Bitcoin's 10x Multiplier: A Realistic Possibility?

Table of Contents

Historical Bitcoin Price Performance and Growth Cycles

Bitcoin's history is marked by dramatic price swings, characterized by distinct bull and bear markets. Understanding these cycles is crucial for assessing the possibility of a 10x multiplier. Analyzing past performance provides valuable insights, although it's important to remember that past performance is not indicative of future results.

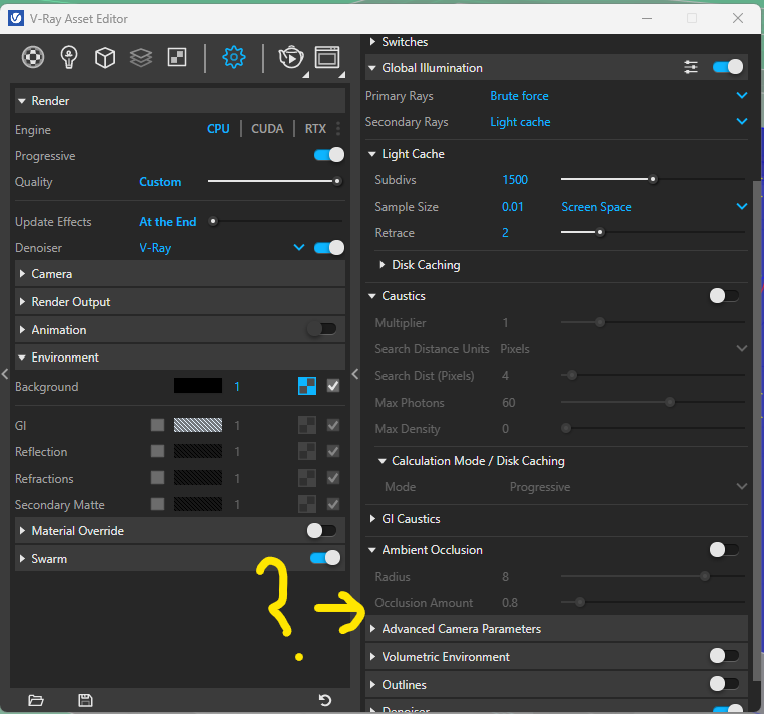

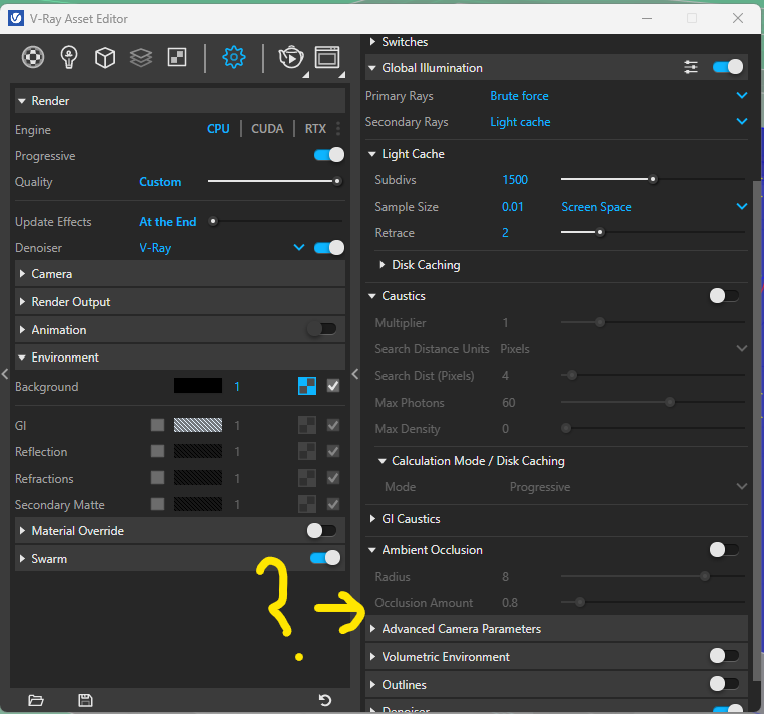

(Insert chart or graph depicting Bitcoin's price history, clearly showing bull and bear cycles.)

-

Analysis of previous halving events and their impact on Bitcoin's price: Bitcoin's supply is halved approximately every four years, a process known as "halving." Historically, halving events have been followed by significant price increases, due to reduced supply and increased scarcity. This suggests a potential correlation between halvings and bull runs.

-

Comparison of previous bull run durations and potential for a similar trajectory: Previous bull runs have varied in length and intensity. Comparing the duration and magnitude of past bull markets can help estimate the potential timeline and extent of a future surge. However, external factors can significantly alter these trajectories.

-

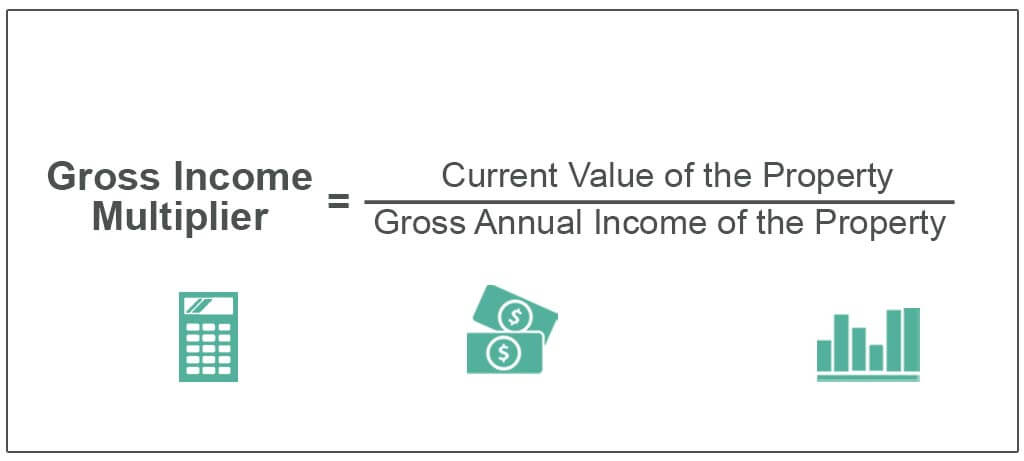

Consideration of market capitalization and its relationship to price appreciation: Bitcoin's market capitalization is a key indicator of its overall value. A 10x multiplier would require a substantial increase in market cap, implying broader adoption and increased investor confidence.

