BP CEO Compensation: A 31% Decrease And Its Implications

The 31% Compensation Reduction: A Detailed Breakdown

The 31% reduction in BP CEO compensation represents a substantial shift in executive pay within the energy industry. Before the decrease, Bernard Looney's total compensation package likely included a substantial base salary, significant bonuses tied to performance metrics, and a considerable amount in long-term incentives such as stock options. While the precise figures for his previous compensation aren't publicly available in complete detail, this reduction signifies a noteworthy change.

- Breakdown of Salary Components (Illustrative): Let's assume, for illustrative purposes, a previous total compensation of $10 million. A 31% reduction would bring the new total to approximately $6.9 million. This decrease might be distributed across all components.

- Percentage Change for Each Component: The decrease might not be evenly distributed. For example, the base salary might see a smaller reduction (perhaps 10%), while bonuses and long-term incentives, heavily performance-dependent, experience more significant cuts (potentially 40-50%). Specifics would depend on BP's internal compensation structure and performance targets.

- Comparison to Competitors: A key aspect of understanding this reduction is comparing it to CEO compensation at rival oil and gas giants like Shell and ExxonMobil. Analyzing their compensation structures and any recent changes provides context and helps determine whether BP's move is an outlier or part of a broader trend. This analysis would necessitate access to the most recent publicly disclosed financial reports for these companies.

The reasons behind this dramatic reduction are multifaceted. While official statements may emphasize performance-based adjustments, it's likely a combination of factors: underperformance relative to targets, shareholder pressure for greater accountability, and a broader societal shift towards more responsible corporate governance.

Implications for BP's Corporate Governance and Shareholder Relations

The 31% decrease in BP CEO pay has profound implications for the company's corporate governance and relationship with its shareholders. It signals a potential shift towards greater accountability and alignment of executive interests with shareholder returns.

- Shareholder Sentiment: The announcement was likely met with mixed reactions. Some shareholders might view it as a positive sign of responsible corporate governance, while others may question whether it reflects poorly on the company's performance or its ability to attract and retain top talent. Analyzing post-announcement stock performance could offer insights into shareholder sentiment.

- Shareholder Activism: It's possible that shareholder activism played a role in the decision. Pressure from activist investors advocating for reduced executive compensation could have influenced the board's decision. Research into any past or ongoing shareholder resolutions related to executive pay would be illuminating.

- Impact on Reputation: This decision can positively impact BP's brand image, portraying it as a company committed to responsible business practices and responding to societal expectations for fair compensation. Positive media coverage and strengthened investor confidence could result.

This decision could set a precedent for future CEO compensation decisions at BP and influence executive pay discussions within the energy industry, promoting greater transparency and alignment with corporate performance and sustainability goals.

Wider Implications for the Energy Sector's Executive Compensation Practices

BP's move could spark a significant discussion – and perhaps a trend – within the energy sector regarding executive compensation.

- Industry Averages: Comparing BP's adjusted CEO compensation to industry averages will reveal whether this is a significant departure from the norm or a sign of a broader shift. Data on executive compensation in the oil and gas industry needs to be collected and analyzed.

- Future Trends: This action could encourage other energy companies to reconsider their executive pay structures, potentially leading to a downward trend in CEO compensation across the sector. However, this will depend on many factors, including individual company performance and regulatory pressures.

- ESG Factors: The increasing importance of Environmental, Social, and Governance (ESG) factors is likely playing a role. Investors are increasingly scrutinizing executive pay in relation to a company's environmental and social performance. This could push companies to link CEO compensation more directly to sustainability targets.

Attracting and retaining top talent remains a key challenge for the industry. Whether this pay cut will negatively impact BP's ability to attract and retain high-performing executives is a crucial consideration that requires further observation and analysis.

Conclusion

The 31% decrease in BP CEO compensation marks a significant development, impacting BP's internal dynamics and potentially reshaping executive pay practices across the energy sector. This decision's implications extend beyond BP itself, highlighting the growing importance of corporate governance, shareholder activism, and ESG factors in shaping executive pay decisions. This reduction represents a potential turning point, signaling a potential shift towards greater accountability and a reassessment of executive compensation in the energy industry. Follow the latest updates on BP CEO compensation and learn more about the implications of executive pay in the energy sector to stay informed about changes in BP's corporate governance and the broader energy landscape. The significance of this 31% decrease in BP CEO compensation cannot be overstated.

Experience Musicale Hellfest Au Noumatrouff De Mulhouse

Experience Musicale Hellfest Au Noumatrouff De Mulhouse

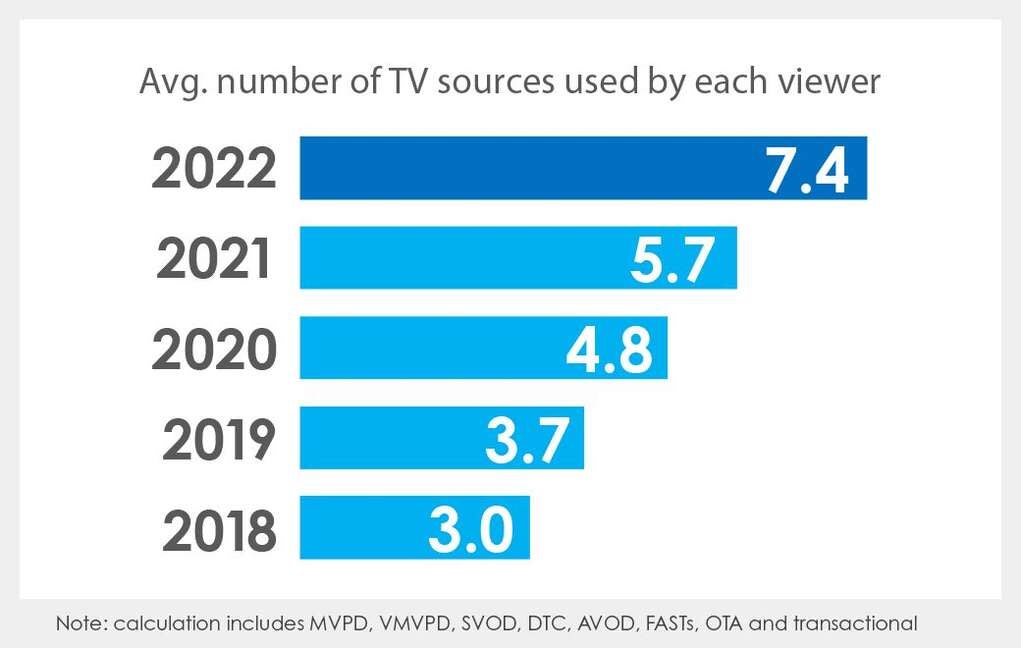

How Streaming Services Are Finally Profitable And What It Means For Viewers

How Streaming Services Are Finally Profitable And What It Means For Viewers

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Truc Giao Thong

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Truc Giao Thong

New Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller

New Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller