BofA Reassures Investors: Why Stretched Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA's analysis points to several key factors supporting current market valuations, despite their seemingly stretched nature. These factors suggest that the market's growth isn't solely fueled by speculation, but by fundamental strength and positive economic trends.

Strong Corporate Earnings Growth

One of the most significant drivers underpinning current valuations is robust corporate earnings growth. Many companies have exceeded earnings expectations, demonstrating strong financial health and resilience. This impressive performance isn't just a short-term phenomenon; it's driven by fundamental factors contributing to sustained revenue growth.

- Increased consumer spending: A robust economy with rising disposable incomes has boosted consumer spending, fueling demand for goods and services across various sectors.

- Technological advancements boosting productivity: Innovation and technological advancements have led to increased efficiency and productivity, allowing companies to generate higher profits with optimized operations.

- Supply chain improvements: Easing supply chain disruptions are contributing to smoother operations and reduced production costs, further enhancing profitability.

These factors collectively demonstrate the underlying strength of the corporate sector, justifying, to some extent, the current valuation levels.

Low Interest Rates and Ample Liquidity

The prevailing environment of low interest rates and ample liquidity plays a crucial role in sustaining high stock market valuations. Low borrowing costs encourage companies to invest in expansion and innovation, further fueling growth. Simultaneously, readily available capital stimulates investor appetite for risk, driving up demand for equities.

- Low borrowing costs for companies: Companies can access capital at historically low rates, enabling them to invest in growth initiatives, research and development, and acquisitions, ultimately boosting earnings and valuations.

- Increased investor appetite for risk: Low-interest rates make risk-free investments less attractive, prompting investors to seek higher returns in the stock market, even with seemingly elevated valuations.

- Sustained capital investment: Easy access to capital leads to sustained capital investment across various sectors, supporting economic growth and bolstering company performance.

Innovation and Technological Advancements

The rapid pace of innovation and technological advancements significantly contributes to justifying higher valuations, particularly within specific sectors. Companies at the forefront of technological breakthroughs often command premium valuations due to their growth potential and disruptive capabilities.

- AI advancements: Artificial intelligence is transforming various industries, creating new opportunities and driving growth for companies leading in AI development and implementation.

- Sustainable energy solutions: The growing focus on sustainability is creating a burgeoning market for renewable energy technologies, attracting significant investment and driving valuations higher.

- Biotechnology breakthroughs: Advancements in biotechnology and pharmaceuticals are creating innovative treatments and therapies, leading to substantial growth and high valuations in this sector.

Addressing Investor Concerns About Stretched Stock Market Valuations

While BofA's analysis suggests that current valuations aren't necessarily a cause for alarm, it's crucial to address investor concerns and understand the limitations of traditional valuation metrics.

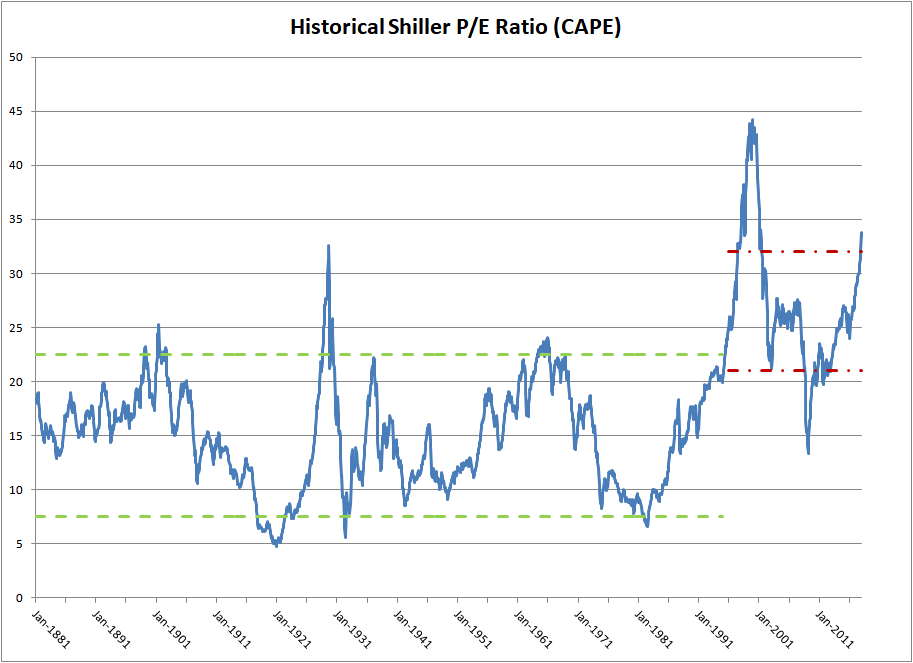

Addressing Valuation Metrics

Traditional valuation metrics like the P/E ratio and PEG ratio may not fully capture the dynamics of a rapidly evolving market driven by innovation and technological disruption. These metrics often struggle to account for future growth prospects accurately.

- Sector-specific valuation considerations: Different sectors have varying growth trajectories and risk profiles, requiring sector-specific valuation approaches instead of a blanket application of general metrics.

- Growth-adjusted valuation models: Models that incorporate future growth projections can offer a more nuanced understanding of valuations than static ratios.

- Discounted cash flow analysis: This method focuses on the present value of future cash flows, providing a more forward-looking valuation approach.

Managing Risk in a High-Valuation Environment

Even with positive underlying factors, investors need strategies to manage risk in a high-valuation environment. This involves careful portfolio management and a long-term investment perspective.

- Diversification across asset classes: Diversifying investments across different asset classes reduces the impact of market fluctuations on the overall portfolio.

- Strategic asset allocation: A well-defined asset allocation strategy that aligns with risk tolerance and investment goals is crucial.

- Regular portfolio review: Periodic portfolio review and rebalancing ensure the investment strategy remains aligned with changing market conditions and investor objectives.

Conclusion

BofA's reassurance regarding stretched stock market valuations is based on several key factors: strong corporate earnings growth, low interest rates and ample liquidity, and the continuous drive of innovation. While traditional valuation metrics might raise concerns, a deeper analysis considering future growth potential and sector-specific dynamics provides a more optimistic outlook. However, responsible investing always involves managing risk. It's crucial to consult with a financial advisor to create a personalized investment strategy that addresses your individual risk tolerance and long-term goals while considering BofA's analysis and the nuances of current stretched stock market valuations. Further research into BofA's reports on this topic is highly recommended.

Featured Posts

-

5880 Rally Why This Altcoin Could Be The Next Xrp

May 07, 2025

5880 Rally Why This Altcoin Could Be The Next Xrp

May 07, 2025 -

Papa Francisco Fieis Acampam No Vaticano Para O Funeral

May 07, 2025

Papa Francisco Fieis Acampam No Vaticano Para O Funeral

May 07, 2025 -

2025 6000

May 07, 2025

2025 6000

May 07, 2025 -

How The Pope Is Elected A Comprehensive Guide To The Conclave

May 07, 2025

How The Pope Is Elected A Comprehensive Guide To The Conclave

May 07, 2025 -

Predicting The Warriors Vs Rockets Nba Playoff Matchup Best Bets And Odds

May 07, 2025

Predicting The Warriors Vs Rockets Nba Playoff Matchup Best Bets And Odds

May 07, 2025