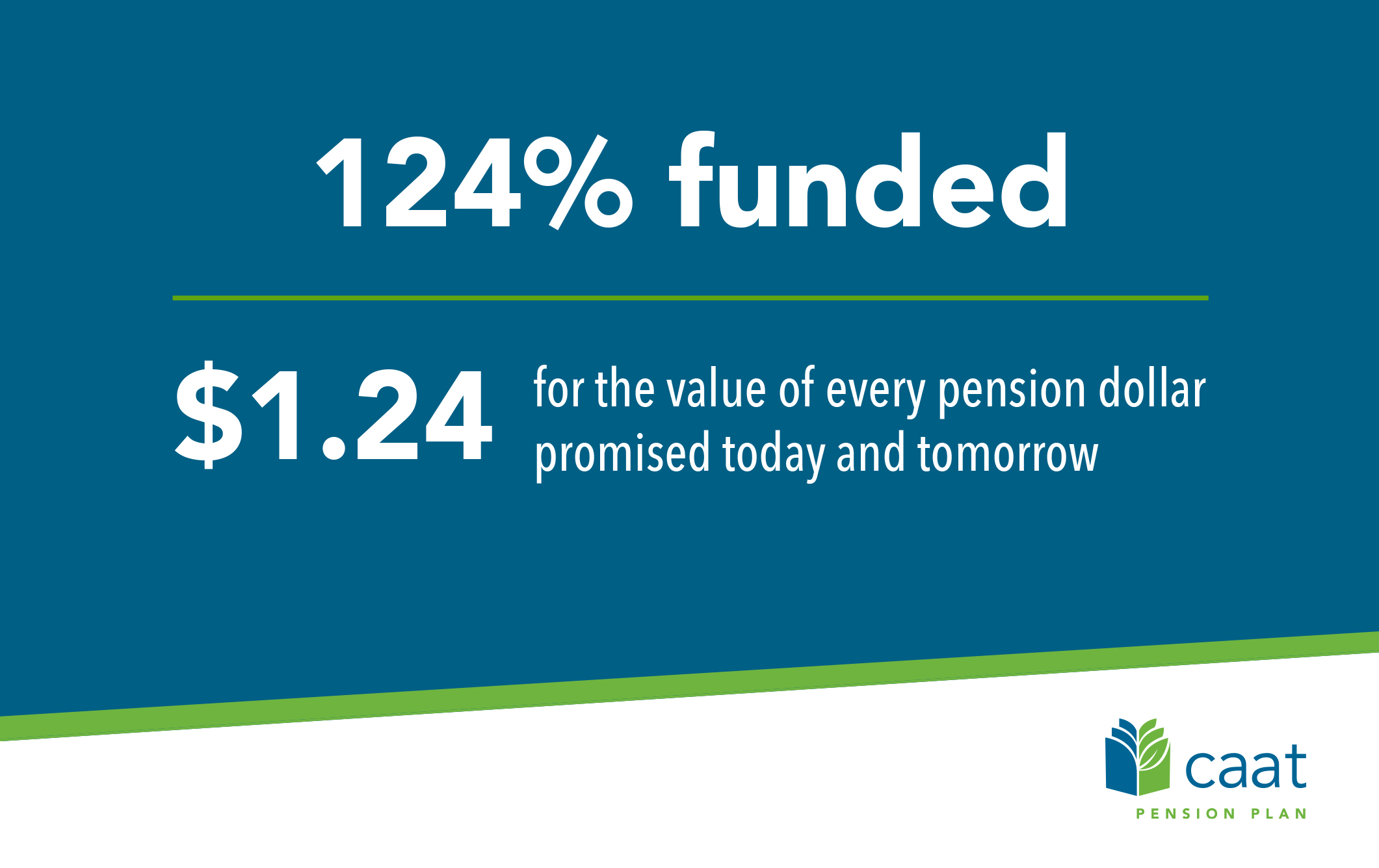

CAAT Pension Plan Seeks Increased Canadian Private Investment

Table of Contents

Why CAAT is Targeting Canadian Private Investment

CAAT's strategic shift towards increased Canadian private investment is driven by several key factors related to its overall pension fund investment strategy. The primary motivation is the pursuit of higher returns and enhanced risk management through diversification.

-

Increased Returns: Private investments, encompassing areas like private equity and infrastructure investment, often present higher potential returns than traditional public market investments. This is due to factors such as less market volatility and the potential for significant capital appreciation in illiquid assets.

