Bitcoin's Surge: US-China Trade Talks Fuel Crypto Market Optimism

Table of Contents

The US-China Trade War and its Impact on Global Markets

The protracted US-China trade war has cast a long shadow over global markets, creating significant uncertainty and risk aversion among investors. This uncertainty has manifested itself in various ways:

Uncertainty and Risk Aversion

- Increased volatility in stock markets: The fluctuating nature of trade negotiations led to unpredictable swings in traditional stock markets, causing anxiety among investors.

- Concerns about global economic slowdown: The trade war threatened to disrupt global supply chains and hamper economic growth, leading to fears of a recession.

- Safe-haven assets like gold and Bitcoin saw increased demand: Investors sought refuge in assets perceived as less susceptible to the volatility caused by the trade war.

Investors increasingly view Bitcoin as a hedge against geopolitical risk and inflation. Its decentralized nature and limited supply make it an attractive alternative to traditional assets during periods of economic uncertainty. The potential for Bitcoin to appreciate in value further enhances its appeal as a safe haven.

Bitcoin as a Safe Haven Asset

Bitcoin's characteristics make it an increasingly compelling safe haven asset in turbulent times.

Decentralization and Limited Supply

- Not subject to government control or manipulation: Unlike fiat currencies, Bitcoin's decentralized nature makes it resistant to government intervention and manipulation.

- Limited supply of 21 million Bitcoins: This inherent scarcity contributes to its perceived long-term value.

- Potential for long-term value appreciation: Many investors believe Bitcoin's limited supply and growing adoption will lead to significant price appreciation over time.

The perception of Bitcoin as a store of value, similar to gold, is growing. However, unlike gold, Bitcoin offers the potential for significantly higher growth, attracting both individual and institutional investors. The increasing involvement of institutional players further legitimizes Bitcoin as a serious asset class.

Positive Trade Signals and Bitcoin's Price Reaction

Recent positive developments in the US-China trade talks have directly influenced Bitcoin's price.

Easing Trade Tensions

- Examples of positive news headlines and announcements: News of renewed negotiations, phased trade deals, and conciliatory statements from both sides have been met with positive reactions in the crypto market.

- Correlation between positive trade news and Bitcoin price increases: A clear correlation exists between positive trade news and subsequent spikes in Bitcoin's price, suggesting a direct link between investor sentiment and cryptocurrency value.

- Mention specific price movements and charts (if appropriate): (Insert relevant data and charts here showcasing the correlation between trade news and Bitcoin price changes.)

The improved outlook for the global economy, resulting from easing trade tensions, boosts investor confidence. This renewed confidence translates into increased demand for Bitcoin, driving its price upwards.

Increased Institutional Interest in Bitcoin

The rising price of Bitcoin is also fueled by the growing acceptance of Bitcoin amongst institutional investors.

Growing Acceptance and Legitimacy

- Examples of institutional investors entering the crypto market: Several large financial institutions have begun investing in Bitcoin and other cryptocurrencies, signaling a shift in market perception.

- Increased regulatory clarity in some jurisdictions: Growing regulatory clarity in certain countries is making it easier for institutions to invest in cryptocurrencies.

- Growth of Bitcoin exchange-traded funds (ETFs): The emergence of Bitcoin ETFs provides a more accessible and regulated investment vehicle for institutional investors.

This institutional interest is not only pushing the price higher but also legitimizing Bitcoin as a viable asset class within traditional financial portfolios. The growing acceptance by established financial players reinforces Bitcoin's long-term potential.

