BofA's Reassuring View: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind the Optimistic Outlook

Bank of America's optimistic outlook on the current market, despite seemingly stretched valuations, rests on several key pillars. Their analysts argue that several factors currently mitigate the risks associated with high price-to-earnings ratios and other valuation metrics. This isn't a blanket endorsement of reckless investment, but rather a reasoned assessment based on their current market analysis.

-

Strong corporate earnings growth projections: BofA forecasts robust earnings growth for many sectors in the coming years, suggesting that current prices might be justified by future profitability. This expectation is supported by various macroeconomic indicators and sector-specific analyses.

-

Low interest rate environment (or expectations thereof): Low interest rates, or the expectation of them remaining low for the foreseeable future, contribute to higher valuations. Lower discount rates used in valuation models lead to higher present values of future earnings streams, making current prices seem less excessive.

-

Potential for further monetary policy support: The possibility of continued monetary easing, depending on economic conditions, further supports BofA’s optimistic stance. This potential for additional support could bolster market performance and justify higher valuations.

-

Long-term growth prospects outweighing current valuation concerns: BofA emphasizes a long-term perspective. They believe that the potential for substantial long-term growth, particularly in certain innovative sectors, outweighs the concerns about potentially high valuations in the short term.

-

Specific BofA reports and analysts: These insights are drawn from various BofA Global Research reports and the analysis of their leading equity strategists, underscoring the institution's commitment to its position.

Addressing the Concerns of High Price-to-Earnings Ratios (P/E)

High Price-to-Earnings ratios (P/E) are a common cause for investor concern. A high P/E suggests that investors are paying a premium for a company's earnings. However, BofA's analysis attempts to contextualize these high ratios.

-

Justification for high P/E ratios: BofA justifies high P/E ratios in certain sectors by pointing to robust future growth potential. They argue that investors are willing to pay more for companies expected to deliver significantly higher earnings in the future.

-

Comparison with historical P/E ratios: BofA's analysis often includes a comparison with historical P/E ratios, emphasizing that current levels, while elevated, may not be unprecedented in the context of periods with similar economic circumstances.

-

Sector-specific P/E variations: They acknowledge that P/E ratios vary significantly across sectors. Their analysis differentiates between sectors with high growth potential and those with more modest prospects, offering sector-specific valuations and risk assessments.

-

Alternative valuation metrics: BofA goes beyond solely relying on P/E ratios. Their analysis incorporates other valuation metrics like Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, providing a more holistic picture of market valuations.

The Role of Inflation and Interest Rates in BofA's Assessment

Inflation and interest rates are crucial factors in BofA's valuation assessment. They directly influence both company profitability and the discount rates used in valuing future earnings.

-

BofA's inflation predictions: BofA regularly publishes its inflation predictions, incorporating these forecasts directly into their valuation models to determine the impact on company profitability and future earnings.

-

Impact of interest rate changes on valuations: Changes in interest rates have a significant impact on stock valuations. Rising interest rates generally lead to lower valuations, while falling rates can support higher valuations. BofA analyzes the potential impacts of various interest rate scenarios.

-

Relationship between inflation, interest rates, and stock market performance: BofA acknowledges the complex interplay between these three factors and its influence on stock market performance. They incorporate these dynamics into their analyses to reach a comprehensive conclusion.

-

Specific models and projections: BofA utilizes sophisticated econometric models and projections to assess the likely impact of inflation and interest rate changes on market valuations.

Diversification and Risk Management Strategies in a High-Valuation Market

Even with seemingly high valuations, investors can manage risk effectively. BofA emphasizes the importance of proactive strategies.

-

Portfolio diversification: Diversification across various sectors, asset classes, and geographies remains crucial to reduce overall portfolio volatility and mitigate specific risks.

-

Risk management strategies: Strategies like dollar-cost averaging and the use of stop-loss orders can help protect against potential market downturns and manage risk.

-

Long-term investing: A long-term investment horizon helps mitigate the impact of short-term market fluctuations and valuation changes. BofA advocates for a long-term perspective, focusing on the underlying fundamentals and growth potential of companies.

-

Investment strategies suggested by BofA: Based on their analysis, BofA often offers specific investment strategies and recommendations, but investors should always perform independent research.

Conclusion

BofA's analysis suggests that while stretched stock market valuations are a valid concern, they shouldn't necessarily trigger panic selling. Their optimistic outlook is based on several factors including strong earnings growth projections, a low interest rate environment, and the potential for continued monetary support. They also stress the importance of considering alternative valuation metrics and employing effective risk management strategies. While high valuations present inherent risks, a well-informed and diversified approach to investing remains crucial. Don't let concerns about stretched market valuations paralyze you. Conduct thorough research, consult a financial advisor, and make informed decisions about your investment strategy. Careful assessment of market valuations, considering factors beyond just P/E ratios, is key to navigating the current market landscape.

