BofA On Stock Market Valuations: A Reason For Calm

Table of Contents

H2: BofA's Key Arguments for a Relatively Calm Outlook

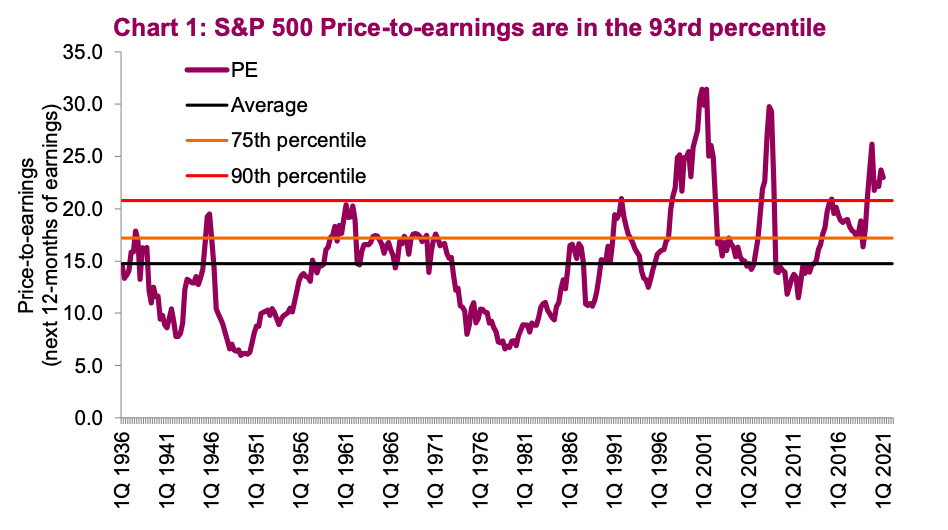

BofA's assessment hinges on several key arguments that paint a picture of relative calm despite market volatility. Their analysis focuses on comparing current stock market valuations to historical data and other asset classes, finding them to be less alarming than headlines might suggest.

- Relative Valuations: BofA likely points to the fact that while valuations are not historically cheap, they are not excessively high compared to long-term averages and especially when compared to the returns available in other asset classes like bonds. This suggests that the market isn't necessarily overvalued to a degree that warrants extreme panic.

- Robust Earnings Growth: The analysis likely incorporates the impact of strong corporate earnings growth. Healthy profits, even in the face of economic headwinds, can support current stock prices and provide a buffer against market downturns. This positive earnings outlook is a key factor contributing to BofA's relatively calm outlook on stock market valuations.

- Valuation Metrics: BofA likely uses various stock market valuation metrics to reach its conclusions. This likely includes the Price-to-Earnings ratio (P/E ratio), which compares a company's stock price to its earnings per share, as well as potentially the cyclically adjusted price-to-earnings ratio (Shiller PE), which smooths out short-term fluctuations in earnings. These metrics help provide a more nuanced understanding of the market's valuation.

- Market Sentiment: BofA likely acknowledges the current negative market sentiment. However, their analysis suggests that this pessimism might be overblown, given the underlying fundamentals of corporate earnings and the relative valuations compared to historical data and other asset classes. The potential for future corrections is acknowledged, but not viewed as necessarily catastrophic.

H2: Understanding BofA's Methodology and Data Sources

To arrive at its conclusions, BofA employs a rigorous methodology, combining quantitative analysis with qualitative factors.

- Data Sources: Their analysis draws upon a wide range of data sources, including company financial statements (balance sheets, income statements, cash flow statements), macroeconomic indicators (GDP growth, inflation rates, interest rates), and consumer sentiment data. This comprehensive approach provides a solid foundation for their conclusions.

- Quantitative Models: BofA likely uses sophisticated quantitative models and financial analysis techniques, such as discounted cash flow analysis and regression analysis, to project future earnings and assess the intrinsic value of stocks. These models provide a framework for evaluating different scenarios and making informed predictions.

