BofA's View: Why Current Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Rationale: Considering the Broader Economic Context

BofA's assessment of current stock market valuations isn't made in a vacuum; it's deeply rooted in their analysis of the broader economic landscape. Several key factors contribute to their relatively positive view.

-

Robust Economic Growth Projections: BofA projects continued, albeit moderate, economic growth. While not explosive, this sustained growth provides a solid foundation for supporting current market capitalization and justifies, to some extent, existing price-to-earnings ratios. Their models incorporate various indicators, including consumer spending, business investment, and global trade dynamics.

-

Inflation and Interest Rate Impact: While inflation remains a concern, BofA anticipates a gradual deceleration, aligning with the Federal Reserve's monetary policy. They believe that the current interest rate environment, while higher than in recent years, is manageable and not drastically prohibitive to sustainable earnings growth, a crucial factor in determining stock market valuations.

-

Earnings Growth Trajectory: BofA's analysis points towards a continued, albeit potentially slower, pace of earnings growth for many companies. This projected growth, when considered alongside other valuation metrics, helps to justify current market valuations, preventing a knee-jerk reaction solely based on price-to-earnings ratios. Specific sectors, such as technology and healthcare, are highlighted as showing promising long-term earnings potential.

-

Federal Reserve's Monetary Policy: BofA closely monitors the Federal Reserve's actions. Their interpretation suggests that the Fed's actions, while aimed at curbing inflation, are carefully calibrated to avoid triggering a significant economic downturn. This measured approach, they believe, helps maintain a stable environment for stock market valuations.

