BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Alarm

BofA's calming assessment isn't based on blind optimism. Their rationale rests on several key pillars supporting the current market environment despite seemingly high valuations. They argue that several factors mitigate the risks associated with these valuations.

- Low Interest Rates: Historically low interest rates continue to fuel investment in equities, making them a relatively more attractive option compared to bonds. This influx of capital supports higher valuations.

- Strong Corporate Earnings: Many companies are reporting robust earnings, demonstrating resilience and underlying strength in the economy. These positive earnings reports justify, to some extent, the higher price-to-earnings (P/E) ratios we're seeing.

- Technological Innovation: Continued advancements in technology are driving growth and creating new opportunities for businesses, further fueling investor confidence and supporting higher valuations for innovative companies.

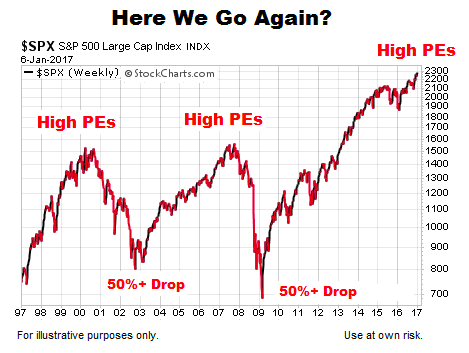

- Historical Context: BofA likely uses historical P/E ratios to contextualize the current situation. While valuations may seem high compared to historical averages, they might still fall within acceptable ranges considering the broader economic and technological landscape. The bank likely points to periods of similar high valuations that were ultimately followed by sustained growth.

Analyzing the Current Economic Landscape: Factors Supporting BofA's View

BofA's optimistic outlook is further underpinned by a positive assessment of the current macroeconomic environment. Several factors contribute to their confidence:

- GDP Growth: Sustained, albeit potentially slowing, GDP growth indicates a healthy economy capable of supporting higher stock prices. BofA's analysis likely includes projections for future GDP growth.

- Inflation and Unemployment: While inflation is a concern, BofA's assessment likely considers the current levels of inflation and their impact on corporate profitability and consumer spending. Similarly, low unemployment figures suggest a strong labor market, further supporting economic growth.

- Government Policies: The impact of government fiscal and monetary policies, such as interest rate adjustments and stimulus packages, plays a crucial role. BofA's analysis will likely include an assessment of the effectiveness and potential impact of these policies on the stock market.

- Geopolitical Risks: Global events and geopolitical uncertainties always present risks. BofA's outlook acknowledges these risks but likely assesses them as manageable within the broader context of a still-positive economic picture.

Long-Term Investment Strategies: BofA's Recommendations for Investors

Navigating the current market requires a strategic approach. BofA likely recommends investors consider the following:

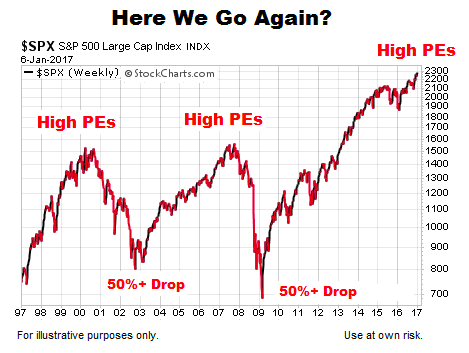

- Diversification: A well-diversified portfolio across different asset classes (equities, bonds, real estate, etc.) is crucial to mitigate risk.

- Long-Term Investing: Focusing on long-term investment goals, rather than short-term market fluctuations, is paramount. BofA likely emphasizes the importance of a buy-and-hold strategy.

- Asset Allocation: BofA might recommend specific asset allocation strategies based on an investor's risk tolerance and time horizon. This might involve a higher allocation to equities for longer-term investors with a higher risk tolerance.

- Risk Management: Implementing appropriate risk management strategies, such as setting stop-loss orders or diversifying investments, is essential to protect against potential market downturns.

Counterarguments and Addressing Potential Risks

While BofA presents a largely optimistic view, it's crucial to acknowledge potential counterarguments and risks:

- Market Correction: High valuations inherently increase the risk of a market correction or downturn. BofA's analysis likely acknowledges this possibility.

- Inflationary Pressures: Sustained high inflation could erode corporate profits and negatively impact stock prices. This is a key risk that BofA likely addresses in its analysis.

- Interest Rate Hikes: Future interest rate hikes by central banks could impact investor sentiment and lead to a market slowdown.

- Unforeseen Events: Unexpected geopolitical events or economic shocks can significantly impact market performance.

Conclusion: Navigating Stock Market Valuations with BofA's Guidance

BofA's analysis suggests that while stock market valuations appear stretched, several factors mitigate the immediate risks. Their assessment emphasizes the importance of considering the broader economic context, including low interest rates, strong corporate earnings, and technological innovation. However, investors should maintain a balanced perspective, acknowledging potential risks such as market corrections and inflationary pressures. By understanding BofA's analysis and conducting your own thorough research, you can develop a well-informed investment strategy that aligns with your risk tolerance and long-term financial goals. Don't let anxieties about stretched stock market valuations paralyze you – understanding these valuations is key to making sound investment decisions. Start your research today and build a robust strategy based on your individual circumstances. Remember to consult with a financial advisor for personalized guidance.

Featured Posts

-

Back From Surgery Christian Yelich Makes First Spring Training Appearance

Apr 23, 2025

Back From Surgery Christian Yelich Makes First Spring Training Appearance

Apr 23, 2025 -

Recession Fears Rise In Canada Economists Analysis Of Tariff Impacts

Apr 23, 2025

Recession Fears Rise In Canada Economists Analysis Of Tariff Impacts

Apr 23, 2025 -

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025 -

L Uvre De Marc Fiorentino Explication De Sa Carte Blanche

Apr 23, 2025

L Uvre De Marc Fiorentino Explication De Sa Carte Blanche

Apr 23, 2025 -

Aaron Judges 3 Hrs Lead Yankees To Record Setting 9 Homer Game

Apr 23, 2025

Aaron Judges 3 Hrs Lead Yankees To Record Setting 9 Homer Game

Apr 23, 2025