Broadcom's VMware Deal: A 1050% Price Increase Sparks Outrage From AT&T

Table of Contents

The Details of Broadcom's VMware Deal

Acquisition Cost and Market Impact

Broadcom's acquisition of VMware closed at a whopping $61 billion, representing a significant consolidation of power in the technology sector. This massive deal significantly strengthens Broadcom's position in the market, potentially impacting competitors and reshaping the competitive landscape.

- Acquisition Value: $61 billion, one of the largest tech acquisitions in history.

- Broadcom's Market Position: The acquisition dramatically expands Broadcom's reach into software and cloud infrastructure, potentially creating a near-monopoly in certain sectors.

- Impact on Competitors: Existing competitors in the virtualization and cloud infrastructure market now face increased pressure from a significantly strengthened Broadcom.

The Controversial Price Hike for AT&T

The most contentious aspect of the deal is the reported 1050% price increase imposed on AT&T for VMware services. This dramatic surge has sparked intense backlash and raises serious questions about fair business practices.

- Previous Pricing: The exact previous pricing structure remains undisclosed, but the scale of the increase is unprecedented.

- New Pricing: A 1050% increase represents a massive cost burden for AT&T, impacting their operational budgets and potentially affecting their service offerings.

- Justification (if any) provided by Broadcom: Broadcom has yet to publicly justify this drastic price increase for AT&T, fueling speculation and fueling the controversy.

- AT&T's Response: AT&T has publicly expressed its outrage and is exploring all possible options to address this exorbitant price hike.

Broadcom's Rationale Behind the Acquisition

Broadcom has cited several reasons for acquiring VMware, including synergies, market expansion, and technological advancements. However, the sheer scale of the price increase for AT&T casts doubt on the stated intentions.

- Synergies: Broadcom aims to integrate VMware's software with its existing hardware portfolio, aiming for increased efficiency and market share.

- Expansion into new markets: The acquisition provides Broadcom access to new markets and customer segments within the cloud computing and virtualization industries.

- Technological advancements: Broadcom hopes to leverage VMware's technology to accelerate its own innovation and product development.

AT&T's Response and Potential Antitrust Concerns

Public Outrage and Legal Action

AT&T's public statement regarding the 1050% price increase has been strongly worded, expressing significant concern and hinting at potential legal action. This is setting the stage for a major legal battle.

- Specific quotes from AT&T: Public statements highlight the unfairness of the price increase and the potential impact on their business.

- Potential lawsuits: AT&T is likely to pursue legal action to challenge the price hike, potentially citing antitrust violations.

- Regulatory scrutiny: The deal is likely to face intense scrutiny from regulatory bodies like the FTC and the EU, who will investigate potential antitrust concerns.

Antitrust Implications and Regulatory Scrutiny

The sheer size of the acquisition and the subsequent price hike raise significant antitrust concerns. The potential for market dominance and stifled competition is a serious cause for concern.

- Market dominance: Broadcom's enhanced market power after the acquisition could lead to less competition and potentially higher prices for consumers.

- Impact on competition: The deal could significantly reduce competition in the virtualization and cloud infrastructure market.

- Potential investigations by regulatory bodies (e.g., FTC, EU): It's highly likely that regulatory bodies will launch thorough investigations into the acquisition and its impact on the market.

Industry Reaction and Expert Opinions

The Broadcom-VMware deal has sparked a range of reactions across the tech industry. Many are concerned about the potential for monopolistic practices.

- Statements from competitors: Competitors are likely to express concerns about reduced competition and potentially unfair business practices.

- Analysts' perspectives: Industry analysts are closely monitoring the situation and offering varied perspectives on the long-term implications.

- Predictions about future market trends: The deal may lead to further consolidation in the tech industry, potentially resulting in higher prices and less innovation.

The Future of VMware and the Broader Tech Landscape

Integration Challenges and Opportunities

Integrating VMware into Broadcom's operations will present significant challenges and opportunities. Success will depend on effective management and a smooth transition.

- Technological integration: Merging different technologies and platforms will require significant effort and expertise.

- Maintaining VMware's customer base: Retaining existing VMware customers will be crucial for Broadcom's success.

- Potential layoffs or restructuring: Integration efforts may lead to workforce reductions or organizational restructuring within VMware.

Long-Term Implications for Businesses Relying on VMware

Businesses reliant on VMware products and services face significant uncertainty in the wake of this acquisition. Potential pricing changes and service disruptions are major concerns.

- Pricing changes: Businesses should expect potential price increases for VMware products and services following the acquisition.

- Service disruptions: The integration process could lead to temporary service disruptions or compatibility issues.

- Potential alternatives: Businesses may start exploring alternative virtualization and cloud infrastructure solutions.

