Boosting Sustainability: Funding Options For Small And Medium Enterprises

Table of Contents

By "sustainability," we mean the integration of environmental, social, and economic considerations into an SME's core operations. This includes reducing environmental impact (e.g., carbon emissions, waste generation), improving social responsibility (e.g., fair labor practices, community engagement), and ensuring long-term economic viability.

Government Grants and Subsidies for Sustainable Practices

Governments at all levels recognize the importance of supporting SMEs in their sustainability journeys. Numerous grant and subsidy programs are available to help offset the costs of implementing eco-friendly practices.

Exploring Federal and Regional Sustainability Initiatives

Many federal and regional governments offer financial incentives for sustainable initiatives. These programs often focus on specific areas:

- Energy Efficiency Grants: Funding to improve energy efficiency through upgrades to equipment, insulation, and lighting.

- Renewable Energy Subsidies: Financial support for installing renewable energy sources such as solar panels, wind turbines, or geothermal systems.

- Waste Reduction Grants: Incentives for implementing waste reduction and recycling programs.

- Sustainable Supply Chain Grants: Funding to support the development of more sustainable supply chains.

Eligibility criteria vary depending on the program, often considering factors like business size, location, and the nature of the proposed project. Application processes typically involve submitting detailed proposals outlining the project's scope, budget, and expected environmental and economic benefits. You can find details on these programs by visiting relevant government websites such as [insert link to relevant federal agency website] and [insert link to relevant regional agency website]. The benefits extend beyond financial assistance; successful grant applications can significantly enhance your brand image, demonstrate your commitment to sustainability, and improve regulatory compliance.

Accessing Local and Municipal Sustainability Funds

Beyond federal and regional programs, many local and municipal governments offer their own sustainability grants and incentives. These programs often focus on local priorities and may be more accessible to smaller businesses. To identify relevant programs in your region, contact your local chamber of commerce, economic development agency, or municipal government offices. Collaborating with local authorities can open doors to additional funding opportunities and strategic partnerships.

Private Investment and Venture Capital for Green Businesses

The private sector is increasingly recognizing the potential of environmentally and socially responsible businesses. This presents significant Funding Options for Small and Medium Enterprises focused on sustainability.

Attracting Impact Investors and Sustainable Venture Capital

Impact investors actively seek opportunities to invest in businesses that generate positive social and environmental impact alongside financial returns. They assess potential investments based on factors such as:

- Environmental impact: The extent to which the business reduces its environmental footprint.

- Social impact: The positive social contributions of the business.

- Financial viability: The business's potential for generating strong financial returns.

Attracting impact investors can provide not only capital but also valuable expertise and network connections.

Securing Loans from Green Banks and Financial Institutions

Green banks are specialized financial institutions that provide financing specifically for sustainable projects. Traditional banks are also increasingly offering loans and other financing options tailored to businesses with strong sustainability commitments. A well-structured business plan emphasizing your sustainability strategy and demonstrating strong financial projections will be crucial in securing these loans. Highlighting the long-term cost savings and revenue generation potential of your sustainable initiatives will strengthen your application.

Crowdfunding and Community-Based Funding for Sustainability Projects

Crowdfunding presents an innovative approach to securing funding, especially for projects with strong community appeal.

Leveraging Crowdfunding Platforms for Sustainability Initiatives

Various crowdfunding platforms, such as Kickstarter and Indiegogo, allow businesses to raise capital directly from the public. Different models exist:

- Rewards-based crowdfunding: Backers receive rewards in exchange for their contributions.

- Equity crowdfunding: Backers receive equity in the business in return for their investment.

- Donation-based crowdfunding: Backers contribute without expecting a direct return.

While crowdfunding can be effective, it requires a well-defined campaign, strong marketing, and engaging communication to attract backers. Successful campaigns often highlight the unique value proposition and the social and environmental impact of the project.

Building Partnerships with Local Communities for Funding

Building strong relationships with your local community can unlock funding opportunities through community investment initiatives. Collaborating with local stakeholders can demonstrate your commitment to the community and increase the likelihood of securing funding. This approach also fosters shared value creation, benefiting both the business and the community.

Internal Funding Strategies for Sustainability Improvements

Before seeking external funding, exploring internal resources can provide a solid foundation for sustainability initiatives.

Optimizing Operational Efficiency to Free Up Resources

Improving operational efficiency can free up valuable resources that can be reinvested in sustainability projects. Strategies include:

- Reducing energy consumption: Implementing energy-efficient practices and technologies.

- Optimizing waste management: Reducing waste generation and implementing effective recycling programs.

- Streamlining supply chains: Improving the efficiency of the supply chain to reduce costs and environmental impact.

Exploring Innovative Financing Models (e.g., Leasing)

Consider alternative financing options like equipment leasing to reduce upfront capital expenditure on sustainable equipment. Leasing allows you to access the latest technology without significant initial investment, making sustainability improvements more financially feasible. However, weigh the long-term costs and implications before committing to a lease.

Securing Funding for a Sustainable Future

This article has explored diverse Funding Options for Small and Medium Enterprises seeking to improve their sustainability. Remember, a well-defined sustainability strategy and a compelling business plan are crucial for securing funding, regardless of the chosen source. Clearly articulate your sustainability goals, the environmental and social impact of your initiatives, and the expected financial returns. Explore all available options, tailoring your approach to your specific needs and circumstances.

Start exploring Funding Options for Small and Medium Enterprises today. Take the first step towards a more sustainable future for your business and the planet. [Insert links to relevant resources mentioned in the article]

Featured Posts

-

I A Stasi Ton Xairetismon Mia Proseggisi Sta Ierosolyma

May 19, 2025

I A Stasi Ton Xairetismon Mia Proseggisi Sta Ierosolyma

May 19, 2025 -

Austria Wins Eurovision 2025 Jjs Wasted Love Conquers Europe

May 19, 2025

Austria Wins Eurovision 2025 Jjs Wasted Love Conquers Europe

May 19, 2025 -

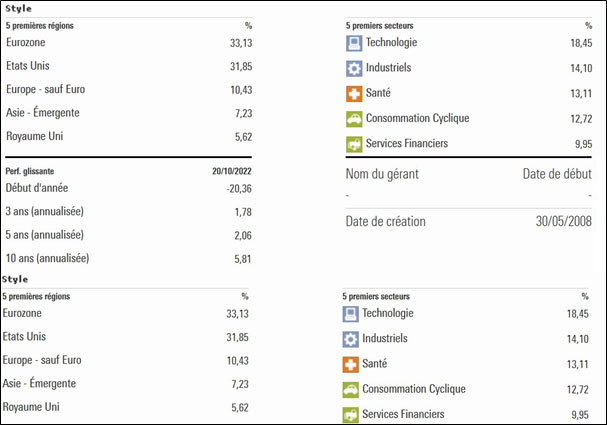

Credit Mutuel Am Previsions Et Performance Financiere Q4 2024

May 19, 2025

Credit Mutuel Am Previsions Et Performance Financiere Q4 2024

May 19, 2025 -

Collier County School Bus Safety Mothers Outrage After Childrens Misdrop

May 19, 2025

Collier County School Bus Safety Mothers Outrage After Childrens Misdrop

May 19, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike

May 19, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike

May 19, 2025