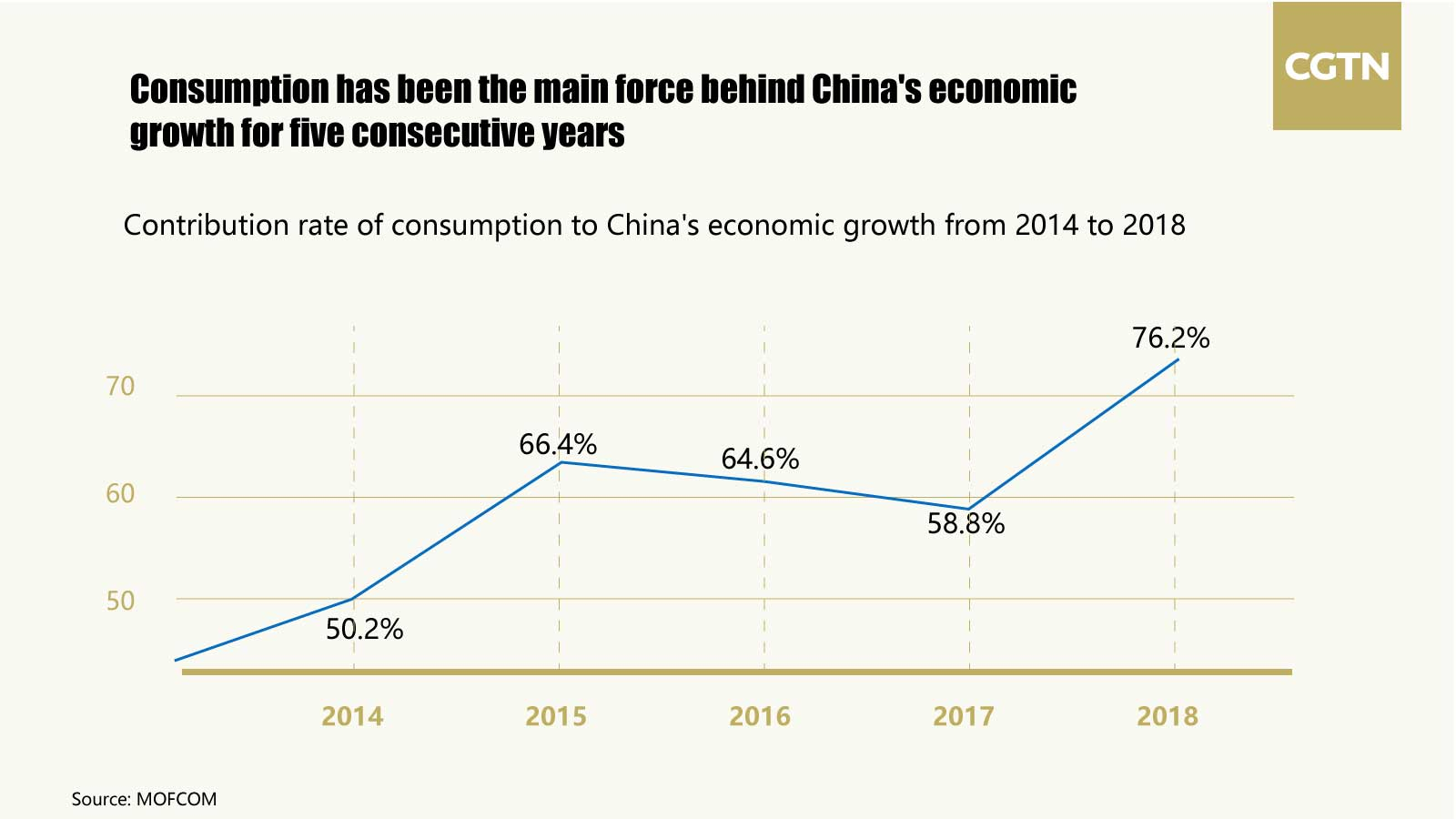

Boosting China's Economy: The Challenges Of Increasing Household Consumption

Table of Contents

The Savings Glut: A Cultural and Systemic Issue

China's high savings rate is a significant obstacle to increasing household consumption. This phenomenon is deeply rooted in cultural values and systemic factors. China's savings, particularly household savings, represent a considerable portion of the national economy. This high savings rate, while appearing positive on the surface, actually hinders domestic demand and economic growth.

-

Traditional emphasis on saving for education, housing, and retirement: Generations of Chinese families have prioritized saving for large, future expenses, viewing it as a form of security in a system that historically lacked robust social safety nets. This cultural emphasis on saving for the long-term continues to impact current spending habits.

-

Lack of comprehensive social safety nets driving precautionary savings: The absence of a universally accessible and reliable social security system forces individuals to save aggressively for healthcare, retirement, and unforeseen circumstances. This precautionary saving reduces disposable income available for consumption.

-

Limited access to affordable and reliable financial products for investment: The limited availability of diverse, accessible, and trustworthy investment options encourages individuals to maintain high savings balances in low-yield accounts rather than investing in potentially higher-return assets.

Systemic factors further contribute to this high savings rate:

-

Limited access to diversified investment options: A relatively underdeveloped financial market limits opportunities for individuals to diversify their investments and potentially earn higher returns, encouraging them to prioritize savings.

-

Concerns about financial market volatility: A lack of trust in the stability of financial markets contributes to a preference for cash savings over investment in stocks or other assets. This fear of loss further restricts household spending.

Income Inequality and its Impact on Consumption

The widening income gap in China significantly impacts overall consumption. Income inequality and wealth distribution are unevenly spread, creating a consumption disparity that limits the potential for broad-based economic growth fueled by household spending.

