Can XRP (Ripple) Investments Help You Achieve Your Financial Goals?

Table of Contents

Understanding XRP's Potential for Growth

XRP, the native cryptocurrency of Ripple Labs, operates within a unique ecosystem designed to facilitate fast and cost-effective cross-border payments. Its potential for growth is linked to several key factors:

XRP's Technological Advantages

XRP boasts several technological advantages over other cryptocurrencies, contributing to its appeal as an investment:

- Faster transaction speeds than Bitcoin or Ethereum: XRP transactions are processed significantly faster, potentially offering quicker settlement times and increased efficiency.

- Lower transaction fees: XRP's low transaction fees make it a cost-effective option, especially for large-scale transactions and cross-border payments.

- Scalability to handle a high volume of transactions: The XRP Ledger is designed to handle a large number of concurrent transactions, making it suitable for widespread adoption.

Ripple's Partnerships and Institutional Adoption

Ripple's strategic partnerships with major financial institutions are a significant driver of XRP's value and potential for growth. These collaborations lend credibility and demonstrate the practical applications of XRP's technology:

- Key Partnerships and Collaborations: Ripple has established partnerships with numerous banks and payment providers globally, expanding its reach and solidifying its position in the financial industry. These partnerships provide significant network effects.

- Impact of Institutional Adoption on Price Stability and Demand: The growing acceptance of XRP by established financial institutions contributes to increased price stability and higher demand, potentially driving future price appreciation.

Market Volatility and Risk Management

The cryptocurrency market is inherently volatile, and XRP is no exception. Successful XRP investment necessitates a robust risk management strategy:

- Diversification Strategies: Diversifying your investment portfolio across multiple asset classes, including traditional investments and other cryptocurrencies, is essential to mitigate risk.

- Invest Only What You Can Afford to Lose: This fundamental principle of investing applies especially to volatile assets like XRP. Never invest borrowed money or funds you rely on for essential expenses.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. Dollar-cost averaging can help to reduce the impact of market volatility.

Aligning XRP Investments with Your Financial Goals

Integrating XRP into your overall financial strategy requires a clear understanding of your goals and risk tolerance.

Short-Term vs. Long-Term Investment Strategies

Your investment horizon significantly influences your approach to XRP investment:

- Short-Term Trading Strategies (Higher Risk, Higher Potential Return): Short-term trading involves frequent buying and selling of XRP based on short-term price movements. This strategy carries higher risk but offers the potential for quicker profits.

- Long-Term Holding Strategies (Lower Risk, Potentially Slower but Steadier Growth): A long-term strategy involves holding XRP for an extended period, aiming to benefit from potential long-term price appreciation. This approach generally carries lower risk.

Setting Realistic Expectations and Goals

Maintaining a realistic perspective is vital for successful XRP investment:

- Avoid Get-Rich-Quick Schemes and Unrealistic Expectations: The cryptocurrency market is unpredictable, and get-rich-quick schemes are rarely sustainable. Set attainable financial goals based on realistic market assessments.

- Develop a Comprehensive Financial Plan: XRP investment should be part of a broader financial plan that considers your overall financial objectives, risk tolerance, and diversification strategy.

Diversification and Portfolio Management

Diversification is crucial for managing risk in any investment portfolio:

- How XRP Fits into a Diversified Portfolio: XRP should complement other assets in your portfolio, reducing overall portfolio volatility.

- Benefits of Professional Financial Advice: Seeking advice from a qualified financial advisor can provide valuable insights and guidance on integrating XRP into your investment strategy.

Conclusion

XRP investment presents both significant opportunities and inherent risks. Its potential for growth is linked to its technological advantages, Ripple's partnerships, and increasing institutional adoption. However, the volatile nature of the cryptocurrency market demands a cautious and well-informed approach. To successfully align XRP investments with your financial goals, carefully consider your risk tolerance, investment timeframe, and the importance of diversification. Remember to conduct thorough research and seek professional financial advice before making any investment decisions. Carefully consider your XRP investment strategy, research Ripple and XRP thoroughly, and consult a financial advisor before making any investment decisions. Informed decision-making is paramount in the dynamic world of XRP investment.

