Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Price Rebound

To assess the potential for a sustained Bitcoin bull run, a comprehensive analysis is crucial. This involves examining both technical and fundamental indicators.

Bitcoin Technical Analysis

Technical analysis focuses on chart patterns and indicators to predict future price movements. Let's examine some key indicators:

-

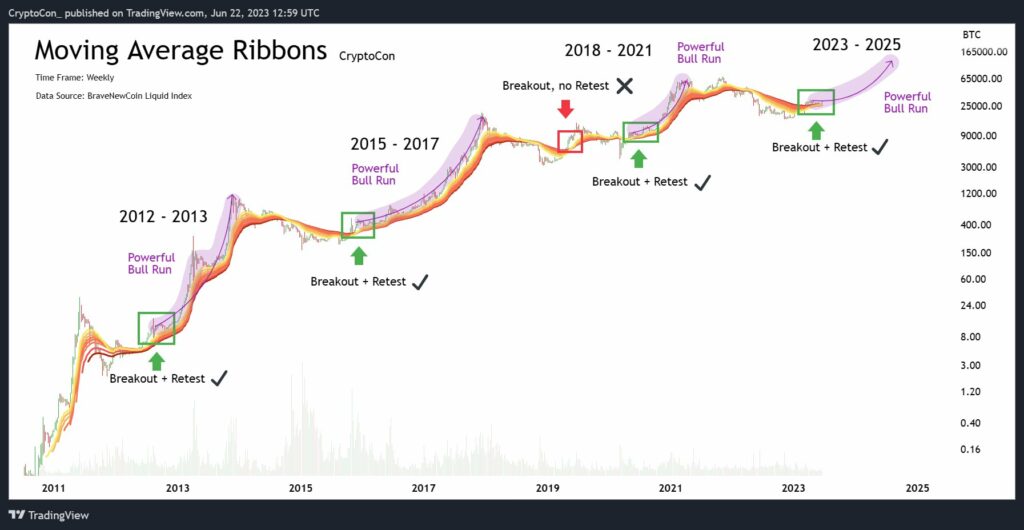

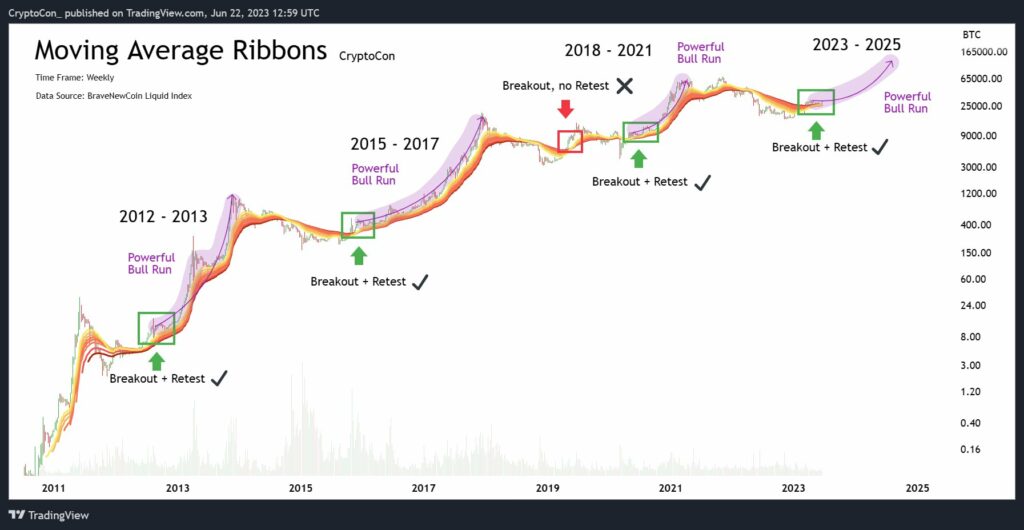

Moving Averages: The 50-day and 200-day moving averages are often used to identify trends. A bullish crossover (50-day crossing above the 200-day) could signal a strengthening uptrend. Analyzing these Bitcoin charts is vital for gauging momentum.

-

RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 might suggest the market is overbought, hinting at a potential correction, while a reading below 30 could signal an oversold market, potentially indicating a buying opportunity.

-

MACD (Moving Average Convergence Divergence): The MACD helps identify changes in momentum. A bullish signal occurs when the MACD line crosses above the signal line. The interplay of these signals within the Bitcoin chart provides crucial insights.

-

Support and Resistance Levels: Identifying significant support and resistance levels on the Bitcoin chart is essential. A break above a key resistance level could confirm a bullish breakout, while a fall below a support level could indicate a potential price decline.

[Insert a relevant Bitcoin price chart here showing key indicators.]

