Bitcoin's (BTC) Rise: Analyzing The Influence Of Trade And Monetary Policy

Table of Contents

Bitcoin as a Hedge Against Inflation and Monetary Instability

The meteoric rise of Bitcoin (BTC) is partly attributed to its perceived role as a hedge against inflation and monetary instability. This perception stems from several factors, deeply intertwined with global macroeconomic trends.

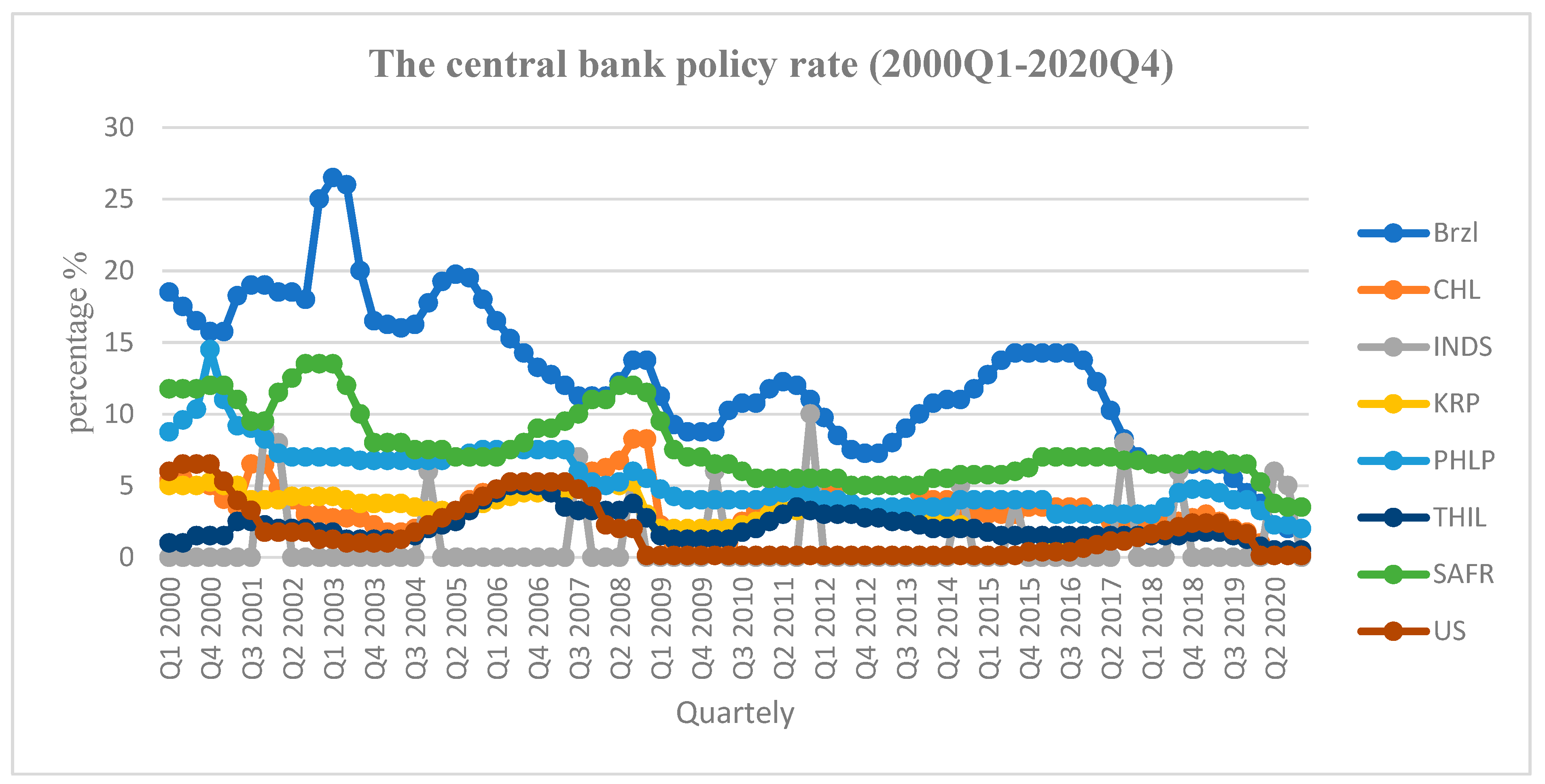

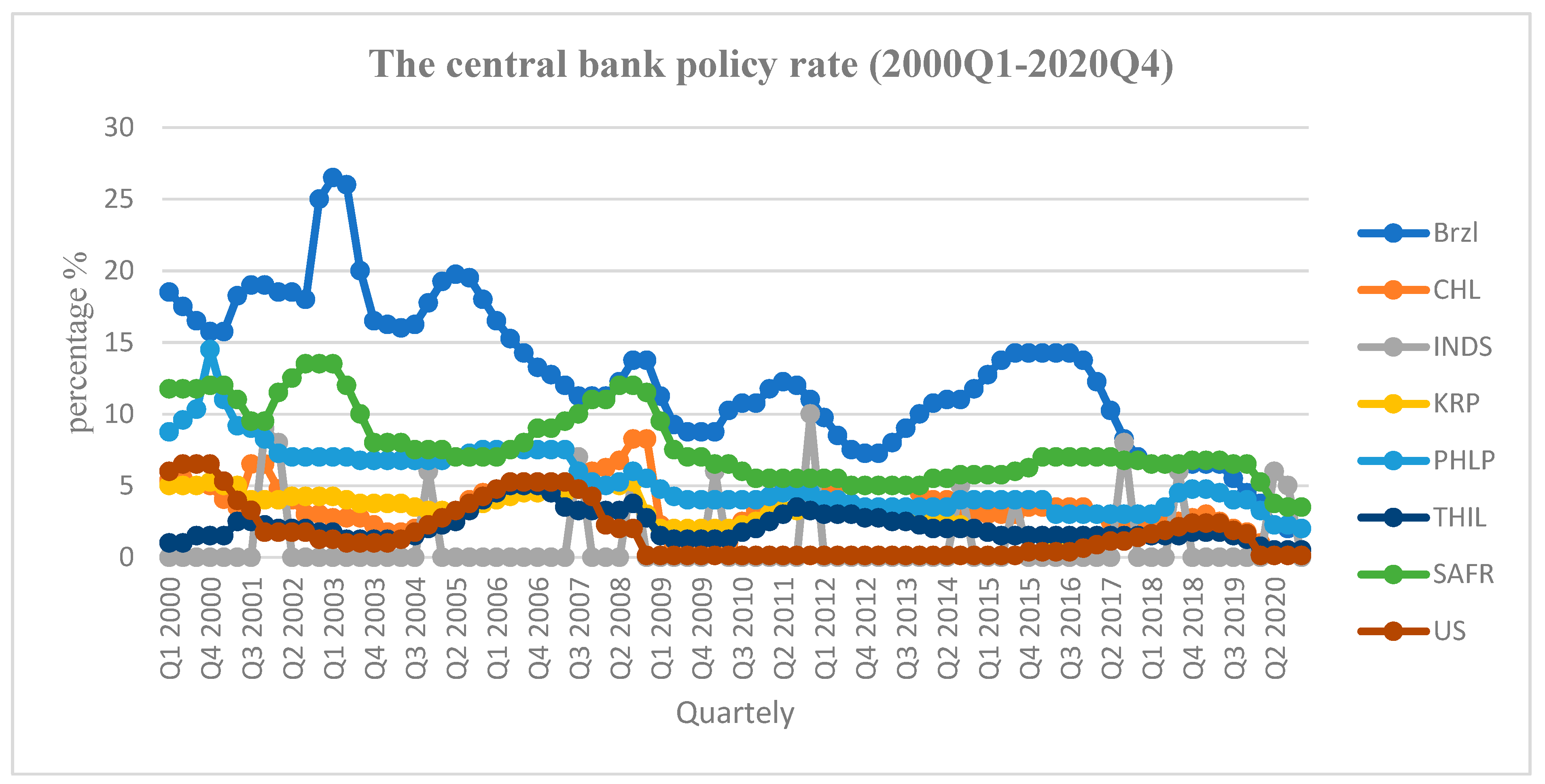

The Role of Central Bank Policies

Expansionary monetary policies, such as quantitative easing (QE), implemented by central banks worldwide have led to concerns about inflation. QE, a tool used to inject liquidity into the economy, often results in an increased money supply, potentially devaluing existing currencies. This devaluation encourages investors to seek alternative assets that hold their value, driving demand for Bitcoin.

- Devaluation of Fiat Currencies: The devaluation of fiat currencies, such as the US dollar or the Euro, directly increases the relative value of Bitcoin, making it an attractive investment option.

- High Inflation and Bitcoin Adoption: Countries experiencing high inflation rates, such as Venezuela and Argentina, have witnessed a significant increase in Bitcoin adoption as citizens seek to preserve their purchasing power.

- Limited Supply: Bitcoin's inherent scarcity, capped at 21 million coins, further fuels its appeal as an inflation hedge. Unlike fiat currencies, which can be printed at will, Bitcoin's finite supply makes it a potentially deflationary asset.

Bitcoin's Decentralized Nature and Resistance to Government Control

Bitcoin's decentralized nature is another crucial factor contributing to its appeal. Unlike traditional financial systems controlled by central banks and governments, Bitcoin operates on a peer-to-peer network, making it resistant to censorship and manipulation.

- Immutable Blockchain: Bitcoin transactions are recorded on a public, immutable blockchain, ensuring transparency and preventing fraudulent alterations.

- Asset Outside Central Bank Control: This decentralization appeals to investors seeking assets outside the direct control of governments and central banks, offering protection against potential financial crises or political instability.

- Safe Haven Asset: In times of political or economic uncertainty, Bitcoin's decentralized nature positions it as a potential safe haven asset, attracting investors seeking to preserve their wealth.

Bitcoin's Growing Role in International Trade and Remittances

Bitcoin's increasing adoption extends beyond investment to its role in facilitating international trade and remittances. Its efficiency and transparency offer advantages over traditional payment systems.

