Bitcoin's Record High: Fueled By US Regulatory Optimism

Table of Contents

The Ripple Effect of Grayscale's Spot Bitcoin ETF Application

Grayscale's application for a spot Bitcoin ETF has sent shockwaves through the cryptocurrency market, significantly impacting Bitcoin's price. The approval of a spot Bitcoin ETF would represent a monumental shift, opening the doors for a flood of institutional investment into Bitcoin.

- Increased institutional investor interest: A spot Bitcoin ETF would provide a regulated and easily accessible investment vehicle for institutional investors, such as hedge funds and pension funds, who have previously been hesitant due to regulatory complexities and custodial challenges.

- Potential for increased liquidity: The increased trading volume associated with an ETF would dramatically boost Bitcoin's liquidity, making it easier to buy and sell large amounts without significantly impacting the price.

- Positive market sentiment surrounding regulatory approval: The mere application of Grayscale has already generated immense positive market sentiment, signaling a potential shift in the SEC's approach towards Bitcoin and cryptocurrencies.

- Discussion of the SEC's potential response and its influence on Bitcoin's future: The SEC's decision will be crucial. Approval would likely trigger a massive influx of capital into Bitcoin, driving the price significantly higher. Conversely, rejection could dampen investor enthusiasm, albeit temporarily, potentially followed by appeals and further legal battles.

Keywords: Grayscale Bitcoin ETF, spot Bitcoin ETF, institutional investors, SEC approval, Bitcoin ETF application, Bitcoin price prediction.

Easing Regulatory Uncertainty in the US

Recent developments and statements from US regulatory bodies, including the SEC and the CFTC, have contributed to a more positive outlook for Bitcoin and the broader cryptocurrency market. This easing of regulatory uncertainty is a key driver of Bitcoin's recent record high.

- Examples of recent positive regulatory pronouncements or actions: While not explicitly endorsing Bitcoin, certain statements and actions from regulators suggest a move towards a more comprehensive and less hostile regulatory framework. This includes increased focus on consumer protection and attempts to clarify the regulatory landscape.

- Explain how these actions reduce uncertainty and encourage investment: Reduced uncertainty creates a more predictable and less risky environment for investors, encouraging larger institutional players to enter the market.

- Contrast this with previous periods of regulatory uncertainty and their impact on the Bitcoin market: Previous periods of regulatory uncertainty have been characterized by significant price volatility and investor hesitancy. The current shift towards clarity is a major departure from this previous pattern.

Keywords: Cryptocurrency regulation, US regulatory landscape, Bitcoin regulation, SEC, CFTC, regulatory clarity, Bitcoin investment.

Increased Institutional Adoption and Market Confidence

The correlation between positive regulatory news and the increased adoption of Bitcoin by institutional investors is undeniable. This institutional adoption is a critical factor driving Bitcoin's price upwards and increasing market confidence.

- Mention specific examples of institutional investment in Bitcoin: Several large corporations and institutional investment firms have publicly announced significant holdings of Bitcoin, underscoring the growing mainstream acceptance of the cryptocurrency.

- Explain how institutional investment drives price increases and market stability: Large institutional buys inject substantial capital into the market, pushing prices higher and creating greater market stability by reducing the impact of smaller price fluctuations.

- Discuss the role of Bitcoin's scarcity in driving its value: Bitcoin's limited supply (21 million coins) is a crucial factor contributing to its long-term value proposition. As demand increases and supply remains fixed, the price is naturally driven higher.

Keywords: Institutional Bitcoin adoption, Bitcoin investment strategies, institutional investors, Bitcoin market capitalization, Bitcoin scarcity.

Macroeconomic Factors Contributing to Bitcoin's Rise

Macroeconomic factors also play a significant role in Bitcoin's recent surge. Concerns about inflation and global economic uncertainty have made Bitcoin increasingly attractive as a potential safe-haven asset.

- Discuss inflation's impact on Bitcoin's value proposition: High inflation erodes the purchasing power of fiat currencies, making Bitcoin, with its fixed supply, a compelling alternative store of value.

- Explore Bitcoin's role as a hedge against economic uncertainty: Investors often turn to Bitcoin during times of economic uncertainty, viewing it as a less correlated asset with the potential to retain or even appreciate its value.

- Mention alternative investment options and compare their performance to Bitcoin's recent surge: Compared to traditional assets like gold or stocks, Bitcoin's recent performance has been exceptionally strong, further bolstering its attractiveness as an investment option.

Keywords: Bitcoin as a safe haven, inflation hedge, macroeconomic factors, Bitcoin price volatility, alternative investments.

Conclusion

Bitcoin's record high is a result of a confluence of factors, primarily fueled by growing US regulatory optimism. The potential approval of Grayscale's spot Bitcoin ETF, along with easing regulatory uncertainty and increased institutional adoption, have all contributed to this significant price surge. The increasing perception of Bitcoin as a safe-haven asset in times of economic uncertainty further strengthens its appeal.

The recent surge in Bitcoin's price, fueled by growing US regulatory optimism, presents a compelling opportunity. Stay informed about the evolving regulatory landscape and consider how this affects your Bitcoin investment strategy. Learn more about Bitcoin and its potential for future growth. Don't miss out on the Bitcoin revolution!

Keywords: Bitcoin investment, Bitcoin future, cryptocurrency investment, Bitcoin price outlook, regulatory developments.

Featured Posts

-

Oleg Basilashvili Test Na Znanie Ego Filmov I Roley

May 24, 2025

Oleg Basilashvili Test Na Znanie Ego Filmov I Roley

May 24, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025 -

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025 -

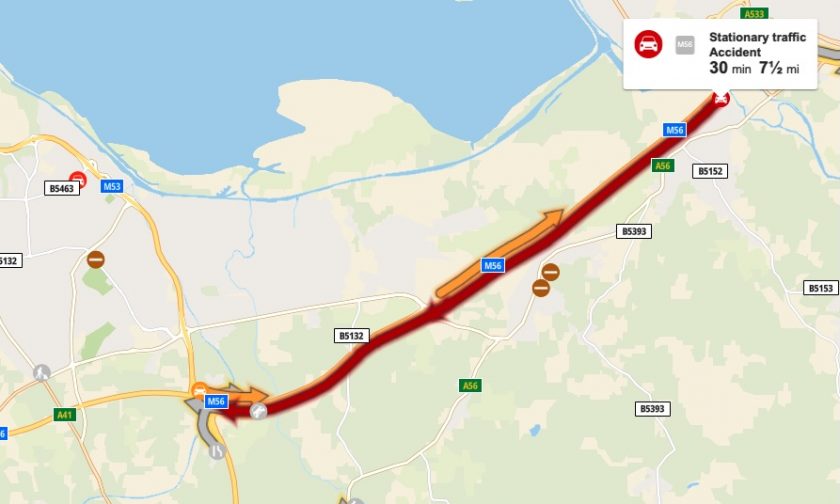

M56 Closed Serious Crash Causes Major Traffic Disruption

May 24, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption

May 24, 2025 -

Cheshire Deeside M56 Traffic Delays Due To Collision

May 24, 2025

Cheshire Deeside M56 Traffic Delays Due To Collision

May 24, 2025