Bitcoin's Crucial Crossroads: Important Price Levels To Monitor

Table of Contents

Key Support Levels to Watch

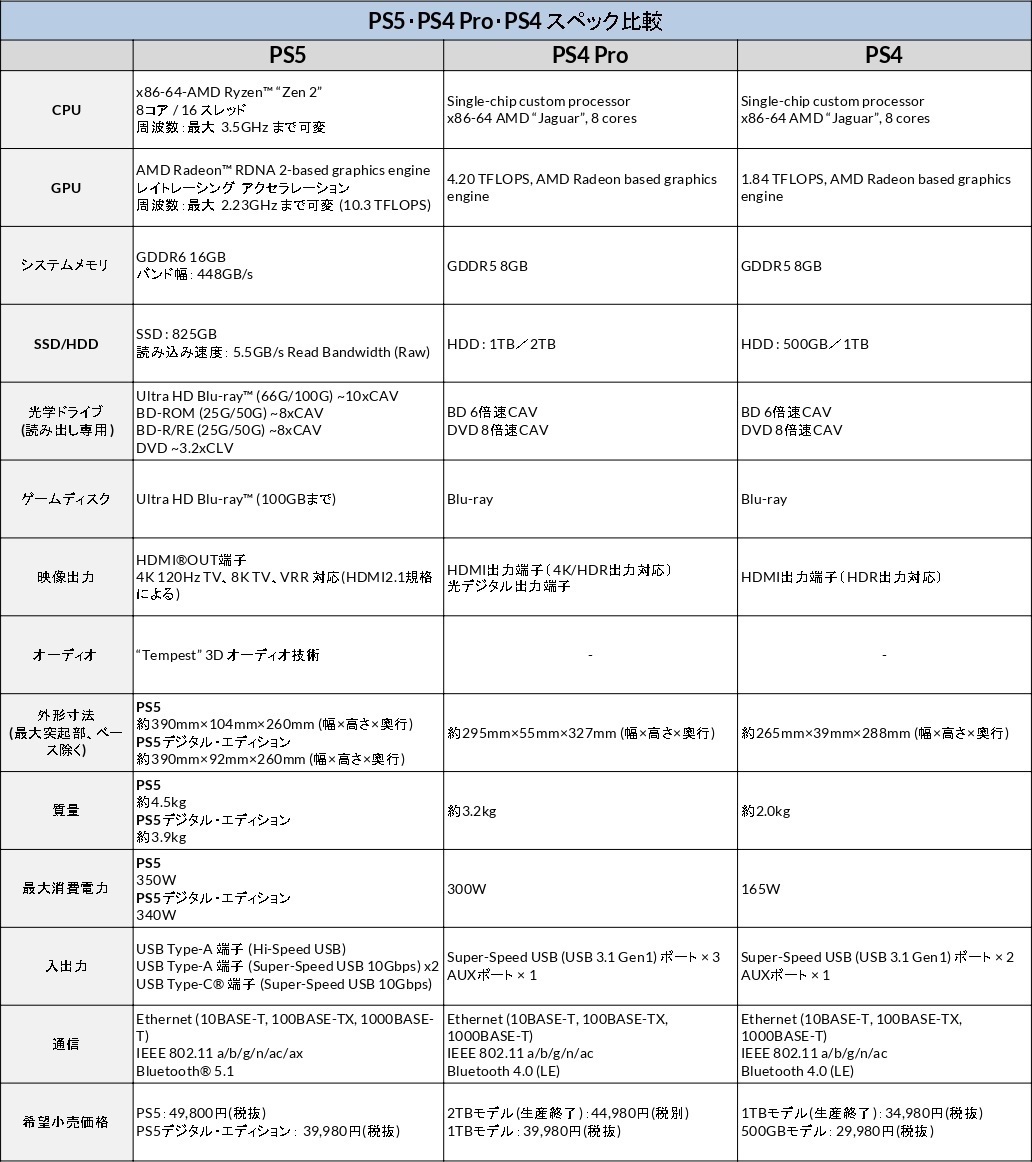

Understanding support levels is crucial for Bitcoin trading. Support levels represent price points where buying pressure is strong enough to prevent further price declines. A break below a significant support level can signal a more substantial downward trend, while holding above it suggests underlying strength. Let's examine some key Bitcoin support levels:

-

Level 1: $20,000: This level holds significant psychological importance. Historically, it has acted as a strong support floor, attracting significant buying interest. Breaching this level could trigger further selling pressure.

