Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Hike Concerns

Table of Contents

AT&T's Specific Concerns Regarding Price Increases

AT&T's reliance on VMware's virtualization technology for its extensive network infrastructure makes them particularly vulnerable to potential price increases resulting from the Broadcom VMware acquisition. The acquisition raises serious questions about the future cost of crucial services and the long-term viability of their current operational model.

Increased Costs for Virtualization Services

AT&T, like many large enterprises, uses VMware's suite of virtualization products extensively. The Broadcom VMware acquisition introduces significant uncertainty around the pricing of these essential tools.

- Increased licensing fees for vSphere, vSAN, and NSX: These core VMware products are integral to AT&T's operations. Any substantial increase in licensing fees could significantly impact their operational budget.

- Potential for reduced flexibility and negotiation power with a monopolized market: With Broadcom controlling VMware, AT&T's bargaining power may diminish, limiting their ability to negotiate favorable pricing. The lack of competition could lead to imposed price increases without much recourse.

- Uncertainty surrounding future product development and support: Concerns exist about the future direction of VMware's product roadmap under Broadcom's ownership. This uncertainty impacts long-term planning and potentially reduces the quality of support AT&T receives.

Impact on AT&T's Competitive Landscape

The potential for significantly increased costs following the Broadcom VMware acquisition places AT&T in a difficult position. Higher operational expenses could ripple through their business model, impacting their competitiveness.

- Difficulty in absorbing increased costs without passing them on to consumers: AT&T may be forced to raise prices for their own services to offset increased VMware costs, potentially affecting their customer base and market share.

- Pressure to find cost-effective alternatives, potentially leading to disruption and service interruptions: Searching for alternative virtualization solutions could be disruptive, causing potential service interruptions and impacting the quality of their network services.

- Risk of losing customers to competitors offering more affordable services: Price increases could make AT&T less competitive, potentially leading to a loss of market share to rivals offering similar services at lower costs.

Broader Implications of the Broadcom VMware Acquisition

The Broadcom VMware acquisition has far-reaching consequences that extend beyond AT&T's concerns. The merger's impact on the wider technology landscape is a significant cause for concern for many industry experts.

Monopoly Concerns and Reduced Competition

The acquisition creates a dominant player in the virtualization market, raising concerns about monopolistic practices and reduced innovation. This lack of competition could stifle the development of new technologies and negatively impact the entire industry.

- Limited choices for enterprises seeking virtualization solutions: The merger significantly reduces the number of major players in the virtualization market, leaving enterprises with fewer options and potentially less choice.

- Reduced pressure on Broadcom to innovate and improve their products: Without significant competition, Broadcom may be less incentivized to invest in research and development, potentially slowing innovation.

- Potential for less customer-focused practices due to decreased competition: A lack of competition can lead to companies prioritizing profits over customer satisfaction and needs.

Regulatory Scrutiny and Antitrust Investigations

Given the scale of the Broadcom VMware acquisition and its potential impact on competition, the deal is likely to face intense scrutiny from antitrust authorities worldwide.

- Potential for delays or even blocking of the acquisition by regulatory bodies: Antitrust regulators may investigate the deal's potential anti-competitive effects, leading to delays or even a complete block of the acquisition.

- Increased legal and compliance costs for Broadcom: Navigating the regulatory landscape and potential lawsuits will inevitably increase costs for Broadcom.

- Uncertain timeline for finalization of the acquisition: The regulatory review process could significantly delay the completion of the merger, creating uncertainty for all stakeholders.

Conclusion

The Broadcom VMware acquisition represents a significant shift in the enterprise software landscape. AT&T's concerns about extreme price hikes highlight the potential downsides for businesses that heavily rely on VMware technologies. The deal's impact on competition, innovation, and pricing requires careful consideration from regulators and businesses. Understanding the potential ramifications of this merger is crucial for businesses to strategize and prepare for the future. Stay informed about the ongoing developments in the Broadcom VMware acquisition and how it might affect your organization's costs and competitiveness. Monitoring the unfolding situation regarding the Broadcom VMware merger is vital for strategic planning and ensuring your organization's future success.