-

Lower-income households prioritize essential spending, leaving little for discretionary purchases: The majority of lower-income households dedicate their income to necessities, leaving minimal funds for non-essential purchases that drive economic growth.

-

High-income households have a higher propensity to save, not spend: While high-income households have more disposable income, a significant portion is often channeled into savings and investments rather than immediate consumption.

-

Regional disparities in income exacerbate the consumption imbalance: Income inequality isn't evenly distributed geographically, creating significant regional differences in consumption patterns. This imbalance necessitates region-specific policies to stimulate local economies.

Addressing income inequality is crucial for boosting household consumption. Policies focused on income redistribution, strengthened social welfare programs, and improved economic equity are needed.

Improving Consumer Confidence and Spending

Economic uncertainty and job security significantly influence household spending decisions. Consumer confidence is a crucial element in driving household consumption. Factors such as economic downturns and job insecurity can significantly impact consumer sentiment and spending habits.

-

Impact of trade wars and global economic slowdowns on consumer sentiment: Global economic uncertainty and trade tensions can negatively impact consumer confidence, leading to reduced spending.

-

Concerns about property market fluctuations and debt levels: Fluctuations in the property market and high levels of household debt can create uncertainty, prompting consumers to prioritize debt reduction over increased spending.

-

The role of government communication in managing expectations and boosting confidence: Clear, transparent, and consistent communication from the government regarding economic policies and prospects can significantly influence consumer confidence and encourage spending.

Strategies to boost consumer confidence and encourage spending include:

-

Targeted government subsidies and tax breaks for certain goods and services: Strategic fiscal policies can incentivize consumption in specific sectors, stimulating economic activity.

-

Strengthening consumer protection laws and regulatory frameworks: A robust consumer protection framework builds trust and encourages spending.

Infrastructure Development and its Role in Boosting Consumption

Investment in infrastructure plays a crucial role in stimulating consumption. Infrastructure investment acts as a significant catalyst for economic growth. By creating jobs and boosting related industries, it indirectly boosts household disposable incomes and consumption.

-

Investment in transportation, logistics, and urban development: Infrastructure projects in these areas create jobs, improve efficiency, and stimulate related industries.

-

Development of advanced technologies and related industries: Investments in technology infrastructure foster innovation, create high-skilled jobs, and drive consumption of related products and services. This further expands the economic multiplier effect.

Fostering a Consumption-Driven Economy: Policy Recommendations

Stimulating household consumption requires a comprehensive set of policy measures. Effective economic policy is needed to transition China toward a more consumption-driven growth model.

-

Strengthening social safety nets (healthcare, pensions, unemployment benefits): Robust social safety nets reduce the need for precautionary saving, freeing up disposable income for consumption.

-

Improving access to credit and affordable financial products: Increased access to credit and diversified investment options can channel savings into the economy, driving consumption.

-

Promoting financial literacy and education: Educating consumers about financial products and responsible spending habits can increase confidence and improve investment decisions.

-

Enhancing consumer protection and market regulation: Protecting consumer rights and ensuring fair market practices builds confidence and encourages spending.

Conclusion

Increasing household consumption is paramount to achieving sustainable economic growth in China. Addressing the challenges of high savings rates, income inequality, and low consumer confidence requires a multi-pronged approach involving structural reforms, targeted policy interventions, and a shift in cultural attitudes. By implementing the strategies discussed above – including bolstering social safety nets, improving access to financial services, and fostering greater economic equity – China can successfully transition towards a more consumption-driven economy. Let's work towards actively boosting China's economy by strategically focusing on increasing household consumption and creating a more robust and sustainable growth model.

Featured Posts

-

Bon Plan Samsung Galaxy S25 256 Go 5 Etoiles A 699 90 E

May 28, 2025

Bon Plan Samsung Galaxy S25 256 Go 5 Etoiles A 699 90 E

May 28, 2025 -

Ipswichs Victory Over Bournemouth Broadhead The Matchwinner

May 28, 2025

Ipswichs Victory Over Bournemouth Broadhead The Matchwinner

May 28, 2025 -

Kantor Nas Dem Bali Dari Mimpi Satu Kursi Dpr Ke Kenyataan

May 28, 2025

Kantor Nas Dem Bali Dari Mimpi Satu Kursi Dpr Ke Kenyataan

May 28, 2025 -

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025 -

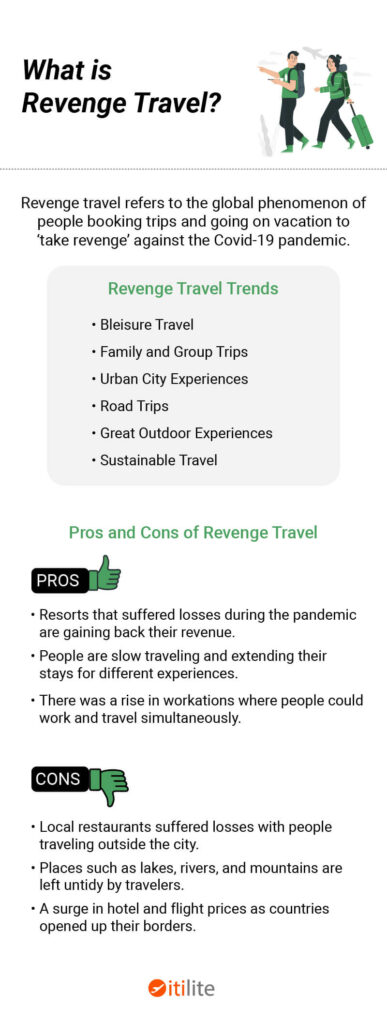

American Revenge Travel Slowdown Fear Uncertainty And Shifting Travel Trends

May 28, 2025

American Revenge Travel Slowdown Fear Uncertainty And Shifting Travel Trends

May 28, 2025