Buying Canadian: A Key Strategy For Napoleon

Table of Contents

Strengthening Domestic Market Position through Strategic Acquisitions

Acquiring Canadian companies significantly bolsters Napoleon's market share within Canada. This strategic move leverages existing infrastructure and customer relationships, providing immediate benefits. By purchasing established businesses, Napoleon gains access to pre-built distribution networks and loyal customer bases, significantly reducing time-to-market and marketing expenses.

- Reduced marketing and distribution costs: Pre-existing infrastructure eliminates the substantial investment required to establish new distribution channels and build brand awareness from scratch.

- Immediate access to a loyal customer base: Acquiring companies with established customer loyalty translates into instant revenue streams and brand recognition.

- Enhanced brand recognition within the Canadian market: Expanding through acquisition accelerates brand awareness and market penetration compared to organic growth.

- Mitigation of risks associated with entering new markets: Buying Canadian minimizes the uncertainties inherent in navigating unfamiliar regulatory landscapes and cultural nuances.

Leveraging Canadian Innovation and Expertise

Canada boasts a vibrant ecosystem of innovative companies, particularly in [mention specific sectors relevant to Napoleon's industry]. Acquiring Canadian businesses with specialized technologies or expertise allows Napoleon to access cutting-edge knowledge and talent, fueling further innovation and growth.

- Access to cutting-edge technology and intellectual property: Acquisitions can provide access to patents, proprietary technologies, and industry secrets, giving Napoleon a competitive edge.

- Acquisition of skilled workforce and specialized talent: Canadian companies often possess highly skilled employees, adding valuable expertise to Napoleon's team.

- Boosting innovation and product development: Synergies between acquired companies and Napoleon's existing operations can lead to new product lines and improved existing offerings.

- Potential for developing new product lines or services: Acquisitions can open doors to entirely new markets and revenue streams, diversifying Napoleon's offerings.

Access to Government Incentives and Support Programs

The Canadian government offers various programs designed to stimulate economic growth and support business acquisitions. These initiatives can significantly reduce the financial burden of acquiring Canadian companies. Depending on the specific nature of the acquired business and its sector (e.g., manufacturing, technology), Napoleon may be eligible for grants, tax credits, and other incentives.

- Reduced acquisition costs through government grants or subsidies: Several government programs provide financial assistance for mergers and acquisitions, potentially lowering the overall cost.

- Tax advantages and incentives for research and development: Investing in R&D after an acquisition may qualify for tax credits and other benefits, promoting innovation.

- Support for job creation and economic growth: Government programs often favor acquisitions that lead to job creation and economic expansion within Canada.

Mitigation of Supply Chain Risks and Enhanced Security

"Buying Canadian" directly addresses concerns regarding global supply chain vulnerabilities. By acquiring Canadian suppliers or manufacturers, Napoleon strengthens its supply chain resilience, reduces reliance on foreign sources, and lowers transportation costs and lead times.

- Reduced vulnerability to global supply chain disruptions: A more localized supply chain is less susceptible to geopolitical events, pandemics, or other unforeseen circumstances.

- Improved control over production and quality: Closer proximity to suppliers allows for greater oversight of the manufacturing process and quality control.

- Lower transportation costs and lead times: Shorter supply chains significantly reduce shipping expenses and delivery times.

- Enhanced security and reliability of supply: Domestic sourcing ensures a more predictable and dependable flow of materials and components.

Positive Public Relations and Enhanced Brand Image

The "Buying Canadian" strategy resonates strongly with Canadian consumers, who increasingly favor businesses that support domestic industries and jobs. This approach fosters positive public relations and enhances Napoleon's brand image as a responsible corporate citizen.

- Improved brand reputation and customer loyalty: Consumers are more likely to support companies demonstrating commitment to the Canadian economy.

- Enhanced corporate social responsibility (CSR) profile: Supporting local businesses strengthens Napoleon's CSR standing and attracts socially conscious consumers.

- Stronger relationships with Canadian consumers and stakeholders: A "Buying Canadian" strategy fosters closer ties with the community and builds trust with stakeholders.

- Potential for increased media coverage and positive public relations: The decision to acquire Canadian businesses generates positive media attention and enhances brand visibility.

Embrace the Strategy: Buying Canadian for Napoleon's Future Growth

In conclusion, a "Buying Canadian" strategy offers Napoleon a powerful combination of benefits: strengthened market position, access to innovation and talent, government support, supply chain resilience, and enhanced brand image. By strategically acquiring well-suited Canadian companies, Napoleon can accelerate its growth trajectory, enhance its competitiveness, and solidify its position as a leader in its industry. We encourage Napoleon, and other businesses, to thoroughly investigate potential acquisition targets within the Canadian market and explore the various government support programs available to facilitate this strategic approach. Contact experts in mergers and acquisitions and government incentives to unlock the full potential of "Buying Canadian" strategies.

