Boeing's $5.6 Billion Jeppesen Sale To Thoma Bravo: A Deep Dive

Table of Contents

Jeppesen: A Deep Dive into its Business and Market Position

Jeppesen, a long-standing name in aviation, provides a comprehensive suite of navigation data, flight planning software, and other crucial aviation-related services. Its core offerings include:

- Digital Charts and Navigation Data: Providing essential navigational information for pilots worldwide, encompassing everything from en-route charts to airport diagrams.

- Flight Planning Software: Sophisticated software solutions streamlining flight planning, optimizing routes, and managing fuel consumption for airlines and other operators.

- Air Traffic Management Solutions: Jeppesen offers software and services to support air traffic control operations, improving efficiency and safety.

- Training and Simulation: Providing advanced training and simulation tools for pilots and air traffic controllers, ensuring proficiency and preparedness.

Jeppesen holds a substantial market share in the aviation data and software industry, commanding a significant portion of the market for digital charts and flight planning solutions. Key clients include major airlines, airports, and air traffic management organizations globally, many of whom rely heavily on Jeppesen's services for daily operations. Its revenue streams primarily come from subscription-based software licenses, data provision, and training services, generating considerable profitability prior to the sale. The company's established reputation as a market leader in aviation software and navigation data played a crucial role in attracting Thoma Bravo's interest.

Thoma Bravo: Understanding the Private Equity Firm's Acquisition Strategy

Thoma Bravo is a renowned private equity firm with a strong track record of successful investments in the software and technology sectors. Their investment thesis focuses on identifying and acquiring high-growth businesses within the software industry, leveraging their operational expertise to drive further growth and enhance value.

- Software Focus: Thoma Bravo's portfolio predominantly consists of software companies, demonstrating their specific expertise in this area.

- Operational Excellence: They actively work with portfolio companies to improve operational efficiency, enhance product offerings, and expand market share.

- Long-Term Vision: Thoma Bravo typically holds investments for several years, allowing ample time for value creation and strategic development.

The acquisition of Jeppesen aligns perfectly with Thoma Bravo's investment strategy. Jeppesen's position as a leading provider of critical aviation software and data fits seamlessly into their existing portfolio. Thoma Bravo likely sees significant potential for growth through technological advancements, market expansion, and operational improvements, making Jeppesen a lucrative addition to their portfolio. Their history of successful acquisitions in the tech sector underscores their capability to leverage their expertise and resources to propel Jeppesen's future success.

Boeing's Rationale Behind the Jeppesen Sale

Boeing's decision to divest Jeppesen is part of a broader strategic realignment aimed at sharpening its focus on its core aerospace and defense businesses.

- Financial Restructuring: The $5.6 billion sale generated significant capital, allowing Boeing to reduce debt and improve its overall financial position.

- Core Business Focus: By divesting Jeppesen, Boeing can dedicate more resources and attention to its core competencies in aircraft manufacturing, defense systems, and related services.

- Portfolio Optimization: The sale is viewed as a strategic move to optimize Boeing's portfolio, shedding non-core assets to enhance its overall efficiency and profitability.

While Jeppesen was a profitable subsidiary, it didn't directly contribute to Boeing's primary strengths in aircraft production and defense contracts. The sale allows Boeing to streamline operations, strengthen its financial standing, and concentrate resources on its core growth areas. This decision reflects a strategic shift towards a more focused business model.

Future Implications and Potential Outcomes of the Sale

The Jeppesen sale carries significant implications for various stakeholders:

- Jeppesen Employees: While Thoma Bravo has indicated a commitment to retaining Jeppesen's workforce, potential changes in management and operational strategies may lead to some adjustments.

- Jeppesen Clients: Clients can expect a continuation of services, though potential changes in pricing and product offerings remain possible under new ownership.

- Aviation Industry: The acquisition could foster increased competition within the aviation data and software market, potentially leading to innovations and improvements in service offerings.

