Caesar's Palace Las Vegas: Slight Property Value Dip In 24 Hours

Table of Contents

Analyzing the 24-Hour Dip in Caesar's Palace Las Vegas Property Value

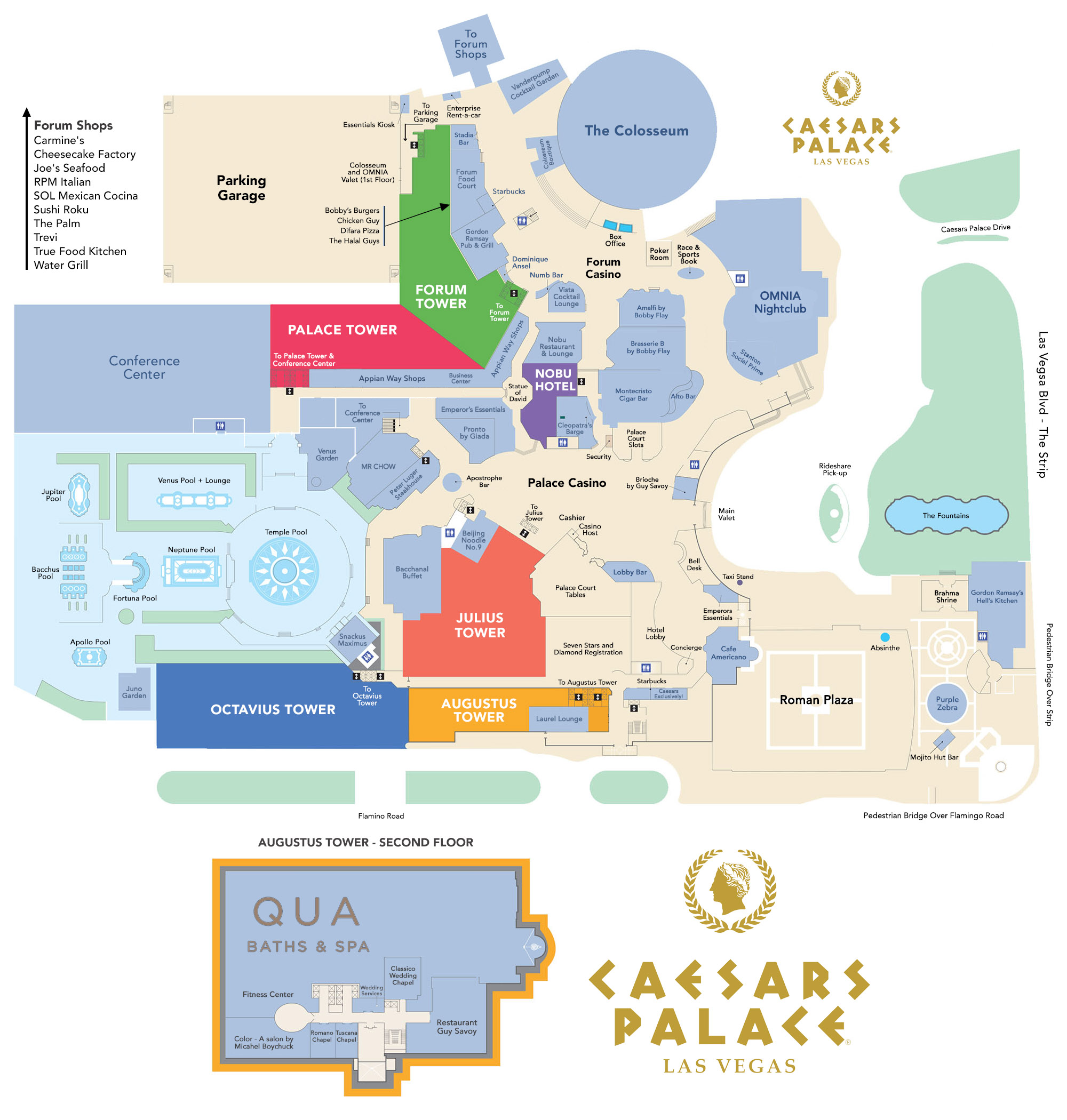

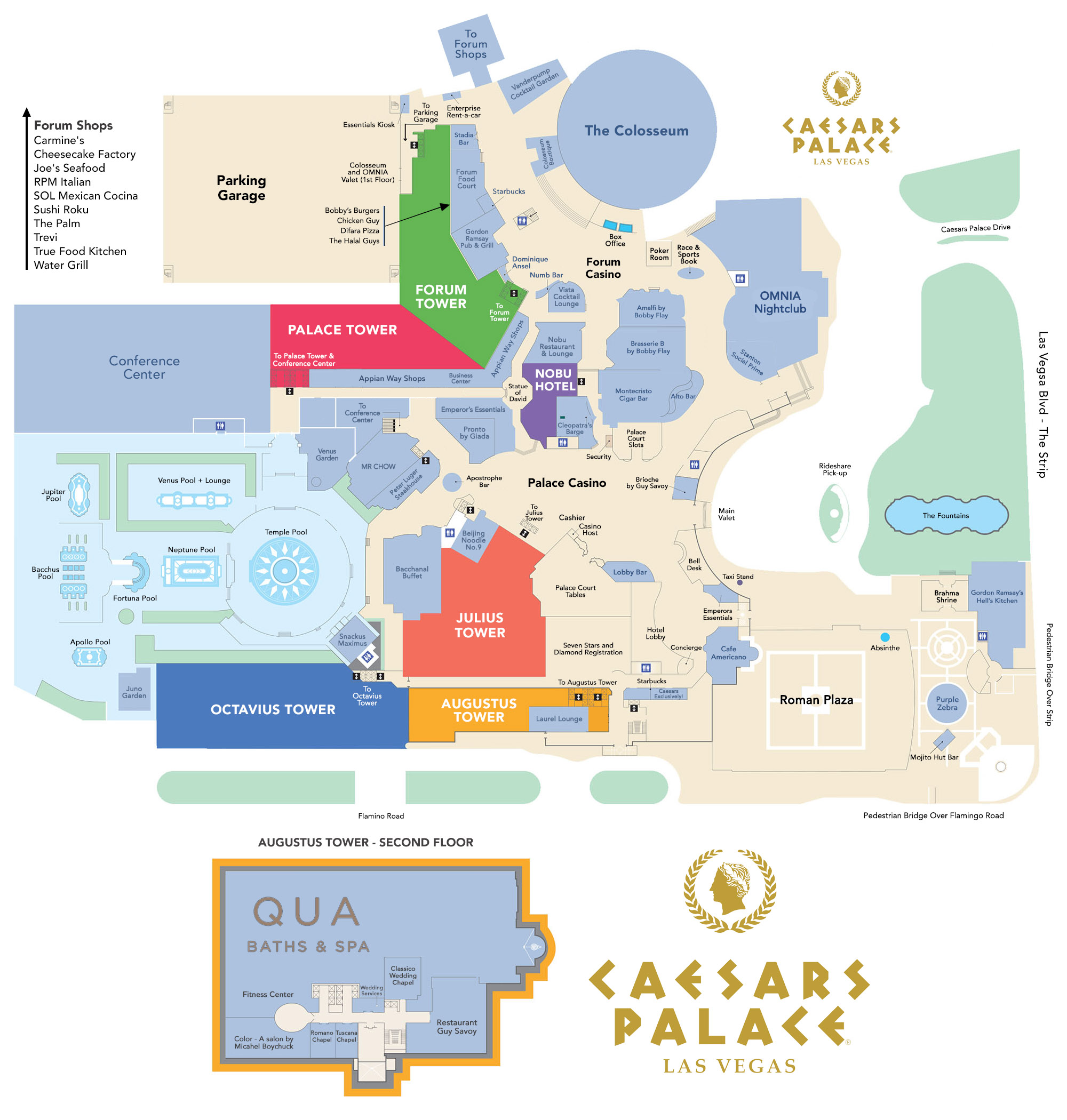

Reports surfaced indicating a notable decrease in the estimated value of properties within the Caesar's Palace complex. While the exact percentage or dollar amount of the drop remains somewhat opaque due to the complex nature of property valuation in this sector, preliminary data suggests a significant decline. This unexpected event underscores the volatility that can exist even within seemingly stable investment markets like the Las Vegas Strip.

- Source: The data comes from a confluence of sources, including preliminary reports from [Name of Real Estate Data Provider/News Source] and internal analyses performed by several major Las Vegas real estate firms. It is important to note that these figures are subject to further review and confirmation.

- Specific Properties: While specifics aren't publicly available due to confidentiality agreements, the dip appears to affect a range of properties within the Caesar's Palace complex, including both residential and commercial units.

- Timeframe: The dip occurred primarily within a 24-hour period, making it an unusually sharp and sudden event within the typically more stable Las Vegas luxury real estate market.