Analyzing Valuation Metrics: Beyond Simple Price-to-Earnings Ratios

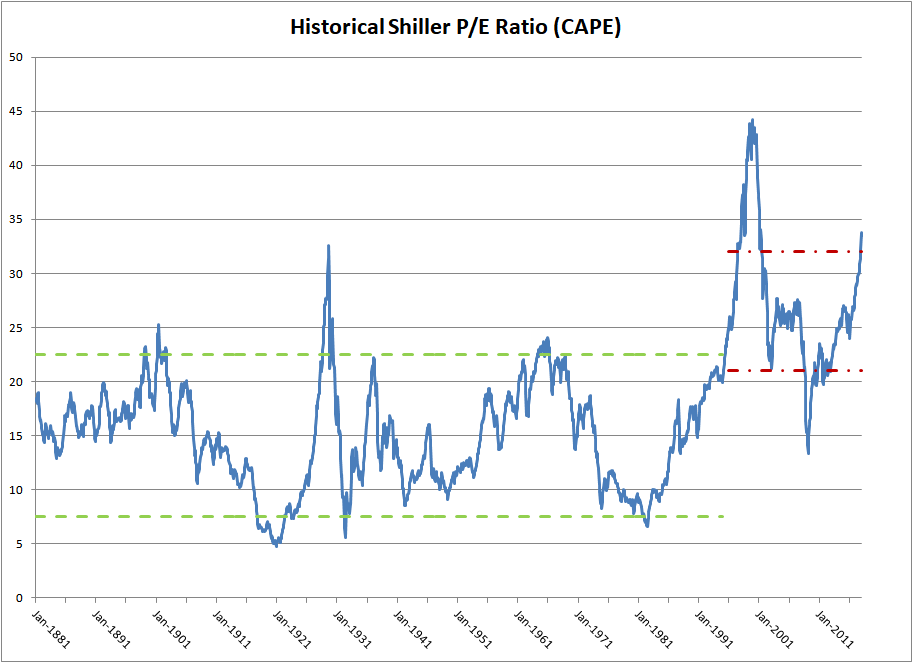

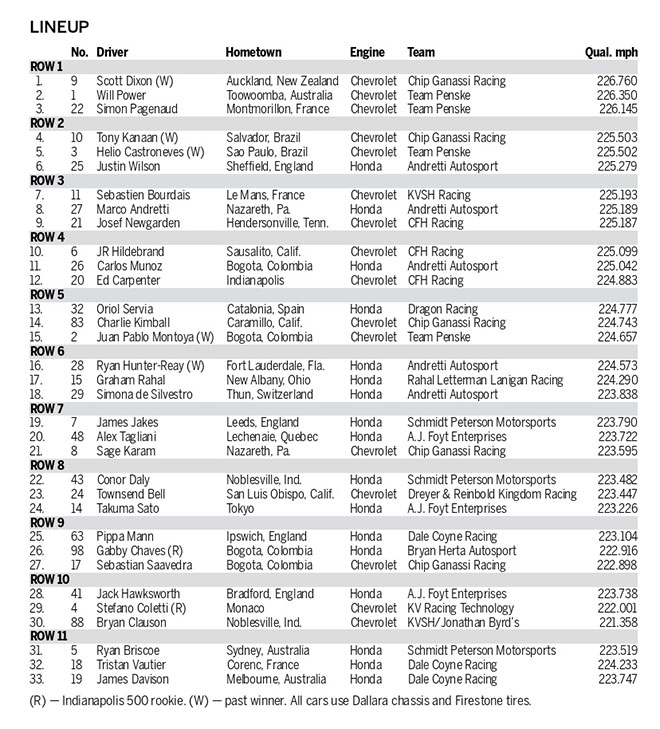

Relying solely on the price-to-earnings ratio (P/E) to assess stock market valuations can be misleading. BofA employs a more nuanced approach, incorporating a range of valuation metrics to build a comprehensive picture.

-

Beyond P/E: BofA acknowledges the limitations of the P/E ratio, especially in periods of rapid economic shifts. They emphasize the importance of looking beyond this single metric.

-

Diverse Valuation Tools: Their analysis incorporates other crucial valuation multiples such as the price-to-sales ratio (P/S), dividend yield, and discounted cash flow (DCF) analysis. These provide a more comprehensive perspective, accounting for variations in revenue streams and future growth potential.

-

Nuanced Market Valuation: By employing multiple valuation metrics, BofA identifies sectors and individual companies where current valuations are more strongly supported by fundamentals. This granular analysis allows for a more accurate assessment of risk and reward.

-

Market Cap Context: BofA uses market capitalization alongside other valuation metrics to determine whether current valuations are accurately reflecting the underlying value and future potential of the companies within specific sectors.

Long-Term Perspective: Understanding the Cyclical Nature of the Market

BofA strongly advocates for a long-term investment strategy when evaluating stock market valuations. Understanding the cyclical nature of the market is crucial to navigating periods of perceived high valuations.

-

Long-Term Investment Strategy: BofA emphasizes that short-term market fluctuations are normal. Investors should focus on long-term growth potential rather than reacting to short-term volatility.

-

Market Cycle Understanding: Periods of higher valuations are a natural part of market cycles. Historically, these periods have often been followed by periods of consolidation and subsequent growth.

-

Investor Sentiment: BofA acknowledges the significant role investor sentiment plays in driving market fluctuations. Fear and panic can lead to irrational sell-offs, creating opportunities for long-term investors.

-

Risk Management and Diversification: BofA advises investors to manage risk through diversification and a well-defined investment horizon. This approach helps mitigate the potential downsides associated with periods of market uncertainty.

Addressing Specific Investor Concerns: Debunking Common Myths

Many investors harbor anxieties surrounding potential market crashes and recessions. BofA directly addresses these concerns.

-

Market Crash Fears: BofA's analysis suggests that while a correction is always possible, the current market conditions don't necessarily point towards an imminent major crash. Their projections and analysis of underlying economic factors help contextualize the current situation.

-

Recession Concerns: While economic growth may slow, BofA doesn't foresee a deep or prolonged recession. Their analysis considers several leading economic indicators and anticipates a relatively soft landing.

