Brands Scramble For New Retail Space After Hudson's Bay Departures

Table of Contents

Prime Retail Locations Become Highly Contested

The former Hudson's Bay locations are highly desirable due to their prime positioning. These aren't just any vacant retail properties; they're often situated in high-traffic areas with established brand recognition and existing infrastructure, making them incredibly attractive to competing retailers.

- Examples of desirable locations: Many downtown cores and key positions within established shopping malls, previously occupied by Hudson's Bay, are now up for grabs. These locations benefit from high foot traffic and strong brand visibility.

- Impact on surrounding businesses: The departure of a major anchor tenant like Hudson's Bay can initially create uncertainty for neighboring businesses. However, the influx of new retailers can revitalize these areas, potentially boosting overall foot traffic and sales.

- Brands showing interest: Industry insiders are buzzing with speculation about which brands will ultimately secure these coveted spaces. Reports suggest a range of retailers, from established national brands to ambitious smaller players, are actively pursuing these opportunities.

- Increased rental costs/purchase prices: The intense competition for these prime retail locations is driving up rental costs and purchase prices, reflecting the high value placed on these strategic assets. Securing a space means paying a premium.

Strategic Implications for Retailers

Securing a former Hudson's Bay location is a significant strategic decision, demanding careful consideration of various factors. It's not simply about acquiring space; it's about aligning the brand with the location and its demographics, and adapting to the space's existing infrastructure.

- Lease terms: Retailers must carefully analyze lease terms and their implications for their business models. Long-term leases offer stability but also carry risks, while shorter-term options offer flexibility but less security.

- Brand alignment: A crucial aspect is ensuring that the brand's image and target demographic align with the location and its surrounding area. A luxury brand might not thrive in a location previously associated with a more mass-market retailer.

- Adapting existing store formats: Existing store formats may need significant adaptation to fit the new spaces. Renovations and fit-outs represent substantial investment costs, impacting profitability.

- Investment costs: The costs associated with renovations, fit-outs, and potential modifications to align with the brand's identity can be substantial, adding to the overall financial commitment.

The Shifting Retail Landscape and Future Trends

Hudson's Bay's departures are symptomatic of a broader shift in the retail sector. The rise of e-commerce and evolving consumer behavior are forcing retailers to rethink their brick-and-mortar strategies.

- E-commerce impact: The dominance of online shopping has significantly impacted traditional retail, forcing many businesses to adapt or face closure.

- Omnichannel strategies: Retailers are increasingly focusing on omnichannel strategies, integrating online and offline experiences to enhance customer engagement.

- Future trends: We're likely to see a continued evolution in retail real estate, with a greater emphasis on smaller-format stores, pop-up shops, and experiential retail spaces.

- Alternative retail models: Pop-up shops and smaller-format stores are becoming increasingly popular, offering retailers more flexibility and lower risk compared to large, long-term commitments.

Winners and Losers in the Retail Space Scramble

The competition for vacant Hudson's Bay locations will create both winners and losers. The most successful retailers will be those able to adapt quickly, strategically, and financially to the changing retail landscape.

- Successful brands: Brands with strong omnichannel strategies, adaptable business models, and sufficient financial resources are best positioned to succeed.

- Struggling brands: Retailers with outdated business models, limited financial flexibility, or a poor understanding of the evolving consumer landscape may struggle to compete.

- Market consolidation: We may see increased market consolidation, with larger, more established brands acquiring smaller players or expanding into new territories.

Navigating the Aftermath of Hudson's Bay Departures: A New Era in Retail Real Estate

The impact of Hudson's Bay departures on the retail real estate market is profound. The scramble for prime retail locations underscores the importance of strategic planning and adaptability in today's dynamic retail environment. Securing these coveted spaces is crucial for brand success, but requires careful consideration of financial implications and market trends. Stay informed about developments in the retail sector and the ongoing consequences of these Hudson's Bay departures. Monitor industry news and resources specializing in retail real estate trends to gain a competitive edge in this evolving landscape.

Featured Posts

-

Invesco And Barings Democratize Private Credit Investing

Apr 23, 2025

Invesco And Barings Democratize Private Credit Investing

Apr 23, 2025 -

Private Credit Investment Opportunities Now Open To Everyday Investors Through Invesco And Barings

Apr 23, 2025

Private Credit Investment Opportunities Now Open To Everyday Investors Through Invesco And Barings

Apr 23, 2025 -

Yankees Cortes Dominates Reds Suffer Third Consecutive Defeat

Apr 23, 2025

Yankees Cortes Dominates Reds Suffer Third Consecutive Defeat

Apr 23, 2025 -

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Walk Off

Apr 23, 2025

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Walk Off

Apr 23, 2025 -

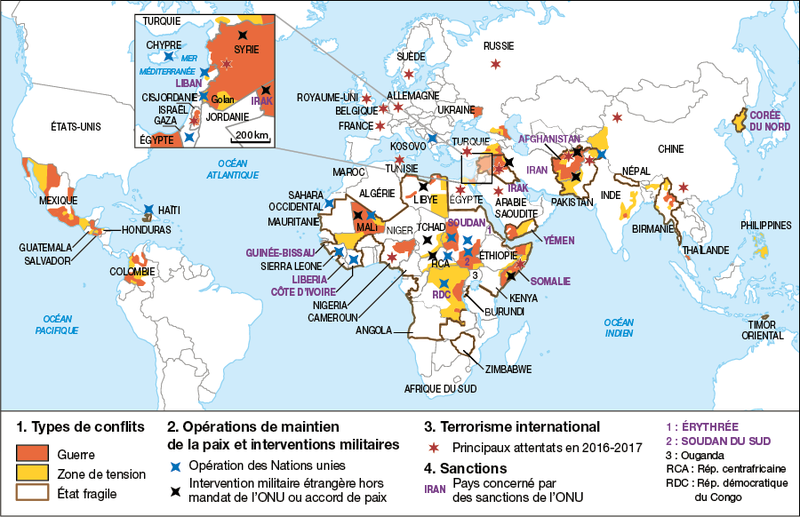

L Analyse Geopolitique D Amandine Gerard Je T Aime Moi Non Plus

Apr 23, 2025

L Analyse Geopolitique D Amandine Gerard Je T Aime Moi Non Plus

Apr 23, 2025