Broadcom's VMware Acquisition: A 1050% Price Surge For AT&T

Table of Contents

Understanding the Broadcom-VMware Merger

Broadcom's acquisition of VMware, finalized in late 2022, was a monumental deal in the enterprise software market. The $61 billion price tag signaled Broadcom's aggressive expansion strategy and its ambition to become a major player in cloud infrastructure and software. This Broadcom VMware merger was driven by several strategic objectives:

- Increased Market Share: Gaining control of VMware's significant market share in virtualization and cloud management instantly boosted Broadcom's position in the enterprise software market.

- Access to Cutting-Edge Technology: VMware's innovative technologies in areas like virtualization, cloud computing, and network security provided Broadcom with a wealth of intellectual property and expertise.

- Synergies and Cross-Selling Opportunities: Integrating VMware's portfolio with Broadcom's existing offerings allows for significant cost savings and enhanced cross-selling opportunities.

The Broadcom acquisition of VMware had immediate implications for the tech industry, solidifying Broadcom's position as a dominant force and potentially impacting competition in various sectors. The VMware acquisition cost, while substantial, was deemed strategically worthwhile by Broadcom, signaling a significant shift in the enterprise software landscape.

AT&T's Unexpected Beneficiary Status

Prior to the Broadcom VMware merger, AT&T held a substantial investment in VMware stock. This investment, previously viewed as a relatively standard part of their portfolio, unexpectedly transformed into a massive financial gain. The Broadcom deal catapulted the value of AT&T's VMware holdings, resulting in the aforementioned 1050% price surge. This unexpected profit significantly impacted AT&T's balance sheet, bolstering its financial position and offering new strategic opportunities. The sudden increase in AT&T's stock price, directly linked to their VMware holdings, highlights the unpredictable nature of the investment market and the potential for substantial returns from seemingly unassuming assets.

Analyzing the Reasons for AT&T's Substantial Gains

The 1050% increase in the value of AT&T's VMware holdings was not solely a consequence of the acquisition price. Several factors likely contributed to this dramatic surge:

- Market Speculation: Anticipation surrounding the merger and the potential value of VMware within Broadcom's portfolio fueled significant market speculation, driving up the stock price.

- Investor Sentiment: Positive investor sentiment towards the Broadcom VMware merger and the perceived strength of the combined entity likely contributed to the price increase.

- Strategic Divestment Opportunities: The surge in value presented AT&T with attractive opportunities for strategic divestment, allowing them to capitalize on the increased valuation.

Long-Term Implications of the Broadcom-VMware Deal

The Broadcom VMware deal has far-reaching implications that will continue to shape the technology landscape for years to come. Its effects will be felt across several key areas:

- Future of Enterprise Software: The merger has led to consolidation in the enterprise software market, potentially influencing the development and adoption of new technologies.

- Market Competition: The combined strength of Broadcom and VMware may reduce competition in certain sectors, leading to potential changes in pricing and innovation.

- Long-Term Investment Strategy: The unexpected gains for AT&T highlight the importance of diversification and long-term investment strategies, emphasizing the potential for significant returns from seemingly minor holdings. This Broadcom deal serves as a case study in the volatile yet potentially lucrative nature of tech investments.

Conclusion: The Broadcom VMware Acquisition: A Case Study in Unexpected Financial Gains

Broadcom's successful acquisition of VMware proved to be a game-changer, not just for the two primary players but also for AT&T, which experienced an astonishing 1050% price surge on its VMware investments. This unexpected windfall underscores the unpredictable nature of the market and the potential for significant gains from seemingly standard investments. The Broadcom VMware acquisition serves as a compelling case study, highlighting the far-reaching consequences of major mergers and acquisitions and the importance of carefully analyzing investment portfolios. Learn more about the impact of the Broadcom VMware acquisition and its implications for the future of enterprise software and your investment strategy. Analyze your investment portfolio in light of this unexpected surge, and understand the implications of this pivotal Broadcom deal.

