BP CEO Pay Drop: 31% Reduction In Executive Compensation

Table of Contents

Reasons Behind the 31% Reduction in BP CEO Compensation

The 31% reduction in BP CEO compensation is a complex issue with multiple contributing factors. Let's examine the key drivers:

-

BP's Financial Performance in 2022/2023: The energy market experienced significant volatility in 2022 and 2023, impacting BP's financial results and profits. While BP may have recorded substantial profits, the reduction in CEO pay could reflect a strategic decision to align executive compensation more closely with overall company performance, especially in light of these market fluctuations.

- BP profits: While specific figures are needed for a complete analysis, any decline in BP profits compared to previous years would naturally influence the level of executive compensation.

- Energy market volatility: The fluctuating oil prices throughout this period significantly impacted profitability. A reduction in the CEO's pay could be interpreted as a response to market conditions impacting the company’s bottom line.

- Data and figures: Detailed analysis of BP's financial statements is necessary to fully understand the correlation between financial performance and the CEO's pay cut. (Note: Insert relevant data and figures if available at the time of writing).

-

Shareholder Activism and Executive Pay Transparency: Growing shareholder pressure has undoubtedly played a significant role. Investors are increasingly scrutinizing executive pay packages, demanding greater transparency and accountability. The rise of ESG (Environmental, Social, and Governance) investing has further amplified this pressure.

- Shareholder votes and resolutions: Examine any shareholder resolutions regarding executive pay at recent BP annual general meetings. Any significant shareholder votes against the existing compensation structure would support the argument that shareholder activism contributed to the pay cut.

- Executive pay transparency: The movement toward greater transparency in executive compensation is forcing companies to justify their executive pay structures more rigorously.

- ESG investing: The growing importance of ESG factors in investment decisions is pushing companies to align their executive compensation with their broader sustainability goals.

-

Public Pressure and Media Scrutiny: Public outrage over high executive pay, particularly in the context of rising energy costs and the energy crisis, has undoubtedly influenced BP's decision. Negative media coverage of excessive executive compensation can severely damage a company's reputation.

- Public perception: Negative public perception of high executive pay can lead to boycotts, reduced consumer confidence, and ultimately impact the company's bottom line.

- Media coverage: Analyzing the tone and focus of media coverage surrounding BP's executive compensation in the preceding months will provide insight into public sentiment.

- Corporate responsibility: The pay cut could be seen as a strategic move to enhance BP's image and demonstrate a commitment to corporate social responsibility.

Comparison with Other Oil Company CEO Compensation

To understand the significance of the BP CEO pay drop, comparing it to the compensation packages of other oil and gas industry CEOs is crucial. A comprehensive analysis requires looking at:

- Oil and gas industry compensation: Benchmarking BP's CEO pay against industry averages provides context.

- Competitor executive pay: Comparing the pay of BP's CEO to that of CEOs at ExxonMobil, Chevron, Shell, and other major players allows for a relative assessment.

