BofA On Stock Market Valuations: Addressing Investor Concerns

Table of Contents

BofA's Current Stance on Stock Market Valuations

BofA's recent reports suggest a cautious outlook on current stock market valuations. While not outright declaring the market overvalued, their analysts express concerns about certain sectors and highlight the need for careful consideration before investment. This nuanced perspective reflects the complexities of the current economic landscape.

-

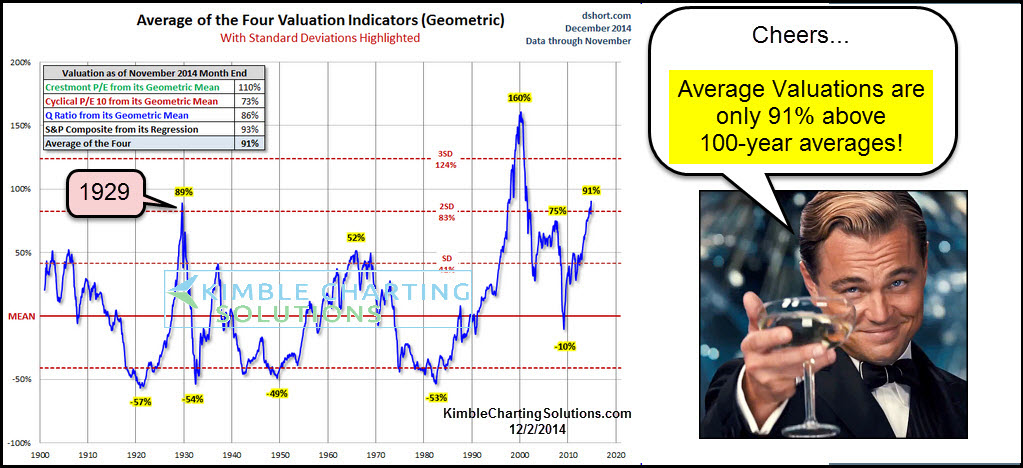

Key metrics BofA uses to determine valuations: BofA employs a range of metrics, including the widely used Price-to-Earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various discounted cash flow models to assess valuations across different sectors. Their analysis incorporates both historical data and forward-looking projections.

-

Specific sectors BofA views as overvalued or undervalued: Recent BofA reports have highlighted potential overvaluation in certain technology sectors, particularly those with high growth expectations but limited current profitability. Conversely, they might identify opportunities in value sectors like energy or financials, depending on prevailing market conditions and their internal models. Specific sectors mentioned in any particular report should be referenced here, if available.

-

BofA's predicted market performance in the short-term and long-term: BofA's predictions often reflect a degree of uncertainty. While specific predictions change frequently, their general approach usually involves outlining potential scenarios – optimistic, neutral, and pessimistic – and their likely impact on various market segments. This cautious approach emphasizes the importance of diversified portfolios and risk management strategies.

Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis isn't conducted in a vacuum; it considers a multitude of macroeconomic factors influencing investor sentiment and market performance.

-

Interest rate hikes and their impact on valuations: The Federal Reserve's interest rate hikes significantly impact borrowing costs for businesses and consumers. BofA meticulously analyzes the effects of these hikes on corporate earnings, discount rates used in valuation models, and investor risk appetite, all of which influence stock valuations.

-

Inflation and its effect on corporate earnings and investor sentiment: Persistent inflation erodes purchasing power and increases input costs for businesses, potentially squeezing profit margins. BofA closely monitors inflation data and its impact on corporate earnings forecasts, investor confidence, and consequently, stock valuations.

-

Geopolitical risks and their influence on market stability: Geopolitical events, such as international conflicts or trade disputes, introduce uncertainty and volatility into the market. BofA incorporates geopolitical risk assessments into its valuation models, acknowledging their potential to significantly impact market performance and investor sentiment.

-

Potential recessionary scenarios and their implications: BofA's economists regularly assess the probability of a recession and its potential impact on corporate earnings and stock prices. These recessionary scenarios are factored into their overall market valuation analysis, helping investors understand potential downside risks.

Addressing Investor Concerns Regarding Volatility

Market volatility is a major concern for investors. BofA acknowledges these anxieties and offers strategies to navigate challenging market conditions.

-

Strategies for mitigating risk in a volatile market: BofA often recommends diversification as a cornerstone of risk management. Diversifying across different asset classes (stocks, bonds, real estate) and sectors helps reduce the impact of losses in any single investment. Hedging strategies, such as using options or futures contracts, can also be employed to mitigate risk.

-

BofA's advice on asset allocation based on risk tolerance: BofA emphasizes the importance of tailoring investment strategies to individual risk tolerance. They offer guidance on asset allocation, advising investors with higher risk tolerance to allocate more towards equities, while those with lower risk tolerance should maintain a larger portion in less volatile assets.

-

Explanation of BofA's predictions for future market trends and their impact on investment strategies: BofA's predictions are rarely absolute. Instead, they provide a range of possible outcomes and their implications for investment strategies. This nuanced approach encourages investors to stay informed and adapt their portfolios according to evolving market conditions and BofA's updated analyses.

BofA's Recommendations for Investors

Based on its valuation analysis, BofA often provides specific recommendations for investors.

-

Specific investment strategies suggested by BofA: BofA may suggest value investing strategies, focusing on undervalued companies with strong fundamentals, or growth investing, concentrating on companies with high growth potential. The specific recommendations depend heavily on the prevailing market conditions and the bank's updated assessments.

-

Sectors or asset classes BofA recommends focusing on: This will vary based on their current market outlook. BofA might suggest overweighting certain sectors deemed undervalued or underrepresented in investor portfolios.

-

Advice on holding periods and potential exit strategies: BofA likely advises investors on holding periods, considering both their risk tolerance and the projected performance of specific investments. Clear exit strategies, outlining potential sell points based on market conditions or individual investment performance, are also crucial aspects of BofA's recommendations.

Conclusion

BofA's analysis of stock market valuations reveals a cautious yet nuanced perspective. Their assessment considers a wide array of macroeconomic factors, from interest rate hikes and inflation to geopolitical risks and recessionary scenarios. This comprehensive approach allows them to provide valuable insights and actionable recommendations for investors. BofA's emphasis on diversification, risk management, and adapting strategies to individual risk tolerance underscores the importance of a well-informed and dynamic investment approach. To gain a more comprehensive understanding of BofA's perspective on BofA Stock Market Valuations, we encourage you to delve deeper into their research and reports available on their website. Stay informed on BofA's perspective on stock market valuations to make well-informed investment decisions.

Featured Posts

-

Exclusive Final Chapter In The Sale Of Elon Musks X Corporation Debt

May 01, 2025

Exclusive Final Chapter In The Sale Of Elon Musks X Corporation Debt

May 01, 2025 -

Cap Nhat Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

Cap Nhat Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025 -

Kampen Duurzame School Zonder Stroom Kort Geding Tegen Netbeheerder

May 01, 2025

Kampen Duurzame School Zonder Stroom Kort Geding Tegen Netbeheerder

May 01, 2025 -

10 Game Winning Streak For Cavaliers De Andre Hunters Impact

May 01, 2025

10 Game Winning Streak For Cavaliers De Andre Hunters Impact

May 01, 2025