Facilitating Cross-Border Transactions

Bitcoin offers a faster, cheaper, and more transparent alternative to traditional international payment systems, especially for remittances.

- Reduced Reliance on Intermediaries: Bitcoin reduces reliance on intermediaries like banks and payment processors, streamlining the transaction process.

- Lower Transaction Fees: Bitcoin transactions typically involve significantly lower fees compared to traditional international wire transfers.

- Examples of Bitcoin Use: Several companies and individuals are already using Bitcoin for international payments, demonstrating its growing practical application.

The Impact on Global Trade Flows

The increasing acceptance of Bitcoin as a payment method could reshape global trade patterns, potentially reducing reliance on traditional financial institutions.

- Increased Efficiency and Reduced Costs: Bitcoin's efficiency could lead to increased efficiency and reduced costs in international commerce.

- Regulatory Uncertainty and Volatility: However, challenges remain, including regulatory uncertainty and the inherent volatility of the Bitcoin market.

- Future Developments: The future role of Bitcoin in global trade is a topic of ongoing discussion and research, with potential for significant growth.

Regulatory Developments and Their Impact on Bitcoin's Price

Regulatory developments across different jurisdictions significantly impact Bitcoin's price and adoption rate. The approach taken by governments shapes market sentiment and investor confidence.

Government Regulations and their Influence on Market Sentiment

Varying regulatory approaches influence Bitcoin's price and adoption.

- Favorable Regulations: Countries with relatively favorable Bitcoin regulations often experience increased market activity and price appreciation.

- Restrictive Regulations: Conversely, countries with restrictive regulations often see decreased market activity and potentially lower prices.

- Ongoing Debate: The debate surrounding Bitcoin regulation is ongoing, with different countries adopting various approaches.

The Influence of Institutional Investors

The growing involvement of institutional investors (hedge funds, investment firms) is another crucial factor affecting Bitcoin's price stability and volatility.

- Impact on Market Liquidity: Large-scale institutional investments increase market liquidity and can influence price movements.

- Potential for Long-Term Appreciation: Increased institutional adoption could drive long-term price appreciation.

- Risks of Market Manipulation: However, there are risks associated with institutional investment, including the potential for market manipulation.

Conclusion

Bitcoin's (BTC) rise is a multifaceted phenomenon shaped by monetary policies, global trade dynamics, and regulatory developments. Understanding the interplay of these factors is critical for navigating the cryptocurrency landscape. As monetary policies evolve and Bitcoin's role in international commerce expands, its future remains a subject of intense interest. Further research into the correlation between monetary policy, global trade, and Bitcoin (BTC) adoption is crucial. Stay informed about the latest developments in Bitcoin and its impact on the global financial system to make informed decisions regarding this dynamic asset.

Featured Posts

-

Village Roadshow And Alcon 417 5 Million Deal Officially Approved

Apr 24, 2025

Village Roadshow And Alcon 417 5 Million Deal Officially Approved

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025 -

Bold And The Beautiful April 3 Episode Recap Liams Shocking Collapse

Apr 24, 2025

Bold And The Beautiful April 3 Episode Recap Liams Shocking Collapse

Apr 24, 2025 -

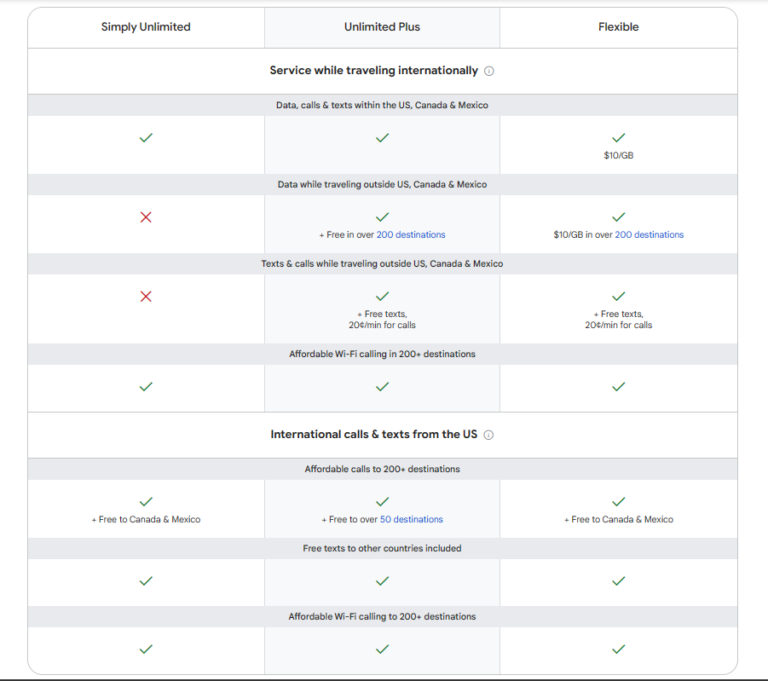

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

Teslas Q1 2024 Financial Results 71 Net Income Decline Explained

Apr 24, 2025

Teslas Q1 2024 Financial Results 71 Net Income Decline Explained

Apr 24, 2025