Brookfield's US Manufacturing Investment: Tariffs Weigh Heavily

Table of Contents

Increased Manufacturing Costs Due to Tariffs

Tariffs have undeniably increased the cost of manufacturing in the US, significantly impacting Brookfield's investments. This cost escalation stems from two primary sources: rising raw material prices and increased transportation and logistics challenges.

Raw Material Price Increases

Tariffs on imported raw materials have directly increased the cost of production for numerous US manufacturers, including those in Brookfield's portfolio. This price inflation is particularly pronounced in:

- Steel and Aluminum: Tariffs on these crucial materials have led to substantial price increases, affecting manufacturers across various sectors, including construction, automotive, and appliances. Estimates suggest a 15-25% increase in the cost of steel in certain markets since the imposition of tariffs.

- Electronic Components: Many electronic components are imported, and tariffs on these parts have increased the cost of manufacturing electronics, impacting profitability for companies in Brookfield's portfolio. One study suggests a 10% average increase in component costs due to tariffs.

These price hikes directly translate into reduced profitability for Brookfield's manufacturing investments. Higher input costs squeeze margins and necessitate price increases for finished goods, potentially affecting market competitiveness.

Transportation and Logistics Challenges

Tariffs also complicate the supply chain, leading to increased transportation costs and longer lead times. Increased customs processing delays, heightened scrutiny of imported goods, and the need for alternative sourcing strategies all contribute to a less efficient and more expensive logistics network.

- Increased Shipping Costs: The added cost of navigating tariffs adds to freight and handling expenses, impacting overall manufacturing costs.

- Supply Chain Disruptions: Uncertainty and delays in the supply chain can lead to production slowdowns and missed deadlines, negatively impacting project timelines and profitability.

To mitigate these challenges, Brookfield is likely exploring strategies like near-shoring and reshoring – relocating manufacturing closer to or within the US – although these options introduce their own complexities and costs.

Shifting Investment Strategies in Response to Tariffs

Brookfield's response to the tariff environment reflects a proactive shift in its investment strategy, focused on risk mitigation and long-term sustainability.

Diversification of Sourcing

To reduce reliance on tariff-affected materials, Brookfield is likely diversifying its sourcing strategies. This involves:

- Exploring Alternative Suppliers: Identifying and engaging suppliers in different countries, potentially those with more favorable trade agreements, to ensure a more resilient supply chain.

- Developing Domestic Supply Chains: Investing in domestic raw material sourcing to reduce reliance on imports and lessen tariff vulnerability.

This diversification strategy has implications for global supply chains and could lead to new partnerships and collaborations between US and international manufacturers.

Focus on Automation and Technology

Brookfield might be increasing investments in automation and advanced technologies to offset increased labor costs or mitigate the impact of tariffs. This could lead to:

- Increased Productivity: Automation can improve efficiency and reduce reliance on labor-intensive processes, making US manufacturing more cost-competitive.

- Reduced Reliance on Imported Components: Automation can sometimes reduce the need for certain imported components, offering another layer of mitigation against tariffs.

While this focus on technology presents opportunities for productivity gains, it also carries implications for the future of US manufacturing jobs and the need for reskilling and upskilling initiatives.

Lobbying and Advocacy

Brookfield, like other major investors, might be engaging in lobbying efforts to influence tariff policy and advocate for a more favorable trade environment. This advocacy may involve:

- Engagement with Government Officials: Direct lobbying efforts aimed at influencing trade negotiations and tariff decisions.

- Industry Associations: Participation in industry groups to exert collective influence on trade policy.

The success of these efforts will significantly shape the future investment climate for US manufacturing and the overall attractiveness of investments in the sector.

The Broader Economic Impact on US Manufacturing

The impact of tariffs extends beyond Brookfield’s investments, affecting the competitiveness and stability of the entire US manufacturing sector.

Competitiveness Concerns

Tariffs make US-manufactured goods more expensive compared to those from countries without similar tariffs, impacting competitiveness on the global stage:

- Reduced Export Opportunities: Higher prices make US goods less attractive in international markets, leading to reduced exports and potential job losses.

- Increased Import Competition: While tariffs aim to protect domestic industries, they may also lead to higher prices for inputs that are essential to other industries.

This diminished competitiveness can discourage further investment in US manufacturing, potentially slowing sector growth.

Consumer Price Increases

The increased costs due to tariffs are often passed on to consumers in the form of higher prices for manufactured goods:

- Inflationary Pressures: Widespread price increases contribute to inflation, impacting consumer purchasing power and potentially slowing economic growth.

- Reduced Consumer Spending: Higher prices can reduce consumer demand for manufactured goods, potentially impacting sales and profitability.

The macroeconomic consequences of this price inflation can be significant, requiring careful monitoring and potential policy adjustments.

Conclusion

Tariffs present significant challenges to Brookfield's US manufacturing investments and the wider US manufacturing sector. Increased costs due to raw material price increases and supply chain disruptions necessitate strategic adjustments, including sourcing diversification, technological advancements, and active engagement in policy discussions. The impact on US manufacturing competitiveness and consumer prices highlights the broad economic ramifications of the current trade environment. The long-term effects of tariffs on Brookfield’s US manufacturing investment strategy, and the broader economy, require continued analysis and monitoring. Stay informed about policy changes and their impact to make informed investment decisions regarding Brookfield's US manufacturing investment strategy. Further research into the lasting effects of this complex trade landscape is crucial for understanding its long-term impact.

