BSE Market Surge: Stocks Jump Over 10% - Sensex Gains

Table of Contents

Key Drivers Behind the BSE Market Surge

Several interconnected factors contributed to this impressive BSE market surge and the significant Sensex gains. Let's examine the key drivers:

Positive Global Economic Indicators

Positive global economic news played a significant role in boosting investor confidence, impacting the Indian stock market. This positive sentiment spilled over into the Indian markets.

- Stronger-than-expected GDP growth in major economies: Reports of robust growth in the US, Europe, and other key markets signaled a healthy global economic outlook, encouraging international investment in emerging markets like India.

- Easing inflation concerns: Signs of easing inflation in several countries reduced fears of aggressive interest rate hikes, creating a more favorable environment for stock market investment. This reduced risk perception encouraged investors to allocate more capital towards equities.

- Positive corporate earnings reports globally: Strong corporate earnings from multinational companies further strengthened the positive global narrative, adding to the overall bullish sentiment. This demonstrated business resilience and potential for continued growth.

These global factors significantly impacted investor confidence in the Indian market, leading to increased capital inflows and a subsequent rise in the BSE Sensex and stock prices.

Domestic Economic Factors

Positive developments within the Indian economy also fueled the BSE market surge. Government policies and strong economic indicators played a critical role.

- Government policy announcements: Supportive government policies aimed at boosting economic growth, such as infrastructure spending initiatives and reforms in key sectors, created a positive outlook for businesses and investors.

- Positive industrial production numbers: Strong industrial production figures indicated a healthy growth trajectory for the Indian economy, bolstering investor confidence. This demonstrated robust economic activity within the country.

- Robust consumer spending: Increased consumer spending further fueled economic growth, signaling a strong domestic market and increased demand for goods and services. This indicates confidence in the Indian economy from within.

- Favorable monsoon predictions: Positive monsoon forecasts promised a good agricultural season, which would positively impact rural consumption and overall economic growth. A strong agricultural sector contributes significantly to the Indian economy.

These positive domestic factors significantly contributed to the impressive BSE Sensex gains and the overall market surge.

Sector-Specific Performance

The BSE market surge wasn't uniform across all sectors. Certain sectors outperformed others, driving a significant portion of the overall gains.

- Strong performance in the IT sector: The IT sector saw exceptionally strong performance, driven by increased demand for technology services globally and strong earnings reports from major Indian IT companies like Infosys and TCS.

- Pharmaceutical sector growth: The pharmaceutical sector also contributed significantly, boosted by new product launches, increased exports, and strong domestic demand.

- Other key sectors: Other sectors, such as banking and finance, also showed significant gains, although perhaps less dramatically than the IT and pharmaceutical sectors.

The outperformance of these specific sectors contributed significantly to the overall BSE market surge and the impressive Sensex gains.

Impact on Investors

The BSE market surge presents both significant opportunities and inherent risks for investors.

Opportunities and Risks

- Opportunities: The market surge offers investors the potential for higher returns on their investments. Strategic investment during such periods can potentially yield substantial profits. However, this requires careful timing and understanding of market dynamics.

- Risks: The market's volatility remains a significant risk. Sharp gains can be quickly reversed, and investors need to be prepared for potential market corrections. Diversification and a long-term investment strategy are crucial to mitigate risk. Timing the market perfectly is extremely difficult, and trying to do so can often lead to losses.

Investors need to carefully weigh the opportunities and risks before making any investment decisions. The timing of investment within such a surge is crucial to maximizing returns while limiting losses.

Expert Opinions and Analysis

Market analysts have offered varied perspectives on the sustainability of this BSE market surge.

- Short-term outlook: Many analysts believe that the current positive momentum could continue in the short term, driven by continued positive economic indicators and investor sentiment.

- Long-term outlook: The long-term outlook remains cautiously optimistic, with analysts emphasizing the importance of monitoring global and domestic economic factors for potential shifts in the market trend. Sustained growth requires continued positive economic performance.

Understanding expert opinions is crucial for informed investment decisions, but these should be taken as only one piece of the puzzle.

Analyzing the Sensex Gain

Understanding the market surge requires a multi-faceted analysis, encompassing both technical and fundamental factors.

Technical Analysis

Technical indicators suggest a strong upward trend in the market.

