BofA On Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Current Market Outlook

BofA generally maintains a cautiously optimistic outlook on the current market, leaning towards neutral rather than outright bullish or bearish. Their predictions are contingent on several key economic factors, and they emphasize the importance of monitoring these indicators closely. While acknowledging significant challenges, BofA believes the market possesses resilience and potential for future growth, albeit at a potentially slower pace than previously anticipated.

- Specific data points: BofA's recent reports suggest a moderate GDP growth rate for the coming year, slightly lower than previous projections due to persistent inflationary pressures. They also forecast a gradual decline in inflation, but warn that this process may be prolonged.

- Sector-specific views: BofA exhibits a more positive outlook on sectors such as technology and healthcare, viewing them as potentially less susceptible to immediate economic downturns. Conversely, they express some caution regarding sectors highly sensitive to interest rate changes and consumer spending.

- Key economic indicators: BofA closely monitors inflation figures (CPI and PPI), interest rate decisions by central banks, and consumer confidence indices to gauge the overall health of the economy and its impact on stock market valuations.

Understanding BofA's Valuation Metrics

BofA employs a range of valuation metrics to assess the current market environment. These metrics provide a comprehensive picture, enabling a more informed perspective than relying on a single indicator. Understanding these metrics is crucial for interpreting BofA's conclusions on BofA stock market valuations.

