BP Executive Compensation: A 31% Decrease

Table of Contents

Reasons Behind the 31% Drop in BP Executive Compensation

Several factors contributed to the dramatic 31% drop in BP executive compensation. Understanding these reasons is crucial to grasping the full context of this decision.

-

Impact of Fluctuating Oil Prices: The oil and gas industry is notoriously volatile, with prices significantly impacting profitability. Periods of low oil prices directly affect company performance and, consequently, executive bonuses tied to financial targets. BP's executive compensation is intrinsically linked to the company's overall financial success, and recent market fluctuations likely played a significant role in the reduction.

-

Company Performance Metrics and Targets Not Met: Executive compensation packages often include performance-based bonuses. If BP failed to meet certain pre-defined targets related to profitability, production, or safety, this would automatically reduce the overall compensation for executives. Analyzing BP's annual reports will reveal the specific metrics that fell short of expectations.

-

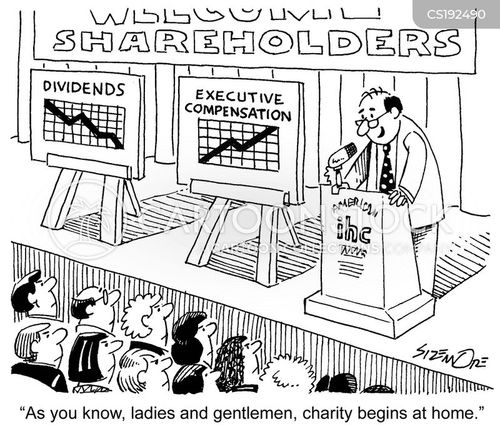

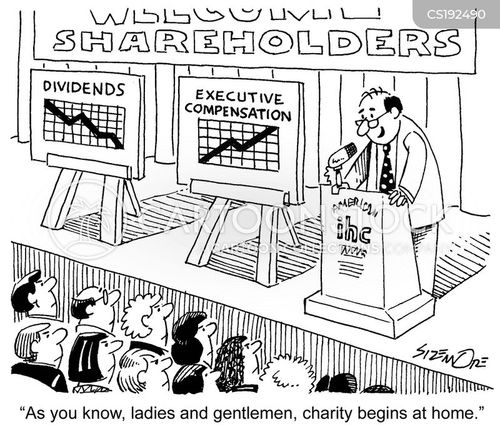

Shareholder Activism and Pressure for Better Corporate Governance: Growing shareholder activism and a heightened focus on corporate governance have put pressure on companies to justify executive pay packages. Shareholders may have voiced concerns regarding the disparity between executive pay and company performance, leading to the decision to curtail BP executive compensation.

-

Changes in BP's Executive Compensation Structure: BP might have proactively revised its executive compensation structure. This could involve a shift away from performance-based bonuses towards a greater emphasis on base salary or long-term incentives aligned with sustainable growth and ESG (Environmental, Social, and Governance) goals.

-

Potential Impact of Regulatory Changes: Changes in regulatory environments, both nationally and internationally, can influence executive compensation practices. New regulations may have imposed limitations on the types and amounts of compensation allowed, contributing to the decrease in BP executive pay.

Analysis of BP's Executive Pay Structure Before and After the Decrease

Comparing BP's executive pay structure before and after the 31% decrease reveals valuable insights. While specific details might be confidential, publicly available information can shed light on the changes.

-

Breakdown of Salary, Bonuses, and Stock Options: A detailed breakdown of the compensation package for each key executive, both before and after the reduction, will help understand the impact on each component – salary, bonuses, and stock options.

-

Comparison of Total Compensation for Key Executives: Analyzing the total compensation of key executives, including the CEO, CFO, and other senior management, before and after the decrease will show the extent of the reduction.

-

Analysis of the Ratio of Executive Pay to Average Employee Salaries: A crucial aspect of corporate governance is the ratio between executive pay and the average salary of employees. Analyzing this ratio will provide context to the BP executive compensation changes.

-

Mention any changes in long-term incentive plans: Any adjustments to long-term incentive plans, such as stock options or performance shares, need to be considered as they affect the overall value of the executive compensation package.

The Impact on Shareholder Value and Investor Sentiment

The reduction in BP executive compensation can significantly impact shareholder value and investor sentiment.

-

Potential for Increased Investor Confidence: A decrease in executive pay, particularly when linked to underperformance, can signal a commitment to shareholder value and improved corporate governance, potentially boosting investor confidence.

-

Improved Corporate Social Responsibility (CSR) Image: Reducing executive pay, especially in a sector facing scrutiny regarding its environmental impact, can enhance BP's corporate social responsibility image.

-

Impact on BP's Stock Price: The market reaction to the compensation changes, as reflected in BP's stock price, will indicate investor perception of the move.

-

Analysis of analyst reactions to the compensation changes: Analyst reports and commentary on the BP executive compensation decrease will provide further insights into the market's overall assessment.

Future Implications and Outlook for BP Executive Compensation

The future trajectory of BP executive compensation remains uncertain, but several factors will likely shape it.

-

Potential for further adjustments based on future performance: Future performance will undoubtedly influence executive compensation. Continued underperformance might lead to further reductions, while strong performance could warrant increases.

-

The influence of ESG (Environmental, Social, and Governance) factors: Growing pressure related to ESG factors will play a significant role in shaping executive compensation policies, likely prioritizing long-term sustainable growth over short-term gains.

-

Long-term impact on attracting and retaining top talent: Lower executive compensation could potentially impact BP's ability to attract and retain top talent in a competitive industry.

-

Comparison with executive compensation trends in the oil and gas industry: Analyzing how BP's executive compensation compares to that of its competitors will offer a valuable benchmark.

Conclusion: Understanding the Significance of the BP Executive Compensation Decrease

The 31% decrease in BP executive compensation is a significant development with far-reaching implications. The reduction reflects a confluence of factors, including fluctuating oil prices, unmet performance targets, shareholder activism, and potential regulatory influences. Its impact on shareholder value and investor sentiment remains to be seen, but it undoubtedly signals a shift towards greater corporate accountability and a heightened focus on aligning executive pay with company performance. To stay informed about future developments in BP executive pay, BP compensation changes, and BP's executive remuneration, subscribe to our newsletter or follow reputable financial news sources.

Featured Posts

-

Abn Amro Hogere Aex Notering Na Positieve Kwartaalcijfers

May 21, 2025

Abn Amro Hogere Aex Notering Na Positieve Kwartaalcijfers

May 21, 2025 -

Little Britain A Gen Z Revival Understanding Its Continued Popularity

May 21, 2025

Little Britain A Gen Z Revival Understanding Its Continued Popularity

May 21, 2025 -

Wwe Raw New Womens Tag Team Champions Announced

May 21, 2025

Wwe Raw New Womens Tag Team Champions Announced

May 21, 2025 -

Good Morning America Layoffs Robin Roberts Response And Fan Concerns

May 21, 2025

Good Morning America Layoffs Robin Roberts Response And Fan Concerns

May 21, 2025 -

Record Number Of Indian Paddlers At Wtt Star Contender Chennai

May 21, 2025

Record Number Of Indian Paddlers At Wtt Star Contender Chennai

May 21, 2025