-

Level 2: $25,000: This level represents a confluence of support from previous lows and technical indicators. Holding above this level could indicate a potential bullish reversal.

-

Level 3: $28,000: This aligns with a long-term moving average, often a key indicator of underlying trend strength. A break below this level may weaken bullish sentiment.

-

Level 4: $30,000: This significant psychological level has acted as a strong support and resistance in the past. Holding above this level would reinforce the potential for a bullish trend.

[Insert chart or graph illustrating these support levels]

Resistance Levels to Consider

Conversely, resistance levels represent price points where selling pressure is strong enough to prevent further price increases. Breaking through a significant resistance level can signal a potential upward trend, while failing to do so suggests continued bearish pressure. Here are key Bitcoin resistance levels to monitor:

-

Level 1: $35,000: This level has historically acted as a strong resistance, encountering high selling pressure in the past. Breaking above this could be a significant bullish signal.

-

Level 2: $40,000: This psychological barrier represents a significant hurdle for Bitcoin's price. Overcoming this resistance would signal strong bullish momentum.

-

Level 3: $45,000: This level aligns with previous highs, making it a significant resistance point. A decisive break above this level could spark a significant price rally.

-

Level 4: $50,000: This is a major psychological resistance level and represents a significant price target for many investors. Breaking through would confirm very strong bullish momentum.

[Insert chart or graph illustrating these resistance levels]

Indicators to Combine with Price Levels

Analyzing price levels alone is insufficient for a comprehensive understanding of Bitcoin's price movements. Combining them with technical indicators provides a more robust analytical framework.

-

RSI (Relative Strength Index): The RSI helps identify overbought (above 70) and oversold (below 30) conditions, indicating potential price reversals. An overbought RSI at a resistance level suggests a potential pullback, while an oversold RSI at a support level could signal a bounce.

-

MACD (Moving Average Convergence Divergence): The MACD highlights momentum changes, indicating potential trend shifts. Bullish crossovers (MACD line crossing above the signal line) can signal upward momentum, while bearish crossovers suggest downward momentum.

-

Moving Averages (MA): Moving averages, such as the 50-day and 200-day MAs, smooth out price fluctuations and help identify trends. A price breaking above a long-term moving average is generally seen as bullish, while a break below is bearish.

-

Volume Analysis: Analyzing trading volume helps confirm price movements. High volume during a price break confirms the strength of the move, while low volume suggests weak momentum.

Risk Management Strategies

Investing in Bitcoin carries inherent risks. Implementing robust risk management strategies is crucial to protect your capital.

-

Stop-Loss Orders: Stop-loss orders automatically sell your Bitcoin if the price falls to a predetermined level, limiting potential losses. Place these strategically below key support levels.

-

Position Sizing: Determine the appropriate amount to invest based on your risk tolerance and capital. Never invest more than you can afford to lose.

-

Diversification: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

Conclusion

Understanding Bitcoin's crucial crossroads: important price levels to monitor is essential for navigating the cryptocurrency market successfully. By carefully analyzing key support and resistance levels, and combining this analysis with relevant technical indicators, you can develop a more informed trading strategy. Remember, the market is inherently unpredictable, and effective risk management is paramount. Conduct your own thorough research and develop a well-defined trading plan before making any investment decisions. For further reading on technical analysis and risk management in the cryptocurrency market, explore reputable resources dedicated to financial education. Remember, responsible investing is key to navigating the complexities of Bitcoin’s price fluctuations.

Featured Posts

-

Analyzing Ps 5 Pro Sales A Comparison With The Successful Ps 4 Pro Launch

May 08, 2025

Analyzing Ps 5 Pro Sales A Comparison With The Successful Ps 4 Pro Launch

May 08, 2025 -

Pese Yje Te Psg Largohen Nen Drejtimin E Luis Enriques

May 08, 2025

Pese Yje Te Psg Largohen Nen Drejtimin E Luis Enriques

May 08, 2025 -

5 0 355 3

May 08, 2025

5 0 355 3

May 08, 2025 -

Analysis Uber Stock And The Promise And Peril Of Robotaxis

May 08, 2025

Analysis Uber Stock And The Promise And Peril Of Robotaxis

May 08, 2025 -

Star Wars Andor Book Scrapped The Impact Of Ai

May 08, 2025

Star Wars Andor Book Scrapped The Impact Of Ai

May 08, 2025