-

Portfolio Diversification: By reducing its reliance on public markets, CAAT aims to mitigate overall portfolio risk. The lower correlation between private investments and public market equities and bonds helps to smooth out portfolio volatility over time. This is a critical element of any robust pension fund investment strategy.

-

Long-Term Growth Opportunities: Private investments frequently align well with the long-term investment horizon of pension funds. CAAT is looking for opportunities that will provide sustainable growth over many years, ensuring the financial security of its members' retirement savings.

-

Supporting Canadian Businesses: Investing domestically fosters economic growth within Canada. This approach allows CAAT to contribute to the development of Canadian businesses while simultaneously generating strong returns for its members' retirement plans.

Bullet Points:

- Lower correlation with public markets, reducing overall portfolio volatility.

- Access to illiquid assets with potential for significant appreciation.

- Opportunities for active management and value creation through partnerships with portfolio companies.

- Alignment with environmental, social, and governance (ESG) investing principles, a growing trend in responsible investment.

Types of Canadian Private Investments Sought by CAAT

CAAT is actively exploring a range of Canadian private investment opportunities across various sectors. Their focus is on diversifying across different asset classes to optimize risk and return.

-

Private Equity Canada: CAAT is interested in investing in established Canadian companies with strong management teams and a proven track record of success. These investments offer potential for significant capital appreciation and participation in the growth of promising businesses.

-

Infrastructure Investments Canada: Investments in Canadian infrastructure projects, such as renewable energy, transportation networks, and utilities, are attractive due to their long-term, stable cash flows and contribution to sustainable development. This aligns perfectly with long-term pension fund objectives.

-

Real Estate Investment Canada: CAAT is evaluating opportunities in the Canadian real estate market, including both commercial and residential properties. This asset class offers diversification benefits and potential for rental income and capital appreciation.

-

Venture Capital Canada: While perhaps less of a focus than the other three, CAAT may also consider venture capital investments in innovative early-stage Canadian companies with disruptive technologies. This area carries higher risk but potentially significantly higher rewards.

Bullet Points:

- Focus on established Canadian companies with a proven track record and strong management teams.

- Interest in technology-driven businesses and sustainable infrastructure projects reflecting ESG considerations.

- A rigorous due diligence process emphasizes strong business models and financial projections.

- Alignment with CAAT's responsible investment framework, ensuring investments align with their ethical and social values.

The Impact on the Canadian Private Investment Market

CAAT's increased allocation to Canadian private investments will have a notable impact on the Canadian private equity market and the broader Canadian investment landscape.

-

Increased Competition: The influx of capital from a major pension fund like CAAT will undoubtedly increase competition for attractive private investment deals. This could potentially drive up valuations for desirable assets.

-

Greater Liquidity: The increased investment from CAAT will enhance liquidity for Canadian private companies seeking capital. This will facilitate growth and expansion for businesses.

-

Potential for Job Creation and Economic Growth: Investment in Canadian companies will likely stimulate job creation and economic growth, particularly in sectors like technology and infrastructure.

-

Increased Availability of Capital for Canadian Entrepreneurs: CAAT’s investment will make capital more readily available for Canadian entrepreneurs, helping to foster innovation and entrepreneurship within the Canadian economy.

Bullet Points:

- Stimulating growth in under-served sectors of the Canadian economy.

- Attracting more international investment into Canada by demonstrating the appeal of Canadian private investment opportunities.

- Supporting the development of a more robust and diversified Canadian private equity ecosystem.

Conclusion

The CAAT Pension Plan's strategic decision to increase Canadian private investment marks a significant development for both the pension fund and the Canadian investment landscape. By pursuing diversification and higher returns through Canadian Private Investment, CAAT is strengthening its members' long-term financial security while simultaneously boosting the Canadian economy. The fund's focus on specific sectors like private equity, infrastructure, and real estate reflects a well-considered, responsible investing approach. Learn more about CAAT's investment strategy and explore how your business could benefit from CAAT’s investment focus on growing Canadian companies. Contact us today to discuss how your company might be a good fit for CAAT’s increased investment in the Canadian private sector.

