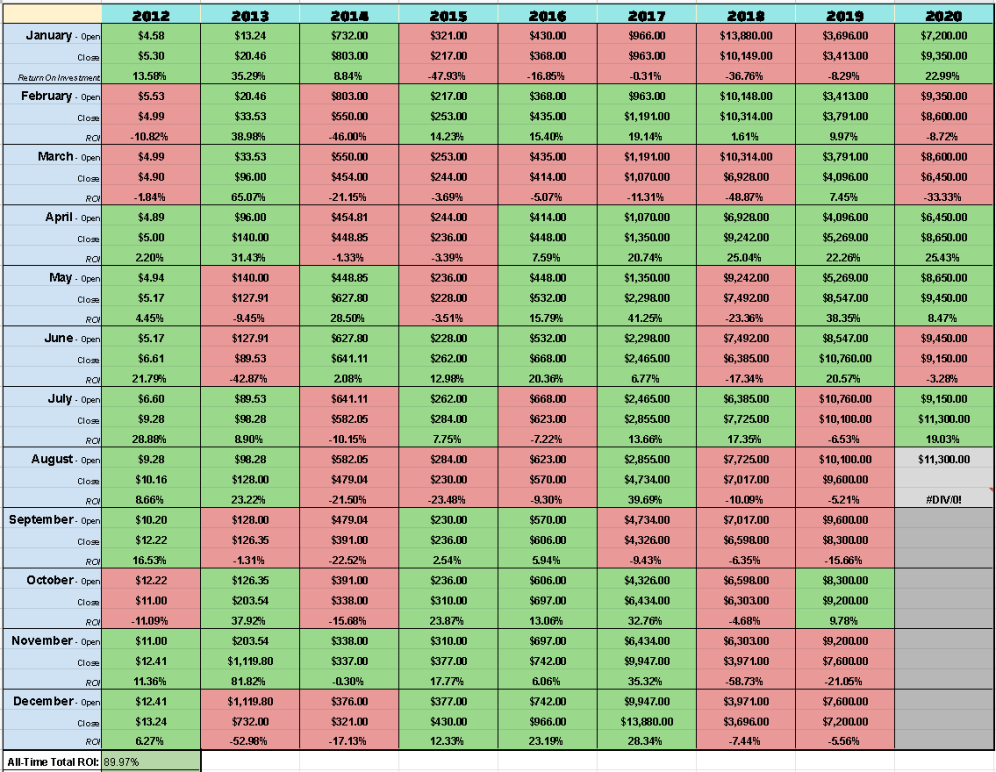

Bitcoin's Golden Cross: Historical Analysis And Future Price Predictions

Table of Contents

Understanding the Bitcoin Golden Cross

What is a Golden Cross?

A Golden Cross is a bullish technical indicator formed when a shorter-term moving average (typically the 50-day moving average) crosses above a longer-term moving average (typically the 200-day moving average). In the context of Bitcoin trading, this crossover suggests a potential shift from a bearish to a bullish trend. The intersection signifies that short-term momentum has overtaken long-term momentum, hinting at increased buying pressure.

[Insert a simple chart visually depicting a Golden Cross formation with the 50-day and 200-day moving averages.]

Historical Occurrences of Bitcoin Golden Crosses

Past instances of the Bitcoin Golden Cross offer valuable insights into its predictive power. While not a foolproof predictor, analyzing historical data can reveal patterns and probabilities.

- [Date]: A Golden Cross occurred, followed by a [percentage]% price increase over [timeframe]. Market conditions at the time included [mention relevant market factors, e.g., positive regulatory news, increased institutional adoption].

- [Date]: Conversely, a Golden Cross was followed by a [percentage]% price decrease within [timeframe]. This was during a period of [mention relevant market factors, e.g., heightened regulatory uncertainty, a major market crash].

- [Date]: Another example showed a less dramatic price movement after a Golden Cross, indicating the importance of considering other factors besides just the Golden Cross itself.

It's crucial to note that not all Golden Crosses result in significant price surges. The magnitude and duration of subsequent price movements vary significantly depending on the broader market context. It's vital not to treat this indicator in isolation but rather as one piece of the overall puzzle in Bitcoin price prediction.

Analyzing Past Bitcoin Golden Crosses

Bullish or Bearish Signals?