Featured Posts

-

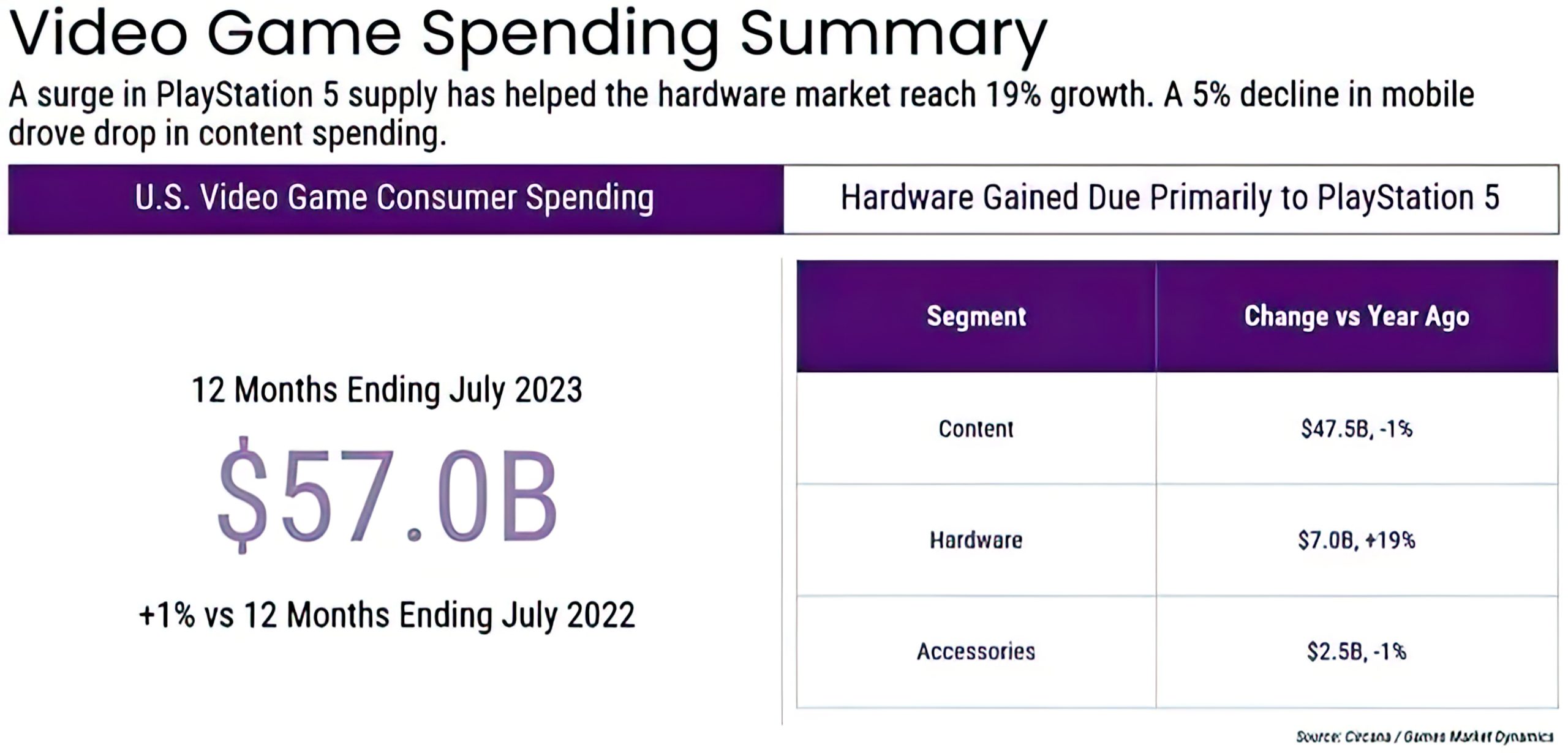

Analyzing Ps 5 And Xbox Series X S Sales Performance In The United States

May 02, 2025

Analyzing Ps 5 And Xbox Series X S Sales Performance In The United States

May 02, 2025 -

Utahs Clayton Keller Reaches 500 Nhl Points

May 02, 2025

Utahs Clayton Keller Reaches 500 Nhl Points

May 02, 2025 -

Rugby Six Nations England Beats France Thanks To Dalys Late Show

May 02, 2025

Rugby Six Nations England Beats France Thanks To Dalys Late Show

May 02, 2025 -

Decades Long School Desegregation Order Lifted Implications And Concerns

May 02, 2025

Decades Long School Desegregation Order Lifted Implications And Concerns

May 02, 2025 -

Azad Kshmyr Brtanwy Parlymnt Ky Janb Se Msylh Kshmyr Ke Hl Ky Hmayt

May 02, 2025

Azad Kshmyr Brtanwy Parlymnt Ky Janb Se Msylh Kshmyr Ke Hl Ky Hmayt

May 02, 2025