BofA's Analysis: Addressing Investor Concerns About Stock Market Valuations

Table of Contents

BofA's Valuation Metrics and Key Findings

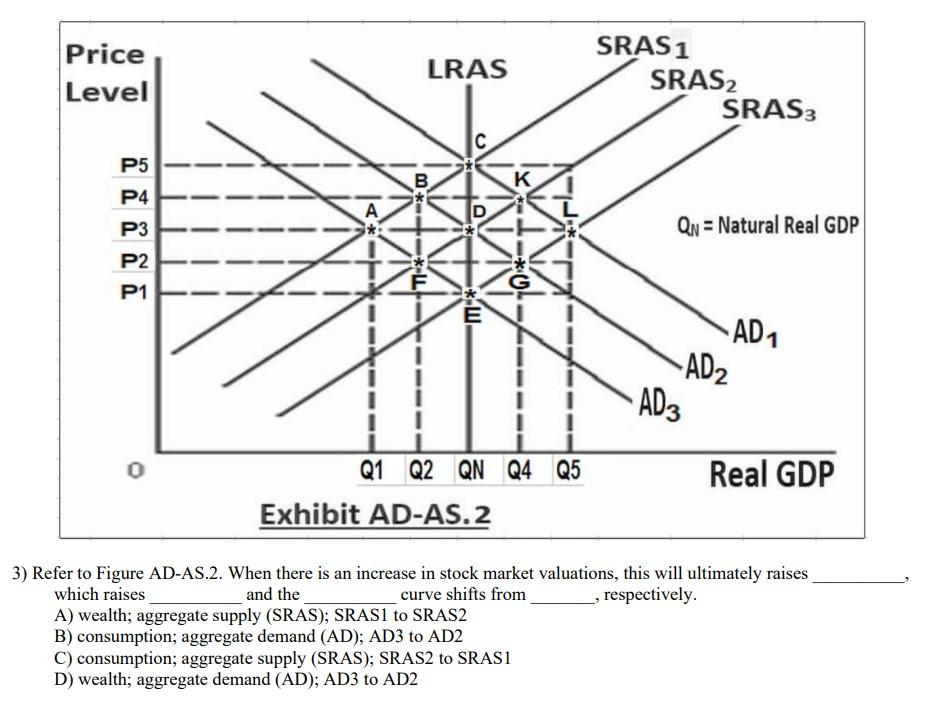

BofA employs a sophisticated methodology to assess stock market valuations, utilizing a range of widely accepted valuation ratios. Their analysis goes beyond simple Price-to-Earnings (P/E) ratios, incorporating metrics such as the Price-to-Sales (P/S) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE), offering a more nuanced picture. In their latest report, BofA concluded that, while certain sectors show signs of overvaluation, the overall market is currently considered to be fairly valued, albeit with significant sector-specific variations. This assessment is supported by their detailed analysis of earnings growth projections and discounted cash flow models.

- Specific valuation metrics used: Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, Shiller PE ratio, Dividend Yield.

- Key sectors identified as potentially overvalued: Technology, particularly high-growth tech stocks, and certain consumer discretionary sectors.

- Key sectors identified as potentially undervalued: Financials, energy, and some healthcare segments, depending on the specific valuation metric used.

- BofA's forecasts for future market performance: BofA projects moderate growth, with potential for increased volatility depending on the trajectory of interest rates and inflation.

Addressing Investor Concerns about Interest Rate Hikes

Interest rate hikes significantly impact stock market valuations. Higher rates increase borrowing costs for companies, potentially reducing profitability and impacting future earnings growth. This, in turn, can lead to lower stock prices as investors adjust their expectations for future returns. BofA's analysis highlights a complex relationship between interest rates and stock market performance. While higher rates can initially dampen investor sentiment, they can also signal a stronger economy and increased corporate borrowing capacity in the longer term.

- The impact of rising interest rates on corporate earnings: Reduced profitability due to higher borrowing costs, potential for decreased capital expenditure.

- BofA's projected interest rate trajectory: BofA's projections indicate a potential plateauing of interest rates in the near future, with a gradual downward trend thereafter, depending on the inflation scenario.

- Strategies for investors to navigate rising interest rates: Diversification across asset classes, focusing on value stocks, and potentially increasing exposure to higher-yielding fixed-income securities.

The Impact of Inflation on Stock Market Valuations

Inflation erodes purchasing power and affects corporate profitability by increasing input costs. High inflation can lead to decreased consumer spending and ultimately reduced earnings. BofA's analysis emphasizes the current inflationary environment and its significant impact on stock market valuations. They highlight the uneven impact of inflation on different sectors, with some companies better positioned to pass on increased costs than others.

- BofA's inflation forecast: BofA anticipates a gradual decline in inflation, but acknowledges the risk of persistent inflationary pressures.

- How inflation affects different sectors differently: Energy and commodity-based sectors tend to benefit from inflationary periods, while consumer staples are more susceptible to decreases in consumer spending.