The acquisition's long-term impact hinges on Thoma Bravo's ability to successfully integrate Jeppesen into its portfolio and execute its growth strategy. There are risks associated with the transition, including potential disruptions to service and integration challenges. However, Thoma Bravo’s expertise in the software sector positions them favorably to overcome these challenges. The potential for innovation and expansion under new ownership remains significant, shaping the future of Jeppesen's role within the aviation industry.

Conclusion: The Long-Term Impact of the Boeing Jeppesen Sale

The $5.6 billion sale of Jeppesen to Thoma Bravo represents a pivotal moment in the aviation industry. Boeing's decision to divest this significant subsidiary reflects a strategic shift towards focusing on its core aerospace and defense competencies, while Thoma Bravo's acquisition underscores their ongoing commitment to investing in the software sector. The long-term impact remains to be seen, but the potential for Jeppesen's growth and innovation under new ownership is substantial. This acquisition could reshape the aviation data and software landscape, potentially driving innovation and enhanced competition. We encourage you to share your thoughts on the Boeing Jeppesen sale and its implications for the aviation industry. What are your predictions for the future of this key player in aviation software, and what impact will the Jeppesen acquisition have on the broader market? Let's discuss the future of Jeppesen, the Boeing divestiture, and the Thoma Bravo investment in the comments below!

