Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Financial Performance

Palantir's current financial health and market standing are crucial indicators of its potential to reach a trillion-dollar valuation. Let's examine the key aspects of its performance.

Revenue Growth and Profitability

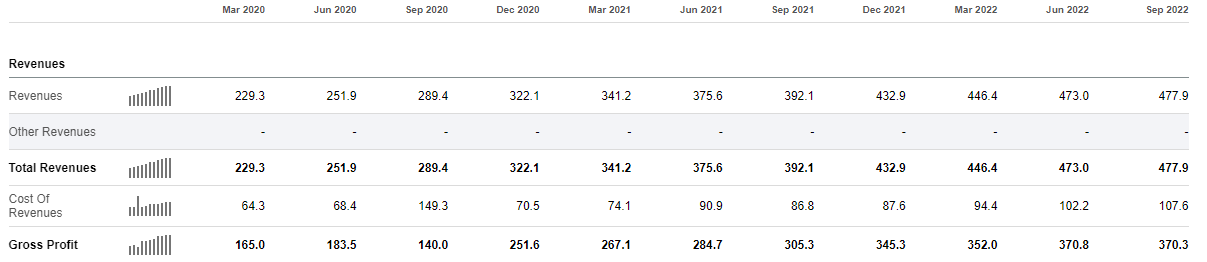

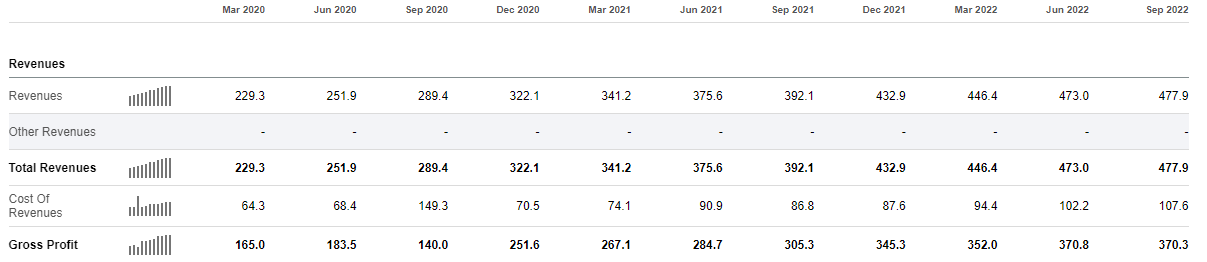

Palantir has demonstrated consistent revenue growth, though profitability remains a key focus. Examining year-over-year growth rates, net income figures, and operating margins is critical to assessing its financial trajectory.

- Year-over-Year Revenue Growth: Analyzing consistent year-over-year growth rates reveals the momentum of Palantir's business. Significant and sustained increases suggest a strong foundation for future growth.

- Net Income and Profitability Margins: Tracking net income and operating margins provides insights into Palantir's efficiency and ability to translate revenue into profit. Improving margins are crucial for achieving a high valuation.

- Key Partnerships and Contracts: Major contracts with government agencies and large commercial enterprises are vital to Palantir's revenue streams. Securing and expanding these relationships directly influences the company's financial outlook. For example, continued success in winning substantial government contracts for national security and intelligence operations could significantly impact revenue projections.

Market Share and Competitive Landscape

Palantir faces stiff competition from established tech giants like AWS, Microsoft, and Google. However, its proprietary technology and strong relationships with government agencies offer a competitive edge.

- Competitive Advantages: Palantir's unique data integration and analysis capabilities, combined with its strong reputation within government circles, provide a significant advantage over competitors offering more generalized solutions.

- Direct Competitors: A detailed comparative analysis against AWS, Microsoft Azure, and Google Cloud Platform, focusing on specific market segments, reveals Palantir's position in the overall market. Analyzing the relative strengths and weaknesses against these competitors provides a clearer picture of its market share and competitive dynamics.

- Government and Commercial Market Penetration: Palantir's success in both government and commercial markets is crucial. Assessing its market share in each sector helps to predict future growth potential.

Growth Projections and Future Market Opportunities

Palantir's potential for a trillion-dollar valuation relies heavily on its ability to expand into new markets and develop innovative products.