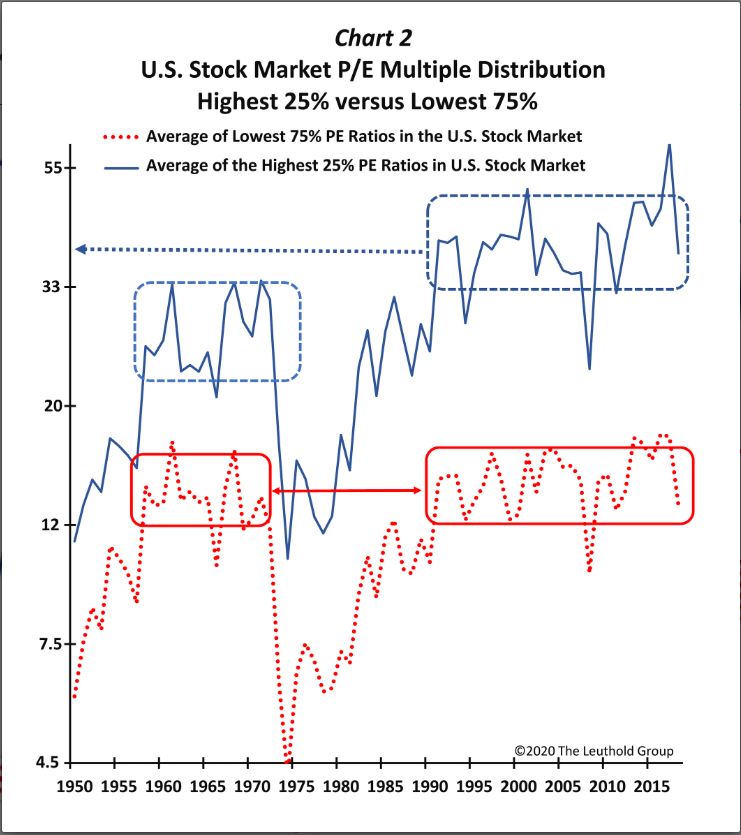

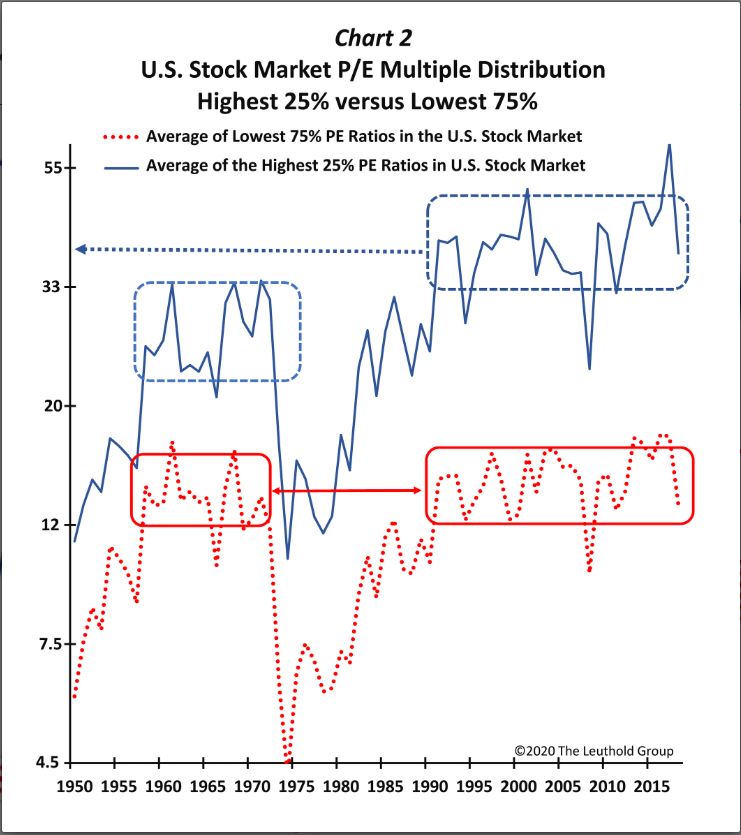

- Price-to-Earnings Ratio (P/E): This metric compares a company's stock price to its earnings per share. A high P/E ratio may suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. BofA uses P/E ratios to assess individual company valuations and the overall market P/E to gauge market sentiment.

- Price-to-Sales Ratio (P/S): This compares a company's market capitalization to its revenue. It's often used for companies with negative earnings, offering a broader valuation perspective. BofA incorporates P/S ratios, particularly when analyzing companies in high-growth sectors.

- Historical Comparisons: BofA compares current valuation metrics to historical averages, providing context and highlighting potential overvaluation or undervaluation relative to past market cycles. They often emphasize that current valuations, while perhaps elevated in some areas, are not unprecedented in historical terms.

Addressing Market Concerns

Several factors contribute to current investor anxieties. BofA addresses these head-on in its analysis:

- Inflation: BofA acknowledges the persistent inflationary pressure but emphasizes the anticipated gradual decline and the central banks' commitment to controlling it. They highlight that while inflation impacts valuations, the market is adapting to a new environment.

- Interest Rate Hikes: BofA anticipates further interest rate adjustments but suggests that the pace of hikes might slow. They analyze the impact on different sectors and highlight the potential for strategic adjustments in investment portfolios to mitigate the impact of higher interest rates.

- Geopolitical Instability: BofA considers geopolitical risks but stresses that the market has proven resilient to such events in the past. They incorporate scenarios involving varying degrees of geopolitical risk into their models to offer a more comprehensive analysis.

Long-Term Investment Strategies

BofA's analysis supports a long-term investment approach. Based on their BofA stock market valuations assessment, they recommend:

- Diversification: Spreading investments across different asset classes and sectors to mitigate risk.

- Strategic Sector Rotation: Shifting investments towards sectors perceived as less susceptible to economic downturns based on BofA's insights.

- Value Investing: Focusing on companies with strong fundamentals and undervalued stock prices.

- Risk Management: Employing stop-loss orders and regularly reviewing investment portfolios to adapt to evolving market conditions.

Alternative Perspectives and Cautions

While BofA offers a relatively reassuring view, it's crucial to acknowledge alternative perspectives and potential risks:

- Differing Opinions: Other analysts may hold more pessimistic views, highlighting potential risks not fully addressed by BofA's analysis.

- Unforeseen Events: Unpredictable events, such as a sudden escalation of geopolitical tensions or an unexpected economic downturn, can significantly impact market valuations.

- Independent Research: Investors should conduct thorough independent research and consider diverse perspectives before making investment decisions.

Conclusion

BofA's analysis of BofA stock market valuations offers a valuable perspective, suggesting that while challenges exist, panic selling may be an overreaction. Their assessment highlights the importance of a long-term perspective, diversification, and careful consideration of various valuation metrics. However, remember that this analysis represents just one viewpoint. While BofA's assessment offers a reassuring perspective on current stock market valuations, remember that individual investment decisions should be based on careful consideration of personal circumstances and a comprehensive risk assessment. Conduct thorough research and consult a financial advisor before making any significant investment changes based on this or any market analysis. Don't let fear drive your decisions; use sound judgment and carefully consider the implications of BofA stock market valuations before acting.

