Bundestag Elections And Their Influence On The Dax: A Market Overview

Table of Contents

Historical Impact of Bundestag Elections on the DAX

Analyzing the historical performance of the DAX around previous Bundestag elections reveals interesting trends. While the impact isn't always dramatic, a discernible level of volatility often surrounds these events. The average volatility in the weeks leading up to and following elections tends to be higher than during more stable periods. This is largely due to uncertainty surrounding the election outcome and the potential policy changes that may follow.

[Insert Chart/Graph 1: DAX Performance Around Previous Bundestag Elections - showing average volatility and pre/post election trends]

Bullet points:

- 2017 Bundestag Election: This election resulted in a coalition government, leading to a period of relative stability in the DAX after an initial period of uncertainty during coalition negotiations.

- 2013 Bundestag Election: The election saw a change in government, but the DAX remained relatively stable due to a positive global economic climate.

- 2009 Bundestag Election: This election coincided with the global financial crisis, making it difficult to isolate the election's specific impact on the DAX. The market experienced significant volatility driven by global factors.

- Analysis of Market Reactions: Historically, elections resulting in clear single-party majorities have tended to lead to less market volatility compared to elections resulting in coalition governments, which can necessitate lengthy and uncertain coalition negotiations. Significant policy announcements regarding fiscal policy, or tax reforms, often influence investor confidence and market movements.

Factors Influencing DAX Performance After Bundestag Elections

Several key factors influence DAX performance in the aftermath of Bundestag elections. These factors are intertwined and their impact can be complex.

Coalition Negotiations and Policy Uncertainty

Prolonged coalition negotiations are a major source of market uncertainty. The longer the process, the more likely investors are to adopt a "wait-and-see" approach, potentially leading to decreased investment and increased volatility. The composition of the coalition government significantly impacts investor sentiment. A coalition perceived as stable and economically competent tends to boost confidence, while a coalition perceived as unstable or ideologically divided can negatively affect investor sentiment.

Bullet points:

- Example: The 2017 election's prolonged coalition negotiations led to some initial DAX dips before the formation of a stable government.

- Policy Sensitivity: Areas like fiscal policy (government spending and taxation), environmental regulations, and labor market reforms are particularly sensitive to changes in government, impacting investor confidence and DAX performance. Changes to corporate tax rates or environmental regulations, for example, can significantly impact specific sectors represented in the DAX.

Economic Outlook and Investor Sentiment

The election outcome influences investor sentiment concerning Germany’s future economic performance. A government perceived as fiscally responsible and supportive of business generally fosters positive sentiment. Pre-election economic conditions also play a significant role. A strong economy before the election tends to mitigate negative impacts from election-related uncertainty.

Bullet points:

- Key Economic Indicators: GDP growth, inflation rates, and unemployment figures are crucial indicators that significantly correlate with DAX performance. Positive economic indicators generally lead to higher confidence and increased investment.

- Political Platforms: Investor confidence is highly sensitive to the economic platforms of different political parties. Parties perceived as pro-business or fiscally conservative often elicit more positive market reactions than parties seen as implementing potentially harmful economic policies.

Global Market Conditions

It's crucial to acknowledge that global market conditions significantly influence the DAX, regardless of the election outcome. External shocks can overshadow the election's immediate impact.

Bullet points:

- Global Events: Financial crises, geopolitical instability, or major international trade disputes can significantly impact the DAX regardless of the Bundestag election results. The impact of these global factors often outweighs the impact of any domestic policy.

- Interaction of Factors: Global factors and domestic political developments frequently interact, making it challenging to isolate the influence of the election alone. For instance, a global economic downturn could exacerbate the negative effects of an uncertain political situation after an election.

Strategies for Investors During Bundestag Election Periods

Navigating the market volatility surrounding Bundestag elections requires careful planning and risk management. Investors should prioritize diversification across asset classes to minimize risk. Hedging strategies such as options or futures contracts can mitigate potential losses during periods of increased market uncertainty.

Bullet points:

- Diversification: A well-diversified portfolio, including a mix of stocks, bonds, and potentially other assets, is crucial to minimize the impact of any single event, including election-related volatility.

- Hedging: Investors with a higher risk tolerance might consider hedging strategies to protect against potential downturns.

- Long-Term Strategy: Maintaining a long-term investment strategy is key. Short-term market fluctuations should not deviate from a well-defined long-term investment plan.

Conclusion

Understanding the potential impact of Bundestag elections on the DAX is crucial for informed investment decisions. Coalition negotiations, the economic outlook, and global market conditions all play significant roles in shaping DAX performance after an election. By carefully considering these factors and developing a well-diversified strategy, investors can effectively navigate this period of potential market uncertainty and potentially capitalize on opportunities presented by Bundestag elections and their influence on the DAX. Staying informed about the political landscape and economic forecasts leading up to and following the election is paramount for investors seeking to make sound choices in this dynamic market environment.