Featured Posts

-

Cherry Red Heels And A Show Stopping Ring Rihannas Latest Look

May 07, 2025

Cherry Red Heels And A Show Stopping Ring Rihannas Latest Look

May 07, 2025 -

La Salud Mental Y Fisica De Simone Biles Mi Cuerpo Se Derrumbo Explica Su Retirada

May 07, 2025

La Salud Mental Y Fisica De Simone Biles Mi Cuerpo Se Derrumbo Explica Su Retirada

May 07, 2025 -

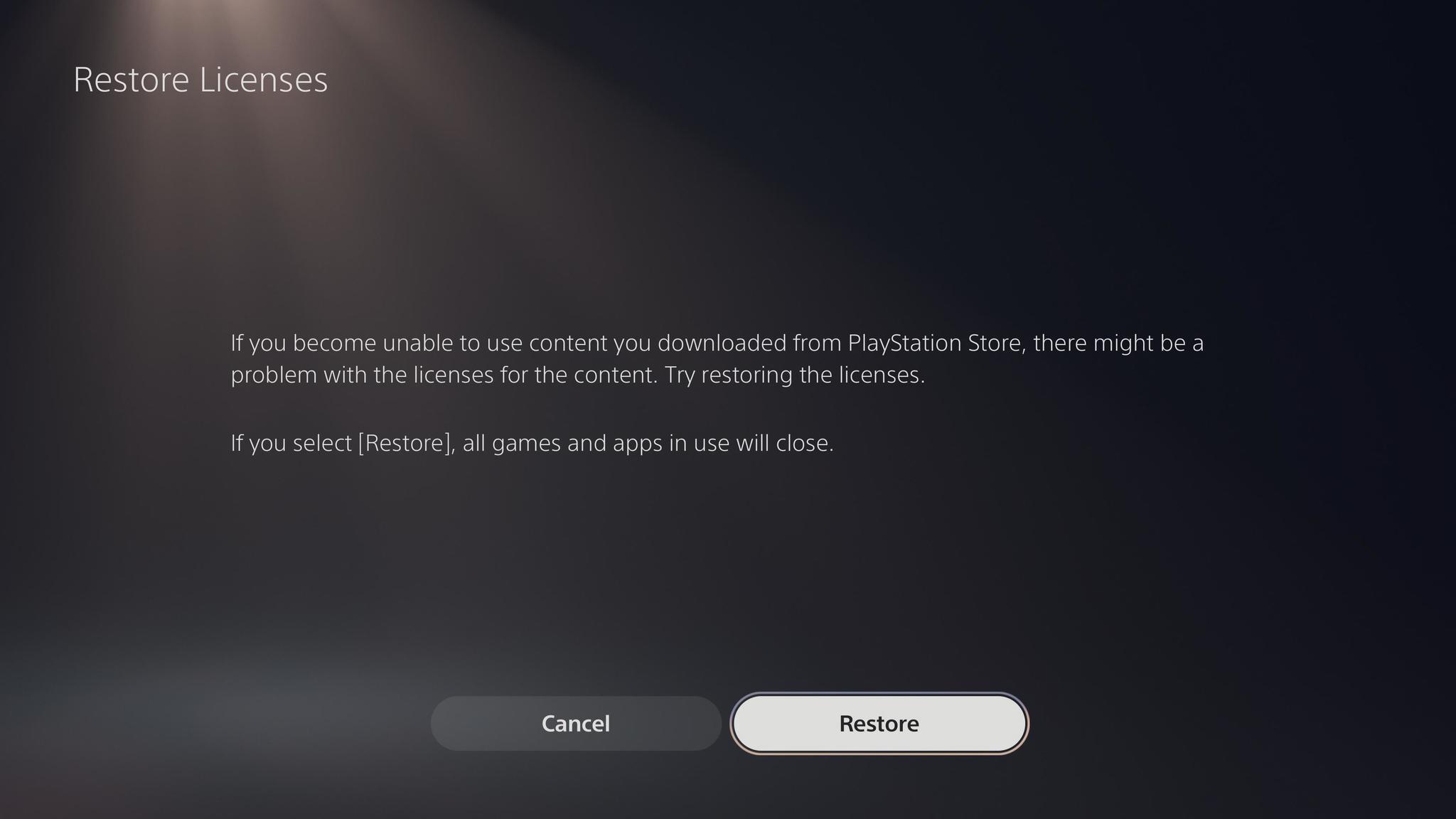

Why Is My Ps 5 Stuttering Troubleshooting Common Issues

May 07, 2025

Why Is My Ps 5 Stuttering Troubleshooting Common Issues

May 07, 2025 -

Palantir Stock High Multiple Despite Earnings Volatility

May 07, 2025

Palantir Stock High Multiple Despite Earnings Volatility

May 07, 2025 -

Ayesha Currys Marriage First Balancing Family And Career

May 07, 2025

Ayesha Currys Marriage First Balancing Family And Career

May 07, 2025