-

Countering Negative Sentiment: BofA provides concrete examples and data points to counter the prevailing negative sentiment, highlighting sectors and companies demonstrating robust fundamentals that justify their valuations. This data-driven approach aims to reduce investor anxiety.

Conclusion

BofA's analysis suggests that while current stock market valuations may appear high at first glance, a comprehensive assessment considering economic fundamentals, diverse valuation metrics, and the cyclical nature of the market indicates they are not inherently alarming. Their detailed analysis, incorporating factors beyond simple price-to-earnings ratios, provides a more nuanced and reassuring perspective. Consider BofA's insights when forming your own investment strategies. Further research into BofA's reports and resources will provide a more detailed understanding of the current stock market valuations and equip you to make informed decisions. Don't panic; make informed decisions based on a thorough understanding of the market and its underlying stock market valuations.

Featured Posts

-

L Autruche Demasquee Chantal Ladesou Et Laurent Ruquier Reagissent A Mask Singer 2025

May 12, 2025

L Autruche Demasquee Chantal Ladesou Et Laurent Ruquier Reagissent A Mask Singer 2025

May 12, 2025 -

Is Aaron Judge A Future Hall Of Famer A Look At His 1 000th Game

May 12, 2025

Is Aaron Judge A Future Hall Of Famer A Look At His 1 000th Game

May 12, 2025 -

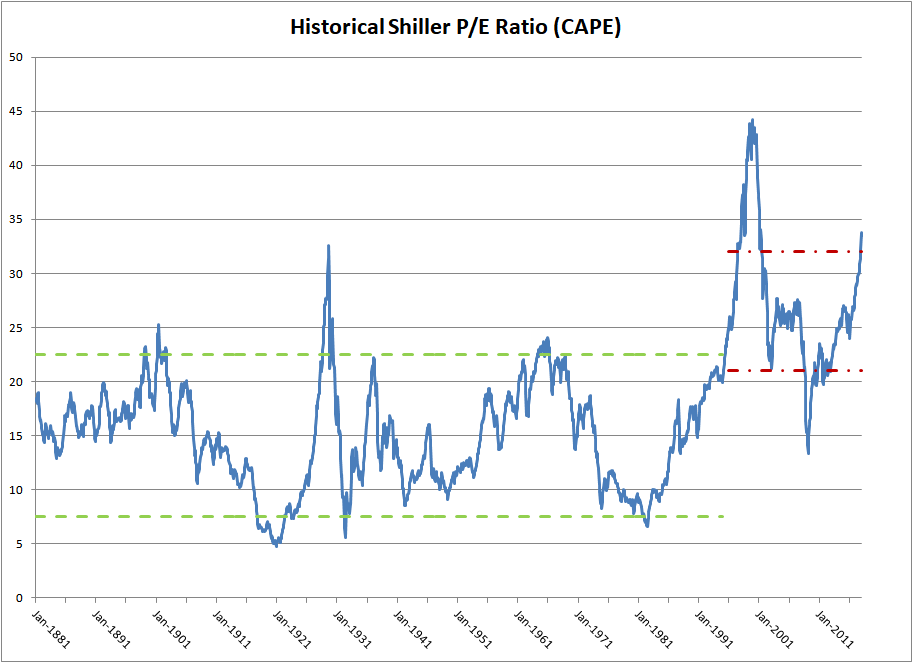

2025 Indy 500 Lineup Incomplete One Drivers Absence

May 12, 2025

2025 Indy 500 Lineup Incomplete One Drivers Absence

May 12, 2025 -

Us Government Downplays Auto Industry Anxiety Regarding Uk Trade Agreement

May 12, 2025

Us Government Downplays Auto Industry Anxiety Regarding Uk Trade Agreement

May 12, 2025 -

Crazy Rich Asians Jon M Chus Next Chapter At Max

May 12, 2025

Crazy Rich Asians Jon M Chus Next Chapter At Max

May 12, 2025