BofA On Stock Market Valuations: Why Investors Shouldn't Be Alarmed

Table of Contents

BofA's Key Arguments Against Immediate Market Correction

BofA's relatively optimistic outlook on current stock market valuations is grounded in several key factors. Their analysis suggests that the current high valuations are supported by a combination of strong economic fundamentals and positive corporate performance. This isn't to say there are no risks; however, BofA's assessment points toward a more balanced picture than the widespread fear suggests.

-

Strong Corporate Earnings Growth Projections: BofA's analysts project continued robust earnings growth for many companies, suggesting that current valuations are at least partially justified by future profitability. These projections consider various factors, including projected revenue growth and cost-cutting measures.

-

Positive Economic Indicators Despite Inflation Concerns: While inflation remains a concern, BofA notes that several key economic indicators remain positive, suggesting continued economic growth. This includes data on employment, consumer spending, and industrial production. The bank acknowledges inflation's impact but believes its effect on valuations is already largely priced in.

-

Low Interest Rates (Relative to Historical Averages): Although interest rates are rising, they remain relatively low compared to historical averages. This low-interest-rate environment helps support higher stock valuations by lowering the cost of borrowing for companies and making investments in equities more attractive.

-

Focus on Long-Term Growth Potential: BofA emphasizes the importance of considering long-term growth potential rather than focusing solely on short-term market fluctuations. Their analysis weighs factors that contribute to sustainable, long-term growth.