- Potential Causes (Speculative): At this early stage, the exact cause remains unclear. However, several possibilities are being explored, including broader economic factors and events specific to Caesar's Palace and the Las Vegas market.

Potential Factors Contributing to the Caesar's Palace Las Vegas Property Value Decrease

Several factors, both macroeconomic and microeconomic, could be contributing to this unexpected downturn in Caesar's Palace Las Vegas property value.

Macroeconomic Factors:

- Interest Rate Hikes and Inflation: The recent aggressive interest rate hikes by the Federal Reserve, coupled with persistent inflation, have increased borrowing costs, making real estate investments less attractive. This has a knock-on effect on property values across various sectors, including luxury properties on the Las Vegas Strip.

- Tourism Slowdown: Any downturn in tourism, even a temporary one, can directly impact the profitability of hotels and casinos, potentially influencing property values. Recent data on Las Vegas visitor numbers will be crucial in analyzing this aspect.

- Overall Las Vegas Real Estate Market: The health of the broader Las Vegas real estate market plays a significant role. A cooling market trend can cause a domino effect, impacting even high-end properties like those within Caesar's Palace.

Microeconomic Factors Specific to Caesar's Palace:

- Operational Changes: Any significant internal changes at Caesar's Palace, such as management shifts or large-scale renovations that disrupt operations, could temporarily affect investor confidence.

- Occupancy Rates and Revenue: Lower-than-expected occupancy rates or a decline in revenue streams at Caesar's Palace would certainly impact its overall valuation. Transparency in these key performance indicators is critical.

- Legal and Regulatory Issues: Any potential legal challenges or regulatory changes affecting the casino industry or the Caesar's Palace complex directly could negatively influence property values.

Market Speculation and Investor Sentiment:

- Investor Reaction and Trading Activity: The initial reaction of investors to the reported dip will play a significant role in shaping the trajectory of property values. Panic selling or a cautious approach by investors could exacerbate the decline.

- News Cycle Influence: The speed and extent of the spread of information through news outlets and social media contribute to market speculation, impacting investor sentiment and driving short-term fluctuations in prices.

- Investor Confidence in the Las Vegas Casino Market: Overall confidence in the long-term stability and profitability of the Las Vegas casino market significantly influences investment decisions and property values.

Long-Term Outlook for Caesar's Palace Las Vegas Property Value

Predicting the future of Caesar's Palace Las Vegas property value requires careful consideration of various factors.

- Potential for Recovery: The Las Vegas real estate market has historically shown remarkable resilience, bouncing back from previous downturns. The intrinsic value of prime real estate on the Strip remains high.

- Potential for Further Decline: However, persistent macroeconomic headwinds or unforeseen negative developments at Caesar's Palace could prolong the decline or even lead to a more significant drop.

- Future Development Plans: Any future development plans for Caesar's Palace or the surrounding area will likely impact property values. Positive developments could boost investor confidence and lead to a recovery. The resilience of the Las Vegas market historically provides some indication of a potential rebound.

Conclusion:

The unexpected 24-hour dip in Caesar's Palace Las Vegas property value highlights the volatility inherent in the real estate market. While the precise cause remains under investigation, a combination of macroeconomic factors such as rising interest rates and inflation, along with microeconomic factors specific to Caesar's Palace, are likely contributing to the decline. The long-term outlook, however, remains uncertain, depending on the resolution of these underlying issues and the broader trajectory of the Las Vegas economy. While a short-term dip is concerning, the historical resilience of the Las Vegas market suggests a potential recovery. Stay informed about fluctuations in Caesar's Palace Las Vegas property value by following reputable real estate news sources and conducting further research into Las Vegas investment opportunities to make informed decisions.

Featured Posts

-

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

May 18, 2025

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

May 18, 2025 -

Uber Stock Soars Analyzing Aprils Double Digit Gains

May 18, 2025

Uber Stock Soars Analyzing Aprils Double Digit Gains

May 18, 2025 -

Open Ai Simplifies Voice Assistant Creation Key Highlights From The 2024 Developer Event

May 18, 2025

Open Ai Simplifies Voice Assistant Creation Key Highlights From The 2024 Developer Event

May 18, 2025 -

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 18, 2025

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 18, 2025 -

Spring Breakout 2025 Roster Composition And Team Strategies

May 18, 2025

Spring Breakout 2025 Roster Composition And Team Strategies

May 18, 2025