BofA's Analysis: Addressing Concerns Over High Stock Market Valuations

Table of Contents

BofA's Valuation Metrics and Methodology

BofA employs a sophisticated approach to evaluating market valuations, utilizing a range of established metrics and proprietary models. Key valuation metrics employed include the Price-to-Earnings ratio (P/E), the Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE), each offering a unique perspective on market pricing relative to underlying fundamentals.

Their methodology involves a meticulous process:

-

Data Collection: BofA gathers comprehensive data from a variety of sources, including financial statements, market transactions, and macroeconomic indicators.

-

Model Application: They utilize econometric models and statistical analysis to interpret this data, considering historical trends, economic forecasts, and industry-specific factors.

-

Qualitative Assessment: BofA's analysis isn't solely quantitative. Experienced analysts incorporate qualitative factors, such as geopolitical risks and regulatory changes, to refine their valuation estimates.

-

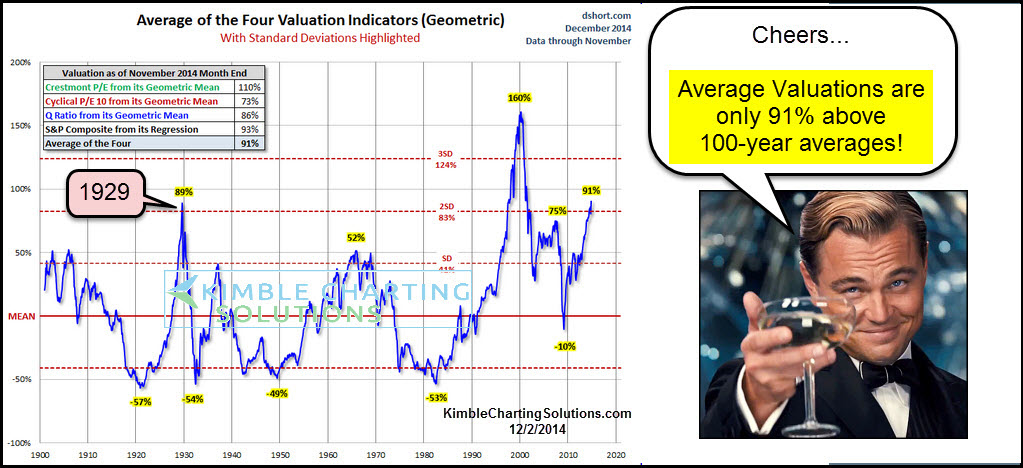

BofA's Findings: Recent BofA reports have indicated that certain sectors are trading at significantly elevated valuations compared to historical averages.

-

Historical Comparison: The current P/E ratios, for instance, are being compared to those observed during previous market peaks, highlighting potential overvaluation in specific sectors.

-

Sectoral Analysis: BofA has specifically highlighted technology and consumer discretionary sectors as potentially overvalued, while certain defensive sectors might be relatively undervalued.

Identifying Potential Risks and Challenges

BofA's analysis doesn't shy away from the inherent risks associated with elevated market valuations. These risks include:

-

Market Corrections: The elevated valuations increase the potential for significant market corrections or even a more substantial downturn.

-

Interest Rate Hikes: Rising interest rates, a common tool to combat inflation, can negatively impact stock prices by increasing borrowing costs for companies and reducing investor appetite for riskier assets.

-

Inflationary Pressures: Persistent high inflation erodes corporate profits and reduces consumer spending, potentially triggering a decline in stock prices.

-

Geopolitical Uncertainty: Global events, such as wars or political instability, can create market uncertainty and trigger sell-offs.

-

BofA's Risk Highlights: BofA has explicitly pointed to the vulnerability of growth stocks to interest rate increases and potential profit squeezes due to inflation.

-

Impact on Asset Classes: High valuations increase the risk of losses across various asset classes, including equities, bonds, and real estate.

-

Macroeconomic Influence: The report emphasizes the interplay between macroeconomic factors, like inflation and interest rates, and their significant influence on market valuations.

BofA's Outlook and Investment Strategies

Given the elevated valuations, BofA's outlook is cautiously optimistic. They advise a more defensive investment posture, emphasizing risk management and diversification.

- Recommendations: BofA recommends a more balanced portfolio, emphasizing value stocks and defensive sectors.

- Asset Allocation: They suggest reducing exposure to growth stocks and increasing allocations to sectors less susceptible to economic downturns.

- Promising Sectors: BofA points to certain sectors, such as healthcare and utilities, as offering relatively better risk-adjusted returns in the current market environment.

Comparing BofA's Analysis to Other Market Experts

While BofA's analysis carries significant weight, it's crucial to compare it with the views of other leading financial institutions. Some analysts share BofA's concerns about overvaluation, while others express a more optimistic outlook.

- Differing Perspectives: Goldman Sachs, for example, might hold a slightly less pessimistic view, highlighting specific growth opportunities within the technology sector.

- Methodological Variations: Different institutions employ variations in their valuation methodologies, which can lead to differing conclusions.

- Market Consensus: While there isn't a complete consensus, a growing number of analysts are expressing caution regarding current market valuations, mirroring BofA's concerns.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis provides a valuable framework for understanding the complexities of the current market environment. Their findings highlight the risks associated with high stock market valuations, emphasizing the potential for corrections and the importance of defensive investment strategies. By understanding BofA's analysis of high stock market valuations and their recommended approach, investors can make more informed decisions. Learn more about BofA's approach to managing high valuations and take action based on BofA's insights into high stock market valuations. Consult with a financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

The Iam Expat Fair Your Guide To Housing Finance And Family Fun

May 25, 2025

The Iam Expat Fair Your Guide To Housing Finance And Family Fun

May 25, 2025 -

Transparency And Accountability Examining Presidential Expenditures On Seals Watches And Entertainment

May 25, 2025

Transparency And Accountability Examining Presidential Expenditures On Seals Watches And Entertainment

May 25, 2025 -

Eldorados Fall A Behind The Scenes Look At A Failed Bbc Soap Opera

May 25, 2025

Eldorados Fall A Behind The Scenes Look At A Failed Bbc Soap Opera

May 25, 2025 -

Alex Ealas Grand Slam Moment Paris 2024

May 25, 2025

Alex Ealas Grand Slam Moment Paris 2024

May 25, 2025 -

Menya Vela Kakaya To Sila Dokumentalniy Portret Innokentiya Smoktunovskogo

May 25, 2025

Menya Vela Kakaya To Sila Dokumentalniy Portret Innokentiya Smoktunovskogo

May 25, 2025