Featured Posts

-

Brewers Win Walk Off Thriller Against Royals

Apr 23, 2025

Brewers Win Walk Off Thriller Against Royals

Apr 23, 2025 -

Zuckerberg And Trump A New Era For Tech And Politics

Apr 23, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 23, 2025 -

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025 -

Calendario Laboral 2024 El Puente Del 21 De Abril

Apr 23, 2025

Calendario Laboral 2024 El Puente Del 21 De Abril

Apr 23, 2025 -

Bu Aksamki Diziler 7 Nisan Pazartesi Televizyon Rehberi

Apr 23, 2025

Bu Aksamki Diziler 7 Nisan Pazartesi Televizyon Rehberi

Apr 23, 2025

Latest Posts

-

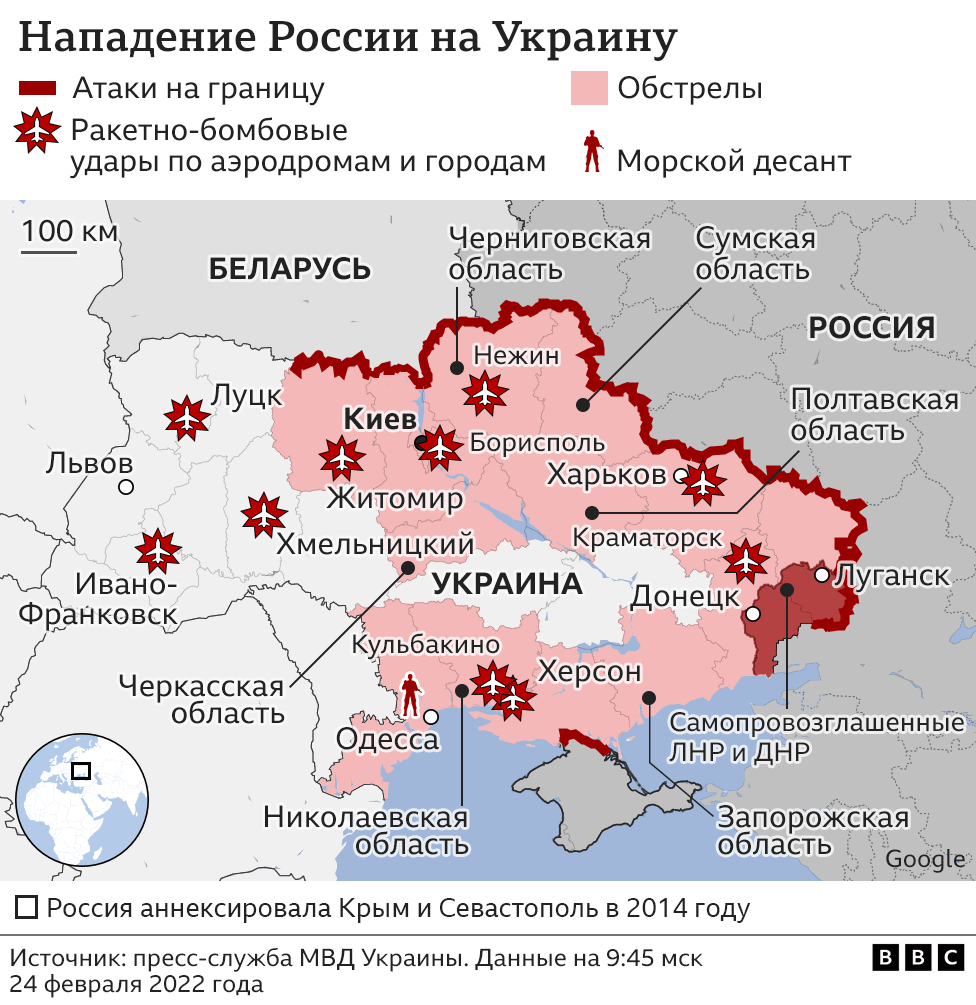

Bezhentsy Iz Ukrainy Germaniya Otsenivaet Riski Novogo Naplyva V Svyazi S Deystviyami S Sh A

May 10, 2025

Bezhentsy Iz Ukrainy Germaniya Otsenivaet Riski Novogo Naplyva V Svyazi S Deystviyami S Sh A

May 10, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package

May 10, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package

May 10, 2025 -

Vozmozhniy Noviy Potok Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 10, 2025

Vozmozhniy Noviy Potok Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 10, 2025 -

Germaniya Riski Novogo Volny Ukrainskikh Bezhentsev Sprovotsirovannoy S Sh A

May 10, 2025

Germaniya Riski Novogo Volny Ukrainskikh Bezhentsev Sprovotsirovannoy S Sh A

May 10, 2025 -

Firstpost Imfs Decision On Pakistans 1 3 Billion Package And Current Events

May 10, 2025

Firstpost Imfs Decision On Pakistans 1 3 Billion Package And Current Events

May 10, 2025