- Defensive investment strategies during inflationary periods: Investing in inflation-hedged assets (e.g., commodities, real estate), focusing on companies with strong pricing power, and considering treasury inflation-protected securities (TIPS).

BofA's Recommendations for Investors

Based on their comprehensive valuation analysis, BofA recommends a cautious yet opportunistic approach for investors. They advise maintaining a diversified portfolio, focusing on sectors with strong fundamentals and the ability to withstand economic headwinds. Risk management strategies are paramount, including careful consideration of portfolio diversification and appropriate risk tolerance.

- Specific investment recommendations: BofA suggests a balanced approach, neither overly bullish nor excessively bearish. They recommend a selective approach, favoring undervalued sectors and avoiding excessively overvalued pockets of the market.

- Sectors or asset classes to favor: Financials, energy (with caution due to price volatility), and healthcare. They recommend a careful look at value stocks within the technology sector.

- Risk management strategies: Diversification across asset classes, hedging strategies against inflation, and careful monitoring of market conditions.

Conclusion: Understanding BofA's Analysis on Stock Market Valuations

BofA's analysis concludes that while the overall stock market is currently fairly valued, significant sector-specific variations exist. Key investor concerns regarding interest rate hikes and inflation have been addressed, highlighting the need for a nuanced and diversified investment strategy. BofA's recommendations emphasize a cautious approach, focusing on value stocks, diversification, and effective risk management. Learn more about BofA's stock market valuation analysis by visiting their official website. Stay informed about stock market valuations with BofA's insightful reports and consult with a financial advisor to assess your portfolio based on BofA's insights on stock market valuations.

Featured Posts

-

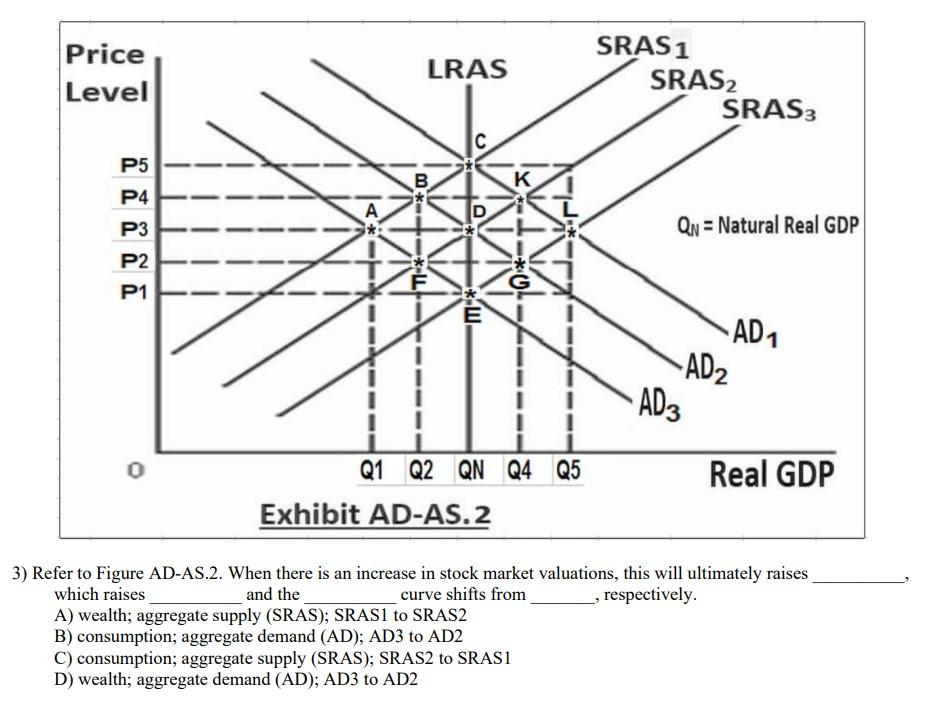

Ufc 314 Star Studded Card Suffers Setback Neal Vs Prates Off

May 05, 2025

Ufc 314 Star Studded Card Suffers Setback Neal Vs Prates Off

May 05, 2025 -

Eubank Jr Claims Benn Bout Eclipse Canelo Clash

May 05, 2025

Eubank Jr Claims Benn Bout Eclipse Canelo Clash

May 05, 2025 -

Ufc Des Moines Betting Preview Top Mma Picks And Odds Today

May 05, 2025

Ufc Des Moines Betting Preview Top Mma Picks And Odds Today

May 05, 2025 -

Blake Lively And Anna Kendrick A Red Carpet Reunion Amidst Feud Rumors

May 05, 2025

Blake Lively And Anna Kendrick A Red Carpet Reunion Amidst Feud Rumors

May 05, 2025 -

Lizzos Transformation How She Achieved Her Weight Loss Goals

May 05, 2025

Lizzos Transformation How She Achieved Her Weight Loss Goals

May 05, 2025