While the Golden Cross is often interpreted as a bullish signal, a thorough analysis of past Bitcoin Golden Crosses reveals a mixed bag. Statistical analysis of historical data suggests a [percentage]% success rate in identifying sustained upward trends following a Golden Cross, demonstrating it's not an absolute guarantee of future price increases. However, it does statistically show a higher likelihood of positive price action following a cross, compared to a random chance.

[Insert chart showing success rates of Bitcoin Golden Crosses over time. Clearly label axes and provide data sources.]

Factors Influencing Price After a Golden Cross

Several external factors can influence Bitcoin's price trajectory after a Golden Cross:

- Regulatory Changes: Positive regulatory developments often boost investor confidence, amplifying the impact of the Golden Cross.

- Institutional Adoption: Increased adoption by institutional investors injects significant capital into the market.

- Macroeconomic Factors: Global economic conditions, including inflation and interest rates, profoundly impact Bitcoin's price.

- Bitcoin Halving Events: The halving events, which reduce the rate of new Bitcoin creation, can significantly influence long-term price trends, sometimes amplifying or dampening the effects of a Golden Cross.

Understanding these factors is critical in accurately predicting Bitcoin's future price movements.

Comparing Bitcoin Golden Crosses to Other Assets

The Golden Cross is a widely used technical indicator across various asset classes, including stocks and commodities. While the underlying principle remains consistent, the effectiveness of the Golden Cross can differ depending on the specific asset's characteristics and market dynamics. Bitcoin's high volatility and susceptibility to external factors can make interpreting the Golden Cross more challenging compared to less volatile assets.

Predicting Bitcoin's Future Based on the Golden Cross

Current Market Conditions and Technical Analysis

[Insert current chart showing Bitcoin's price relative to its 50-day and 200-day moving averages.] As of [date], Bitcoin's price is [current price], with the 50-day MA at [50-day MA price] and the 200-day MA at [200-day MA price]. [Analyze the current relationship between the moving averages and their proximity to a potential Golden Cross or recent crossing.]

Potential Price Targets Based on Past Performance

Based on historical data following past Bitcoin Golden Crosses, coupled with current market sentiment and technical analysis, a potential price range could be estimated. However, it is crucial to reiterate that these are estimations and not definitive predictions. Possible price targets could range from [lower bound] to [upper bound], but this is highly dependent on numerous factors beyond the scope of this analysis.

Risk Assessment and Disclaimer

It is imperative to understand that predicting Bitcoin's price is inherently speculative and carries significant risk. The Bitcoin Golden Cross is merely a technical indicator, not a crystal ball. Past performance is not indicative of future results. Investing in Bitcoin or any cryptocurrency involves potential for substantial losses. Do not make impulsive trading decisions solely based on technical indicators like the Golden Cross.

Conclusion

Historical analysis of the Bitcoin Golden Cross reveals its potential as a bullish indicator but doesn't guarantee price increases. The success rate varies, and numerous external factors heavily influence the subsequent price action. While the Golden Cross offers valuable insights, it should be used in conjunction with fundamental analysis and other technical indicators. Before making any investment decisions related to Bitcoin or other cryptocurrencies, conduct thorough research and consider consulting a qualified financial advisor. Learn more about Bitcoin Golden Cross strategies, analyze the Bitcoin Golden Cross for yourself, and master Bitcoin Golden Cross trading to make informed decisions in this dynamic market. Remember to always assess and manage your risk accordingly.

Featured Posts

-

Tatums Respect For Curry Post All Star Game Comments

May 08, 2025

Tatums Respect For Curry Post All Star Game Comments

May 08, 2025 -

Son Dakika Sms Dolandiriciligi Sikayetleri Ve Guevenlik Oenerileri

May 08, 2025

Son Dakika Sms Dolandiriciligi Sikayetleri Ve Guevenlik Oenerileri

May 08, 2025 -

El Psg Se Impone Al Lyon En Un Partido Disputado En Lyon

May 08, 2025

El Psg Se Impone Al Lyon En Un Partido Disputado En Lyon

May 08, 2025 -

Jimmy Olsens 85th Anniversary James Gunns Daily Planet Set Photo Hints At A Unique Superman Easter Egg

May 08, 2025

Jimmy Olsens 85th Anniversary James Gunns Daily Planet Set Photo Hints At A Unique Superman Easter Egg

May 08, 2025 -

Cleveland Browns Sign De Andre Carter Versatile Wide Receiver Joins Roster

May 08, 2025

Cleveland Browns Sign De Andre Carter Versatile Wide Receiver Joins Roster

May 08, 2025