Featured Posts

-

Benson Boone I Heart Radio Music Awards 2025 Sheer Lace Top Look

Apr 26, 2025

Benson Boone I Heart Radio Music Awards 2025 Sheer Lace Top Look

Apr 26, 2025 -

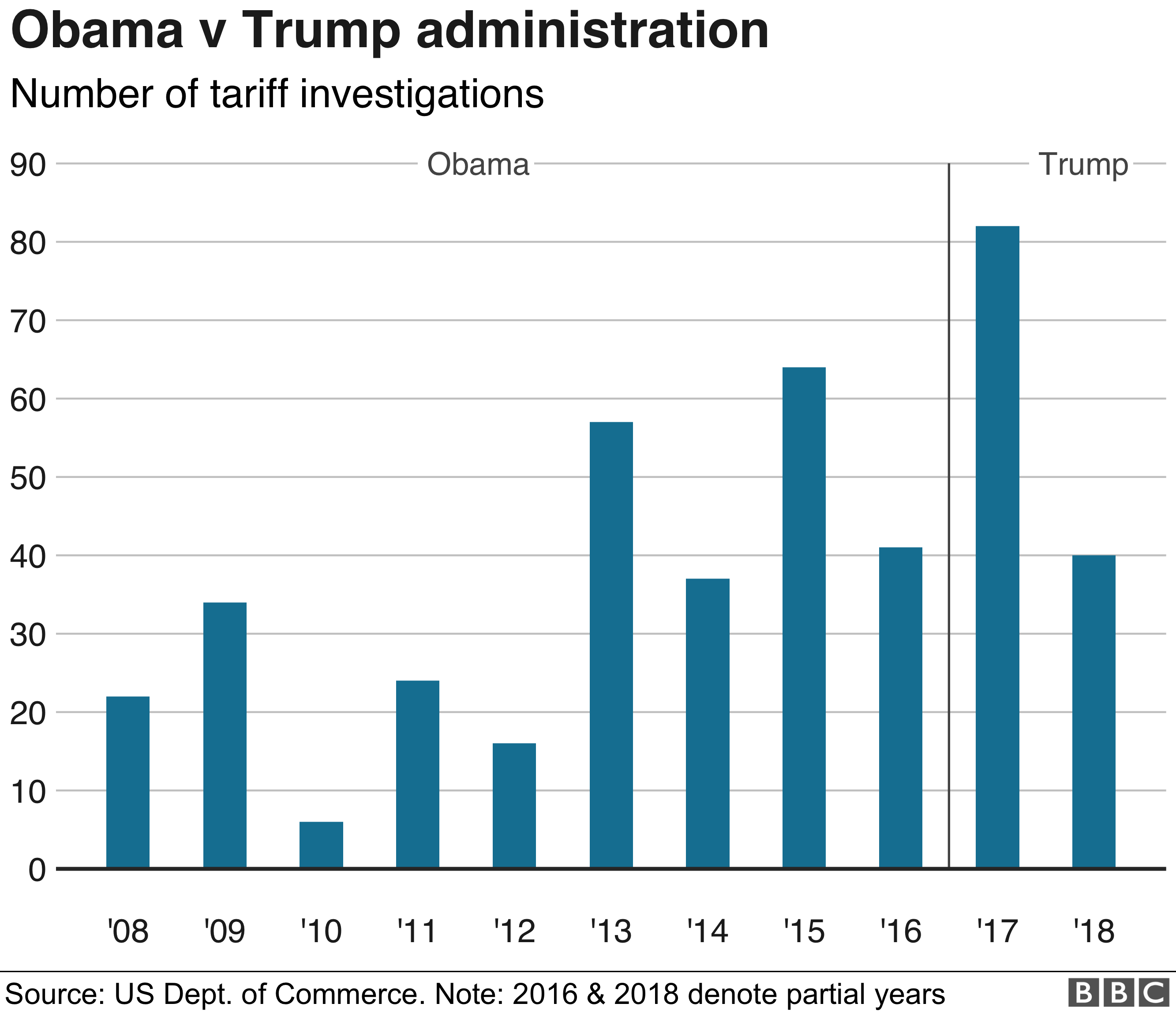

Trump Tariffs Ceo Concerns And The Impact On Consumers

Apr 26, 2025

Trump Tariffs Ceo Concerns And The Impact On Consumers

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two First Look At Cinema Con Standee

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two First Look At Cinema Con Standee

Apr 26, 2025 -

Millions Stolen Insider Reveals Executive Office365 Compromise

Apr 26, 2025

Millions Stolen Insider Reveals Executive Office365 Compromise

Apr 26, 2025 -

Chelsea Handlers Whistler Adventure Unexpected Celebrity Encounter

Apr 26, 2025

Chelsea Handlers Whistler Adventure Unexpected Celebrity Encounter

Apr 26, 2025