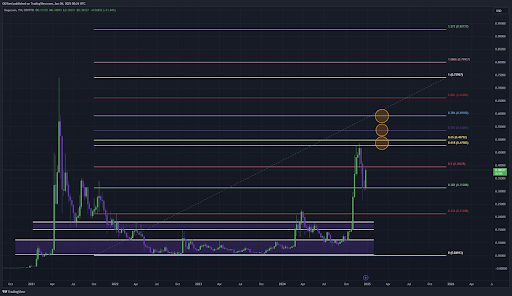

Bitcoin Price Prediction: 1,500% Growth In 5 Years?

Table of Contents

Factors Suggesting Potential for Significant Bitcoin Growth:

Increasing Institutional Adoption

The growing acceptance of Bitcoin as a legitimate asset class by institutional investors is a significant factor influencing the Bitcoin price forecast. This institutional adoption of Bitcoin is driving demand and potentially increasing price stability.

- Grayscale Bitcoin Trust holdings: Grayscale's substantial Bitcoin holdings demonstrate institutional confidence in the asset.

- MicroStrategy's Bitcoin investment: MicroStrategy's significant Bitcoin investment serves as a powerful endorsement for other corporations.

- Other corporate adoption examples: Many other companies, from Tesla to Square, have embraced Bitcoin, further legitimizing it in the financial world.

- Impact on price stability and demand: This influx of institutional capital helps stabilize the market and significantly increases demand, pushing the Bitcoin price higher.

Growing Global Adoption and Demand

Expanding global adoption and increased demand are crucial elements in any Bitcoin price prediction. The more people use Bitcoin, the higher the price is likely to go.

- Expansion into emerging markets: Bitcoin's adoption in emerging markets with unstable currencies offers significant growth potential.

- Increased merchant adoption: A growing number of merchants are accepting Bitcoin as payment, enhancing its practicality and driving demand.

- Use cases beyond speculation: Bitcoin's use extends beyond speculation; its use in remittances and other financial transactions further bolsters its value proposition.

Limited Supply and Halving Events

Bitcoin's inherent scarcity is a major driver of its value. The limited supply and the periodic halving events contribute significantly to the long-term Bitcoin price prediction.

- Bitcoin's fixed supply of 21 million: This hard cap creates scarcity, a fundamental economic principle influencing price appreciation.

- Upcoming halving events: Halving events reduce the rate of new Bitcoin creation, further increasing scarcity and potentially driving up the price.

- Impact on inflation and scarcity: The limited supply contrasts sharply with inflationary fiat currencies, making Bitcoin an attractive hedge against inflation.

Technological Advancements

Technological advancements enhance Bitcoin's scalability, usability, and overall appeal, positively influencing the Bitcoin price forecast.

- Layer-2 scaling solutions (Lightning Network): These solutions drastically improve transaction speeds and reduce fees, making Bitcoin more practical for everyday use.

- Improved transaction speeds: Faster transactions are essential for wider adoption and increased usage.

- Reduced fees: Lower transaction fees make Bitcoin more accessible and competitive with traditional payment systems.

Factors That Could Limit Bitcoin's Growth:

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty and potential government intervention pose significant challenges to the Bitcoin price prediction.

- Varying regulatory landscapes across countries: Different countries have different regulatory approaches to cryptocurrencies, creating uncertainty and potentially hindering adoption.

- Potential for bans or heavy restrictions: Government bans or heavy restrictions could severely impact Bitcoin's price and accessibility.

Competition from Other Cryptocurrencies

The cryptocurrency market is highly competitive. The emergence of altcoins could affect Bitcoin's dominance and its future price.

- Emergence of altcoins: New cryptocurrencies with innovative features could attract investors and divert attention from Bitcoin.

- Competition for market share: Bitcoin faces competition for market share and investor interest from a growing number of alternative cryptocurrencies.

- Potential for disruptive technologies: Disruptive technologies in other cryptocurrencies could challenge Bitcoin's position.

Market Volatility and Economic Downturns

Bitcoin's price is highly volatile and susceptible to macroeconomic factors, impacting the Bitcoin price prediction.

- Correlation with traditional markets: Bitcoin's price is often correlated with traditional markets, making it vulnerable to economic downturns.

- Susceptibility to macroeconomic factors: Global economic events and shifts can significantly impact Bitcoin's price.

- Potential for sharp price corrections: The cryptocurrency market is known for its sharp price corrections, which can lead to substantial losses.

Security Concerns and Hacking Risks

Security breaches and hacking incidents can significantly affect user confidence and thus impact the Bitcoin price forecast.

- Exchange hacks: High-profile exchange hacks can erode user trust and negatively impact Bitcoin's price.

- Vulnerabilities in wallets and software: Security vulnerabilities in wallets and software can lead to theft and loss of funds.

- Potential impact on user confidence: Security concerns can discourage new users and potentially lead to price drops.

Conclusion:

While a 1,500% increase in Bitcoin's price over five years is a bold prediction, various factors suggest the possibility of significant growth. However, substantial risks and uncertainties remain. Institutional adoption, expanding global demand, and technological advancements all contribute to a potential bullish outlook. Conversely, regulatory hurdles, competition, market volatility, and security concerns present significant challenges. The Bitcoin price prediction remains inherently uncertain.

Call to Action: Conduct thorough research, understand the inherent risks, and only invest what you can afford to lose before making any decisions regarding Bitcoin investment. Further research into Bitcoin price prediction and cryptocurrency market analysis is crucial for informed decision-making. Stay updated on the latest news and analysis surrounding Bitcoin price prediction to make smart investment choices. Remember, this is not financial advice.

Featured Posts

-

Xrp Price Surge 400 Increase Is Now The Time To Buy

May 08, 2025

Xrp Price Surge 400 Increase Is Now The Time To Buy

May 08, 2025 -

Bitcoin Madenciligi Son Durak Mi

May 08, 2025

Bitcoin Madenciligi Son Durak Mi

May 08, 2025 -

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025 -

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025 -

Colin Cowherd Doubles Down Is Jayson Tatum Underrated Or Overrated

May 08, 2025

Colin Cowherd Doubles Down Is Jayson Tatum Underrated Or Overrated

May 08, 2025