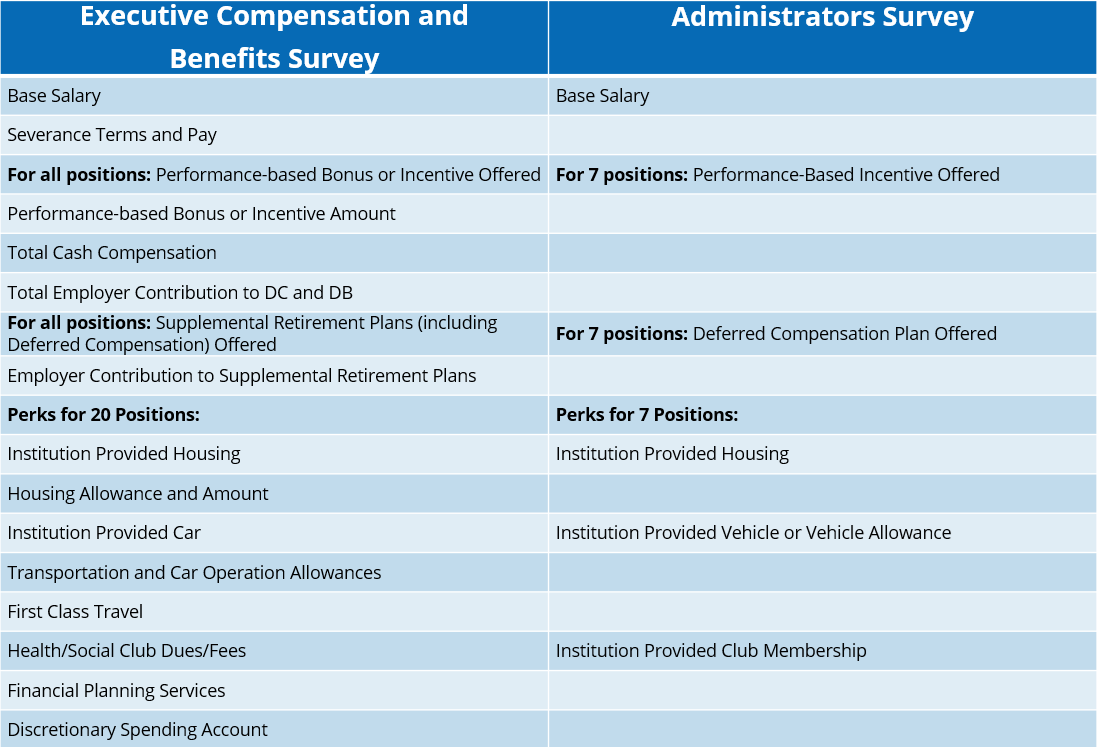

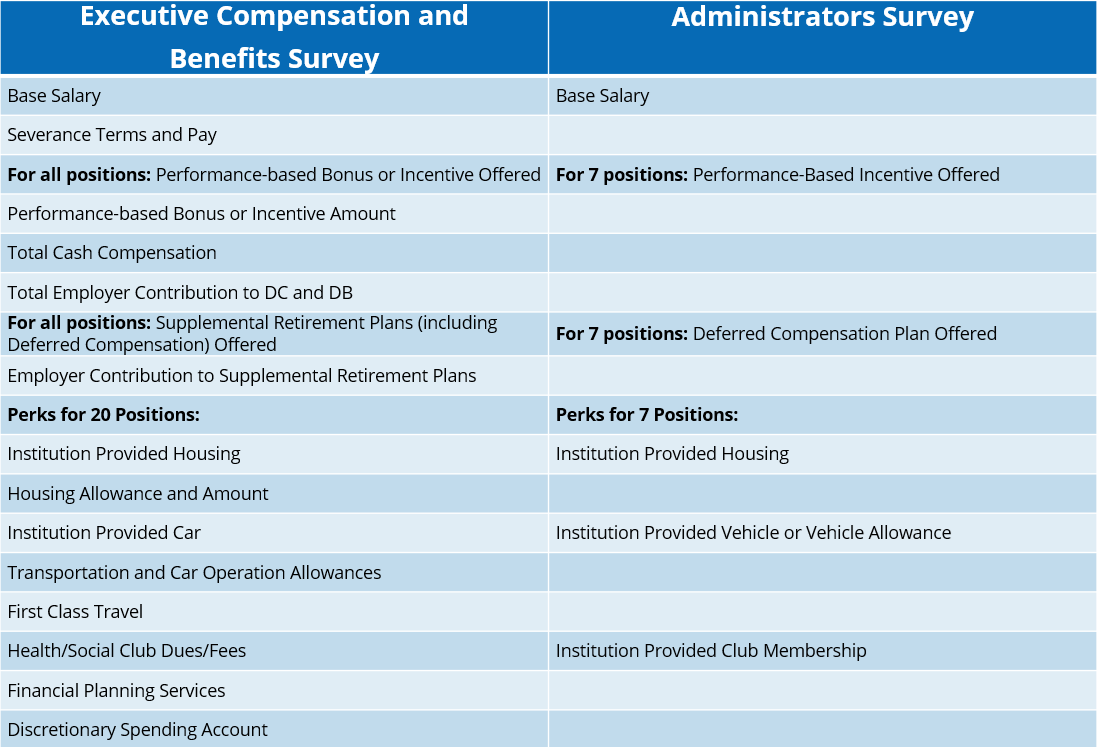

- Industry benchmarks: Analyzing industry benchmarks for executive compensation helps determine if the BP CEO's pay cut aligns with industry trends or represents a significant departure. (Note: Insert a table comparing CEO compensation for major oil companies if data is available).

Long-Term Implications of the Pay Cut

The long-term impact of this 31% reduction in BP CEO pay remains to be seen. However, several key areas warrant consideration:

- Long-term strategy: The decision might influence BP's long-term strategic planning, potentially affecting risk-taking and investment decisions.

- Talent retention: Significantly reducing executive compensation may make it harder to attract and retain top talent in a competitive industry.

- Executive incentives: Changes in the compensation structure need to ensure that appropriate incentives remain in place to motivate effective leadership.

- Employee morale: The impact on overall employee morale and perceptions of fairness within the company should also be assessed.

Conclusion: Understanding the BP CEO Pay Drop and Its Significance

The 31% reduction in BP CEO pay is a multifaceted issue influenced by BP's financial performance, intensifying shareholder pressure for greater executive pay transparency, and growing public concern about high executive compensation within the energy sector. The move represents a significant shift in the context of the oil and gas industry, potentially setting a precedent for increased scrutiny of executive pay and reinforcing the importance of ESG factors in corporate governance. While the long-term implications remain to be seen, this decision underscores the changing dynamics of executive compensation within large corporations. Stay updated on BP CEO pay and follow the latest on executive compensation trends in the energy sector to learn more about BP's compensation strategy and analyze the implications of the BP CEO pay drop.

Featured Posts

-

Southern France Alps Region Severe Weather And Late Snow Conditions

May 22, 2025

Southern France Alps Region Severe Weather And Late Snow Conditions

May 22, 2025 -

Blake Lively And The Recent Allegations What We Know

May 22, 2025

Blake Lively And The Recent Allegations What We Know

May 22, 2025 -

Is Core Weave Stock A Good Investment Current Market Analysis

May 22, 2025

Is Core Weave Stock A Good Investment Current Market Analysis

May 22, 2025 -

Two Fan Favorite Villains Return In Dexter Resurrection

May 22, 2025

Two Fan Favorite Villains Return In Dexter Resurrection

May 22, 2025 -

Grocery Shopping Guide 2000 Quarter Found And Doge Poll Gbrs Top News

May 22, 2025

Grocery Shopping Guide 2000 Quarter Found And Doge Poll Gbrs Top News

May 22, 2025