BofA's Take: Why Stretched Stock Market Valuations Shouldn't Concern Investors

Table of Contents

BofA's Bullish Outlook Despite High Valuations

Despite acknowledging high valuations, BofA maintains a bullish outlook on the stock market. Their positive stance is supported by several key factors. Firstly, robust corporate earnings growth continues to exceed expectations, indicating a healthy underlying economy. Secondly, the sustained low-interest-rate environment, while potentially subject to future adjustments, currently provides a supportive backdrop for investment. BofA's analysts have historically predicted a gradual interest rate increase, but current projections should be checked with the latest reports. Finally, several positive macroeconomic indicators, such as consistent GDP growth and strong employment figures, point towards sustained economic expansion.

BofA's research often utilizes various data points to support its analysis. While specific charts and graphs cannot be replicated here, their reports consistently highlight the strength of corporate earnings as a primary driver of their optimism. This strength offsets concerns about elevated valuation metrics.

- Robust earnings growth exceeding valuation concerns.

- Sustained low interest rate environment (check for latest BofA predictions).

- Positive macroeconomic indicators pointing towards sustained growth (e.g., GDP growth, employment data).

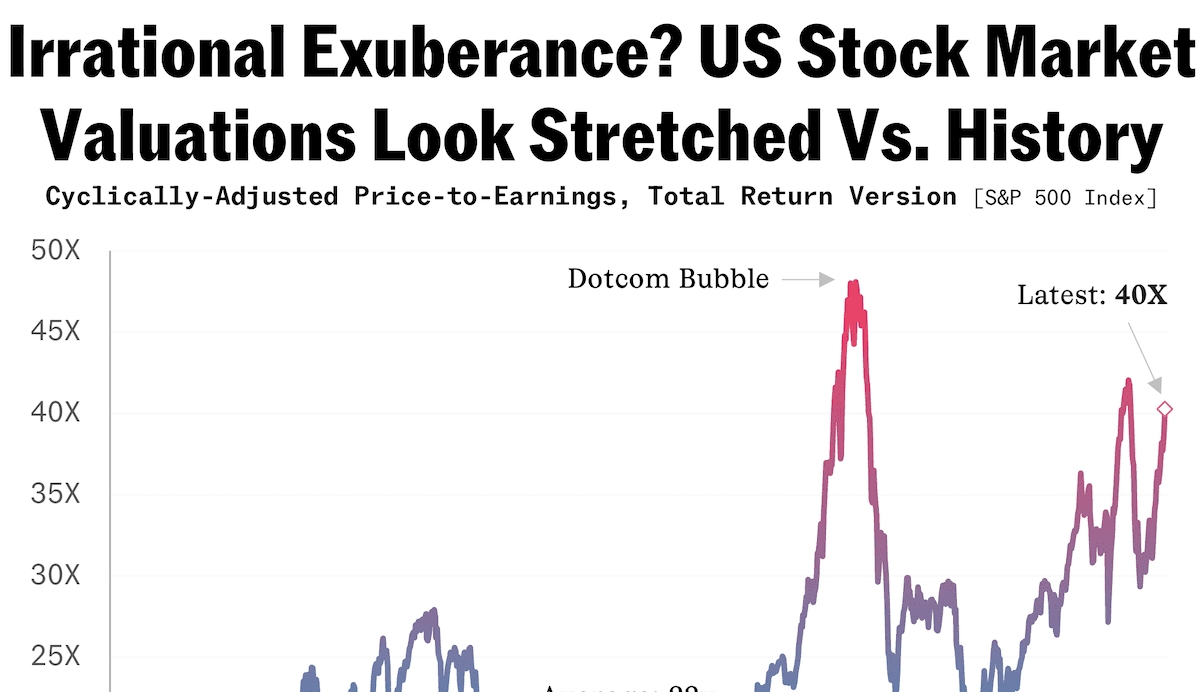

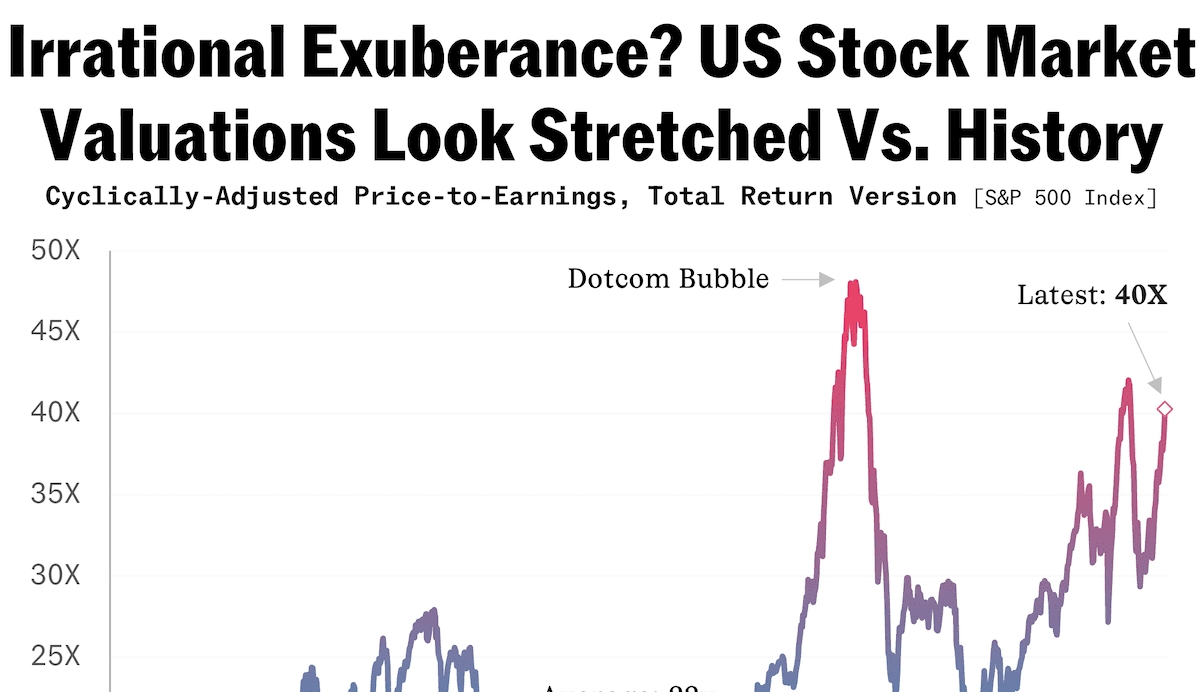

Understanding the Nuances of Stock Market Valuations

It's crucial to understand the limitations of relying solely on single valuation metrics like the Price-to-Earnings (P/E) ratio to assess the entire market. These metrics offer a snapshot but fail to capture the complexities of the broader economic landscape. Several other factors must be considered:

- Interest rate environment: Low interest rates can support higher valuations, as borrowing costs remain low for companies.

- Inflation expectations: Moderate inflation can be positive for stock valuations, while high inflation can be detrimental.

- Growth potential of specific sectors: Some sectors, driven by technological innovation or strong demand, may justify higher valuations than others.

History shows that high valuations don't automatically predict an imminent market crash. There have been instances where periods of high valuations were followed by extended periods of market growth. The key lies in understanding the underlying economic drivers and assessing the long-term growth potential of individual companies and sectors.

- Single valuation metrics provide an incomplete picture.

- The broader economic environment significantly impacts valuations.

- Sector-specific growth potential must be considered.

The Role of Innovation and Technological Advancements

