BofA's Reassurance: Why Current Stock Market Valuations Aren't A Worry

Table of Contents

BofA's Bullish Outlook: Understanding the Rationale

BofA's positive stance on the stock market isn't based on blind optimism. Their analysis points to several key factors supporting their bullish outlook. These factors, when considered together, paint a picture of a market poised for continued, albeit potentially moderate, growth.

Strong Corporate Earnings as a Supporting Factor:

Robust corporate earnings are a cornerstone of BofA's positive market outlook. Strong profit reports from various sectors indicate a healthy underlying economy, justifying, at least in part, current valuation levels.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have shown particularly strong earnings growth in recent quarters.

- Positive earnings surprises: Many companies have exceeded analysts' expectations, demonstrating resilience in the face of economic headwinds.

- Projected future earnings growth: BofA's analysts project continued earnings growth in the coming years, fueled by factors like technological innovation and expanding global markets. For example, their projections for the S&P 500 earnings growth are consistently above the historical average. (Note: Specific data and statistics should be inserted here from a reliable BofA report.)

Inflation's Impact and the Fed's Response:

Inflation remains a key concern for investors, and its impact on stock market valuations is undeniable. However, BofA's analysis suggests a nuanced perspective.

- BofA's inflation predictions: BofA's economists generally predict a gradual decline in inflation, although the trajectory remains uncertain. (Note: Insert specific data from BofA reports here).

- Expected interest rate trajectory: The Federal Reserve's interest rate hikes are a significant factor. BofA anticipates a potential pause or even rate cuts depending on inflation data, which could positively impact market sentiment and valuations. (Note: Insert specific data from BofA reports).

- Impact of monetary policy on stock prices: While interest rate hikes can initially dampen stock prices, BofA suggests that the current level is already factoring in the expected trajectory and may provide a solid foundation for future growth. A visual representation (chart or graph) showing the historical relationship between interest rates and market valuations would significantly strengthen this point.

Long-Term Growth Projections:

BofA's optimism extends beyond short-term indicators. Their long-term growth projections suggest a positive outlook for sustained market performance.

- Key growth drivers: Technological advancements, demographic shifts, and emerging markets are highlighted as key drivers of long-term economic growth.

- Sector-specific growth outlooks: BofA's analysis often provides sector-specific growth predictions, allowing investors to make informed decisions based on individual investment objectives. (Note: Insert specific sector examples and growth projections from BofA reports).

- Long-term valuation projections: BofA's models likely suggest that current valuations, while elevated, are not necessarily unsustainable in the context of long-term growth projections. (Note: Insert relevant data from BofA's long-term projections).

Addressing Concerns About High Valuations

It's crucial to acknowledge that concerns about high price-to-earnings ratios (P/E) and other valuation metrics are valid. However, BofA's analysis offers counterarguments that help mitigate these worries.

BofA's Counterarguments and Nuances:

BofA likely addresses the high valuations by contextualizing them within a broader framework.

- Comparison of current valuations to historical averages: While current valuations may seem high, BofA might compare them to historical averages, considering factors like interest rate environments and economic cycles. This context helps determine whether current levels represent significant overvaluation.

- Consideration of low interest rates: Low interest rates can justify higher valuations as investors seek higher returns in the stock market. This factor is often crucial in BofA's argument.

- Discussion of specific market segments with higher/lower valuations: BofA's analysis might point out sectors where valuations are more reasonable, encouraging diversified investment strategies.

Considering Alternative Investment Strategies:

Based on their assessment, BofA likely recommends specific strategies for navigating the current market.

- Suggestions for portfolio adjustments: This could include shifting towards sectors with more attractive valuations or increasing exposure to assets less correlated with the overall market.

- Recommendations for risk management: Appropriate risk management strategies are crucial. BofA may recommend diversification, hedging, or other techniques to mitigate potential downsides.

- Consideration of different asset classes: BofA might advise including alternative asset classes, like real estate or commodities, to further diversify portfolios.

The Importance of a Long-Term Investment Perspective

BofA likely emphasizes the critical role of long-term investing in navigating market volatility.

Avoiding Emotional Decision Making:

Short-term market fluctuations are inevitable. Reacting emotionally can lead to poor investment decisions.

- Risks of panic selling: Panic selling during market downturns can lock in losses and prevent participation in subsequent market rallies.

- Benefits of patience: A long-term perspective allows investors to ride out market corrections and benefit from long-term growth.

- Importance of a well-defined investment plan: Having a clear investment plan based on long-term goals is essential for navigating market uncertainty.

Staying Informed and Adapting:

The market is dynamic. Staying informed and adjusting strategies is crucial.

- Importance of financial news and market analysis: Following financial news and utilizing market analysis tools can help investors stay abreast of developments.

- Value of professional financial advice: Consulting with financial advisors can provide personalized insights and guidance in navigating the complexities of the market.

Conclusion

Bank of America's positive outlook on current stock market valuations is grounded in several key factors: strong corporate earnings, a manageable inflation outlook, and promising long-term growth projections. While acknowledging concerns about high valuations, BofA's analysis provides counterarguments, emphasizing the importance of context and a long-term investment strategy. The key takeaway is that reacting solely to short-term market fluctuations can be detrimental. Assess your investment strategy based on BofA's insights into current stock market valuations, considering diversification and risk management techniques. Learn more about BofA's market outlook and optimize your portfolio accordingly. Consulting with a financial advisor is highly recommended for personalized advice tailored to your individual investment goals and risk tolerance.

