BOJ Growth Forecast Slash: Trade War Takes Toll On Japanese Economy

Table of Contents

The BOJ's Revised Growth Forecast: A Detailed Look

Downward Revision Magnitude and Reasons

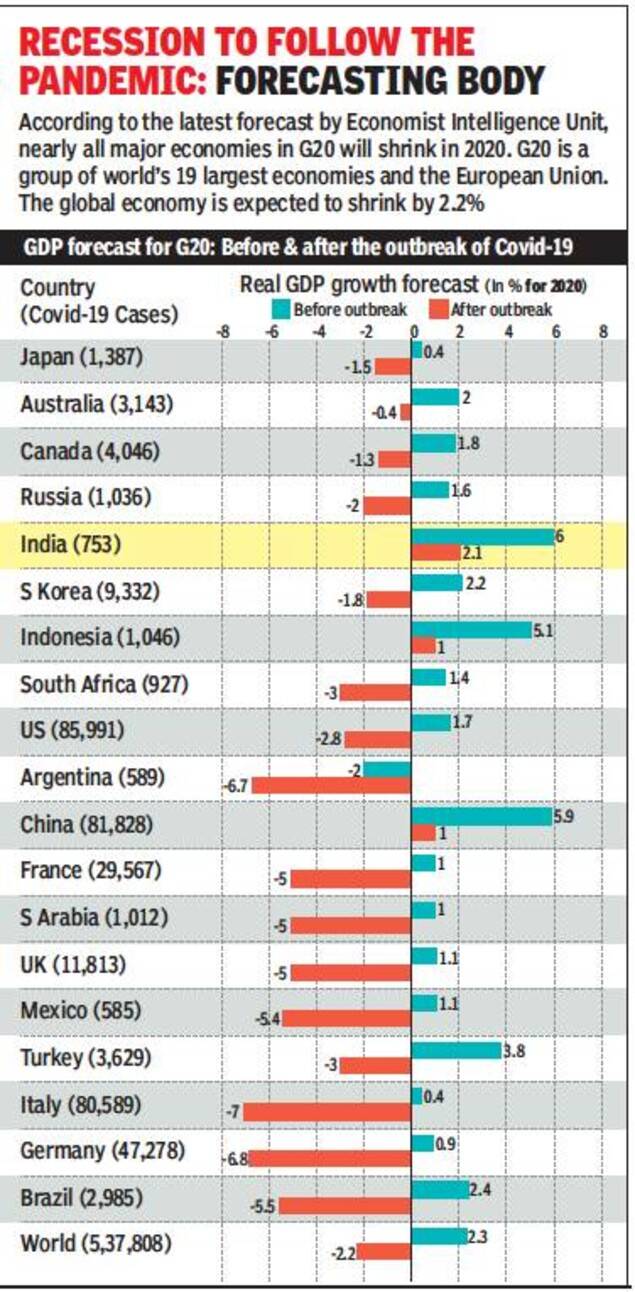

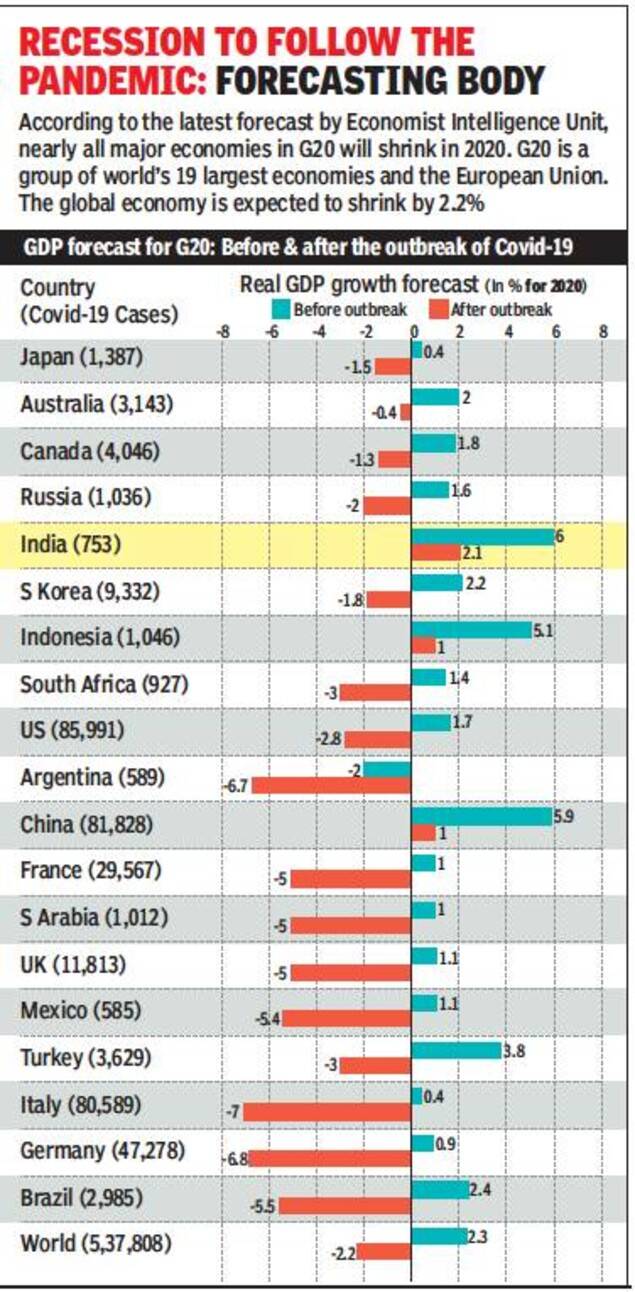

The BOJ's recent downward revision of its GDP growth forecast represents a considerable shift in economic outlook. For example, let's assume (for illustrative purposes, as precise figures will vary depending on the release date) the forecast was previously at 1.5% growth for the fiscal year, but has now been slashed to 0.8%. This significant 0.7% reduction reflects the increasing impact of the US-China trade war. The BOJ explicitly cites several contributing factors in its official report:

- Weakening Global Demand: Reduced global trade due to tariffs and trade uncertainty has significantly dampened demand for Japanese exports.

