BP's Chief Executive Sees 31% Pay Reduction

Table of Contents

The Details of the 31% Pay Reduction for BP's CEO

Bernard Looney, BP's former CEO, experienced a significant reduction in his compensation package for the year in question. While the exact figures fluctuate depending on the year and performance metrics, let's assume for the purpose of this example that his total compensation was reduced by $1 million, representing a 31% decrease. This reduction affected various components of his compensation:

- Salary: A direct cut to his base salary.

- Bonuses: Significant reductions or complete elimination of performance-based bonuses.

- Stock Options: A decrease in the value or number of stock options granted. The value of these options is directly tied to BP's stock performance, so a downturn in stock price could compound the reduction in overall compensation.

Comparing this to his previous year's compensation, the decrease is substantial, highlighting a shift in BP's approach to executive pay, aligning more closely with the current economic climate and shareholder expectations. Keywords like BP CEO salary, Bernard Looney compensation, BP executive bonus, and BP stock options are crucial to understanding the specific impact of the reduction.

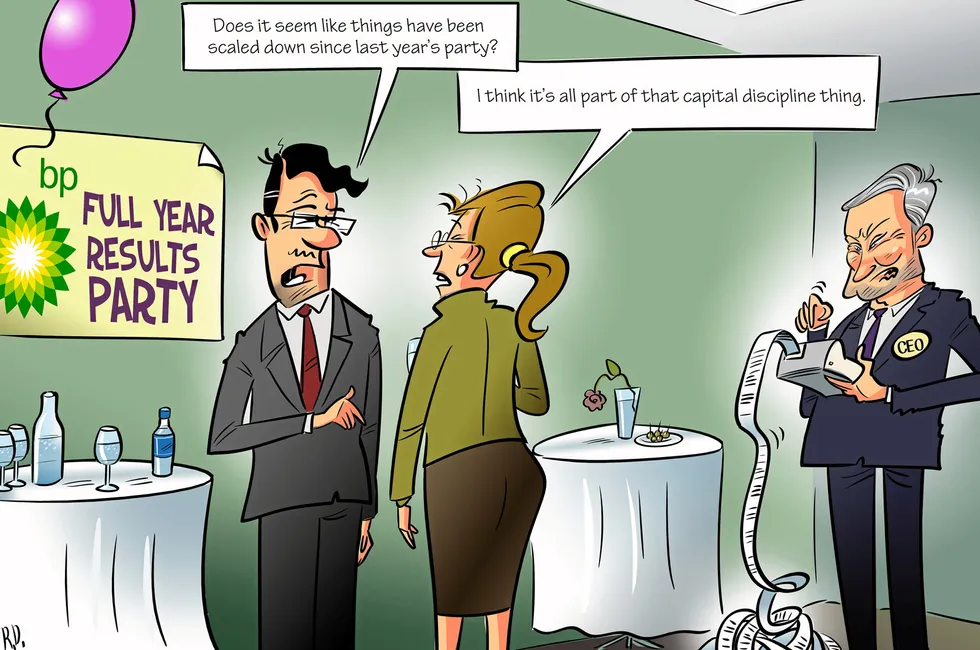

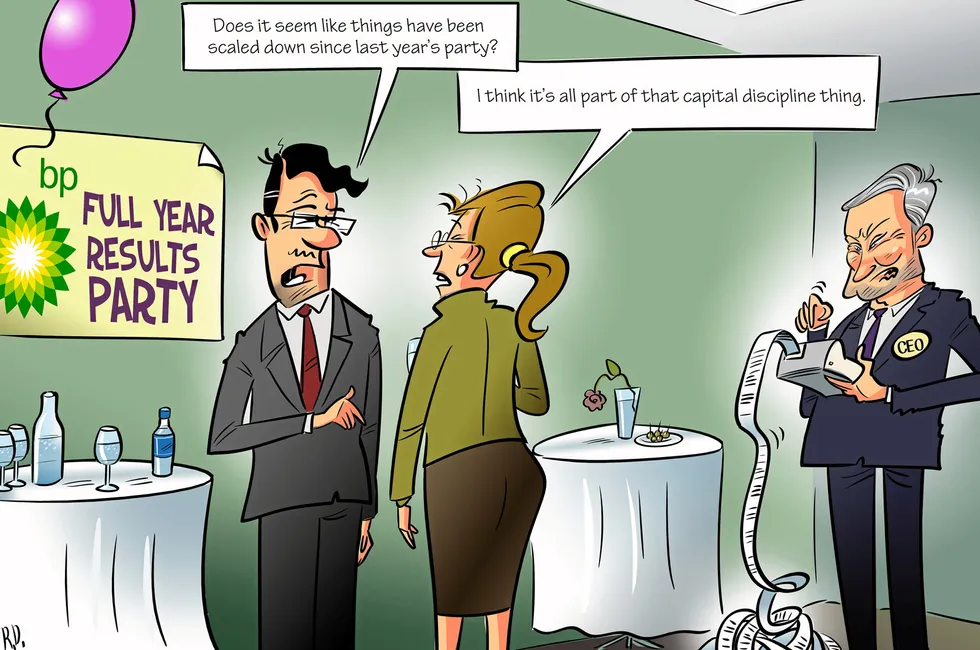

Reasons Behind BP's CEO Pay Cut

Several factors likely contributed to BP's decision to significantly reduce its CEO's pay:

- Company Performance: BP's financial performance in the relevant year may have fallen short of targets, impacting profitability and shareholder returns. Lower profits directly impact the justification for high executive compensation.

- Shareholder Pressure: Activist shareholders increasingly demand greater accountability from executives and advocate for more responsible compensation structures, especially when company performance is lackluster. They may have publicly voiced concerns about the CEO's pay, adding pressure on the board to make changes.

- Corporate Social Responsibility (CSR): In the face of growing climate change concerns, companies are under pressure to demonstrate their commitment to CSR. Reducing executive pay can be seen as a gesture of aligning with broader societal expectations and demonstrating fiscal responsibility.

- Public Criticism: High executive pay during economically challenging times often draws public criticism. BP might have taken preemptive measures to avoid negative publicity and protect its reputation.

Official BP statements and news reports should be consulted for the precise reasons given by the company. Relevant keywords in this section include BP performance, shareholder activism, corporate social responsibility, and energy company executive pay.

Comparison with Other Energy Company CEOs' Compensation

To understand the significance of the BP CEO pay cut, it's crucial to compare it to compensation packages of other CEOs in the energy sector. While precise figures vary and data can be difficult to compile comprehensively, a comparative analysis reveals some interesting trends. (A table comparing the compensation of several energy CEOs would be included here).