-

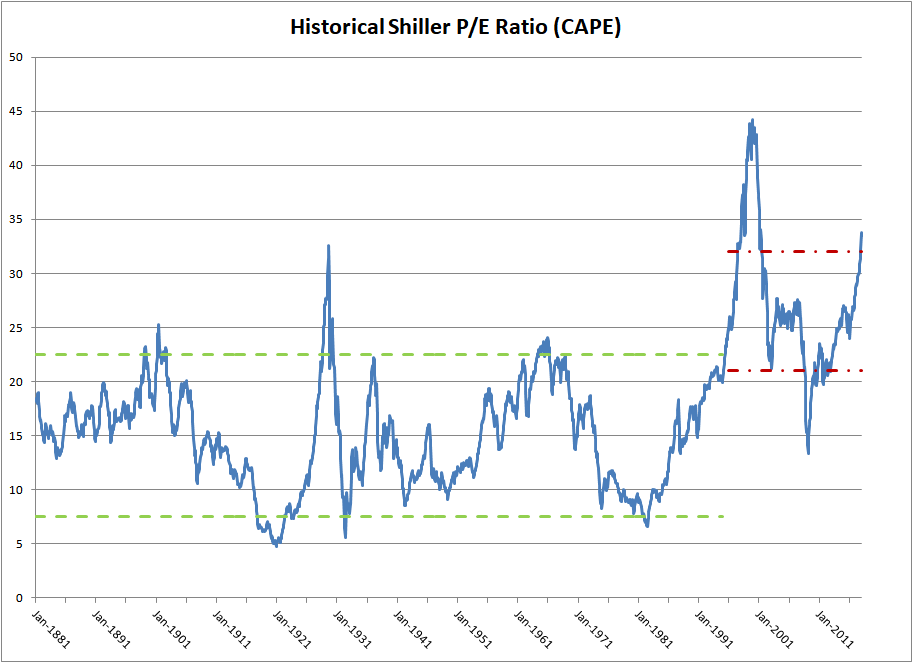

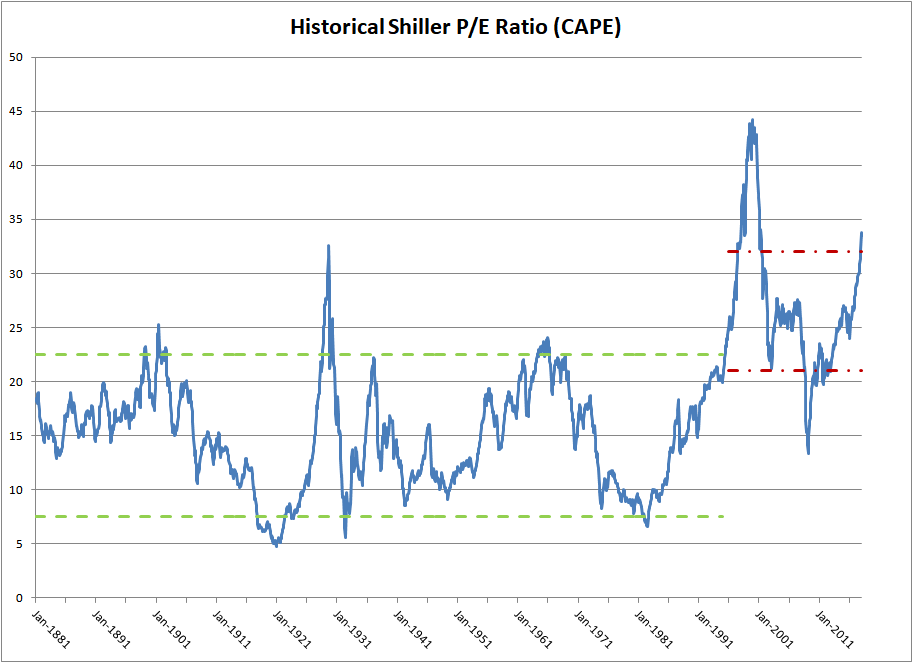

Specific Metrics and Data Points: BofA's analysis relies on numerous metrics, including Price-to-Earnings (P/E) ratios, forward earnings estimates, and discounted cash flow models. While the specific data is proprietary, their conclusions indicate a more positive outlook on long-term investor returns than many market commentators suggest.

Addressing Common Investor Concerns About High Valuations

It's undeniable that high stock market valuations raise valid concerns. Many investors fear a market "bubble" and the potential for a significant correction. Let's address these concerns:

-

Counterargument to the "Market Bubble" Narrative: BofA counters the "bubble" narrative by highlighting the underlying strength of corporate earnings and the positive economic outlook. They argue that while valuations are high, they are not detached from fundamentals to the extent seen in previous bubbles.

-

Potential Risks and Downside Scenarios: BofA acknowledges the potential risks, including the possibility of further inflation, rising interest rates, or unexpected geopolitical events. However, their analysis suggests that these risks are largely accounted for in their projections, and that the potential upside still outweighs the downside.

-

Accounting for Inflation and Interest Rate Hikes: BofA's projections explicitly account for the expected impact of inflation and interest rate hikes on corporate earnings and market valuations. Their models incorporate different scenarios to assess potential impacts.

-

Concerns About Specific Sectors or Market Segments: BofA's analysis is not a blanket statement applicable to every sector. They likely acknowledge that certain sectors are more vulnerable than others to economic shifts. A deeper dive into their sector-specific analyses would provide a more granular understanding.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA offers the following recommendations for investors:

-

Maintain a Long-Term Investment Strategy: BofA emphasizes the importance of maintaining a long-term perspective and avoiding knee-jerk reactions to short-term market volatility.

-

Diversify Portfolios Across Different Asset Classes: Diversification is crucial to mitigate risk. BofA likely suggests a balanced portfolio encompassing stocks, bonds, and potentially other asset classes.

-

Focus on Fundamentally Strong Companies with Sustainable Growth Potential: Investors should focus on companies with solid financials, strong competitive advantages, and a clear path to sustainable growth.

-

Consider Dollar-Cost Averaging to Mitigate Risk: Dollar-cost averaging can help reduce the impact of market fluctuations on investment returns.

-

Avoid Rash Decisions Based on Short-Term Market Fluctuations: The key takeaway is to avoid making impulsive decisions based on short-term market noise.

The Importance of Considering Long-Term Growth

BofA's analysis underscores the critical importance of adopting a long-term perspective in investing.

-

Historical Context: History shows that periods of high valuations have often been followed by extended periods of market growth. While past performance is not indicative of future results, historical context can help investors understand the cyclical nature of the market.

-

Focus on Sustainable Growth Metrics: BofA likely focuses on sustainable growth metrics rather than short-term gains. This means evaluating factors like consistent revenue growth, strong profit margins, and robust balance sheets.

-

The Importance of Patience in Investing: Successfully navigating market volatility requires patience. BofA's message emphasizes the long game, focusing on the potential for long-term growth rather than trying to time the market perfectly.

Conclusion: BofA on Stock Market Valuations: A Reasoned Optimism

In summary, while BofA acknowledges the elevated nature of current stock market valuations, their analysis suggests a more balanced approach than the pervasive fear might indicate. Their key arguments center around strong corporate earnings projections, positive economic indicators, relatively low interest rates, and a focus on long-term growth potential. BofA recommends a long-term investment strategy, portfolio diversification, and a focus on fundamentally strong companies. Don't let short-term market fluctuations deter you from a well-planned investment strategy based on BofA's analysis of stock market valuations. Learn more about BofA's insights on stock market valuations and make informed investment decisions.

Featured Posts

-

The Bold And The Beautiful Spoilers For February 20th Steffy Comforts Liam Poppy Warns Finn

Apr 24, 2025

The Bold And The Beautiful Spoilers For February 20th Steffy Comforts Liam Poppy Warns Finn

Apr 24, 2025 -

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

Apr 24, 2025

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025 -

Eu Plans Spot Market Ban For Russian Natural Gas

Apr 24, 2025

Eu Plans Spot Market Ban For Russian Natural Gas

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025