Technological innovation and disruptive technologies significantly influence stock valuations. The potential for future growth driven by these advancements often justifies seemingly high valuations, particularly in specific sectors. Companies at the forefront of technological breakthroughs frequently command premium valuations due to their anticipated future earnings potential. For example, the rapid growth of the tech sector is largely explained by the continual development and deployment of novel technologies and business models.

- Technological advancements drive future growth and justify premium valuations.

- Disruptive technologies reshape industries, creating new investment opportunities.

- Investment in innovation often leads to long-term market gains.

Strategies for Navigating a Potentially Volatile Market

BofA's analysis suggests a long-term positive outlook, but the market can still experience volatility. Therefore, a well-defined investment strategy is crucial. This should include:

- Diversification across asset classes and sectors: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors minimizes risk.

- Long-term investment horizon to weather market volatility: Focusing on long-term growth potential allows investors to ride out short-term fluctuations.

- Consider individual risk tolerance and investment goals: Investment choices should align with an individual's risk tolerance and financial objectives.

Conclusion

BofA's view is that while stock market valuations may appear high, several factors, including strong corporate earnings, low interest rates, and technological innovation, suggest that investors shouldn't be overly concerned. However, it's crucial to consider the broader economic context and diversify investments. While BofA’s analysis suggests a positive outlook for the market, and suggests that stretched stock market valuations may not be as concerning as many investors believe, it’s vital to conduct thorough independent research and seek professional financial advice before making any investment decisions. Learn more about managing your portfolio in a market with potentially "stretched" stock market valuations and develop a robust, diversified investment strategy tailored to your personal risk tolerance and financial goals.

Featured Posts

-

Fede Valverde Toni Kroos Mi Idolo Ineludible

May 29, 2025

Fede Valverde Toni Kroos Mi Idolo Ineludible

May 29, 2025 -

Game Stop Restricts Pokemon Tcg Product Sales To One Per Customer

May 29, 2025

Game Stop Restricts Pokemon Tcg Product Sales To One Per Customer

May 29, 2025 -

Rubios European Envoy Role Under Trump Administration

May 29, 2025

Rubios European Envoy Role Under Trump Administration

May 29, 2025 -

Bargain Hunt Your Guide To Finding The Best Deals

May 29, 2025

Bargain Hunt Your Guide To Finding The Best Deals

May 29, 2025 -

Szazezreket Ero Targyak A Lakasodban Igy Talalhatod Meg Oket

May 29, 2025

Szazezreket Ero Targyak A Lakasodban Igy Talalhatod Meg Oket

May 29, 2025