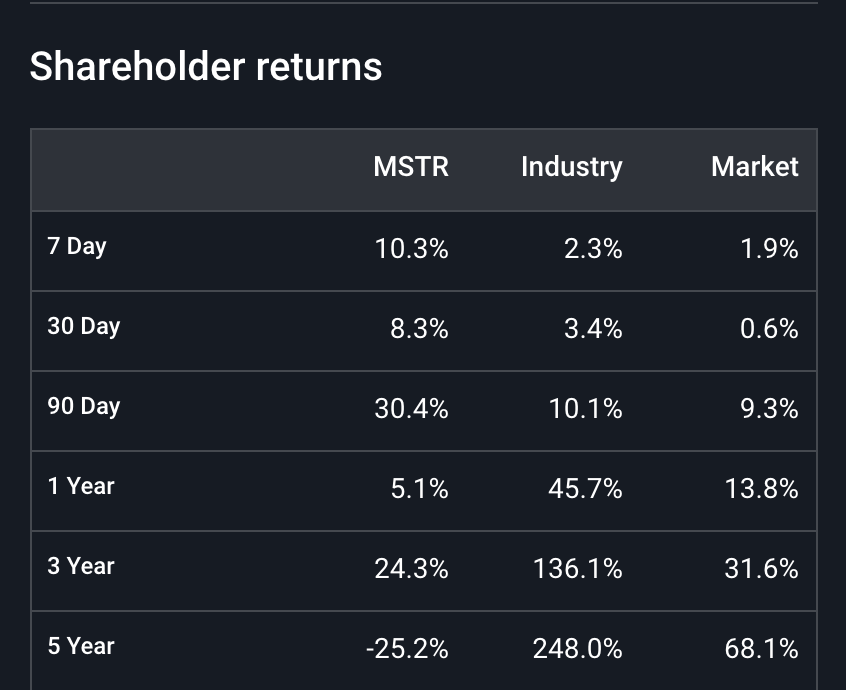

Evaluating MicroStrategy's Stock Performance and Bitcoin Holdings

MicroStrategy's Business Model and Financial Performance

MicroStrategy is a business intelligence company that has adopted a unique strategy of accumulating Bitcoin as a treasury asset. Analyzing MicroStrategy's core business and its financial health is crucial for understanding its stock performance. Factors such as revenue streams, profitability, debt levels, and overall financial stability should be carefully considered. The company's heavy investment in Bitcoin significantly impacts its financial position and the perception of its risk profile.

- Revenue streams: Sources of income and their stability.

- Profitability: The company's ability to generate profits.

- Debt levels: The amount of debt the company carries.

- Overall financial stability: A comprehensive assessment of its financial health.

The Impact of Bitcoin Holdings on MicroStrategy's Stock Price

MicroStrategy's stock price is heavily correlated with the price of Bitcoin. This means that when Bitcoin's price rises, MicroStrategy's stock price tends to rise as well, and vice versa. This strategy presents both significant risks and potential rewards. While large gains are possible if Bitcoin's price increases dramatically, substantial losses could occur if Bitcoin's price falls.

- Price correlation: Strong relationship between Bitcoin's price and MicroStrategy's stock price.

- Exposure to Bitcoin's volatility: Significant risk associated with Bitcoin price fluctuations.

- Potential for significant gains or losses: High reward, high-risk investment strategy.

Risks of Investing in MicroStrategy Stock

Investing in MicroStrategy stock carries several risks. Its dependence on Bitcoin's price is a major factor. If Bitcoin's price declines significantly, MicroStrategy's stock price is likely to decline as well. Other risks include the company's overall business performance, competition within the business intelligence market, and general management risk.

- Business risk: Risks inherent to the company's core business operations.

- Dependence on Bitcoin price: High correlation with Bitcoin's market performance.

- Competition: Competition from other business intelligence companies.

- Management risk: Risks associated with the company's management team.

Bitcoin vs. MicroStrategy Stock: A Comparative Analysis

| Feature | Bitcoin | MicroStrategy Stock |

|---|---|---|

| Risk | High Volatility, Regulatory Uncertainty | High Volatility (linked to Bitcoin), Business Risk |

| Potential Return | Potentially High | Potentially High (linked to Bitcoin) |

| Volatility | Very High | High |

| Investment Strategy | Direct Cryptocurrency Investment | Indirect Bitcoin Exposure via Stock |

| Liquidity | Relatively High | Moderate |

Bitcoin offers direct exposure to the cryptocurrency market, with potentially higher returns but significantly higher volatility. MicroStrategy offers indirect exposure, mitigating some risks but also limiting potential upside.

Conclusion: Making the Right Choice for 2025

Investing in either Bitcoin or MicroStrategy stock for 2025 involves significant risks and potential rewards. Bitcoin offers direct exposure to cryptocurrency market growth but is highly volatile. MicroStrategy provides indirect exposure through its Bitcoin holdings, but its performance is heavily tied to Bitcoin's price and its own business success. Both carry considerable uncertainty.

Predicting future performance with certainty is impossible due to the inherent volatility of both markets. Before making any investment decisions, conduct thorough research and consider your own risk tolerance. Consult with a financial advisor to make an informed choice about whether Bitcoin or MicroStrategy stock is the better investment for you in 2025. Remember, diversification is key in any investment portfolio.

Featured Posts

-

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025 -

North Idaho Event Conservative Commentator Jeanine Pirro Scheduled To Appear

May 09, 2025

North Idaho Event Conservative Commentator Jeanine Pirro Scheduled To Appear

May 09, 2025 -

Palantir Stock Buy Or Sell A Detailed Investment Guide

May 09, 2025

Palantir Stock Buy Or Sell A Detailed Investment Guide

May 09, 2025 -

25m Financial Gap At West Ham Challenges And Opportunities

May 09, 2025

25m Financial Gap At West Ham Challenges And Opportunities

May 09, 2025 -

Watch Pam Bondis Remarks On Eliminating American Citizens Draw Criticism

May 09, 2025

Watch Pam Bondis Remarks On Eliminating American Citizens Draw Criticism

May 09, 2025