Factors that Could Drive a 10x Bitcoin Multiplier

Several factors could potentially fuel a dramatic increase in Bitcoin's price:

Increasing Institutional Adoption

Large financial institutions are increasingly recognizing Bitcoin's potential. This institutional adoption is a significant driver of price appreciation.

-

Examples of major companies investing in or using Bitcoin: Companies like MicroStrategy, Tesla, and Square have made substantial Bitcoin investments, demonstrating growing confidence in the asset.

-

The impact of regulatory clarity (or lack thereof) on institutional investment: Clearer regulatory frameworks could encourage further institutional investment. Conversely, regulatory uncertainty can create hesitancy.

-

The role of Bitcoin ETFs in increasing accessibility and investment: The approval of Bitcoin exchange-traded funds (ETFs) would significantly increase accessibility for mainstream investors, potentially boosting demand and driving price appreciation.

Global Economic Uncertainty and Safe-Haven Demand

Global economic instability can increase demand for safe-haven assets, including Bitcoin. Its decentralized nature and limited supply make it an attractive alternative to traditional assets.

-

Analysis of macroeconomic trends and their influence on Bitcoin's price: Periods of high inflation or economic uncertainty often see increased investment in Bitcoin as a hedge against risk.

-

Discussion of Bitcoin's characteristics as a decentralized, scarce asset: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset, potentially protecting against inflation.

-

Comparison with traditional safe-haven assets like gold: Bitcoin is often compared to gold, but its potential for higher returns makes it an appealing alternative for some investors.

Technological Advancements and Network Upgrades

Continuous development and upgrades to the Bitcoin network enhance its functionality and scalability, potentially driving wider adoption.

-

The Lightning Network and its potential to enhance scalability and transaction speed: The Lightning Network aims to address Bitcoin's scalability issues, enabling faster and cheaper transactions.

-

Taproot upgrade and its impact on transaction privacy and efficiency: The Taproot upgrade improved transaction privacy and efficiency, making Bitcoin more attractive to users.

-

Future developments and their potential influence on Bitcoin's adoption and value: Ongoing development and innovation will continue to shape Bitcoin's future and potentially contribute to price increases.

Challenges and Risks to a 10x Bitcoin Multiplier

Despite the potential for significant growth, several challenges and risks could hinder a 10x Bitcoin price increase:

Regulatory Scrutiny and Government Intervention

Government regulations play a crucial role in shaping the cryptocurrency landscape. Stricter regulations could significantly impact Bitcoin's price.

-

Discussion of varying regulatory approaches across different countries: Different countries have adopted diverse regulatory approaches, creating uncertainty and potentially hindering growth in some regions.

-

Potential for stricter regulations hindering Bitcoin's growth: Increased regulatory scrutiny could limit Bitcoin's adoption and potentially suppress its price.

-

Impact of taxation policies on Bitcoin ownership and trading: Taxation policies surrounding Bitcoin can influence investor behavior and investment decisions.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile, prone to significant price swings and corrections.

-

Historical examples of Bitcoin price crashes and corrections: Bitcoin's history includes several instances of sharp price drops, highlighting the risk of investing in this volatile asset.

-

Factors that contribute to market volatility (e.g., news events, market sentiment): News events, regulatory announcements, and changing market sentiment can trigger significant price fluctuations.

-

Risk management strategies for investors: Investors should employ appropriate risk management strategies, such as diversification and careful position sizing, to mitigate potential losses.

Conclusion

A 10x Bitcoin multiplier presents a significant potential for substantial gains, driven by factors such as increased institutional adoption, growing safe-haven demand, and ongoing technological advancements. However, significant risks remain, including regulatory uncertainty, market volatility, and the potential for sharp price corrections. While the possibility of a 10x Bitcoin multiplier is not guaranteed, understanding the potential drivers and risks is crucial for informed investment decisions. Continue researching the factors influencing Bitcoin's price and stay informed about market trends to make educated choices regarding your Bitcoin investment strategy. Further explore the potential of a Bitcoin 10x multiplier by conducting your own thorough research.

Featured Posts

-

Analysis Trump Media Crypto Com Etf Partnership And The Rise Of Cro

May 08, 2025

Analysis Trump Media Crypto Com Etf Partnership And The Rise Of Cro

May 08, 2025 -

A Look Back The Best Krypto Stories Ever Written

May 08, 2025

A Look Back The Best Krypto Stories Ever Written

May 08, 2025 -

Bitcoins 10x Multiplier Could It Shock Wall Street

May 08, 2025

Bitcoins 10x Multiplier Could It Shock Wall Street

May 08, 2025 -

Arsenals Dembele Concerns Latest Injury News And Impact On Artetas Team

May 08, 2025

Arsenals Dembele Concerns Latest Injury News And Impact On Artetas Team

May 08, 2025 -

Andor Season 1 Where To Watch Episodes Online

May 08, 2025

Andor Season 1 Where To Watch Episodes Online

May 08, 2025