Featured Posts

-

Us Protests Against Trump Voices From Across The Nation

Apr 22, 2025

Us Protests Against Trump Voices From Across The Nation

Apr 22, 2025 -

A Comparative Study Blue Origins Downfall And Katy Perrys Public Image

Apr 22, 2025

A Comparative Study Blue Origins Downfall And Katy Perrys Public Image

Apr 22, 2025 -

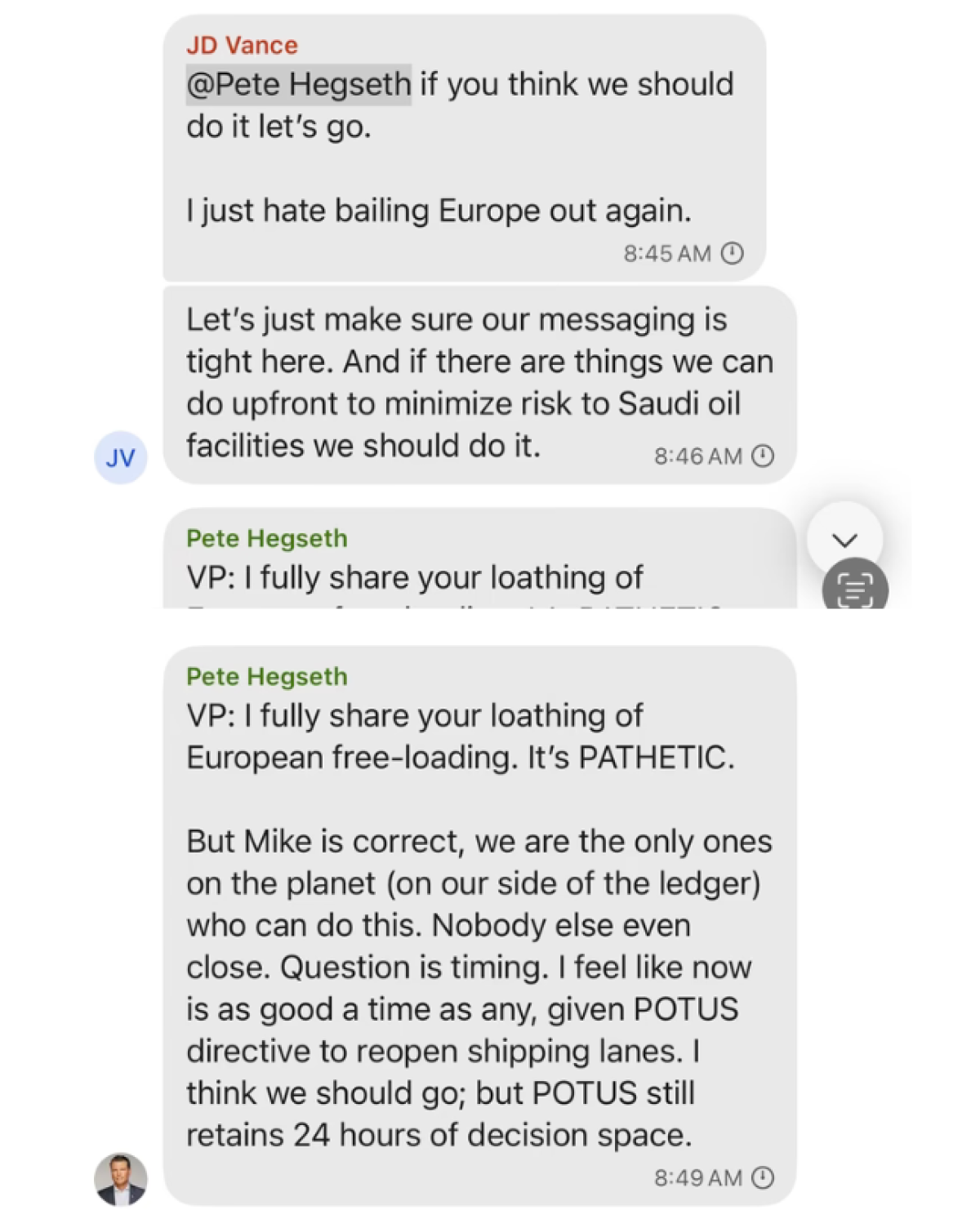

Hegseths Signal Chats Military Plans Disclosed To Family

Apr 22, 2025

Hegseths Signal Chats Military Plans Disclosed To Family

Apr 22, 2025 -

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025 -

From Scatological Data To Engaging Podcast An Ai Powered Solution

Apr 22, 2025

From Scatological Data To Engaging Podcast An Ai Powered Solution

Apr 22, 2025