Featured Posts

-

The Librarians The Next Chapter Premiere Date Trailer And Poster Released By Tnt

May 06, 2025

The Librarians The Next Chapter Premiere Date Trailer And Poster Released By Tnt

May 06, 2025 -

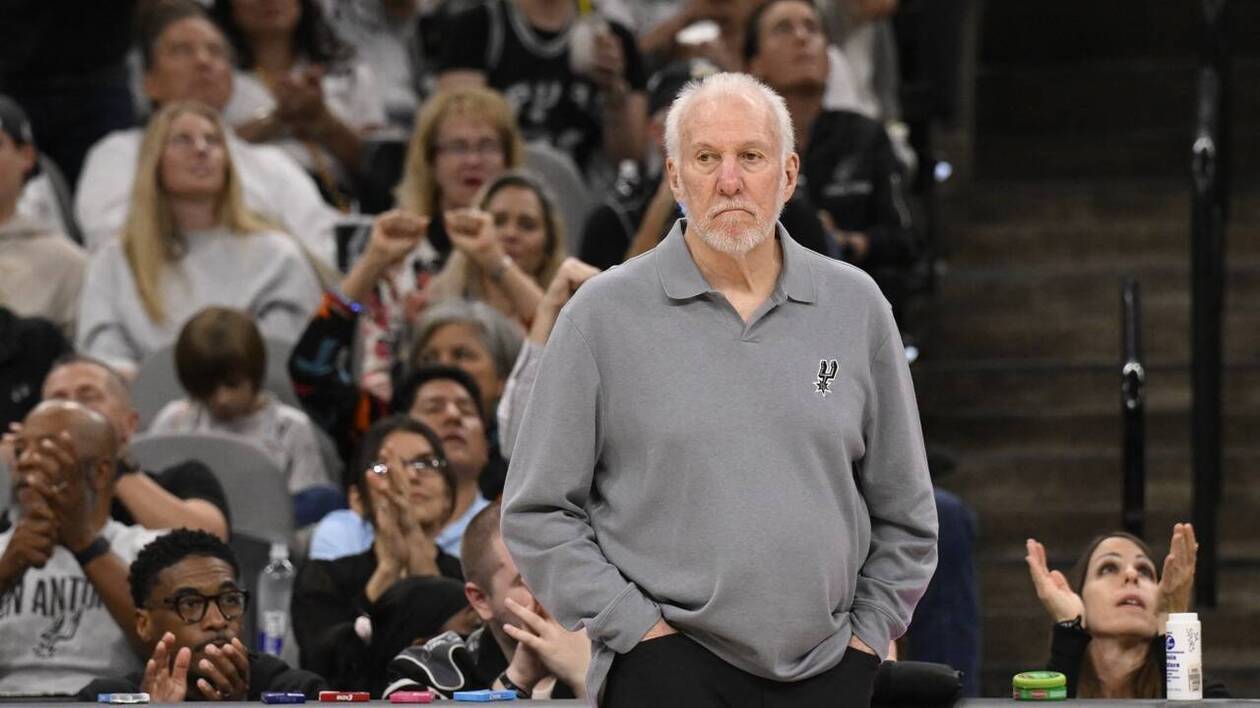

Stephen A Smith On Gregg Popovich A Look At Their Relationship And Mutual Respect

May 06, 2025

Stephen A Smith On Gregg Popovich A Look At Their Relationship And Mutual Respect

May 06, 2025 -

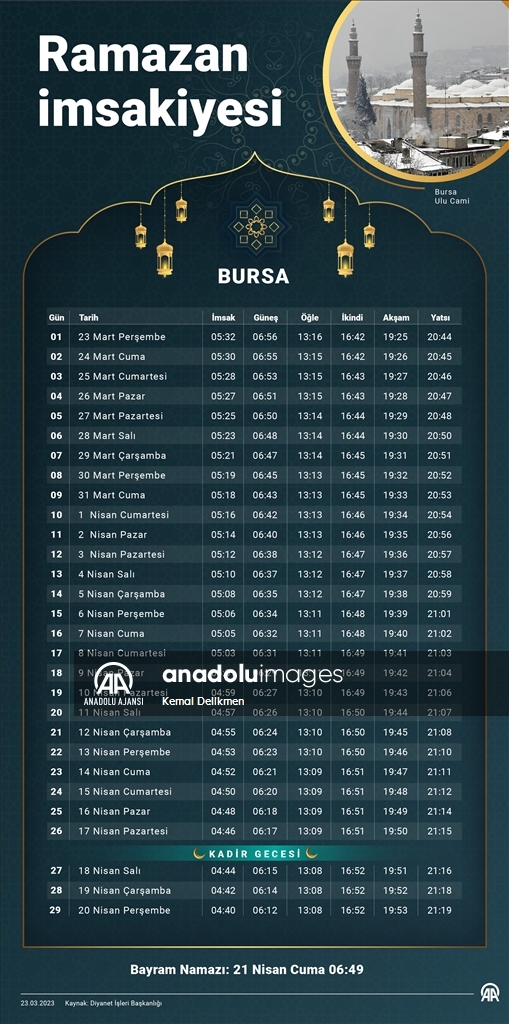

Gazze Den Ramazan Guenleri Anadolu Ajansi Nin Guencel Yayinlari

May 06, 2025

Gazze Den Ramazan Guenleri Anadolu Ajansi Nin Guencel Yayinlari

May 06, 2025 -

Gypsy Rose Blanchard Life After Lockup Season 2 Cast Premiere Date And More

May 06, 2025

Gypsy Rose Blanchard Life After Lockup Season 2 Cast Premiere Date And More

May 06, 2025 -

Gregg Popovich Son Retour Aux San Antonio Spurs En Question

May 06, 2025

Gregg Popovich Son Retour Aux San Antonio Spurs En Question

May 06, 2025