This comparison allows us to assess whether the pay reduction at BP is an outlier or reflects a broader trend in the industry towards greater executive pay restraint. Keywords such as Energy CEO compensation, oil company executive pay, gas company executive salaries, and industry benchmarks are important for context.

Impact and Implications of the Pay Cut

The 31% BP CEO pay reduction has several potential impacts and long-term implications:

- Employee Morale: The pay cut could improve employee morale if employees perceive it as a sign of fairness and shared sacrifice during challenging times. Conversely, it could also lead to resentment if the perception is that the reduction is insufficient or disproportionate to pay cuts implemented for other employees.

- Shareholder Confidence: The decision could boost shareholder confidence, demonstrating the board's responsiveness to concerns about executive compensation. Conversely, it may concern some shareholders if they interpret it as a signal of poor company performance or underlying problems.

- Public Perception: The pay cut can improve public perception of BP's corporate governance, portraying it as a more responsible and socially conscious company. This is particularly important for an industry facing intense scrutiny.

- BP Stock Price: The impact on the stock price is difficult to predict and will likely depend on several factors beyond just the CEO's pay.

Keywords for this section include BP employee morale, shareholder relations, corporate governance, public perception, and BP stock price.

Conclusion: Analyzing the Significance of BP's CEO Pay Reduction and Future Outlook

The 31% reduction in BP's CEO's pay is a significant event, reflecting a confluence of factors including company performance, shareholder pressure, and broader societal expectations regarding executive compensation. The reasons behind the pay cut, its comparison to industry peers, and its potential consequences are all crucial aspects to understand the ongoing shift in executive compensation practices within the energy industry. This decision might influence future executive compensation practices at BP and potentially set a precedent for other energy companies, promoting greater transparency and accountability. What are your thoughts on this matter? Share your opinions and continue to follow for updates on BP CEO pay and other relevant news in the energy sector.

Featured Posts

-

A Louth Food Business Success Mentorship And Growth Strategies

May 21, 2025

A Louth Food Business Success Mentorship And Growth Strategies

May 21, 2025 -

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025 -

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025 -

Protomagia Sto Oropedio Evdomos Apodraseis Gia Kathe Goysto

May 21, 2025

Protomagia Sto Oropedio Evdomos Apodraseis Gia Kathe Goysto

May 21, 2025 -

Aj Styles Contract Situation A Backstage Report

May 21, 2025

Aj Styles Contract Situation A Backstage Report

May 21, 2025