Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

Table of Contents

Identifying and Exploiting Market Dislocation

Understanding Market Volatility

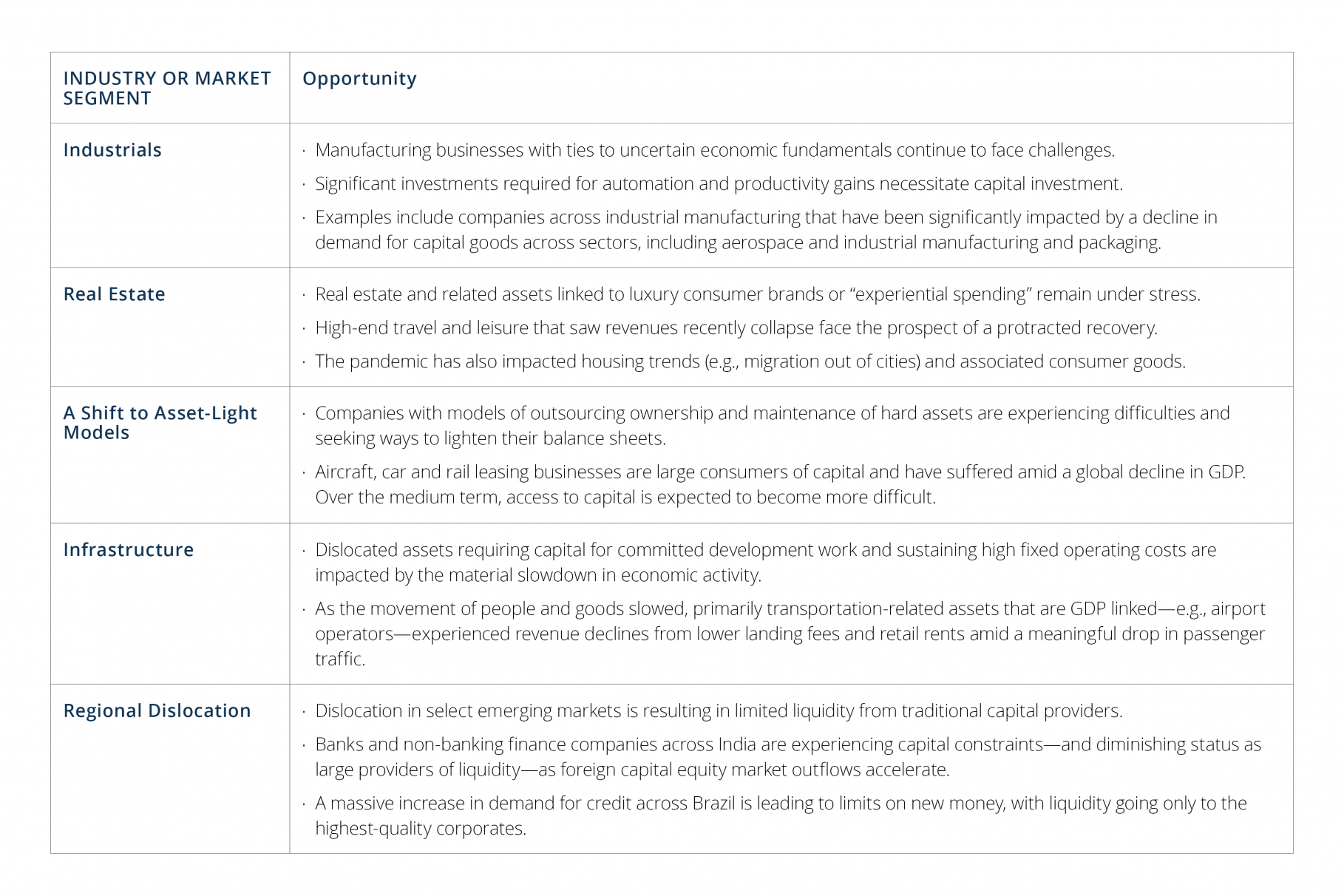

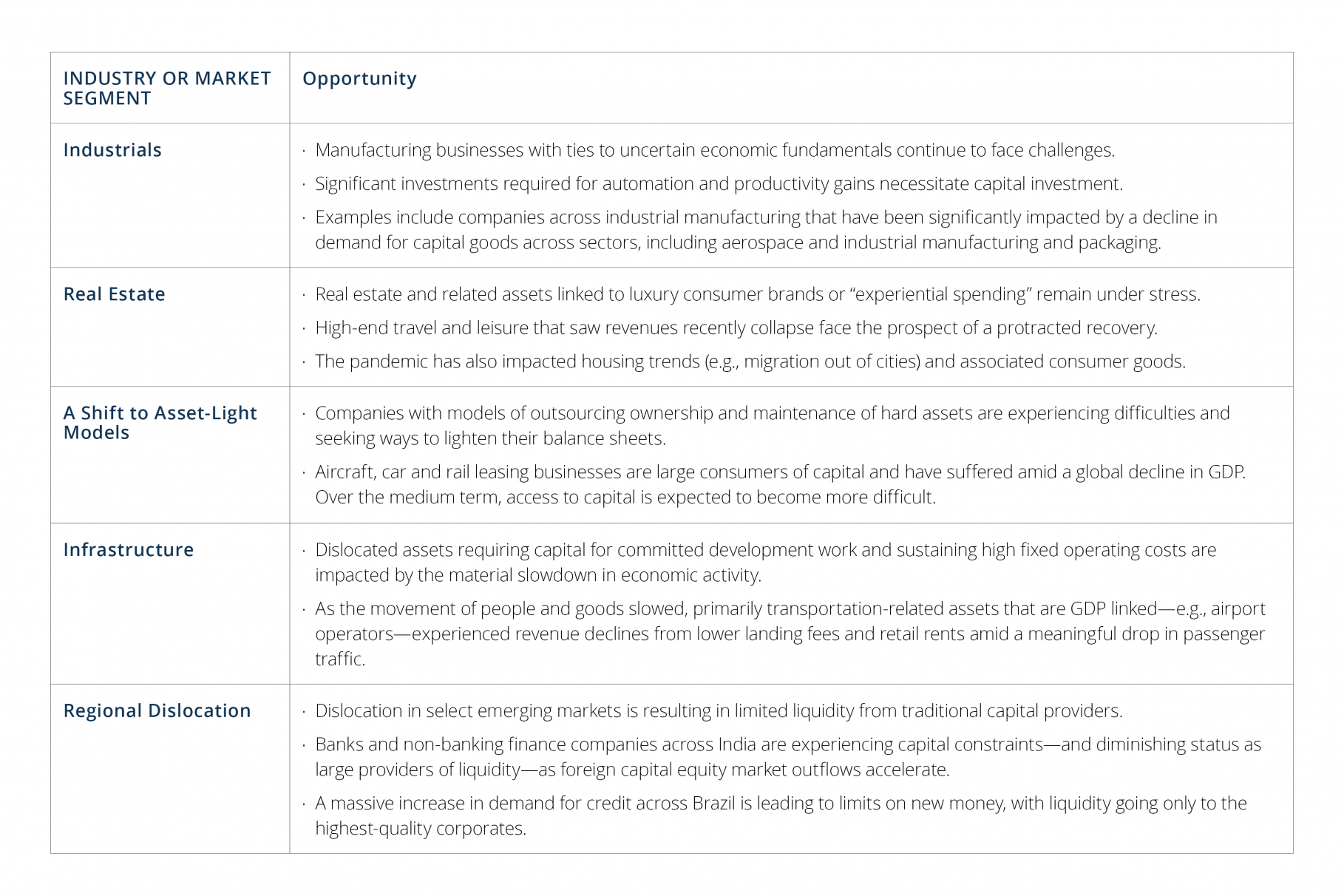

The current market landscape is characterized by significant volatility. Several factors contribute to this instability, creating fertile ground for opportunistic investors like Brookfield:

- Rising Interest Rates: Increased borrowing costs impact asset valuations, creating opportunities to acquire assets at discounted prices.

- Inflation Concerns: High inflation erodes purchasing power and influences investment decisions, leading to price adjustments in certain sectors.

- Geopolitical Uncertainty: Global events create uncertainty, impacting market sentiment and presenting opportunities for those who can navigate complex situations.

- Sector-Specific Challenges: Specific industries face unique headwinds, leading to distressed asset opportunities for those with the expertise to identify undervalued potential.

These factors collectively impact asset valuations, creating a landscape ripe for shrewd investors who can identify undervalued assets and capitalize on distressed situations. Brookfield's expertise lies in precisely this area.

Brookfield's Due Diligence Process

Brookfield's success stems from its rigorous due diligence process. Their ability to identify and acquire undervalued assets while mitigating risks is a core competency. This involves:

- Experienced Teams: Brookfield employs seasoned professionals specializing in various asset classes, including real estate, infrastructure, and private equity. This specialized knowledge allows for in-depth analysis within each sector.

- Comprehensive Risk Assessment: A thorough assessment of potential risks is integral to their process, ensuring informed decision-making and mitigating potential downsides.

- Detailed Financial Modeling: Brookfield utilizes sophisticated financial modeling to predict future performance and assess the long-term value of potential investments. This ensures that investments align with their long-term strategy.

This in-depth analysis enables Brookfield to navigate market uncertainties effectively and secure favorable investment terms, often outpacing competitors less equipped to handle complexity and volatility.