Featured Posts

-

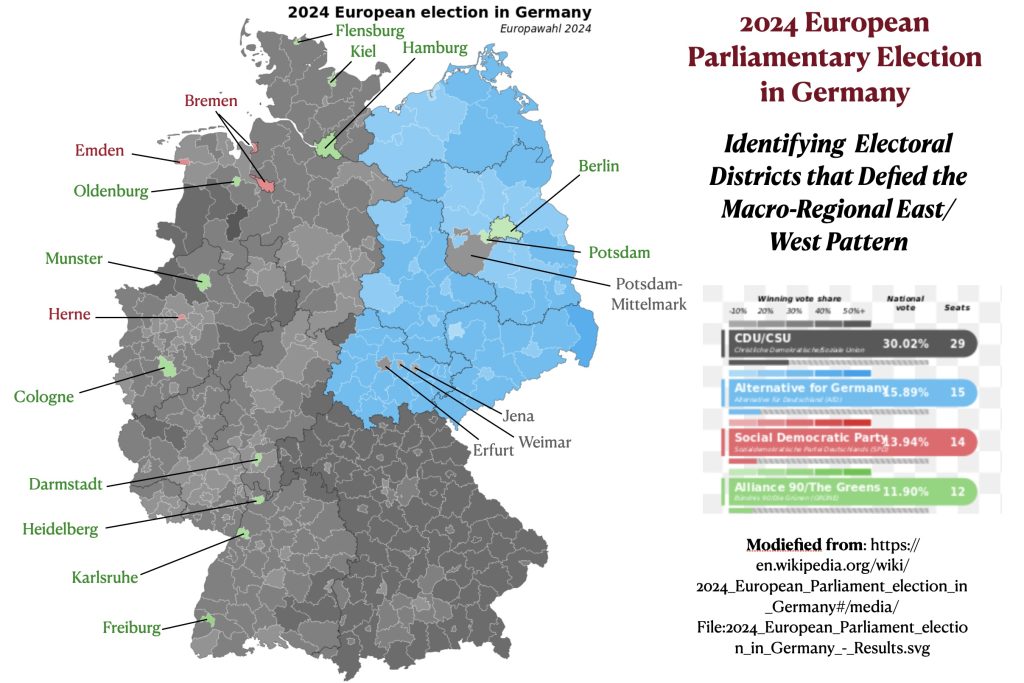

Elections Allemandes 2024 Guide Complet A J 6

Apr 23, 2025

Elections Allemandes 2024 Guide Complet A J 6

Apr 23, 2025 -

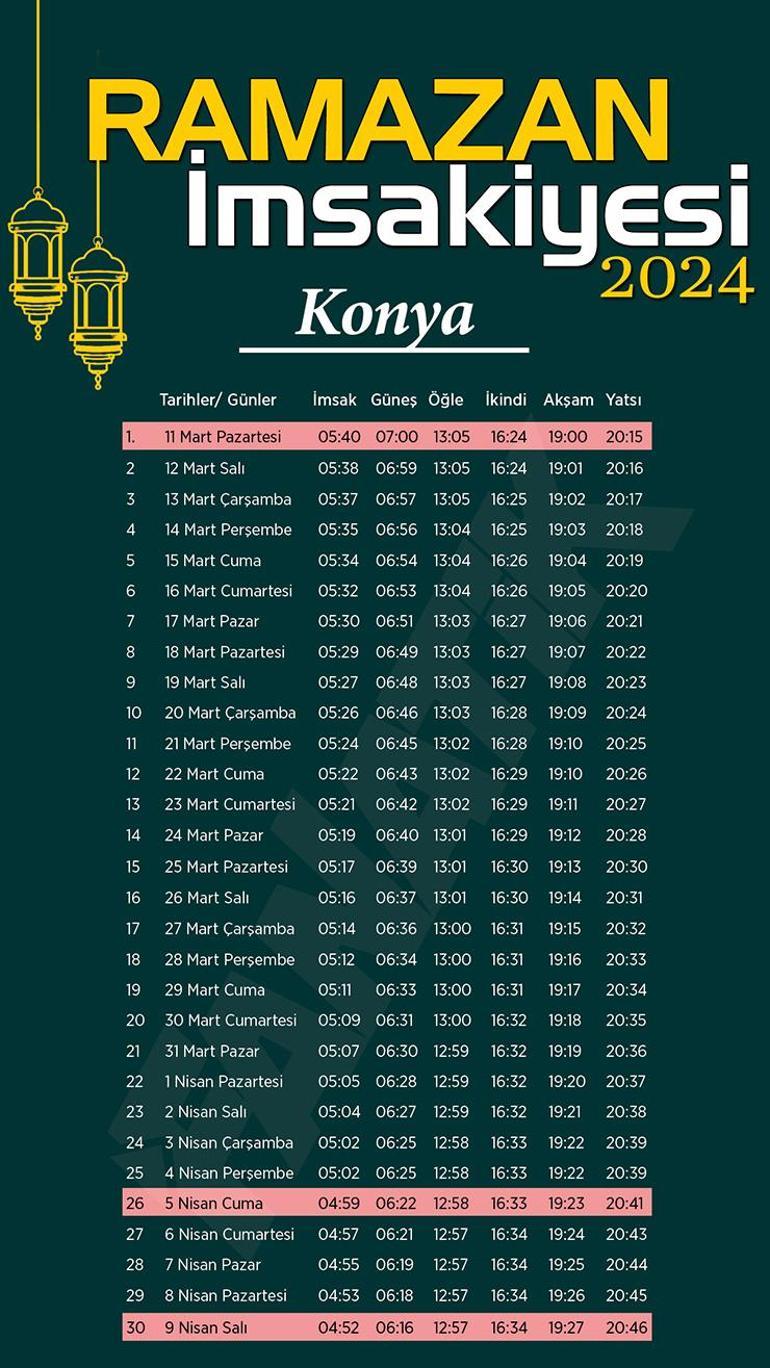

Istanbul Ankara Izmir Ramazan Imsakiyesi 2024 Iftar Ve Sahur Saatleri

Apr 23, 2025

Istanbul Ankara Izmir Ramazan Imsakiyesi 2024 Iftar Ve Sahur Saatleri

Apr 23, 2025 -

Analyzing The Economic Indicators Trumps Performance Under Scrutiny

Apr 23, 2025

Analyzing The Economic Indicators Trumps Performance Under Scrutiny

Apr 23, 2025 -

Pei Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025

Pei Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025 -

Calendario Laboral Confirmacion Del Puente Festivo 28 De Febrero En Espana

Apr 23, 2025

Calendario Laboral Confirmacion Del Puente Festivo 28 De Febrero En Espana

Apr 23, 2025