BOE Rate Cut Probabilities Diminish: Pound Gains Momentum Following UK Inflation Report

Table of Contents

UK Inflation Report Surprises Economists

The latest UK inflation report delivered a shock to economists, revealing a far more resilient inflation picture than anticipated. Instead of showing signs of cooling down, inflation remained stubbornly high, prompting a reassessment of the economic outlook. Key figures significantly exceeded forecasts, forcing a recalibration of expectations regarding the BOE's monetary policy strategy. This unexpected resilience stems from several contributing factors, including persistent wage growth and ongoing supply chain disruptions.

- Specific inflation rate reported: The Consumer Price Index (CPI) increased by [Insert Actual Percentage Here]% in [Month, Year], exceeding the expected [Expected Percentage]% and remaining significantly above the Bank of England's 2% target.

- Comparison to previous month's figures: This represents a [Increase/Decrease] of [Percentage]% compared to the previous month's figure of [Previous Month's Percentage]%.

- Key contributing factors to inflation: Persistent wage growth, elevated energy prices, and lingering supply chain bottlenecks are cited as the primary drivers behind this unexpected inflation persistence.

Market Reaction: BOE Rate Cut Bets Diminish

The market reacted swiftly to the unexpectedly high inflation figures. The immediate consequence was a sharp decline in the probability of a future BOE rate cut. Traders and investors, initially anticipating a potential easing of monetary policy, now believe the central bank is more likely to maintain or even increase interest rates to combat persistent inflation. This shift in expectations is clearly reflected in the trading of interest rate futures contracts.

- Percentage change in probability of a rate cut (before and after report): Before the report, the market priced in a [Percentage]% probability of a rate cut within the next [Timeframe]. Following the report, this probability plummeted to approximately [New Percentage]%.

- Analysis of market sentiment (investor confidence): Investor confidence in the UK economy, while still fragile, has received a minor boost due to the unexpected inflation resilience, reflecting belief in the BOE’s determination to control inflation.

- Impact on government bond yields: The diminished expectations of a rate cut have pushed government bond yields [Up/Down], signaling a shift in investor sentiment towards higher interest rate expectations.

Impact on the Pound Sterling

The pound sterling has experienced a notable appreciation against major currencies following the release of the inflation report. Investors, encouraged by the reduced likelihood of a BOE rate cut and the prospect of potentially higher interest rates, have increased their demand for the pound, driving up its value. This flight to higher-yielding assets has significantly benefited the British currency.

- Specific percentage change in GBP/USD, GBP/EUR exchange rates: The GBP/USD exchange rate has seen an increase of [Percentage]%, while the GBP/EUR exchange rate has improved by [Percentage]%.

- Analysis of trading volume and volatility: Trading volume has increased significantly, indicating heightened market activity. Volatility, while elevated, has shown signs of stabilization.

- Short-term and long-term outlook for the pound: The short-term outlook for the pound remains positive, contingent on further economic data releases. The long-term outlook is more uncertain, contingent upon global economic conditions and further BOE policy decisions.

Future Outlook for BOE Monetary Policy

The Bank of England now faces a challenging balancing act. While the unexpectedly high inflation necessitates a cautious approach, concerns about triggering a recession remain. Several scenarios are possible, ranging from further interest rate hikes to holding rates steady, depending on the evolution of inflation and the overall economic climate. Global economic factors, such as the ongoing war in Ukraine and potential global recessionary risks, will also play a crucial role in shaping future BOE decisions.

- Possible future interest rate scenarios: A range of outcomes, from further rate increases to a pause in rate hikes, remains possible depending on the trajectory of inflation and economic growth.

- Impact of global economic conditions (e.g., recession risks): The risk of a global recession could significantly influence the BOE's future policy decisions, potentially leading them to prioritize economic stability over aggressive inflation control.

- Potential timeline for future policy decisions: The next BOE Monetary Policy Committee meeting is scheduled for [Date], and the market will keenly await any announcements concerning future interest rates.

Conclusion: The Diminishing Probability of a BOE Rate Cut and the Pound's Strength

In conclusion, the recent UK inflation report has significantly altered market expectations. The unexpectedly high inflation figures have diminished the probability of a BOE rate cut and triggered a rally in the pound sterling. This development underscores the significant influence that inflation data has on central bank policy and the subsequent impact on currency exchange rates. The implications for investors and businesses are considerable, particularly those involved in international trade and currency trading.

To stay abreast of changes in BOE interest rate probabilities and the pound's performance, regularly check reliable financial news sources and consider expert advice on currency exchange strategies related to BOE interest rate decisions. Understanding the BOE interest rate forecast and the pound sterling outlook is crucial for navigating this evolving economic landscape. Stay informed about the BOE interest rate and its implications for your investments.

Featured Posts

-

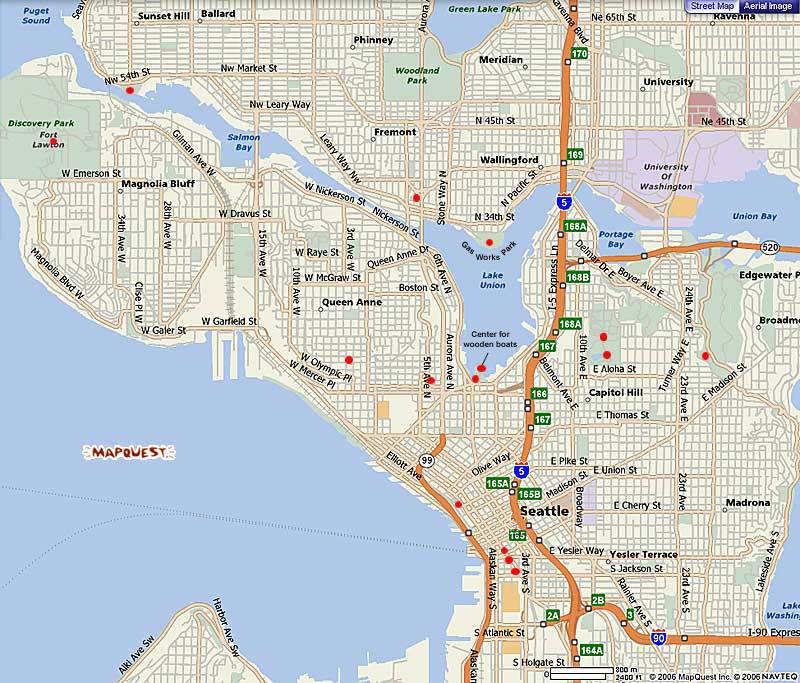

Seattle Parks A Haven During The Pandemic

May 24, 2025

Seattle Parks A Haven During The Pandemic

May 24, 2025 -

Pokolenie Peremen Nashi Uspekhi I Oshibki

May 24, 2025

Pokolenie Peremen Nashi Uspekhi I Oshibki

May 24, 2025 -

Your Guide To Getting Tickets For Bbc Big Weekend 2025 At Sefton Park

May 24, 2025

Your Guide To Getting Tickets For Bbc Big Weekend 2025 At Sefton Park

May 24, 2025 -

Australia Falls To Kazakhstan In Billie Jean King Cup Qualifier

May 24, 2025

Australia Falls To Kazakhstan In Billie Jean King Cup Qualifier

May 24, 2025 -

Nashemu Pokoleniyu Udalos Izmenit Mir K Luchshemu Ili Khudshemu

May 24, 2025

Nashemu Pokoleniyu Udalos Izmenit Mir K Luchshemu Ili Khudshemu

May 24, 2025