Featured Posts

-

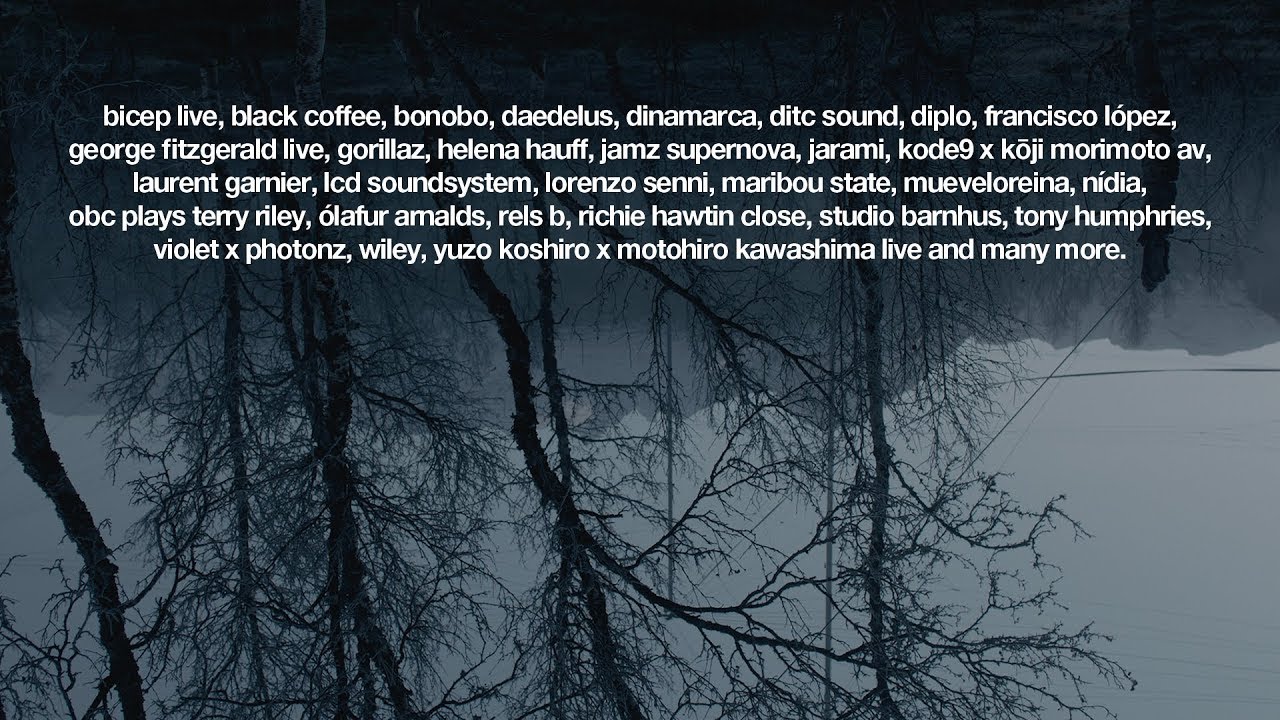

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition And London Shows

May 30, 2025

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition And London Shows

May 30, 2025 -

Caiado Pode Receber Titulo De Cidadao Baiano Apoio Da Fecomercio

May 30, 2025

Caiado Pode Receber Titulo De Cidadao Baiano Apoio Da Fecomercio

May 30, 2025 -

Awstabynkw Zkhm Mwsm Almlaeb Altrabyt Yubshr Bmstqbl Waed Alshrq Alawst

May 30, 2025

Awstabynkw Zkhm Mwsm Almlaeb Altrabyt Yubshr Bmstqbl Waed Alshrq Alawst

May 30, 2025 -

Alcaraz Vs Musetti Rolex Monte Carlo Masters 2025 Final Preview

May 30, 2025

Alcaraz Vs Musetti Rolex Monte Carlo Masters 2025 Final Preview

May 30, 2025 -

Manchester United Star Bruno Fernandes A Real Madrid Target

May 30, 2025

Manchester United Star Bruno Fernandes A Real Madrid Target

May 30, 2025