Strategic Asset Allocation Across Multiple Sectors

Real Estate Investment Opportunities

Brookfield actively pursues opportunistic real estate investments, employing various strategies:

- Acquisitions of Distressed Properties: They identify and acquire properties facing financial difficulties, often at significantly discounted prices.

- Value-Add Strategies: Brookfield implements strategies to enhance the value of acquired properties, such as renovations, repositioning, or improved management.

- Repositioning of Assets: They adapt properties to meet changing market demands, maximizing their potential and returns.

- Development Projects: Brookfield also engages in development projects, leveraging their expertise to create valuable assets in strategic locations.

For example, Brookfield's acquisition of [insert specific example of a distressed property acquisition and subsequent value creation] demonstrates their ability to transform underperforming assets into profitable ventures.

Infrastructure Investments: Building Long-Term Value

Brookfield recognizes the long-term stability and resilience of infrastructure assets. Their investments in this sector include:

- Acquisitions of Undervalued Infrastructure Assets: They target undervalued assets in areas such as renewable energy, transportation, and utilities.

- Public-Private Partnerships (PPPs): Brookfield leverages PPPs to participate in large-scale infrastructure projects, sharing risks and rewards with public entities.

- Long-Term Lease Agreements: They secure long-term lease agreements to generate stable cash flows, mitigating the impact of short-term market fluctuations.

The long-term nature of these investments provides stable returns even during periods of market volatility, a key element of Brookfield's resilient investment strategy.

Private Equity Opportunistic Investments

Brookfield's private equity investments focus on distressed businesses with strong underlying fundamentals:

- Investments in Financially Challenged Companies: They invest in companies facing temporary financial difficulties but possessing significant growth potential.

- Restructuring Strategies: Brookfield implements restructuring strategies to improve operational efficiency and financial performance.

- Operational Improvements: They actively manage portfolio companies, improving operational efficiency and enhancing profitability.

Through active management and restructuring, Brookfield creates value by turning around underperforming businesses and unlocking their inherent potential. [Insert a specific example of a successful turnaround].

Long-Term Value Creation and Risk Mitigation

Active Portfolio Management

Brookfield employs an active portfolio management strategy to maximize long-term value and mitigate risks:

- Operational Improvements: They actively improve the operations of their portfolio companies to enhance efficiency and profitability.

- Cost Reductions: Brookfield identifies and implements cost-reduction measures to enhance margins and profitability.

- Asset Repositioning: They adapt assets to changing market demands, maximizing their value and potential returns.

- Strategic Partnerships: Brookfield leverages strategic partnerships to expand its reach and expertise.

Resilient Investment Strategy

Brookfield's long-term success is rooted in a resilient investment strategy:

- Focus on Essential Assets: They concentrate on assets providing essential services or products, mitigating the impact of economic downturns.

- Diversified Portfolio: A diversified portfolio across various asset classes and geographies reduces exposure to specific risks.

- Long-Term Investment Horizon: Their long-term focus allows them to weather short-term market volatility and capitalize on long-term growth opportunities.

This approach ensures the resilience of their investment strategy, even in the face of significant market volatility.

Conclusion

Brookfield's success in navigating market dislocation is a testament to its strategic approach to opportunistic investments. Their meticulous due diligence, diversified portfolio across real estate, infrastructure, and private equity, and active portfolio management contribute to long-term value creation. Brookfield's focus on essential assets, risk mitigation techniques, and long-term vision enables them to capitalize on market volatility and deliver strong returns for investors.

Call to Action: Learn more about Brookfield's opportunistic investment strategies and how their expertise in navigating market volatility can benefit your investment portfolio. Discover how Brookfield capitalizes on market dislocation to deliver strong, consistent returns. Stay informed about Brookfield's future opportunistic investments and their continued success in a dynamic market environment.

Featured Posts

-

Dyshimet Rreth Arsenalit Dhe Psg Uefa Heton Shkelje Te Rregullores

May 08, 2025

Dyshimet Rreth Arsenalit Dhe Psg Uefa Heton Shkelje Te Rregullores

May 08, 2025 -

The 67 Million Ethereum Liquidation Understanding The Markets Volatility

May 08, 2025

The 67 Million Ethereum Liquidation Understanding The Markets Volatility

May 08, 2025 -

Arsenal Vs Psg Nevilles Prediction And What To Expect

May 08, 2025

Arsenal Vs Psg Nevilles Prediction And What To Expect

May 08, 2025 -

The 10x Bitcoin Multiplier Market Analysis And Implications

May 08, 2025

The 10x Bitcoin Multiplier Market Analysis And Implications

May 08, 2025 -

Top Realistic Wwii Movies A Military Historians Perspective

May 08, 2025

Top Realistic Wwii Movies A Military Historians Perspective

May 08, 2025