Conclusion

The recent surge in Bitcoin's price is a compelling example of the interconnectedness of global markets. The US-China trade talks, and their impact on investor sentiment and risk appetite, have played a significant role in this increase. Bitcoin's decentralized nature, limited supply, and growing institutional adoption are all contributing factors to its status as a safe-haven asset and a potentially lucrative investment. Understanding the relationship between global geopolitical events and Bitcoin’s price fluctuations is crucial for navigating this dynamic market. Stay informed about Bitcoin's price fluctuations and the ongoing US-China trade talks to make informed decisions in this dynamic market. [Link to relevant resources/further reading]

Featured Posts

-

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps And Special Teams

May 08, 2025

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps And Special Teams

May 08, 2025 -

Spk Dan Kripto Piyasalarina Kritik Aciklama Yeni Yoenetmelik

May 08, 2025

Spk Dan Kripto Piyasalarina Kritik Aciklama Yeni Yoenetmelik

May 08, 2025 -

Stephen Kings The Long Walk Movie Adaptation Finally Arrives

May 08, 2025

Stephen Kings The Long Walk Movie Adaptation Finally Arrives

May 08, 2025 -

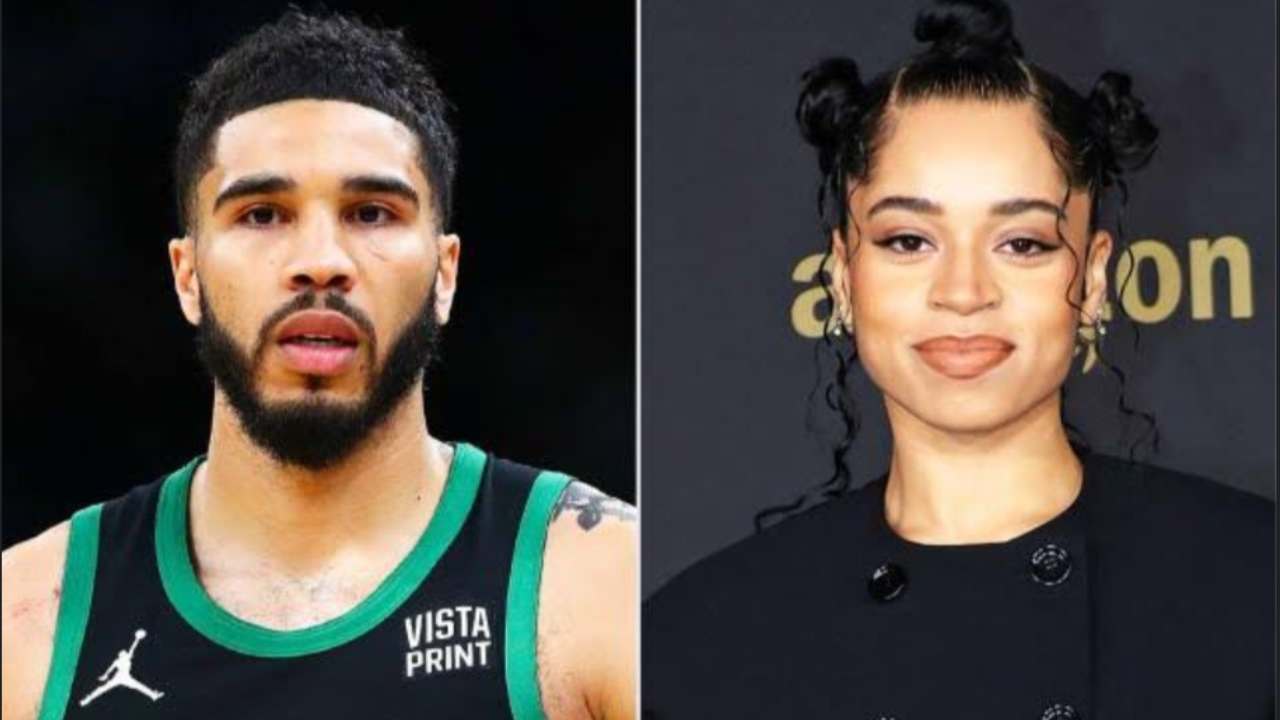

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025 -

El Triunfo De Filipe Luis Detalles De Su Nuevo Titulo

May 08, 2025

El Triunfo De Filipe Luis Detalles De Su Nuevo Titulo

May 08, 2025