Conclusion: Analyzing the Broadcom VMware Deal and its Fallout

The Broadcom-VMware deal, marked by AT&T's 1050% price increase outrage, raises serious concerns about market dominance, antitrust implications, and the future of the tech landscape. The long-term consequences for businesses reliant on VMware and the competitive dynamics of the industry remain to be seen. The massive price increase imposed on AT&T highlights the potential for abuse of market power post-acquisition.

We encourage you to share your thoughts on the Broadcom VMware deal and its implications in the comments section below. Further reading on related topics such as antitrust laws, tech mergers and acquisitions, and the future of virtualization is recommended for a deeper understanding of this complex issue.

Featured Posts

-

Jason Isaacs Picks His Perfect Lucius Malfoy Replacement For A Future Harry Potter Series

May 29, 2025

Jason Isaacs Picks His Perfect Lucius Malfoy Replacement For A Future Harry Potter Series

May 29, 2025 -

Pcc Community Markets Unexpected 2024 Profit Surge

May 29, 2025

Pcc Community Markets Unexpected 2024 Profit Surge

May 29, 2025 -

Como Toni Kroos Inspiro A Fede Valverde

May 29, 2025

Como Toni Kroos Inspiro A Fede Valverde

May 29, 2025 -

Elfeledett Nokia Kincs Igy Deritheted Ki Az Erteket

May 29, 2025

Elfeledett Nokia Kincs Igy Deritheted Ki Az Erteket

May 29, 2025 -

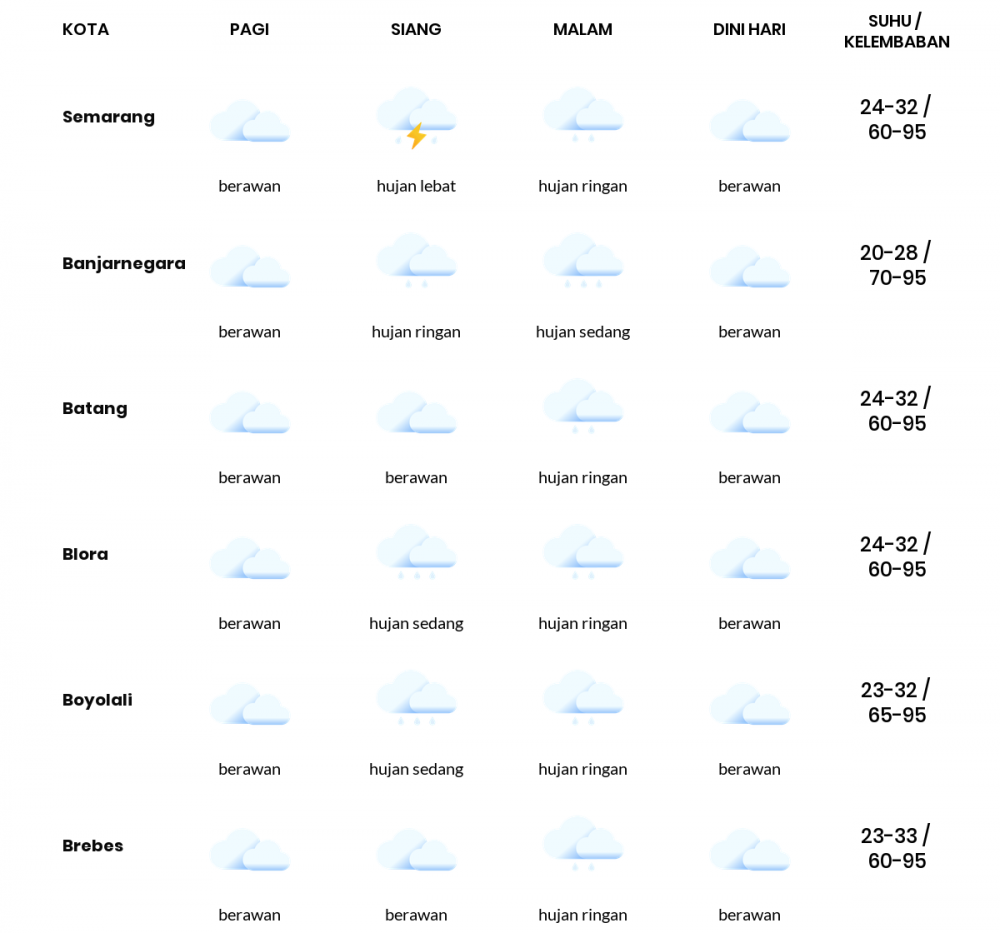

Prakiraan Cuaca Lengkap Jawa Tengah 24 April Antisipasi Hujan

May 29, 2025

Prakiraan Cuaca Lengkap Jawa Tengah 24 April Antisipasi Hujan

May 29, 2025