BlackRock ETF: Soaring 110%? Billionaire Investments Fuel Predictions For 2025

Table of Contents

Billionaire Investment Strategies Driving BlackRock ETF Growth

High-net-worth individuals (HNWIs) and billionaires are increasingly incorporating BlackRock ETFs into their sophisticated, diversified portfolios. Their massive investments directly impact market capitalization and fuel price increases, creating a ripple effect throughout the market. This isn't just about diversifying; it's about strategic allocation based on specific growth projections.

-

The Influence of High-Net-Worth Individuals: Billionaire investors, with their significant capital, act as powerful market indicators. Their allocation decisions influence other investors and contribute significantly to the overall demand for BlackRock ETFs. This snowball effect amplifies the potential for growth.

-

Focus on Specific BlackRock ETF Sectors: Billionaire investment strategies often focus on BlackRock ETFs targeting specific high-growth sectors. These sectors, perceived to have significant growth potential, attract substantial investment capital. This focused approach amplifies returns within these specific ETFs. Examples include:

- Technology ETFs: Capturing the growth of innovative tech companies and the expansion of the digital economy.

- Renewable Energy ETFs: Benefiting from the global shift toward sustainable energy solutions and government initiatives.

- Healthcare ETFs: Capitalizing on advancements in biotechnology, pharmaceuticals, and medical technology.

-

Diversification and Risk Management: BlackRock ETFs offer unparalleled diversification. Billionaire investors utilize these funds to spread risk across numerous asset classes, reducing portfolio volatility and enhancing long-term growth potential.

- Example: A billionaire might invest in a BlackRock iShares Core S&P 500 ETF (IVV) for broad market exposure, alongside a more specialized BlackRock ETF focused on a specific technology sub-sector. This strategy minimizes risk while maximizing exposure to potential high-growth areas.

Analyzing the 110% Growth Prediction for BlackRock ETFs

The 110% growth prediction for BlackRock ETFs isn't pulled from thin air. It's based on a confluence of market forecasts, economic analyses, and the inherent growth potential within specific sectors. However, it's essential to approach such predictions with caution.

-

Market Trends and Economic Factors: Global economic recovery, technological advancements (like AI and automation), and increasing demand for sustainable investments contribute to the positive outlook. These macro-economic trends directly impact the performance of many BlackRock ETFs.

-

Growth Potential of Specific Sectors: Predictions often center around BlackRock ETFs concentrated in high-growth sectors experiencing explosive expansion:

- Artificial intelligence (AI) and machine learning: AI is rapidly transforming industries, creating immense opportunities for investment.

- Clean energy and sustainable technologies: The global push towards decarbonization is driving significant investment in renewable energy sources and related technologies.

- Biotechnology and pharmaceuticals: Advancements in medicine and biotechnology are constantly creating new markets and investment possibilities.

-

Underlying Risks and Cautions: While the predictions are optimistic, remember that market fluctuations are inherent. Geopolitical events, unexpected economic downturns (like recessions), and regulatory changes can significantly impact investment returns. Past performance is never a guarantee of future results.

Investing in BlackRock ETFs: Strategies and Considerations

Investing in BlackRock ETFs requires careful planning and understanding of your personal financial circumstances. Remember that higher potential returns often correlate with higher risk.

-

Understanding your Risk Tolerance: Before investing, honestly assess your risk tolerance and investment goals. Are you a conservative investor prioritizing capital preservation, or are you willing to take on more risk for potentially higher returns?

-

Diversification within your Portfolio: Diversification is key. Don't concentrate your investments in just one or two BlackRock ETFs. Spread your investments across various ETFs and other asset classes to reduce overall portfolio risk.

-

Long-Term Investment Strategy: BlackRock ETFs are generally best suited for long-term investors. A longer time horizon allows you to weather short-term market volatility and potentially maximize returns.

-

Seeking Professional Financial Advice: Consider consulting a qualified financial advisor. They can help you create a personalized investment strategy tailored to your specific risk tolerance, financial goals, and overall investment portfolio.

Conclusion

The potential for substantial growth in BlackRock ETFs, driven by billionaire investments and positive market predictions, presents a compelling investment opportunity. However, it's vital to maintain a balanced perspective, acknowledging both the potential rewards and the inherent risks. Thorough due diligence, a well-diversified portfolio, and a realistic understanding of your risk tolerance are paramount before investing in BlackRock ETFs. Don't miss out on the potential of BlackRock ETFs – conduct your own research, carefully consider your options, and start building your portfolio today. Remember to consult with a financial advisor to determine the best strategy for your individual circumstances.

Featured Posts

-

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 09, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 09, 2025 -

Find Elizabeth Arden Products At Walmart Prices

May 09, 2025

Find Elizabeth Arden Products At Walmart Prices

May 09, 2025 -

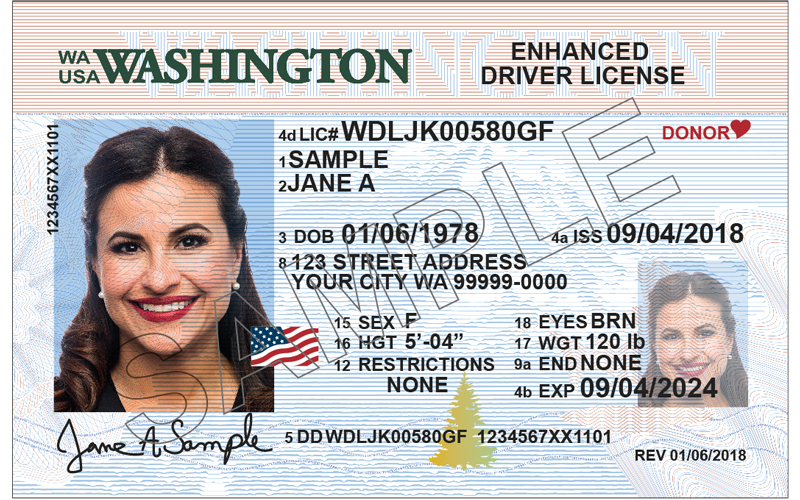

Real Id Enforcement Summer Travel Planning Guide

May 09, 2025

Real Id Enforcement Summer Travel Planning Guide

May 09, 2025 -

New Strategy From Edmonton Unlimited Scaling Tech For Global Reach

May 09, 2025

New Strategy From Edmonton Unlimited Scaling Tech For Global Reach

May 09, 2025 -

Vp Lais Ve Day Message A Call To Vigilance Against Totalitarianism In Taiwan

May 09, 2025

Vp Lais Ve Day Message A Call To Vigilance Against Totalitarianism In Taiwan

May 09, 2025