Bitcoin Fundamental Analysis

Fundamental analysis considers macroeconomic factors and underlying market dynamics to assess Bitcoin's intrinsic value. Several elements influence Bitcoin's price:

-

Institutional Adoption: The growing involvement of institutional investors, such as hedge funds and asset managers, is a significant factor. Their large-scale investments can inject substantial liquidity into the Bitcoin market, driving price appreciation.

-

Regulatory Developments: Changes in regulatory frameworks globally impact Bitcoin's price. Favorable regulations can boost investor confidence, while stricter rules can dampen enthusiasm.

-

Network Upgrades: Technological advancements and network upgrades enhance Bitcoin's scalability and efficiency, potentially increasing its appeal and driving demand.

-

Macroeconomic Factors: Global macroeconomic conditions, such as inflation and interest rates, significantly influence investor sentiment and risk appetite, thereby affecting Bitcoin's price. Inflation often drives investors toward Bitcoin as a hedge against inflation.

Factors that Could Fuel a Bitcoin Bull Run

Several factors could contribute to a sustained Bitcoin bull run:

Increased Institutional Interest

The growing interest from institutional investors is a key catalyst. More and more large financial institutions are allocating assets to Bitcoin, recognizing its potential as a diversifier within their portfolios. This includes:

-

Bitcoin ETFs: The approval of a Bitcoin exchange-traded fund (ETF) in major markets would likely trigger a significant influx of institutional investment.

-

Hedge Fund Bitcoin Investment: The increasing number of hedge funds incorporating Bitcoin into their strategies shows growing confidence in the asset's long-term potential.

Growing Global Adoption

The expanding global adoption of Bitcoin as a payment method and store of value is another vital factor. This includes:

-

Bitcoin Adoption Rate: Countries with higher Bitcoin adoption rates signal increasing mainstream acceptance.

-

Bitcoin Payment: The increasing use of Bitcoin for payments and transactions indicates growing confidence in its usability.

-

Bitcoin as a Store of Value: Bitcoin's perceived value as a store of value, especially amidst economic uncertainty, fuels demand.

Potential Risks and Challenges

Despite the positive indicators, several risks and challenges could hinder a sustained Bitcoin bull run:

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains fluid and uncertain. Governments worldwide are still grappling with how to regulate Bitcoin and other cryptocurrencies. This uncertainty creates risks:

-

Bitcoin Regulation: Unfavorable regulations could suppress market activity and negatively impact Bitcoin's price.

-

Crypto Regulation: Overly restrictive regulations could hinder innovation and adoption.

Market Volatility

The cryptocurrency market is inherently volatile. Sharp price corrections are a common occurrence, and investors need to be prepared for significant price swings.

-

Bitcoin Volatility: Bitcoin's price is notoriously volatile, often experiencing substantial daily fluctuations.

-

Cryptocurrency Market Volatility: The entire cryptocurrency market is susceptible to sharp corrections driven by various factors including regulatory changes, market sentiment, and broader economic conditions. Risk management strategies are essential.

Conclusion: Is a Bitcoin Bull Run Imminent? Your Next Steps

Whether this Bitcoin rebound signals the start of a new bull run remains to be seen. While technical and fundamental analyses suggest a potential for further growth, significant risks and challenges persist, particularly concerning regulatory uncertainty and market volatility. Understanding the Bitcoin rebound is crucial for navigating this dynamic market. The growing institutional interest and global adoption point towards a potentially bullish future, but investors must also carefully consider the inherent volatility and regulatory risks. Learn more about Bitcoin investing and monitor the Bitcoin market closely before making any investment decisions. Conduct thorough research, manage your risk effectively, and stay informed about market trends and developments. The potential rewards of the Bitcoin rebound are substantial, but so are the risks. Informed decision-making is paramount.

Featured Posts

-

The Trump Media And Crypto Com Etf Partnership What It Means For Investors

May 08, 2025

The Trump Media And Crypto Com Etf Partnership What It Means For Investors

May 08, 2025 -

Bitcoin Golden Cross Flash Implications And Trading Strategies

May 08, 2025

Bitcoin Golden Cross Flash Implications And Trading Strategies

May 08, 2025 -

Antisemitic Incidents Prompt Investigation At Boeings Seattle Campus

May 08, 2025

Antisemitic Incidents Prompt Investigation At Boeings Seattle Campus

May 08, 2025 -

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Fyslh Awr Wzart Qanwn Ka Nwtyfkyshn

May 08, 2025

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Fyslh Awr Wzart Qanwn Ka Nwtyfkyshn

May 08, 2025 -

20 M Xrp Purchased Whale Activity Signals Potential Price Surge

May 08, 2025

20 M Xrp Purchased Whale Activity Signals Potential Price Surge

May 08, 2025