Brookfield Re-evaluates US Manufacturing Due To Tariffs

Table of Contents

The Impact of Tariffs on Brookfield's US Manufacturing Portfolio

Brookfield's US manufacturing portfolio encompasses various sectors, including automotive parts, steel production, and potentially others. The imposition of tariffs has significantly burdened these operations, leading to a substantial financial strain. The increased costs of imported raw materials, a direct consequence of tariffs, have squeezed profit margins. Furthermore, reduced competitiveness in global markets due to higher production costs has impacted export opportunities. This has led to pressure from clients to absorb some of these tariff-induced cost increases, further eroding profitability.

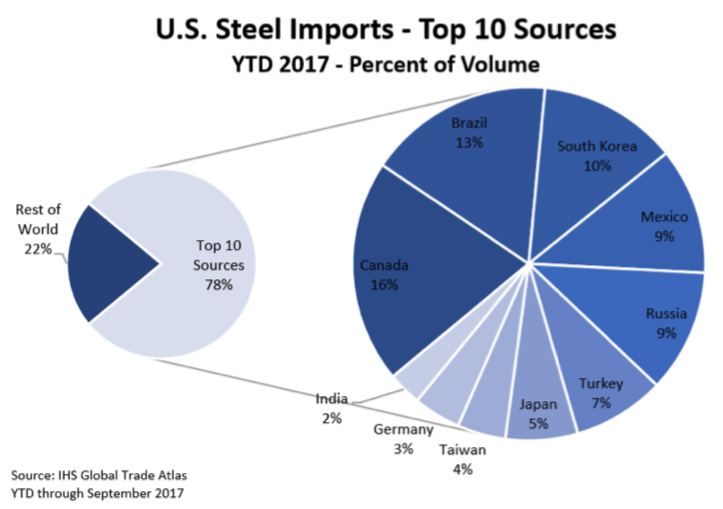

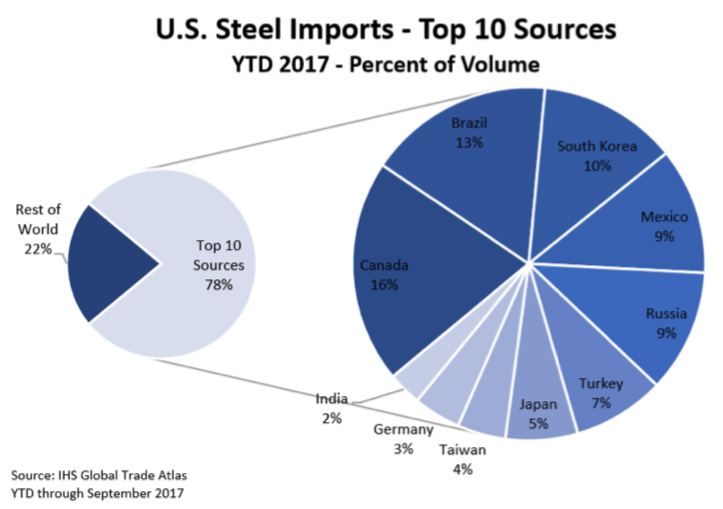

- Increased costs of raw materials: Tariffs on imported steel, for example, directly increase the cost of production for manufacturers using steel as a primary input.

- Reduced competitiveness in global markets: Higher production costs make US-manufactured goods less competitive compared to those from countries without equivalent tariffs.

- Pressure from clients to absorb tariff costs: Brookfield's clients are demanding price reductions, forcing the company to absorb a portion of the tariff burden.

- Potential for job losses due to reduced production: Decreased profitability may lead to production cuts and potential job losses within Brookfield's US manufacturing facilities.

Brookfield's Strategic Re-evaluation Process

Brookfield's response involves a comprehensive re-evaluation process. This likely includes rigorous cost-benefit analyses of each manufacturing facility, considering factors such as production capacity, input costs, and market demand. Market research is crucial to assess future demand for their products, factoring in global competition and the ongoing effects of tariffs. Scenario planning allows Brookfield to model different outcomes under various tariff scenarios, enabling proactive decision-making.

- Cost-benefit analysis of each manufacturing facility: A detailed assessment of the financial viability of each plant under current and projected tariff conditions.