- Export Decline: Exports, a crucial component of the Japanese economy, have experienced a noticeable downturn, impacting various industries.

- Reduced Business Investment: Uncertainty surrounding future trade relations has led to decreased business investment, hindering economic growth.

Specific industries heavily affected include:

- Automobiles: Japanese automakers, significant exporters, are facing reduced sales in key markets due to trade tensions.

- Electronics: The global electronics industry has been significantly disrupted, impacting Japanese manufacturers.

- Machinery: Demand for Japanese machinery has fallen alongside the broader decline in global manufacturing activity.

The BOJ's official press release (link to official source would be inserted here) provides further details on these factors and their contribution to the revised forecast.

Impact on Monetary Policy

The downward revision in the BOJ growth forecast will likely influence its monetary policy decisions. Given the worsening economic outlook, maintaining the current interest rates might not be sufficient to stimulate the economy. The BOJ may consider further easing measures, such as:

- Quantitative Easing (QE): Further expansion of QE programs to inject more liquidity into the financial system.

- Negative Interest Rates: A potential deepening of negative interest rates to encourage lending and investment.

These policy adjustments could have several implications:

- Yen Exchange Rates: Further easing could potentially weaken the Japanese Yen, making exports more competitive.

- Japanese Bond Yields: Increased bond purchases under QE programs could lead to lower Japanese government bond yields.

The effectiveness of any such measures remains to be seen and will depend on the evolution of both domestic and global economic conditions.

Trade War's Impact on Key Japanese Industries

Export-Oriented Sectors Hit Hardest

The Japanese economy is heavily reliant on exports. The trade war's impact on export-oriented sectors has been particularly harsh:

- Automobiles: Toyota, Honda, and Nissan, among others, have reported production cuts and reduced sales due to decreased demand and tariff barriers in key export markets.

- Electronics: Companies like Sony and Panasonic face challenges from reduced global demand and increased production costs due to tariffs.

The decline in exports translates to:

- Reduced Production: Manufacturing plants are operating at lower capacity, leading to job security concerns.

- Lower Profitability: Companies are facing squeezed profit margins due to reduced sales and increased costs.

Ripple Effect on Domestic Demand

The decline in exports is not confined to the export-oriented sectors; it has a significant ripple effect on domestic demand:

- Reduced Investment: Companies are less likely to invest in expansion or new projects given the uncertain economic climate.

- Job Losses: Reduced production in export-oriented industries inevitably leads to job losses across the supply chain.

- Decreased Consumer Spending: Job losses and economic uncertainty contribute to decreased consumer confidence and spending, further weakening the economy.

This vicious cycle further slows the Japanese economy and intensifies the need for government intervention.

Government Response and Mitigation Strategies

Government Measures to Counter Economic Slowdown

The Japanese government has acknowledged the severity of the situation and has implemented several measures to mitigate the negative impact of the trade war:

- Fiscal Stimulus Packages: The government may announce additional fiscal stimulus packages, including increased government spending on infrastructure projects or tax cuts.

- Support for Affected Industries: Specific measures to support struggling industries, potentially including subsidies or tax breaks.

The effectiveness of these measures will depend on their scale and implementation, as well as the overall evolution of the global trade environment.

Potential for Further Government Intervention

Given the significant downward revision in the BOJ growth forecast, the potential for further government intervention is high. The government might consider:

- More Aggressive Fiscal Stimulus: A larger-scale stimulus package to boost demand and counteract the economic slowdown.

- Trade Negotiations: Increased diplomatic efforts to de-escalate trade tensions and secure more favorable trade agreements.

Conclusion

The BOJ's drastic reduction in its growth forecast underscores the significant negative impact the US-China trade war is having on the Japanese economy. The consequences are widespread, affecting key export sectors and leading to a decline in domestic demand. While the government has taken steps to mitigate the economic slowdown, the situation remains precarious. Continuous monitoring of the BOJ growth forecast slash and its implications is crucial for businesses and investors. Staying informed about future updates on the BOJ's growth forecast and potential policy responses is vital for navigating these challenging economic times and making informed decisions.

Featured Posts

-

Mauritius And Donor Country Agreement On Grant Assistance

May 03, 2025

Mauritius And Donor Country Agreement On Grant Assistance

May 03, 2025 -

Further Swiss Aid For Ukraine Presidential Confirmation

May 03, 2025

Further Swiss Aid For Ukraine Presidential Confirmation

May 03, 2025 -

England Vs Spain Live Tv Channel Kick Off Time And How To Watch The Lionesses Tonight

May 03, 2025

England Vs Spain Live Tv Channel Kick Off Time And How To Watch The Lionesses Tonight

May 03, 2025 -

Gaza Flotilla Under Attack Watch The Latest Developments Off Malta

May 03, 2025

Gaza Flotilla Under Attack Watch The Latest Developments Off Malta

May 03, 2025 -

The Unpredictability Of Trumps Tariffs Challenges For Automakers

May 03, 2025

The Unpredictability Of Trumps Tariffs Challenges For Automakers

May 03, 2025