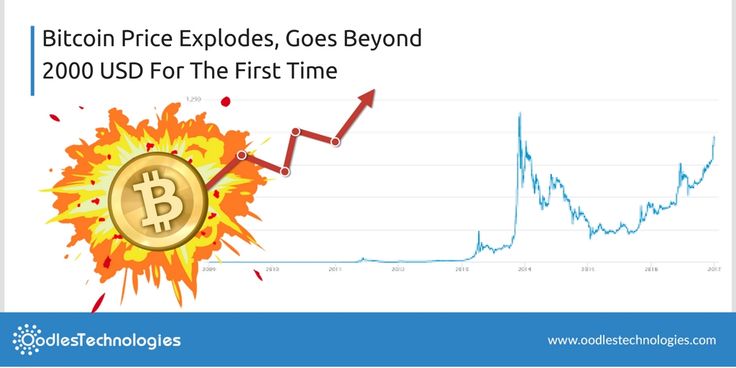

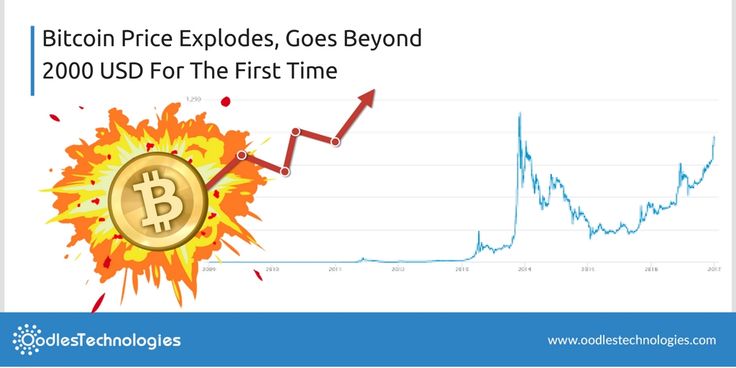

Bitcoin Price Explodes: Approaches $100,000 Following 10-Week Peak

Table of Contents

Factors Fueling Bitcoin's Explosive Growth

Several converging forces have fueled this remarkable Bitcoin price surge, driving its value closer to the $100,000 milestone. Let's examine the key players and trends:

Institutional Investment

Large institutional investors are increasingly embracing Bitcoin, significantly impacting its price. This institutional Bitcoin adoption represents a major shift in the cryptocurrency landscape.

- Examples: BlackRock's recent application for a spot Bitcoin ETF, coupled with other major financial institutions increasing their Bitcoin holdings, demonstrates a growing acceptance of Bitcoin as a legitimate asset class.

- Impact: The influx of capital from institutional investors provides significant buying pressure, pushing the Bitcoin price higher and adding stability to the market. This contrasts sharply with earlier years dominated by individual investors. Hedge fund Bitcoin holdings are also becoming increasingly significant. Corporate Bitcoin investment is another factor driving the surge.

Regulatory Clarity and Acceptance

Positive regulatory developments in several regions are bolstering investor confidence and contributing to the Bitcoin price explosion.

- Examples: While regulatory approaches vary globally, some jurisdictions are showing signs of embracing cryptocurrency regulation in a more favorable manner, creating a more predictable environment for investors. This contrasts with regions where regulatory uncertainty remains a major concern.

- Impact: Increased regulatory clarity reduces uncertainty, making Bitcoin a more attractive investment option for risk-averse institutional investors. The Bitcoin legal status in certain jurisdictions is becoming more clearly defined, further boosting confidence.

Growing Demand and Scarcity

Bitcoin's inherent scarcity, coupled with growing demand, is a fundamental driver of its price appreciation. This scarcity is a core feature of Bitcoin's design.

- Statistics: Bitcoin's fixed supply of 21 million coins ensures its scarcity. As more individuals and institutions seek to acquire Bitcoin, this limited supply creates a powerful upward pressure on the price. Network usage statistics show consistent growth, reflecting increased adoption.

- Halving Events: The halving events, which reduce the rate of Bitcoin mining rewards, contribute to the scarcity and have historically been followed by significant price increases. This mechanism built into the Bitcoin protocol is a crucial factor in its long-term price appreciation.

Technological Advancements

Advancements in Bitcoin technology are enhancing its scalability, usability, and overall appeal.

- Lightning Network: The Lightning Network is a second-layer scaling solution that allows for faster and cheaper Bitcoin transactions, improving the user experience. This is a key example of Bitcoin technology upgrades.

- Impact: These improvements attract more users and facilitate broader adoption, further increasing the demand and contributing to the Bitcoin price surge. Bitcoin scalability remains a critical issue, and advancements help to address these concerns.

Analyzing the $100,000 Milestone and Potential Future Trajectory

Reaching the $100,000 mark represents a significant milestone for Bitcoin, but what lies ahead?

Technical Analysis and Price Predictions

Technical indicators suggest continued upward momentum, but forecasts vary significantly.

- Key Indicators: Analyzing Bitcoin chart analysis, technical indicators such as moving averages and relative strength index (RSI) can provide insights into potential price movements. However, these are not foolproof.

- Price Predictions: Various analysts offer Bitcoin price predictions ranging from further substantial gains to more conservative estimates. It is crucial to remember that these are predictions, not guarantees, and involve significant risk. A careful Bitcoin price prediction should always consider market volatility and underlying factors.

Market Volatility and Risk Assessment

Despite the recent surge, it’s crucial to remember that the cryptocurrency market is inherently volatile.

- Risks: Investing in Bitcoin carries significant risk. Price fluctuations can be dramatic, and the market is susceptible to external factors, such as regulatory changes and macroeconomic conditions. Bitcoin investment risks should never be underestimated.

- Diversification: Diversification is essential to mitigate risk. Don’t put all your eggs in one basket.

Conclusion: Navigating the Bitcoin Price Explosion – What's Next?

The Bitcoin price explosion to near $100,000 is driven by a combination of institutional adoption, regulatory clarity, growing demand, and technological advancements. However, understanding the risks associated with Bitcoin investment is paramount. Learn more about the Bitcoin price surge and stay updated on the latest Bitcoin news to make informed decisions. Understand the risks and rewards of investing in Bitcoin before making any commitments. The Bitcoin price explosion is a significant event, but understanding the market dynamics is crucial before making any investment decisions.

Featured Posts

-

Zyadt Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae Tfasyl Jdydt

May 07, 2025

Zyadt Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae Tfasyl Jdydt

May 07, 2025 -

Harvard President On Trump Attacks The Fight Came To Me

May 07, 2025

Harvard President On Trump Attacks The Fight Came To Me

May 07, 2025 -

Anthony Edwards And The Baby Mama Drama What We Know

May 07, 2025

Anthony Edwards And The Baby Mama Drama What We Know

May 07, 2025 -

Timberwolves Fans And Julius Randle A Relationship Redefined

May 07, 2025

Timberwolves Fans And Julius Randle A Relationship Redefined

May 07, 2025 -

Why Powells Fed Risks Delaying Interest Rate Cuts Trumps Demands And Economic Considerations

May 07, 2025

Why Powells Fed Risks Delaying Interest Rate Cuts Trumps Demands And Economic Considerations

May 07, 2025