- Market research to assess future demand and global competition: Evaluating the long-term viability of each manufacturing operation considering both domestic and international market dynamics.

- Exploration of alternative sourcing strategies: Investigating the possibility of sourcing raw materials from different countries with lower tariff burdens.

- Assessment of automation and efficiency upgrades: Evaluating the feasibility and cost-effectiveness of implementing automation technologies to offset increased labor and material costs.

Alternative Strategies Considered by Brookfield in Response to Tariffs

To mitigate the negative impact of tariffs, Brookfield is likely exploring several strategies. Relocating production to countries with more favorable tariff regimes is a significant possibility. This would reduce input costs but also involves substantial logistical challenges and potential risks associated with setting up new operations in foreign markets. Negotiating better terms with suppliers, perhaps securing long-term contracts with fixed prices, is another avenue. Investing in automation to improve efficiency and reduce reliance on labor, thus minimizing cost increases, is another key consideration. Finally, Brookfield may engage in lobbying efforts, advocating for tariff reductions or exemptions, aiming to influence policy decisions.

- Relocation of production: Shifting manufacturing operations to countries with lower tariffs, potentially impacting US jobs but reducing production costs.

- Negotiating favorable terms with suppliers: Securing long-term supply agreements with price guarantees to protect against fluctuating tariff costs.

- Investing in automation: Implementing automated processes to reduce labor costs and increase overall efficiency.

- Lobbying for tariff reductions or exemptions: Advocating for policy changes to reduce the negative impact of tariffs on US manufacturing.

The Broader Implications for US Manufacturing and Foreign Investment

Brookfield's re-evaluation holds significant implications for the broader US manufacturing landscape and foreign investment. Potential job losses in affected sectors could impact local economies. The reduced competitiveness of US manufacturers could lead to a decline in market share and economic growth. Furthermore, the uncertainty surrounding tariffs creates a chilling effect on foreign direct investment in the US manufacturing sector, deterring future investments. This situation underscores the vulnerability of US manufacturing to global trade policies.

- Potential job losses in affected sectors: Reduced production and potential plant closures could result in significant job losses.

- Reduced competitiveness of US manufacturers: Higher production costs make US goods less attractive in the global market.

- Negative impact on foreign direct investment in the US: Uncertainty surrounding tariffs discourages foreign companies from investing in US manufacturing.

- Uncertainty for other investors considering US manufacturing investments: Brookfield's experience serves as a cautionary tale for other potential investors.

Conclusion: Brookfield's Re-evaluation and the Future of US Manufacturing

Brookfield's re-evaluation of its US manufacturing holdings is a direct consequence of the substantial financial burden imposed by tariffs. This strategic response highlights the significant impact of trade policies on US manufacturing and foreign investment. The potential outcomes – including job losses, reduced competitiveness, and decreased foreign investment – underscore the need for a reassessment of current tariff strategies. Stay informed about Brookfield's ongoing re-evaluation and the evolving landscape of US manufacturing under the pressure of fluctuating tariffs. Understanding these changes is crucial for businesses, investors, and policymakers alike. [Link to relevant resource on US manufacturing and tariffs]

Featured Posts

-

Kshmyr Ka Tnazeh Awr Jnwby Ayshyae Myn Amn Ky Rahyn

May 02, 2025

Kshmyr Ka Tnazeh Awr Jnwby Ayshyae Myn Amn Ky Rahyn

May 02, 2025 -

Manchester United Transfer Blunder Draws Souness Ire

May 02, 2025

Manchester United Transfer Blunder Draws Souness Ire

May 02, 2025 -

Sogd Protivodeystvie Torgovle Lyudmi Novye Strategii

May 02, 2025

Sogd Protivodeystvie Torgovle Lyudmi Novye Strategii

May 02, 2025 -

Tv Dallas Star Dies Another 80s Soap Legend Lost

May 02, 2025

Tv Dallas Star Dies Another 80s Soap Legend Lost

May 02, 2025 -

Bobby Fish Joins Mlw Battle Riot Vii

May 02, 2025

Bobby Fish Joins Mlw Battle Riot Vii

May 02, 2025