Featured Posts

-

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025 -

Pfc Files Complaint Against Gensol Engineering For Falsified Documents

Apr 27, 2025

Pfc Files Complaint Against Gensol Engineering For Falsified Documents

Apr 27, 2025 -

Did You Miss Patrick Schwarzenegger In Ariana Grandes White Lotus Video

Apr 27, 2025

Did You Miss Patrick Schwarzenegger In Ariana Grandes White Lotus Video

Apr 27, 2025 -

Indian Wells Una Favorita Se Despide Temprano Del Torneo

Apr 27, 2025

Indian Wells Una Favorita Se Despide Temprano Del Torneo

Apr 27, 2025 -

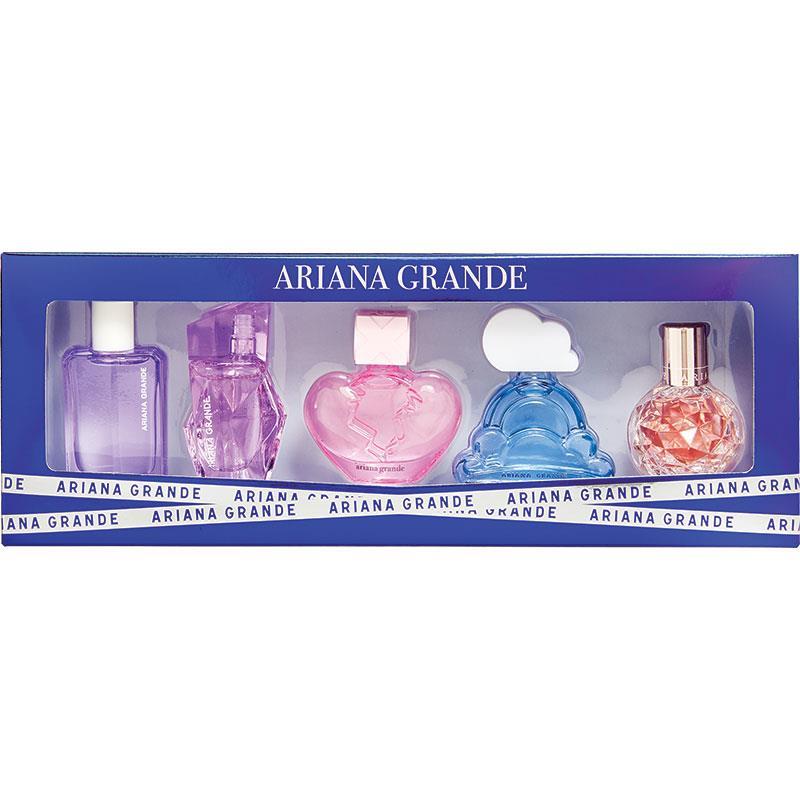

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025

Latest Posts

-

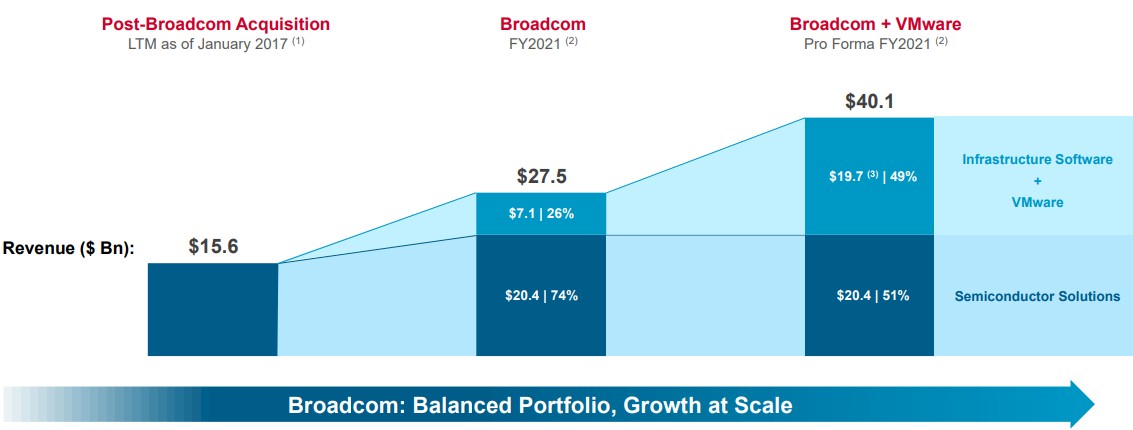

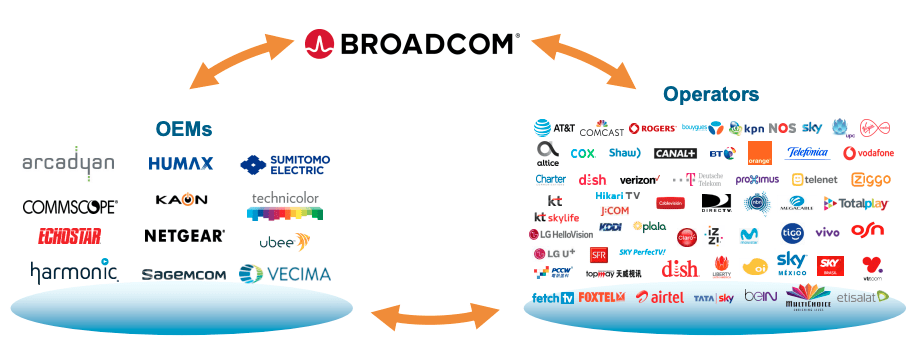

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025