Bitcoin Rally Imminent? Analyst's May 6th Chart Analysis

Table of Contents

Key Technical Indicators Suggesting a Bitcoin Rally

Several key technical indicators point towards a potential Bitcoin rally. Understanding these signals is crucial for informed investment decisions.

Breaking Resistance Levels

Recent Bitcoin price action has shown a decisive break above several significant resistance levels, a bullish sign for many analysts.

- $28,000 Breakthrough: The recent break above the $28,000 resistance level was accompanied by substantial volume, confirming the strength of the move and suggesting a potential shift in market sentiment. This level had acted as a strong barrier for several weeks, indicating significant selling pressure previously overcome.

- Confirmation from Chart Patterns: Some chart patterns, such as a breakout from a symmetrical triangle, further support this upward momentum. These patterns, visible on various Bitcoin price charts, provide further confirmation of the potential for a continued rally.

- Increased Trading Volume: The increased trading volume accompanying these breakthroughs signifies strong conviction from buyers and reinforces the likelihood of sustained upward pressure.

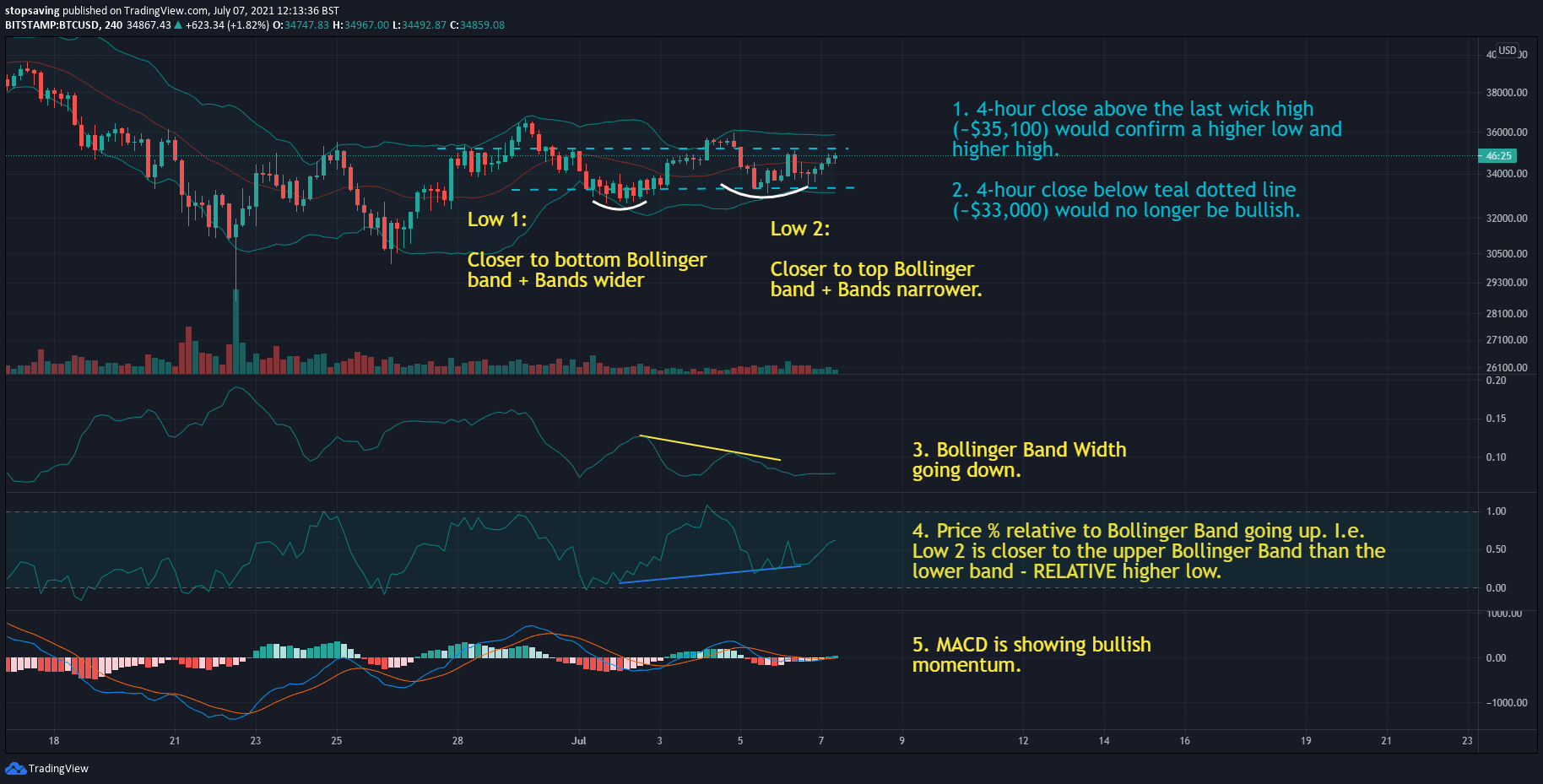

Positive RSI and MACD Readings

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are showing positive signals.

- RSI Above 50: The RSI, a momentum oscillator, moving above the 50 level indicates growing buying pressure and suggests that the upward trend is gaining strength. A reading above 70 often indicates overbought conditions, but within the context of other positive signals, it can still signal further potential gains.

