BofA's View: Addressing Investor Concerns About High Stock Prices

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's current assessment of the market is cautiously optimistic, leaning towards neutral. While acknowledging the significant gains experienced in recent years, their analysts point to several factors that temper outright bullishness. They highlight the potential for increased interest rates and geopolitical uncertainty as significant headwinds. However, robust corporate earnings in certain sectors and continued consumer spending contribute to a more balanced outlook.

- Summary of BofA's key economic indicators: BofA’s analysis incorporates a range of indicators, including GDP growth projections, inflation rates, unemployment figures, and consumer confidence indices. Their recent reports suggest moderate GDP growth, persistent inflationary pressures (though potentially easing), and a stable, albeit slightly elevated, unemployment rate.

- Specific sectors BofA sees as overvalued or undervalued: BofA's research indicates that certain technology sectors might be overvalued relative to their historical P/E ratios and future earnings potential. Conversely, they highlight the potential for undervalued opportunities within the energy and infrastructure sectors, driven by global energy transitions and infrastructure investments.

- Reference to specific BofA reports or publications supporting their view: Investors can find a detailed breakdown of BofA's market analysis in their regularly published "Global Research" reports and investor briefings available on their official website. These reports offer granular data and sophisticated modeling supporting their overall market assessment.

Addressing Concerns About High Price-to-Earnings Ratios (P/E)

High Price-to-Earnings ratios (P/E) are a significant source of investor anxiety. BofA acknowledges these elevated ratios across various sectors, but cautions against interpreting them solely as an indicator of overvaluation. They argue that several factors can justify higher P/E multiples, especially in growth sectors.

- Examples of companies with high P/E ratios and BofA's perspective on their valuations: BofA's analysts analyze individual company performance within the context of broader market trends. They might point to companies with high P/E ratios but also significant revenue growth and expansion potential, justifying the higher valuation.

- Counterarguments to the "overvalued" narrative, supported by BofA's reasoning: BofA often counters the "overvalued" narrative by emphasizing factors like low interest rates, which can support higher valuations by reducing the discount rate used in discounted cash flow models. Furthermore, they examine future earnings potential and the impact of innovation on long-term growth prospects.

- Discussion of alternative valuation metrics beyond P/E ratios: BofA emphasizes the limitations of relying solely on P/E ratios and recommends utilizing a broader range of valuation metrics, including Price-to-Sales (P/S), Price-to-Book (P/B), and discounted cash flow (DCF) analysis to gain a more comprehensive understanding of a company’s value.

BofA's Predictions for Future Market Performance

BofA's predictions suggest a period of moderate growth, tempered by potential challenges. Their short-term outlook is cautiously optimistic, anticipating continued, though potentially slower, economic expansion. However, they acknowledge significant risks, including rising inflation and geopolitical instability, which could impact the market's trajectory. The long-term outlook remains positive, but contingent on successful management of these global uncertainties.

- BofA's forecast for key economic indicators: BofA projects moderate inflation in the coming year, potentially easing towards the central bank's target rate. They anticipate steady GDP growth, driven by consumer spending and business investment.

- Potential impacts of geopolitical events or regulatory changes: Geopolitical events, such as escalating trade tensions or conflicts, could significantly impact market sentiment and volatility. Similarly, regulatory changes impacting specific sectors can influence individual stock performance.

- Investment strategies suggested by BofA based on their predictions: Based on their forecasts, BofA might suggest a diversified portfolio strategy, focusing on sectors with resilience to economic downturns and opportunities for long-term growth.

Strategies for Investors Based on BofA's Analysis

BofA's analysis informs several key investment strategies for investors at various risk tolerance levels.

- Specific investment advice based on risk tolerance (conservative, moderate, aggressive): Conservative investors might be advised to maintain a focus on high-quality, dividend-paying stocks and bonds, mitigating risk through diversification. Moderate investors might consider a balanced approach, combining growth stocks with income-generating assets. Aggressive investors, comfortable with higher risk, may explore growth opportunities in emerging markets or innovative technologies.

- Suggestions for rebalancing portfolios based on BofA's market outlook: BofA may advise investors to periodically rebalance their portfolios to align with their risk tolerance and BofA’s updated market outlook. This could involve adjusting allocations between asset classes based on changing market conditions.