- Chart patterns: Various chart patterns indicate a bullish trend, suggesting further potential gains.

- Trading volume: High trading volumes further support the strength of the upward trend.

- Support and resistance levels: The market has successfully broken through key resistance levels, suggesting a strong momentum.

Technical analysis provides valuable insights into market trends but should be considered alongside fundamental analysis for a comprehensive understanding.

Fundamental Analysis

Fundamental analysis focuses on the underlying economic factors driving the Sensex gains.

- Company earnings: Strong corporate earnings across various sectors support the upward trend in stock prices.

- Valuations: While valuations have increased, many believe they are still relatively attractive compared to historical levels.

- Macroeconomic indicators: Positive macroeconomic indicators such as GDP growth, inflation, and industrial production support the market's positive outlook.

A strong fundamental basis is essential for sustained market growth and should be a crucial aspect of investment decisions.

Conclusion

The substantial BSE market surge and the Sensex gain exceeding 10% are driven by a combination of positive global and domestic economic indicators, coupled with strong sector-specific performance. This presents investors with opportunities but also highlights the inherent risks of market volatility. While the short-term outlook appears positive, investors should exercise caution and conduct thorough research before making investment decisions.

Call to Action: The significant BSE market surge and the impressive Sensex gains present both exciting opportunities and potential challenges. Stay informed about market trends, conduct thorough research, and consider consulting a financial advisor before making any investment decisions related to this BSE market surge. Continue to monitor the BSE and Sensex for further updates and analysis. Learn more about the factors impacting the BSE market surge by exploring reliable financial news sources and conducting your own thorough research.

Featured Posts

-

Andor Season 2 Everything You Need To Know Before Watching

May 15, 2025

Andor Season 2 Everything You Need To Know Before Watching

May 15, 2025 -

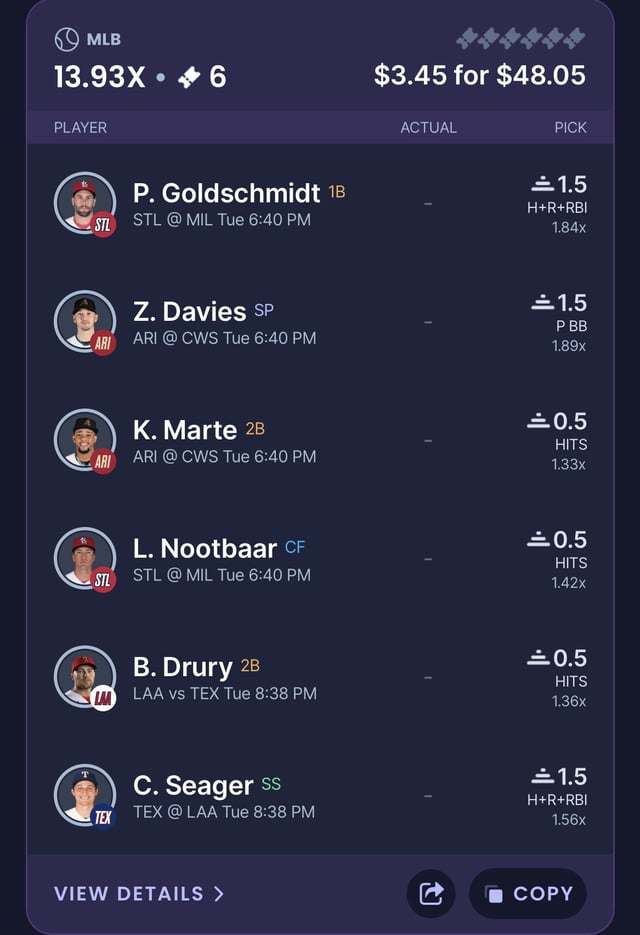

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 15, 2025

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 15, 2025 -

Crucial Clash Looms Butler Ignores Miamis Presence

May 15, 2025

Crucial Clash Looms Butler Ignores Miamis Presence

May 15, 2025 -

La Lakers News Scores And Analysis Vavel United States

May 15, 2025

La Lakers News Scores And Analysis Vavel United States

May 15, 2025 -

A Great Free Game Now Available On Steam

May 15, 2025

A Great Free Game Now Available On Steam

May 15, 2025