- Bullish MACD Crossover: A bullish MACD crossover, where the MACD line crosses above the signal line, is another positive indicator, suggesting a potential acceleration of the upward trend. This signal confirms the bullish momentum indicated by the RSI.

- Historical Context: While these indicators are positive, it’s important to compare current readings to historical context. Comparing to previous bull runs can help assess the significance of the current signals within a broader market perspective.

On-Chain Metrics Showing Accumulation

On-chain data further supports the possibility of an upcoming Bitcoin rally.

- Decreasing Exchange Balances: The decrease in Bitcoin held on exchanges suggests that investors are accumulating Bitcoin, indicating long-term bullish sentiment. Less Bitcoin available on exchanges means less readily available supply to sell, creating upward price pressure.

- Miner Behavior: Analyzing miner behavior, such as hash rate and mining profitability, provides insights into the health of the network and overall market sentiment. Stable or increasing metrics generally reflect positive market conditions.

- Network Activity: Increased network activity, measured by transaction volume and other on-chain metrics, suggests growing adoption and user engagement, further bolstering the potential for price appreciation.

Analyst's May 6th Chart Analysis: Specific Predictions and Rationale

A leading analyst's May 6th chart analysis provides specific predictions and rationale for a potential Bitcoin rally.

Price Targets and Timeframes

The analyst projects several price targets and timeframes for the potential Bitcoin rally.

- $35,000 Target: The analyst predicts Bitcoin could reach $35,000 within the next month, based on the confluence of the technical and on-chain indicators discussed above.

- Further Potential: Some analysts even suggest further potential gains beyond $35,000, dependent on various factors such as regulatory clarity and broader market sentiment. The $40,000 level could be the next significant resistance point.

- Timeframe Considerations: The timeframe for reaching these targets remains uncertain, with potential variations due to market volatility and unforeseen events. However, the analyst's analysis suggests a potential timeline within the coming weeks or months.

Potential Catalysts for the Rally

Several potential catalysts could accelerate a Bitcoin price surge.

- Positive Regulatory News: Favorable regulatory developments in key jurisdictions, particularly the United States, could significantly boost investor confidence and drive price increases. Clarity regarding regulation often leads to increased institutional adoption.

- Increased Institutional Adoption: Continued adoption of Bitcoin by institutional investors, such as corporations and hedge funds, can significantly influence price movements. This often involves large-scale purchases, pushing prices higher.

- Macroeconomic Factors: Changes in macroeconomic conditions, such as inflation or economic uncertainty, can impact investor appetite for risk assets like Bitcoin. A flight to safety might drive Bitcoin adoption.

- Technological Developments: Significant technological developments within the Bitcoin ecosystem, such as upgrades to the Lightning Network or advancements in scalability solutions, could also drive increased demand.

Risks and Considerations

While the outlook is optimistic, potential downsides and risks should be considered.

- Market Volatility: The cryptocurrency market remains highly volatile, and sudden price drops are possible even amidst a bullish trend. Risk management strategies are essential.

- Regulatory Uncertainty: Regulatory uncertainty persists in many jurisdictions, and negative regulatory developments could significantly impact Bitcoin's price. Keeping abreast of regulatory changes is vital.

- Macroeconomic Headwinds: Unforeseen macroeconomic headwinds, such as a global recession, could negatively affect the price of Bitcoin, alongside other risk assets.

Investment Strategies for a Potential Bitcoin Rally

Several investment strategies can help investors navigate a potential Bitcoin rally.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a risk-mitigation strategy involving investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of investing a large sum at a market peak.

Setting Stop-Loss Orders

Setting stop-loss orders is crucial for risk management. A stop-loss order automatically sells your Bitcoin if the price falls to a predetermined level, limiting potential losses.

Diversification

Diversification is key to managing risk. Don't put all your investment eggs in one basket; diversify across various cryptocurrencies and other asset classes to mitigate risk.

Conclusion

This analysis of the analyst's May 6th Bitcoin chart reveals several indicators suggesting a potential imminent rally. Positive technical signals, on-chain data suggesting accumulation, and potential catalysts all contribute to a bullish outlook. However, it is crucial to remember the inherent volatility of the cryptocurrency market.

Call to Action: While a Bitcoin rally isn't guaranteed, the analysis presented provides valuable insights for investors. Stay informed about the latest Bitcoin price prediction and chart analysis to make well-informed decisions in this dynamic market. Continue to monitor Bitcoin price movements and learn more about Bitcoin chart analysis to make informed investment choices. Don't miss out on the potential of a Bitcoin rally – stay informed and strategize effectively.

Featured Posts

-

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025 -

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025 -

Ps 5 Pro Sales Figures Compared To The Ps 4 Pro What The Data Reveals

May 08, 2025

Ps 5 Pro Sales Figures Compared To The Ps 4 Pro What The Data Reveals

May 08, 2025 -

Ripples Xrp Sees Sharp Increase After Presidential Article On Trump Effect

May 08, 2025

Ripples Xrp Sees Sharp Increase After Presidential Article On Trump Effect

May 08, 2025 -

Bitcoin Rebound A New Bull Market Or Temporary Surge

May 08, 2025

Bitcoin Rebound A New Bull Market Or Temporary Surge

May 08, 2025