Expanding into New Markets

Palantir's strategic expansion into sectors like healthcare and finance presents significant growth opportunities.

- Healthcare Market Potential: The use of data analytics in healthcare is rapidly expanding. Palantir's platform can be utilized for disease prediction, drug discovery, and improved patient care. This represents a vast and largely untapped market for Palantir.

- Financial Services Applications: The financial services sector generates enormous amounts of data, making it ripe for Palantir's analytical capabilities in areas such as fraud detection, risk management, and algorithmic trading.

- Challenges of Market Entry: Entering new markets requires significant investment in marketing, sales, and product adaptation. The success of Palantir's expansion strategies is critical to its growth projections.

Technological Innovation and Product Development

Continuous investment in research and development is key to Palantir's long-term success.

- AI and Machine Learning Advancements: Integrating cutting-edge AI and machine learning technologies into its platform will enhance its analytical capabilities and broaden its appeal across various sectors.

- New Product Launches: The introduction of new products or significant upgrades to existing platforms is crucial for staying competitive and attracting new clients. Success in launching innovative solutions will drive future growth.

- R&D Investment: Consistent and significant investment in research and development is critical to maintaining a technological edge and delivering new, valuable solutions.

Challenges and Risks to Reaching a Trillion-Dollar Valuation

While Palantir's prospects are promising, several challenges could impede its path to a trillion-dollar valuation.

Competition and Market Saturation

Increased competition and potential market saturation pose significant threats.

- Competitive Pressure: The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. Palantir needs to maintain its competitive advantage to thrive in this environment.

- Price Wars and Margin Compression: Intense competition could lead to price wars, reducing profitability and squeezing profit margins. This could negatively impact the company's valuation.

- Emergence of Disruptive Technologies: The appearance of innovative, disruptive technologies could render Palantir's existing offerings obsolete or less competitive, requiring substantial adaptation.

Economic and Geopolitical Factors

Macroeconomic conditions and geopolitical events can significantly influence Palantir's growth trajectory.

- Government Spending Fluctuations: Government spending on national security and intelligence, a significant revenue source for Palantir, can fluctuate depending on economic conditions and geopolitical priorities.

- Global Economic Slowdowns: A global recession could reduce spending on data analytics across various sectors, impacting Palantir's revenue and profitability.

- Regulatory Changes and Security Concerns: Regulatory changes or security concerns surrounding data privacy and national security could impact Palantir's operations and access to certain markets.

Conclusion: The Palantir Trillion-Dollar Question – A Verdict

Palantir's journey to a trillion-dollar valuation is ambitious but not entirely impossible. While its strong revenue growth, proprietary technology, and government relationships provide a solid foundation, the intense competition, economic uncertainties, and geopolitical risks represent significant hurdles. Successfully navigating these challenges through continuous innovation, strategic market expansion, and maintaining operational excellence is crucial for achieving this ambitious target. Whether Palantir can reach a trillion-dollar valuation by 2030 remains uncertain. However, continued monitoring of its financial performance, technological advancements, and strategic decisions is crucial for assessing Palantir's potential for a trillion-dollar valuation and for evaluating the likelihood of Palantir reaching a trillion-dollar market cap. Further research into Palantir's performance and the factors influencing its future valuation is strongly recommended.

Featured Posts

-

Two Hat Tricks For Hertl Golden Knights Dominant Victory Over Red Wings

May 09, 2025

Two Hat Tricks For Hertl Golden Knights Dominant Victory Over Red Wings

May 09, 2025 -

Overtaym Drama Vegas Golden Nayts Oderzhivaet Pobedu Nad Minnesotoy V Pley Off

May 09, 2025

Overtaym Drama Vegas Golden Nayts Oderzhivaet Pobedu Nad Minnesotoy V Pley Off

May 09, 2025 -

Nhls Next Generation 9 Players Who Could Surpass Ovechkins Record

May 09, 2025

Nhls Next Generation 9 Players Who Could Surpass Ovechkins Record

May 09, 2025 -

New Anchorage Establishments Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

New Anchorage Establishments Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 09, 2025

Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 09, 2025