Featured Posts

-

Jay Kelly Ola Osa Prepei Na K Serete Gia Tin Tainia Toy Noa Mpompak

May 12, 2025

Jay Kelly Ola Osa Prepei Na K Serete Gia Tin Tainia Toy Noa Mpompak

May 12, 2025 -

Elaqt Twm Krwz Wana Dy Armas Tfasyl Mthyrt En Qst Hb Tkhtt Farq Al 26 Eama

May 12, 2025

Elaqt Twm Krwz Wana Dy Armas Tfasyl Mthyrt En Qst Hb Tkhtt Farq Al 26 Eama

May 12, 2025 -

John Wick 5 Is This The End For Keanu Reeves Iconic Assassin

May 12, 2025

John Wick 5 Is This The End For Keanu Reeves Iconic Assassin

May 12, 2025 -

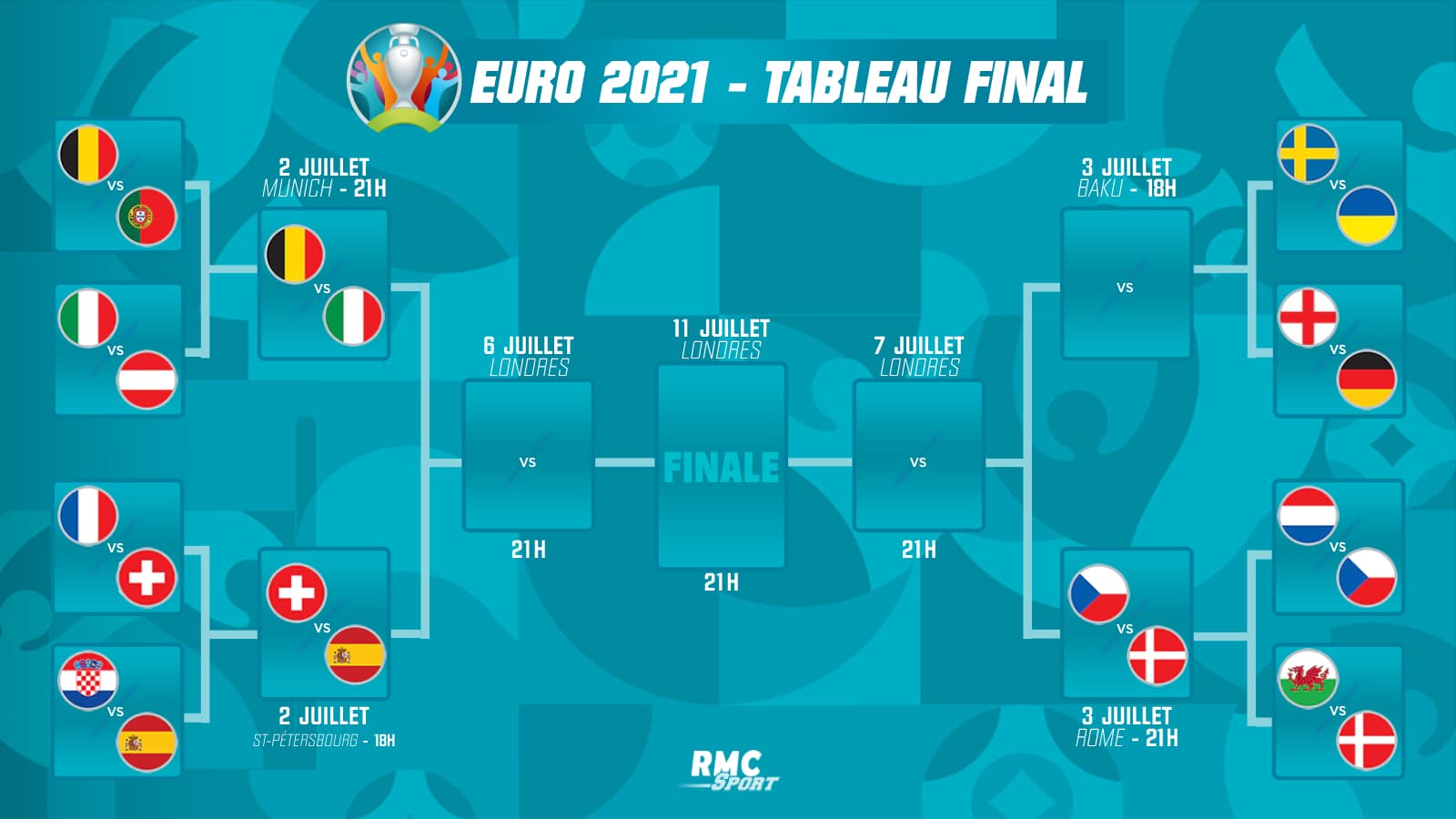

Quarts De Finale C1 Mueller Decisif Pour Le Bayern Face A L Inter

May 12, 2025

Quarts De Finale C1 Mueller Decisif Pour Le Bayern Face A L Inter

May 12, 2025 -

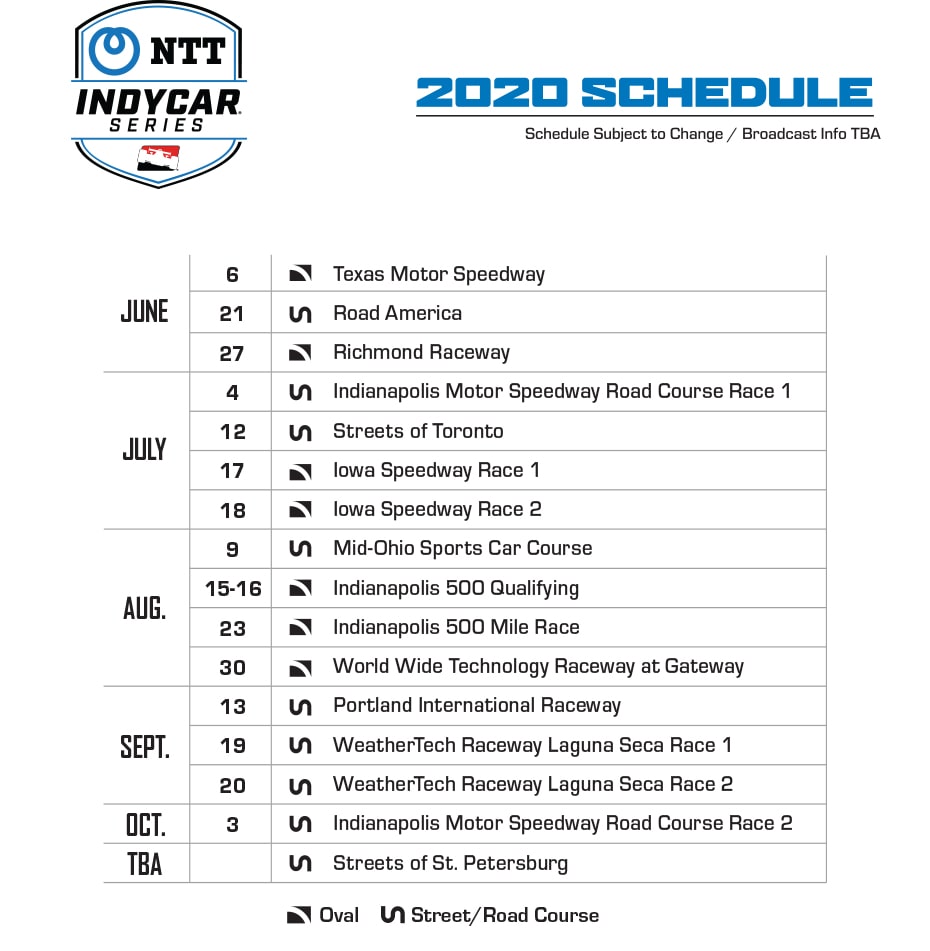

Fox Announces New Indy Car Documentary May 18 Premiere

May 12, 2025

Fox Announces New Indy Car Documentary May 18 Premiere

May 12, 2025