- Limitations: It's important to acknowledge that any analysis, including BofA's, has inherent limitations. Unforeseen events, changes in macroeconomic conditions, or unexpected shifts in investor sentiment can all impact the accuracy of any valuation model. BofA's report likely addresses these potential biases and limitations transparently.

H3: Factors Contributing to BofA's Positive Outlook

Several factors underpin BofA's positive assessment of the stock market outlook, despite current uncertainties.

- Projected Economic Growth: BofA's analysis likely incorporates projections for continued, albeit moderated, economic growth. This growth, though possibly slower than in previous years, would still support corporate earnings and sustain stock prices.

- Interest Rate Impact: While interest rate hikes can negatively impact stock valuations, BofA likely incorporates the anticipated trajectory of interest rate changes into their model, suggesting that the impact might be less severe than feared by some. The analysis might highlight potential scenarios and the sensitivity of stock prices to various interest rate paths.

- Inflation's Effect: While inflation presents challenges, BofA’s analysis might suggest that corporate profitability can withstand the current inflationary environment, and that the impact is factored into the valuations. The effect on company profitability would be considered and incorporated into the valuation metrics.

- Technological Innovation: The analysis might highlight the role of technological innovation as a key driver of future economic growth and corporate earnings, providing a counterbalance to other concerns. Certain sectors, propelled by technological advancement, might be less vulnerable to macroeconomic headwinds.

- Geopolitical Risks: BofA acknowledges the risks stemming from geopolitical instability. However, the analysis likely assesses these risks and incorporates their potential impact on the stock market into their overall valuation. This incorporates a probability-weighted assessment of the likelihood and potential severity of various geopolitical risks.

H2: Counterarguments and Potential Risks

While BofA presents a relatively calm outlook, it's crucial to acknowledge potential counterarguments and risks.

- Recessionary Fears: The risk of a recession remains a significant concern, and a downturn would undoubtedly negatively impact corporate earnings and stock prices. This is an important caveat to the positive outlook presented by BofA.

- Inflationary Pressures: Persistent high inflation could erode corporate profits and lead to further interest rate hikes, negatively impacting the stock market. The potential for runaway inflation poses a substantial risk that needs consideration.

- Geopolitical Uncertainty: The ongoing geopolitical instability creates significant uncertainty, which could trigger sharp market corrections. Unexpected developments in geopolitical landscapes are hard to predict and can significantly impact the market.

Conclusion:

BofA's analysis of stock market valuations offers a nuanced perspective, highlighting a reason for relative calm amidst current volatility. While risks remain, their analysis suggests that current valuations aren't excessively high when compared to historical data and other asset classes, particularly considering robust corporate earnings growth. However, investors should remember that this is just one perspective, and a thorough understanding of various valuation metrics, along with a diversified investment strategy and a long-term perspective, are crucial for effective risk management. Conduct your own thorough research, consult with a financial advisor, and consider BofA's analysis as one factor among many in your investment decisions. Learn more about managing your portfolio in light of BofA's assessment of stock market valuations.

Featured Posts

-

Popovnennya U Rodini Lourens Dzhennifer Stala Mamoyu Vdruge

May 20, 2025

Popovnennya U Rodini Lourens Dzhennifer Stala Mamoyu Vdruge

May 20, 2025 -

Novaya Sharapova Biografiya I Dostizheniya Yunoy Tennisnoy Zvezdy

May 20, 2025

Novaya Sharapova Biografiya I Dostizheniya Yunoy Tennisnoy Zvezdy

May 20, 2025 -

Kaellmanin Kehitys Uusi Luku Huuhkajissa

May 20, 2025

Kaellmanin Kehitys Uusi Luku Huuhkajissa

May 20, 2025 -

Impact Of Abc News Layoffs On Programming And Future Shows

May 20, 2025

Impact Of Abc News Layoffs On Programming And Future Shows

May 20, 2025 -

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025