Featured Posts

-

The Team Behind Ariana Grandes New Look Professional Hair And Tattoo Expertise

Apr 27, 2025

The Team Behind Ariana Grandes New Look Professional Hair And Tattoo Expertise

Apr 27, 2025 -

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025 -

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025 -

A Study Of Canadian Political Sentiment Anti Trump Views Across Provinces

Apr 27, 2025

A Study Of Canadian Political Sentiment Anti Trump Views Across Provinces

Apr 27, 2025 -

Robert Pattinsons Chilling Post Horror Movie Experience

Apr 27, 2025

Robert Pattinsons Chilling Post Horror Movie Experience

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

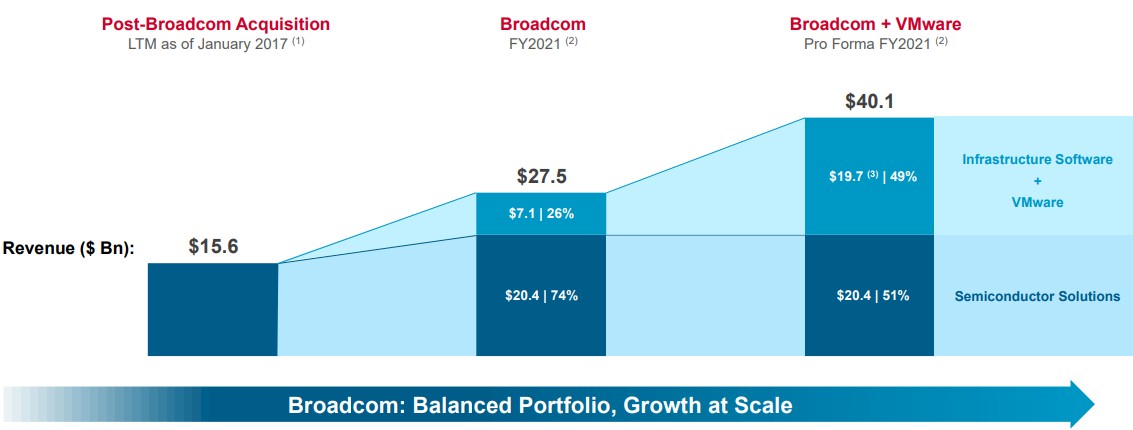

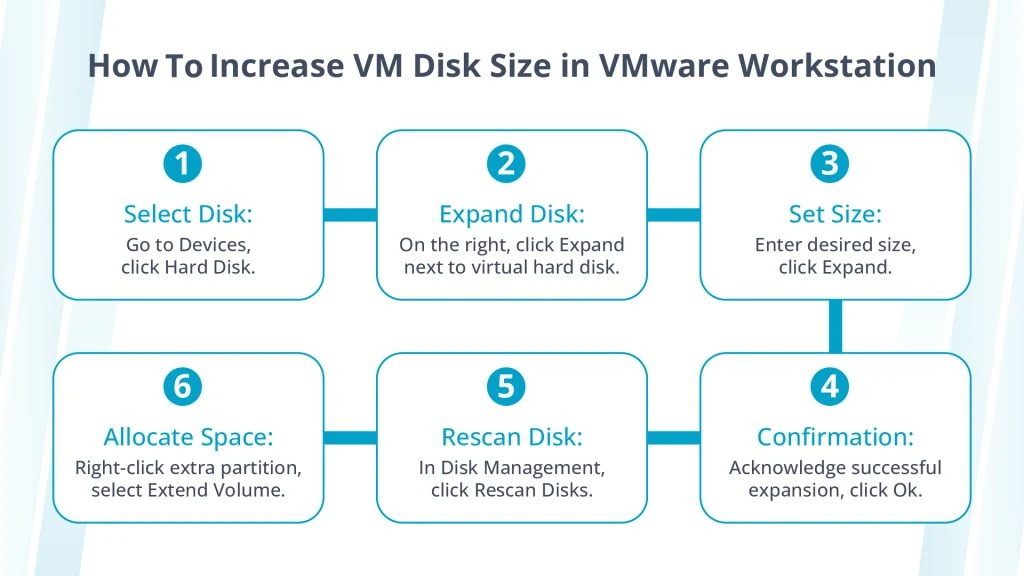

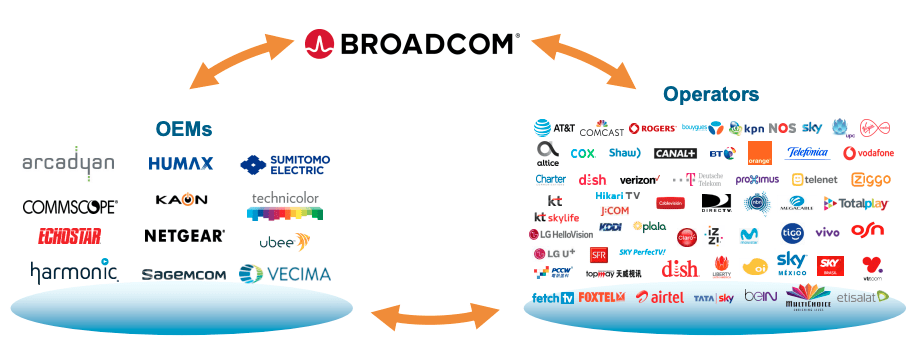

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025