- Recommended actions for investors concerned about high stock prices: For investors concerned about high stock prices, BofA might suggest strategies like dollar-cost averaging (investing fixed amounts at regular intervals) to reduce the impact of market volatility and mitigate the risk of buying high.

Conclusion

BofA's view on addressing investor concerns about high stock prices emphasizes a balanced approach. While acknowledging the elevated valuations in certain sectors, they highlight factors that can justify these prices and emphasize the importance of considering multiple valuation metrics beyond P/E ratios. Their predictions suggest moderate growth tempered by potential challenges. By understanding BofA's view on addressing investor concerns about high stock prices, and by incorporating their insights into your investment strategy, you can navigate the current market with greater confidence. Access BofA's latest research and reports to stay informed and make well-considered investment choices. Understanding BofA's analysis is crucial for navigating the complexities of high stock valuations and making informed investment decisions.

Featured Posts

-

Trumps Legacy The Impact On Transgender Rights And Individuals

May 10, 2025

Trumps Legacy The Impact On Transgender Rights And Individuals

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025 -

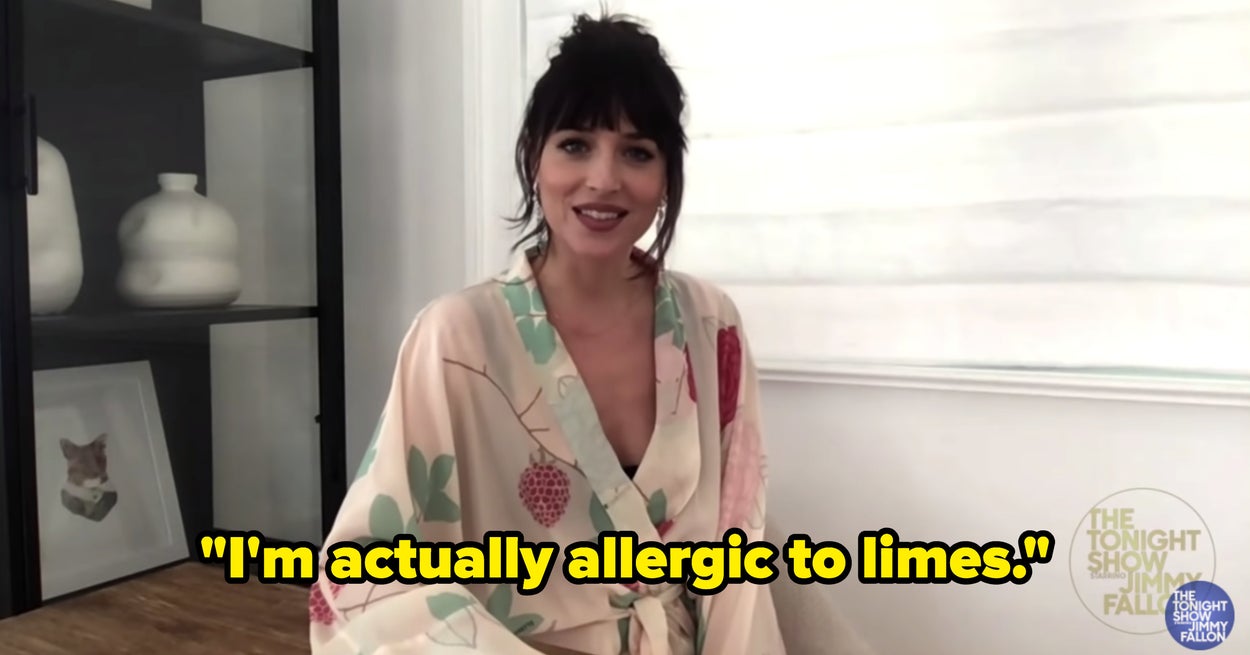

Kas Nutiko Dakota Johnson Paaiskinimas Del Kraujingu Plintu Nuotrauku

May 10, 2025

Kas Nutiko Dakota Johnson Paaiskinimas Del Kraujingu Plintu Nuotrauku

May 10, 2025 -

Exposition Dijon Gustave Eiffel Et L Influence Maternelle

May 10, 2025

Exposition Dijon Gustave Eiffel Et L Influence Maternelle

May 10, 2025 -

Unprovoked Killing Highlights Rise In Racist Hate Crimes

May 10, 2025

Unprovoked Killing Highlights Rise In Racist Hate Crimes

May 10, 2025